Dubai’s Hospitality Sector Market Performance in 2023

Setting the Stage for Growth: Demand

Dubai Tourism in 2023: Recovery and Resilience

Despite global conflicts and recent regional unrest, Dubai’s economy, driven by key sectors, remained steadfast in its recovery. The performance of the tourism sector reflects as much.

In 2023, the city welcomed 17.15 million overnight visitors, surpassing its previous high of 16.73 million in 2019 and the 14.36 million recorded in 2022. Moreover, the tourism sector’s GDP contribution is expected to have nearly doubled this year from 2021 to 36.1%, and is forecasted to reach 2019 levels once again, by 2024. To continue driving the upward trajectory of tourism in the country, the UAE has set ambitious goals in its National Tourism Strategy 2031, aiming to position itself as a top global destination by 2031 [1].

The strategy aims to boost the tourism sector’s contribution to GDP by AED 450 billion, attract investments worth AED 100 billion, and welcome 40 million hotel guests annually by 2031. It also naturally plays into the Dubai Economic Agenda – D33.

In early 2023, the Dubai government unveiled its D33 Economic Agenda, with the goal of doubling the city’s economy within the next decade and solidifying its position among the top three global cities for travel and business. The tools underpinning this initiative are increasing foreign trade and foreign direct investment.

Dubai Tourism’s recent performance and future ambitions have been recognised globally, with the city being ranked as the No. 1 global destination in the TripAdvisor Travellers’ Choice Awards 2024 for the third consecutive year [2].

Additionally, Dubai has been ranked first regionally and sixth globally as the best city in the world in the World’s Best Cities Report 2024. These accolades underscore Dubai’s commitment to tourism excellence and its status as a top global destination.

The growth recorded by Dubai Tourism in 2023 has certainly played an essential role in giving the city’s hospitality and real estate sectors a solid boost.

Dubai’s Airports: Continued Dominance

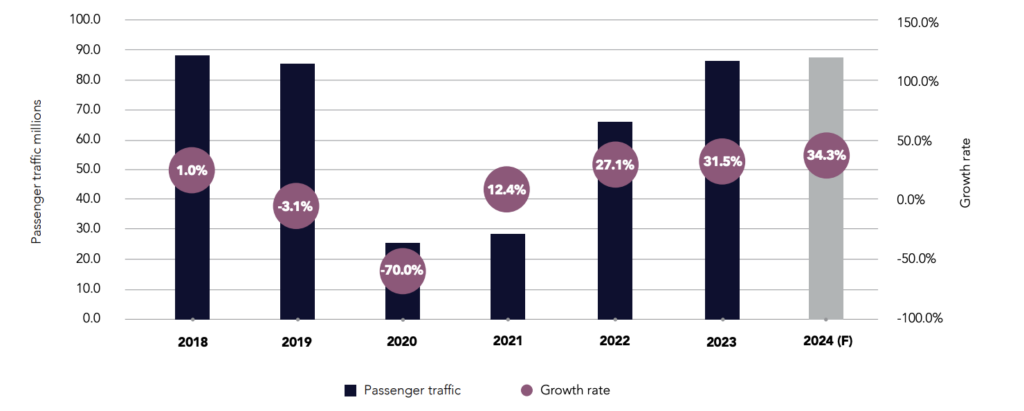

All air traffic in and out of Dubai is managed by two international airports: Dubai International Airport (DXB) and Al Maktoum International Airport (DWC). In 2023, DXB surpassed pre-pandemic levels of passenger traffic, handling 86.9 million passengers. Forecasts suggest that by the end of 2024, this number could reach an estimated 88.8 million, nearing the record high of 89.1 million set in 2018 [3].

The chart below illustrates the annual traffic at DXB airport:

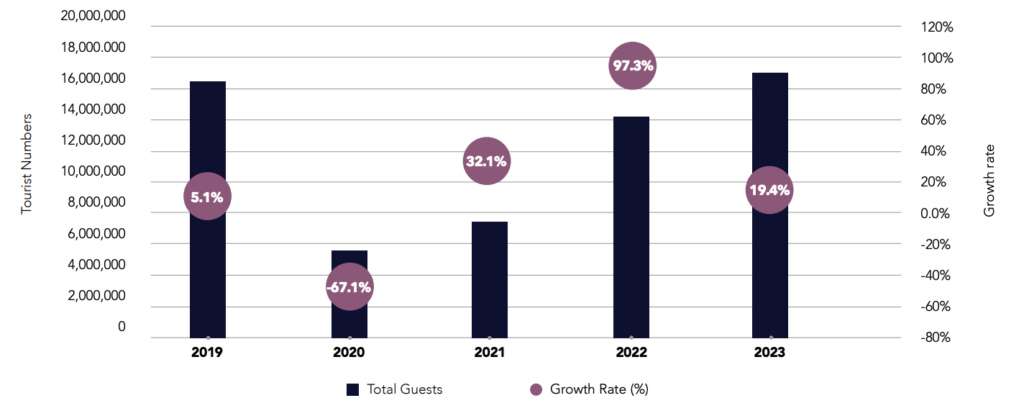

Tourism Demand in Dubai: A Steady Rise

Dubai’s appeal as a tourist destination has been steadily increasing. In 2022, the city welcomed 14.36 million international overnight visitors, marking a 97% increase from 2021 and reaching 86% of pre-pandemic levels. This upward trend continued into 2023, with 17.15 million visitors, a 19.4% year-on-year increase.

Dubai Tourism – Total Overnight Visitors

Dubai Tourism – Total Overnight Visitors

Dubai Tourism – Total Overnight Visitors

Source Markets for Dubai Tourism: A Diverse Mix

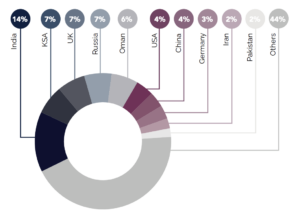

The table below outlines the top ten nationalities by percentage as of Q3 2023

In Q3 2023, India remained the largest source market for overnight visitors in Dubai, accounting for 14% of the total, followed by Saudi Arabia, the UK, and Russia, each at 7%.

Among the top ten source markets, China saw a 304.4% year-on-year increase, followed by Russia at 77.5% and Germany at 49.6%. Notably, Saudi Arabia and Oman experienced drops in visitor numbers by 5.6% and 24.9%, respectively.

The Supply-Side of the Picture

Current Supply: On Track

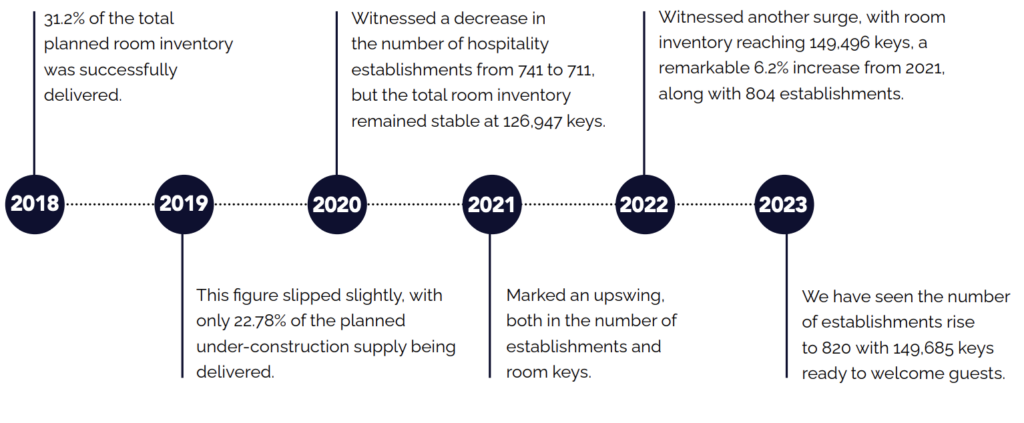

Keeping up with the rise in tourism levels in Dubai, the hospitality industry has successfully adjusted supply to cater to increased demand.

By the first half of 2023, the total number of hospitality establishments in Dubai had risen to 813, with 148,711 keys. Towards the end of the year, the total number of establishments stood at 820, with 149,685 keys ready to welcome guests.

The hospitality industry has been keeping up with tourism levels in Dubai, adjusting supply to meet demand. Our insights reveal that:

Historical Trends & Statistics

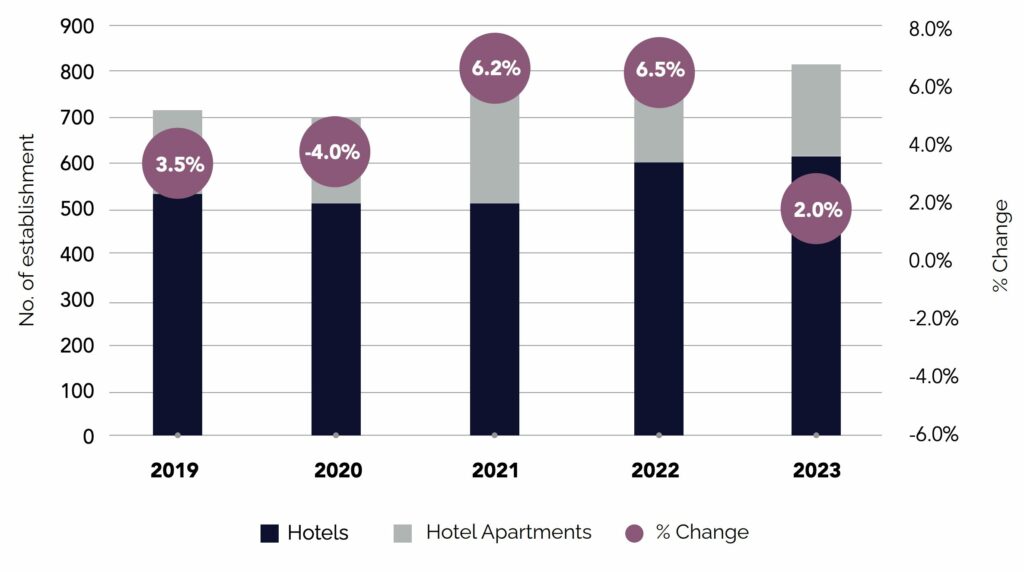

Dubai Hospitality Building Supply – 2019 to 2023

Evolution in number of establishments

- 2021 saw a net increase of 6.2%, with hotel establishments increasing by 47 while hotel apartments decreased by 3 units.

- In 2022, there was a 6.5% boost, welcoming an additional 43 hotels and 6 apartments compared to 2021.

- As of 2023, Dubai boasts a total of 820 hospitality establishments, including 624 hotels and 196 apartments mirroring a modest increase of 2.0% year-on-year.

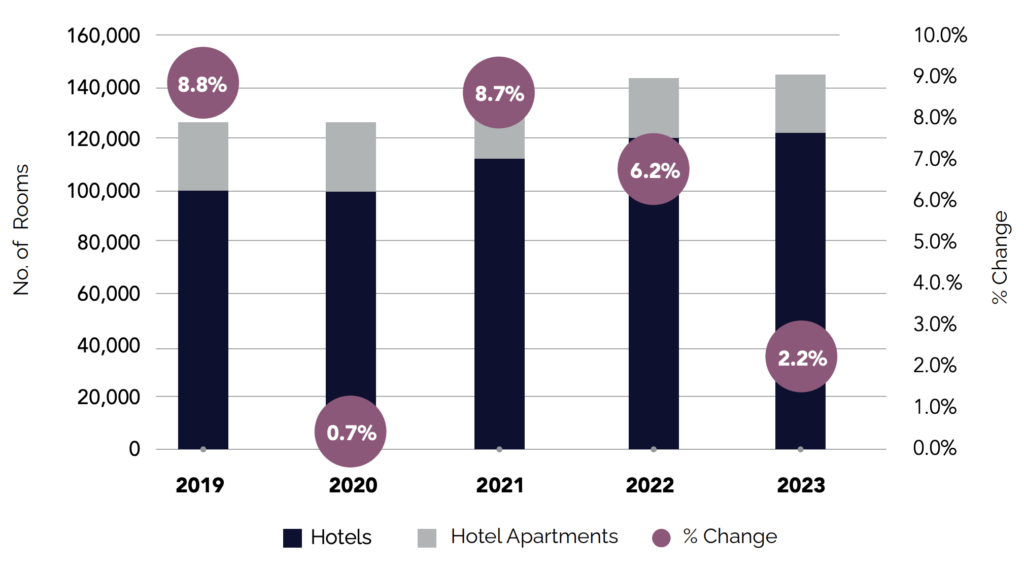

Dubai Hospitality Room Supply – 2019 to 2023

Evolution in keys

- The number of hotel rooms saw a significant increase in 2021, with the largest growth during the recovery period at 8.7%.

- Momentum continued in 2022 with a 6.2% increase, reaching a total of 146,996 rooms.

- In 2023, there was a more modest increase of 2.2%, bringing the total room inventory to 149,685 rooms.

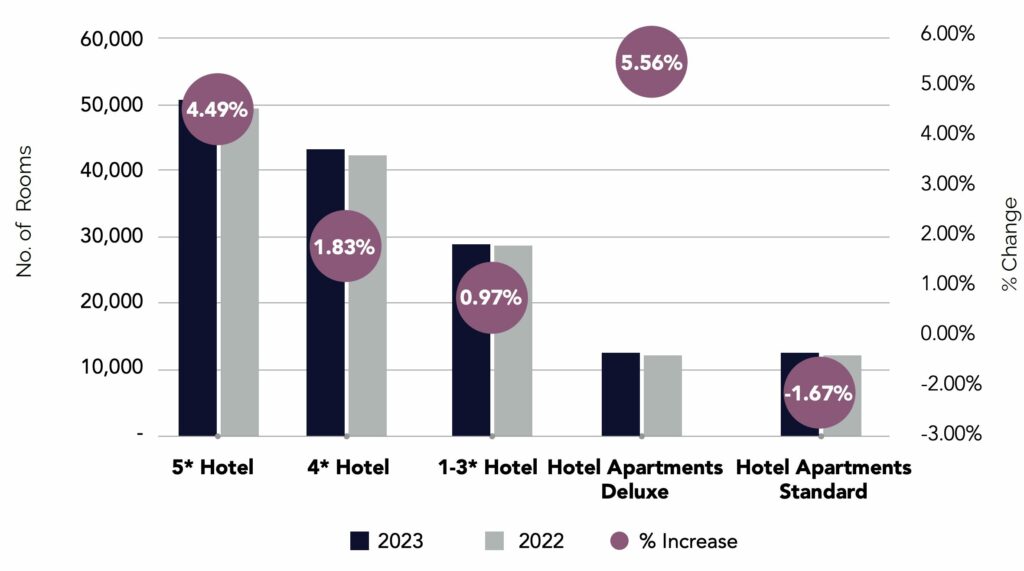

Dubai Hospitality Room Growth by Type – 2023 vs 2022

Room supply by hotel type

- Luxury hotel apartments saw the highest room supply increase yearon-year in 2023, soaring by 5.6%.

- 5 Star hotels experienced a 4.5% growth, while 4 Star hotels recorded a moderate 1.8% increase.

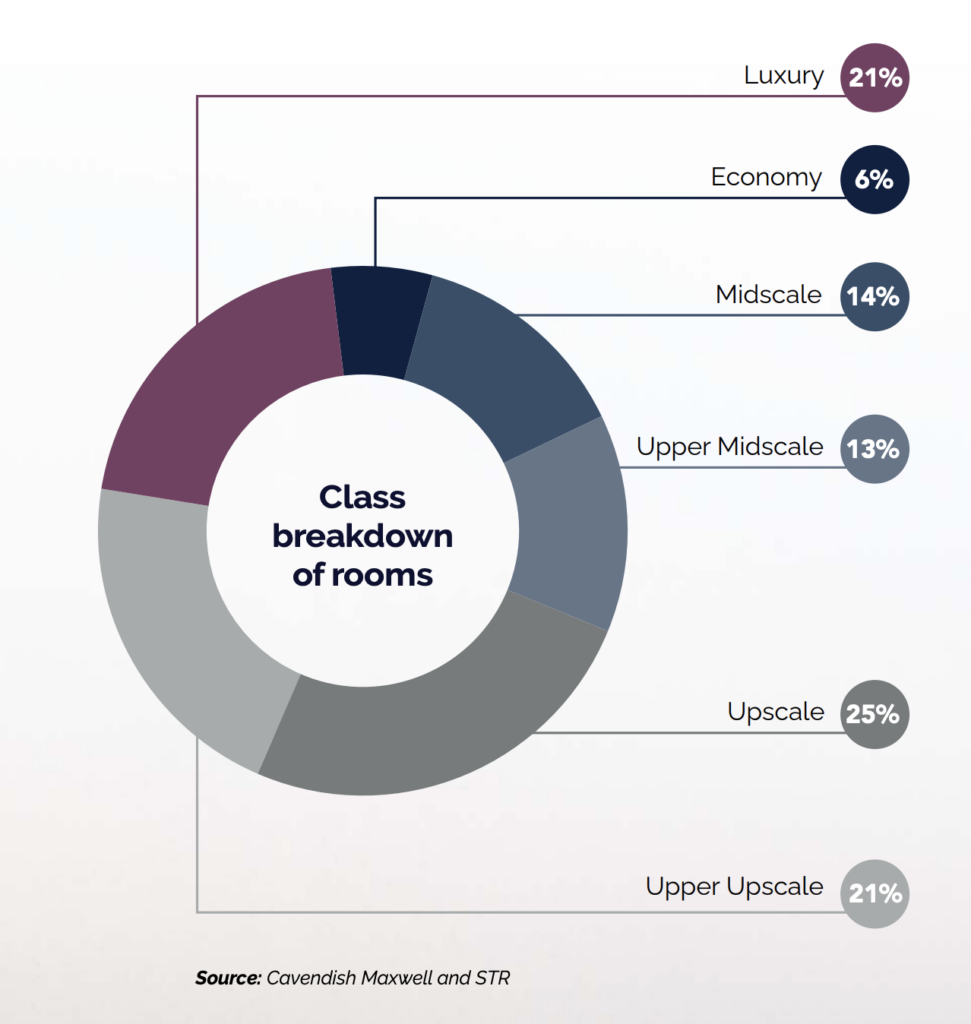

- As of 2023, 67% of the current room supply falls within the Luxury, Upper Upscale, and Upscale classes, while the Upper Midscale and Midscale segments account for approximately one-third (27%) of the total inventory.

- During the year, approximately 73% of the new supply was in the Luxury and Upper Upscale segments.

- Exciting openings in 2023 included Atlantis The Royal, the Cheval Maison, NH Collection Dubai the Palm, and the voco Dubai, The Palm. The Palm contributed approximately 1,600 new rooms to the current supply increase.

- In 2024 luxury supply is expected to experience the most significant growth with 12 new openings planned, adding approximately 3,000 rooms.

Mapping Future Supply: Cavendish Maxwell Insights

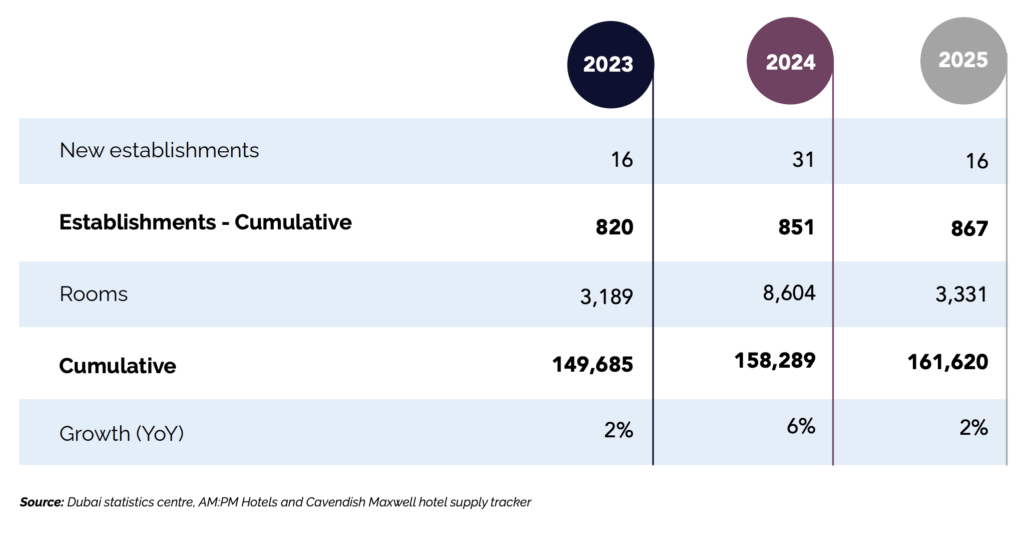

Our estimates suggest that 2024 will see the opening of 31 new hotels in Dubai, while 2025 is expected to add 16 new hotels to the mix. This translates to a cumulative total of 851 by the end of 2024 and 867 by the end of 2025.

An important caveat to note is that the 2024 figures do not include projects that have already opened, such as the ‘One & Only One Za’abeel’ (370 keys – Luxury), the ‘Mercure Dubai Deira’ (152 keys – Upper Midscale), and ‘The Lana Dubai Dorchester Collection’ (225 keys – Luxury).

Evaluating Market Performance

Looking at Occupancy Rates

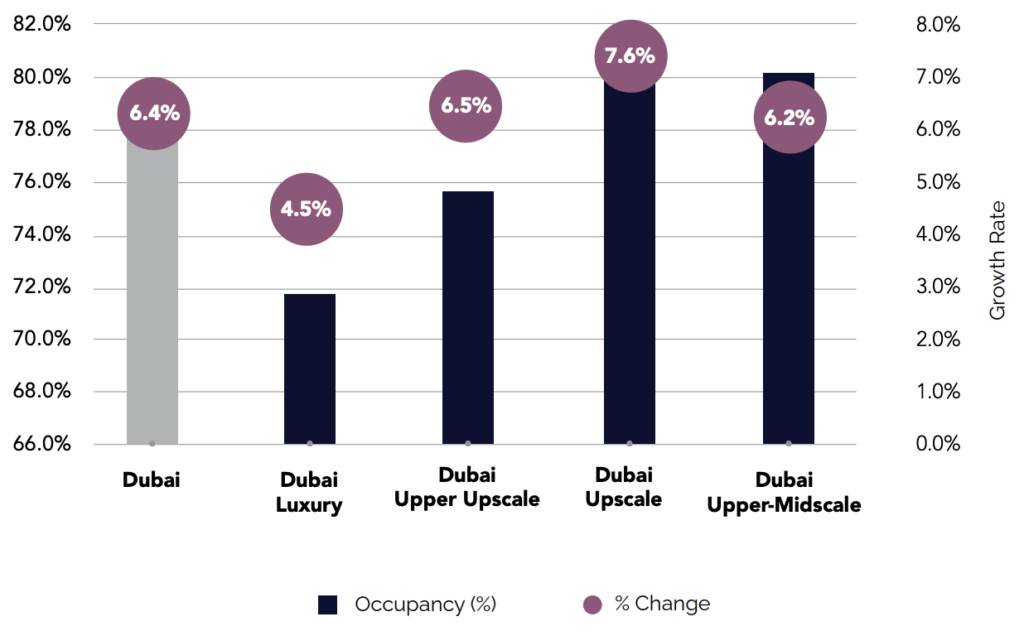

Occupancy by Classification – 2023

Classified Occupancy Rates & Growth

Analysis

- In 2022, occupancy rates at 73% nearly reached pre-pandemic levels at 75%. Dubai nearly reached pre-pandemic levels.

- By the end of 2023, Dubai’s hospitality market achieved an outstanding average occupancy of approximately 77%, surpassing pre-pandemic levels for the first time.

- Occupancy levels across Dubai increased by 6.4% year-on-year, with the Upscale and Upper Upscale segments noting the largest increases of 7.6% and 6.5% respectively. The Dubai Luxury sector saw an increase of 4.5% compared to 2022.

Average Daily Rates (ADRs)

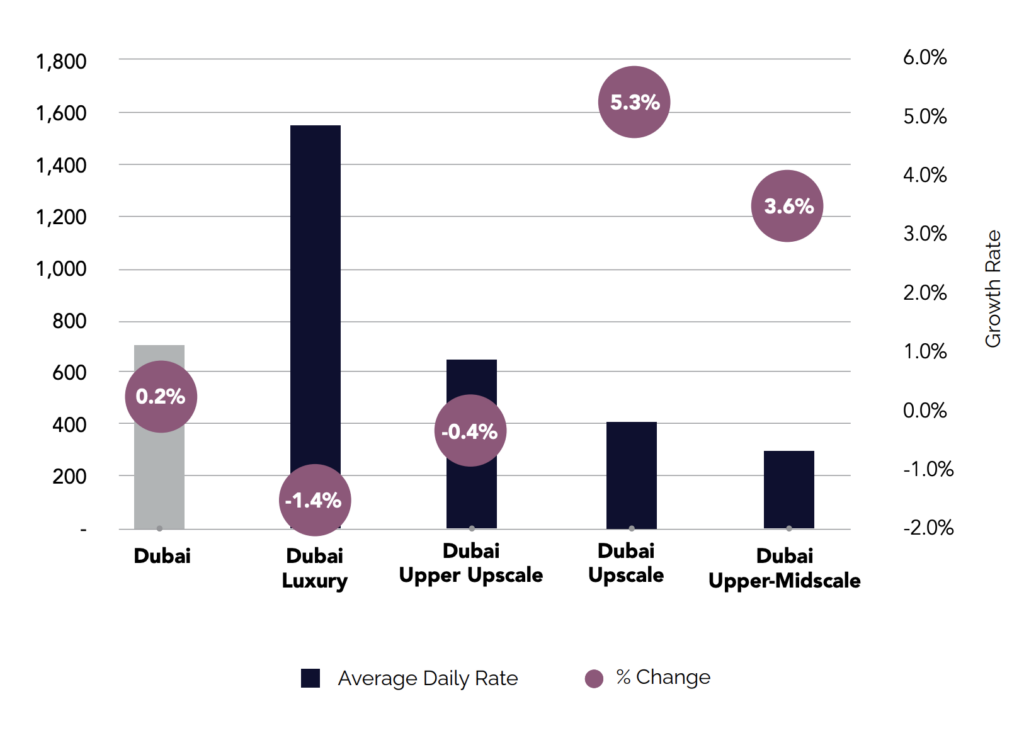

Average Daily Rate by Classification – 2023

Classified ADR Levels & Growth

Analysis

- In contrast to occupancy, 2023 saw market-wide ADR levels stagnating, recording only a minor increase of less than half a percent year-on-year. This is despite Dubai hosting the biannual AirShow as well as the one-off COP28 in November 2023.

- The overall market ADR stood at approximately AED 700.

- Breaking it down further, the Luxury and the Upper-Upscale segments saw ADR levels dropping by 1.4% and 0.4% respectively, whereas the Upscale and Upper-Midscale hotels experienced increases in ADRs of 5.3% and 3.6% respectively.

- ADRs in Dubai saw a compounded annual average growth rate of 5.85% in the period 2018 – 2023.

Forecasting Performance

On the whole, the Dubai Market made a clear recovery in terms of top-line performance with an average growth of 6.6% in RevPAR compared to 2022 figures. All segments achieved an increase year-on-year with the Upscale sector experiencing the largest average growth of around 13% in Revenue Per Available Room (RevPAR).

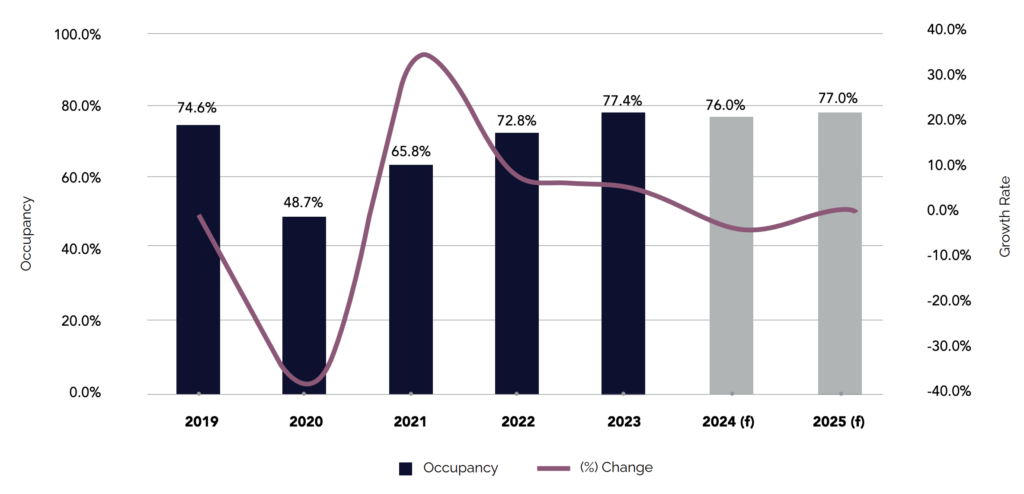

Here’s a look at how we’re forecasting occupancy and ADR levels for tracked inventory:

Dubai – Occupancy – Historic & Forecast

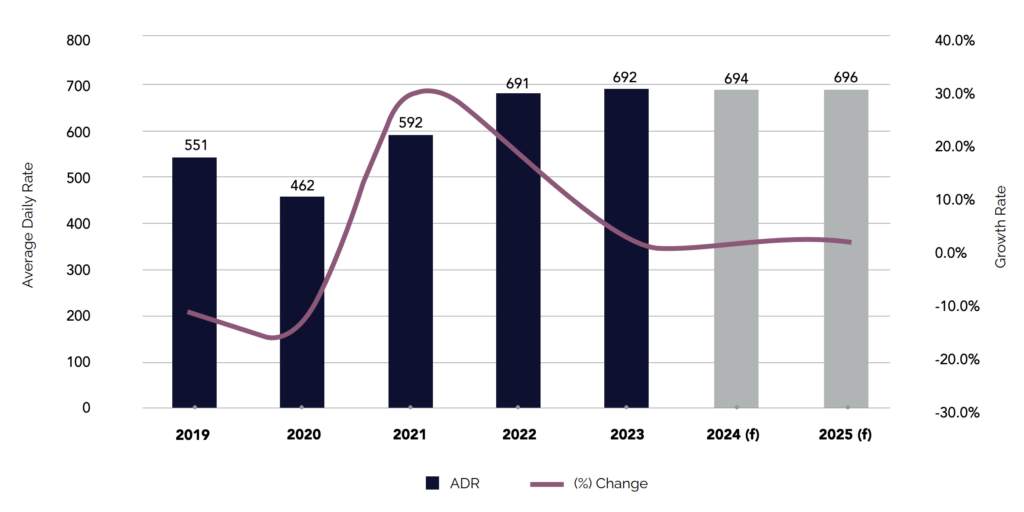

Dubai – ADR – Historic & Forecast

Comparing Performance: Looking at Other Emirates

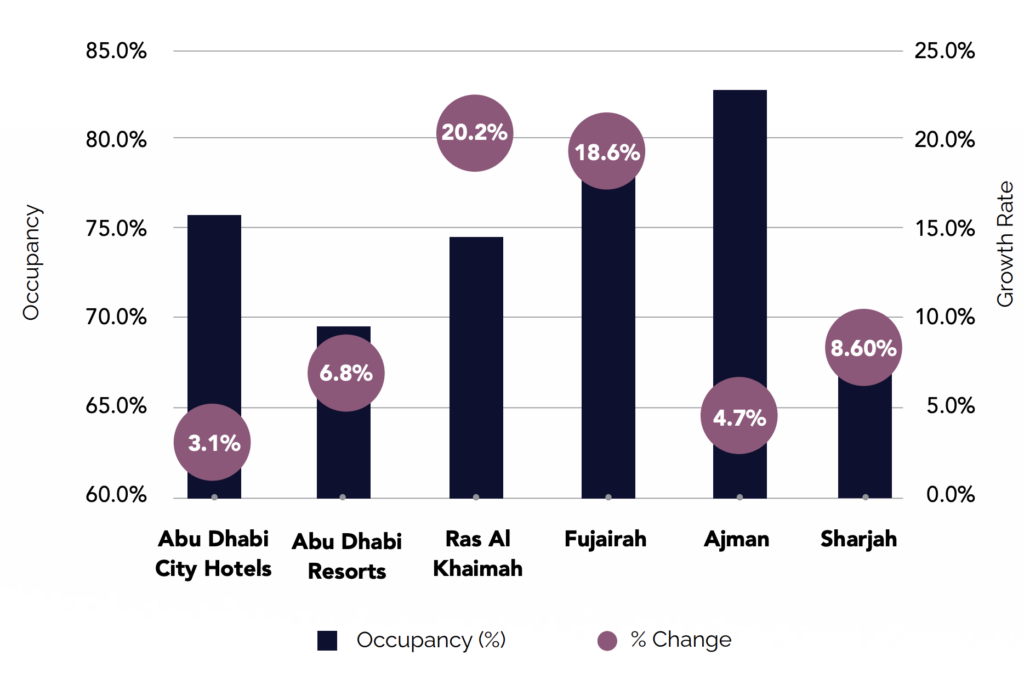

Occupancy by Emirates – 2023

- Economic momentum carried forward from 2022 and 2023 saw a surge in demandpushed performance across the Emirates. All Emirates recorded an upswing in occupancy with figures well above the 70% mark. Abu Dhabi Resorts and Sharjah were the exception, achieving just below the benchmark.

- RAK recorded the highest level of increase year-on-year of about 20%, with average occupancy reaching 74% (up from 61% in 2022) and surpassing pre-pandemic 2019 levels at 72%.

- As per the RAK Tourism Development Authority (RAKTDA), the Emirate welcomed a record 1.2 million arrivals (+7.8%) and recorded 4.35 million guest nights (+23.2%).

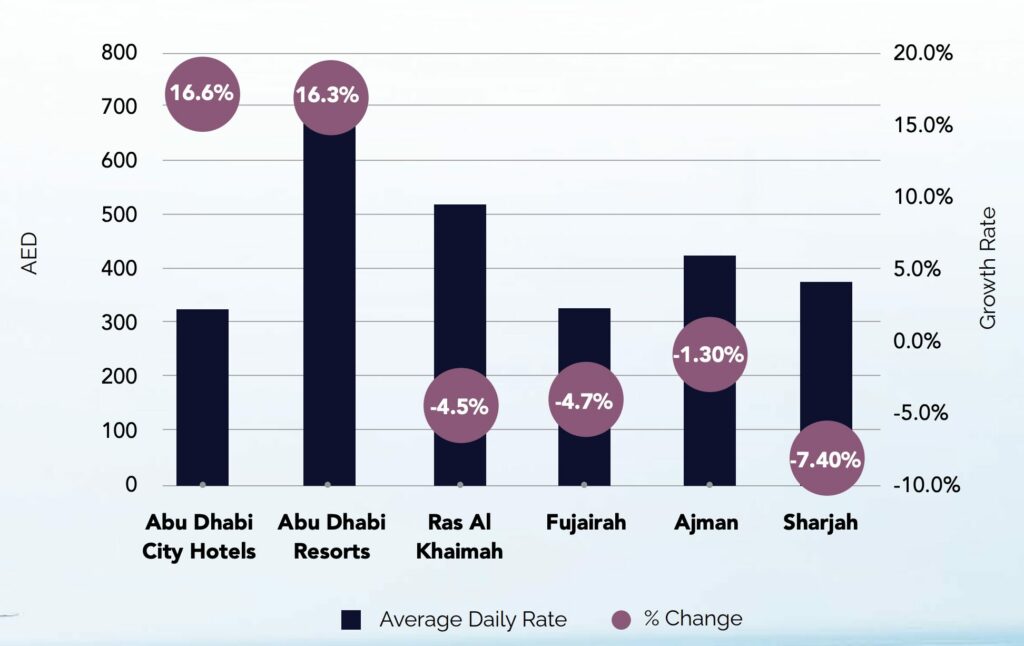

Average Daily Rate by Emirates – 2023

- Abu Dhabi’s hotel market recorded an upward trajectory in 2023 with ADR levels increasing by approximately 16% year-on-year.

- Contrary to increases in occupancy levels across the Emirates, ADRs declined over the same period between 1.3% to 7.4% respectively.