Dubai Office Market Performance Q3 2025

Executive Summary

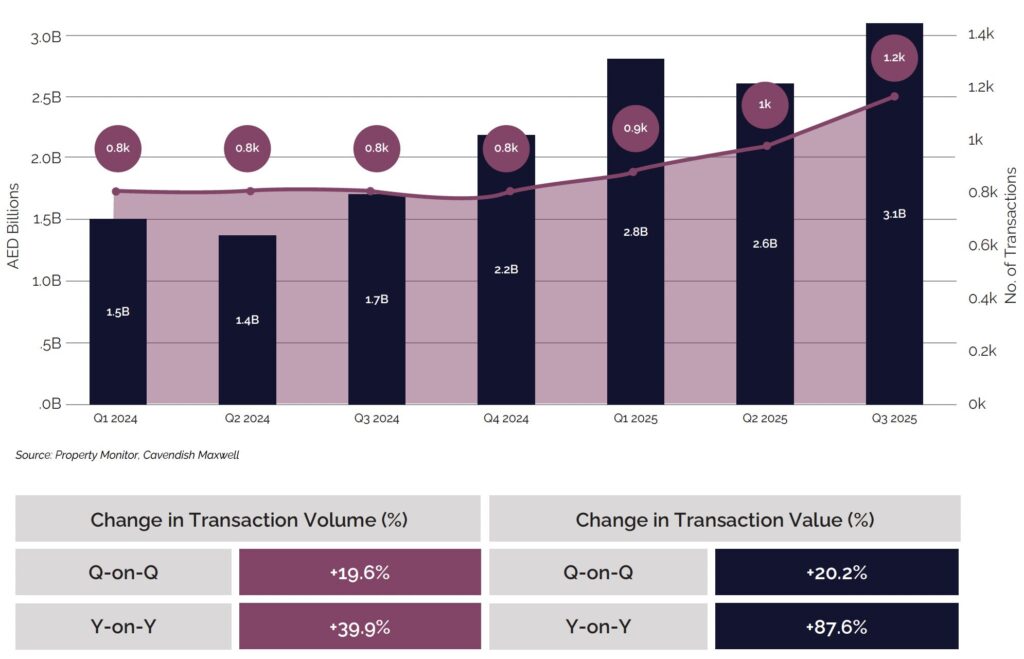

Dubai’s office market delivered a strong performance in Q3 2025, supported by robust economic fundamentals and ongoing business formation activities. Dubai Chamber of Commerce welcomed approximately 53,000 new member companies in the first nine months of 2025, up 4% year-on-year, and attracted 261 foreign companies, a 65.2% increase over the same period in 2024. This surge in business activity fuelled heightened demand for office space, with sales transactions reaching approximately 1,200, up 39.9% year-on-year, and transaction values climbing to AED 3.1 billion, reflecting 87.6% annual growth. The off-plan segment was the primary driver, with volumes rising 463.8% year-on-year.

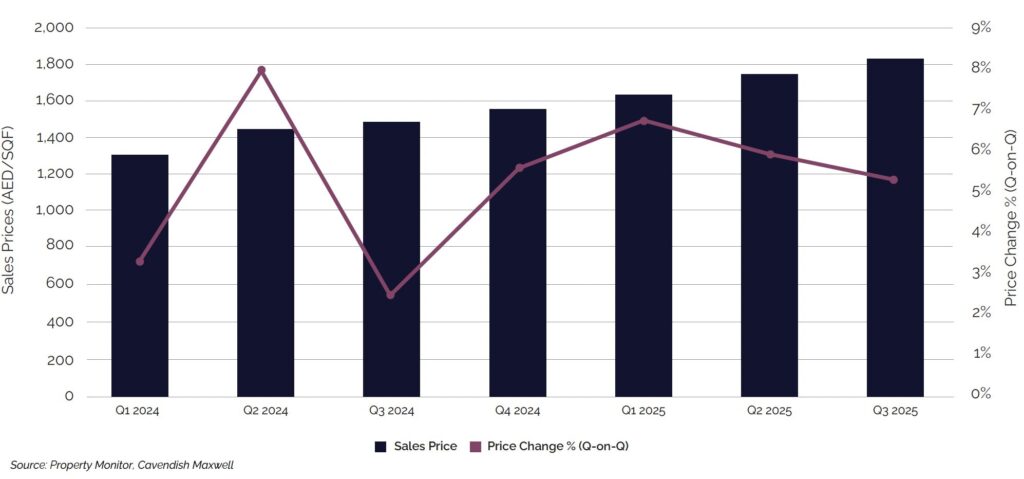

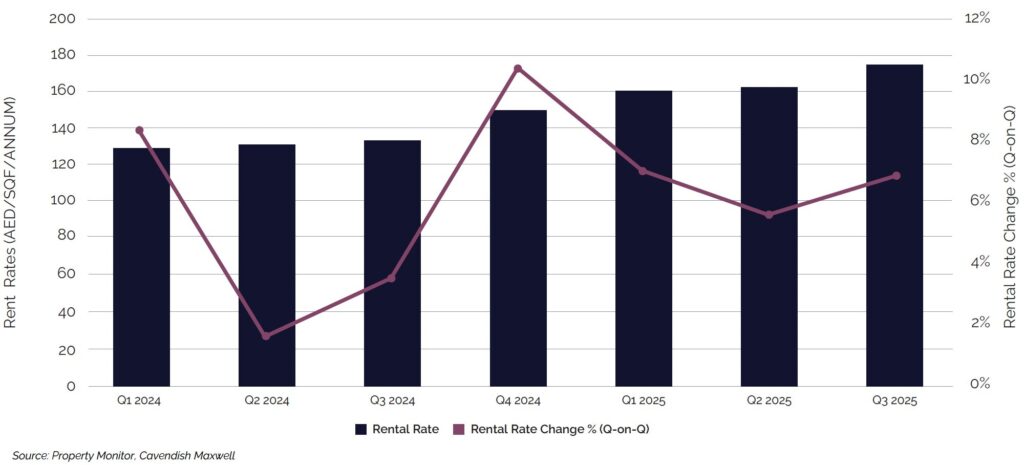

Strong demand combined with constrained supply continued to drive price and rental appreciation throughout Q3 2025. Office sales prices rose 5.3% quarter-on-quarter and 25.2% year-on-year, while rental rates increased 6.3% quarter-on-quarter and 29.5% year-on-year. The upward pressure resulted from limited new completions, with only 36% of the 224,000 sqm initially scheduled for 2025 delivered by Q3, keeping occupancy levels elevated and inventory tight.

The market is expected to remain firmly landlord-favourable through early 2026, with strong demand and modest near-term supply continuing to support rental growth and high occupancy. However, landlords and investors should monitor the longer-term pipeline closely, as approximately 1.1 million sqm of new supply scheduled for 2027-2028 could begin to rebalance market dynamics if economic conditions soften.

This report delves into the key factors fuelling the momentum of the Dubai office market, examines trends in office property prices and transaction volumes, and provides an outlook for the sector.

Dubai Market Snapshot for Q3 2025

- Sales Transactions: ~1,200 (+39.9% Y-on-Y)

- Office Sales Value: AED 3.1 Billion (+87.6% Y-on-Y)

- Office Sales Price: +25.2% Y-on-Y

- Office Rental Rate: +29.5% Y-on-Y

- New International Firms (Q1-Q3 2025): 261

- Multinational: 44

- SME’s: 217

Dubai’s Economic Growth and Investment Highlights

Dubai’s position as a global business hub continued to strengthen in Q3 2025, supported by robust growth in both new business formations and foreign direct investment. According to the latest figures from Dubai Chamber of Commerce, the chamber welcomed approximately 53,000 new member companies in the first nine months of 2025, representing 4% year-on-year growth. This steady expansion reflected the Emirate’s enduring appeal as a business destination, driven by its favourable regulatory environment, strategic geographic location, and world-class infrastructure.

The chamber’s international outreach proved particularly effective in attracting foreign companies to Dubai. Through its network of international offices and targeted engagement initiatives, the chamber attracted 261 companies to the Emirate in the first nine months of 2025, a 65.2% increase over the same period in 2024. This included 44 multinational corporations, up 10% year-on-year, and 217 small and medium-sized enterprises (SMEs), reflecting an 83.9% surge year-on-year.

Dubai’s office sector is experiencing one of its strongest phases in recent years as elevated occupancy, rapid business formation, and tight supply combine to support sustained growth. Prime districts are leading performance although well positioned secondary areas are increasingly benefiting from spillover demand. The market’s depth and stability underscore Dubai’s ability to attract and retain global businesses and continue delivering value for owners and investors.

Vidhi Shah

Director, Head of Commercial Valuation

At the same time, the chamber intensified its support for local companies seeking international expansion. In the first nine months of 2025, it facilitated the international growth of 90 Dubai-based companies, up 20% year-on-year. This highlighted Dubai’s strategic positioning as a two-way business gateway, facilitating both inbound foreign investment and outbound expansion for local companies.

Sales Transactions

Dubai’s office market continued to demonstrate strong momentum in Q3 2025, with both transaction volumes and values reaching one of their highest levels in recent years. Total sales activity rose to around 1,200 transactions, marking a 19.6% increase quarter-on-quarter and a 39.9% rise year-on-year. Although activity strengthened across both the ready and off-plan segments, the uplift was primarily driven by a sharp acceleration in off-plan sales, supported by robust demand for newer office projects featuring efficient layouts, ESG-aligned specifications and attractive developer payment plans.

In terms of transaction value, office sales reached approximately AED 3.1 billion, up 20.2% from the previous quarter and 87.6% higher than a year earlier. This strong performance highlights the growing appeal of Dubai’s office sector and the continued appetite among both investors and end-users for office spaces in the city.

Sales Transactions – By Volume and Value

Sales Transactions: Off-Plan vs. Ready

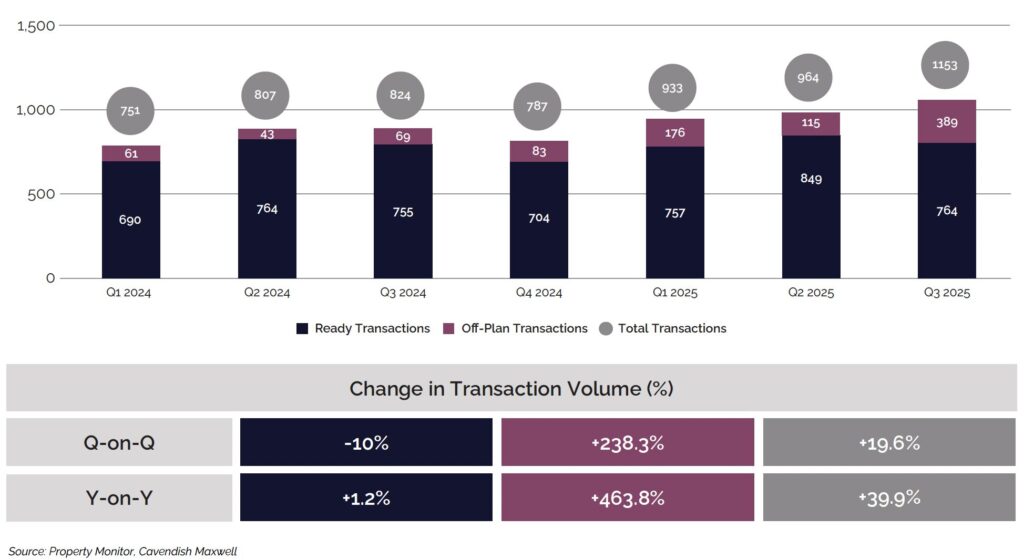

While both the off-plan and ready segments recorded annual growth, their quarterly performance diverged noticeably. The off-plan segment maintained its strong upward trajectory in Q3 2025, with transaction volumes rising by 238.3% compared to Q2 2025 and by 463.8% compared to Q3 2024, driven by a steady stream of new project l aunches and strong demand for future developments.

In contrast, the ready segment saw only a modest 1.2% year-on-year increase and a 10% quarter-on-quarter decline. This trend is consistent with previous years, where ready sales volumes typically soften in Q3 compared with Q2, reflecting seasonal factors that generally weigh on activity during this period.

Sales Transactions – By Volume

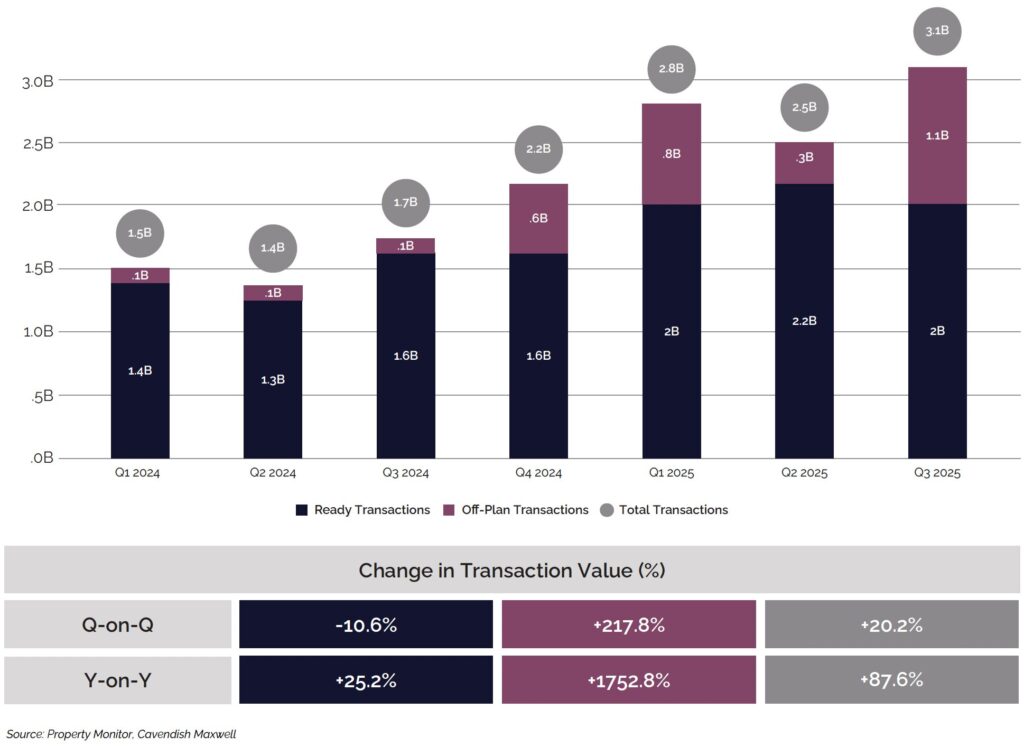

In terms of sales value, the ready segment contributed approximately AED 2.0 billion to the overall market, marking a 25.2% year-on-year increase, with an average transaction value of AED 2.6 million. Meanwhile, the off-plan segment surpassed the AED 1 billion threshold for the first time since Q2 2010, reaching AED 1.1 billion in total sales value, up sharply from just AED 0.1 billion recorded during the same period last year.

Sales Transactions – By Value (AED Billions)

Sales Transactions: Top 5 Areas by transactional volume

Combined Ready and Off-Plan Transactions

In Q3 2025, sales activity remained highly concentrated, with the top five locations accounting for 77.9% of all transactions. Business Bay led the market with 328 transactions, reflecting its continued appeal as a central business district, followed by Jumeirah Lakes Towers, which reinforces the strength of established commercial hubs. Meanwhile, newer areas such as Majan and Jumeirah Village Circle entered the top five for the first time, signalling growing buyer interest beyond the traditional commercial districts.

- Business Bay

328 Transactions - Jumeirah Lakes Towers

277 Transactions - Majan

112 Transactions - Jumeirah Village Circle

110 Transactions - Barsha Heights (Tecom)

71 Transactions

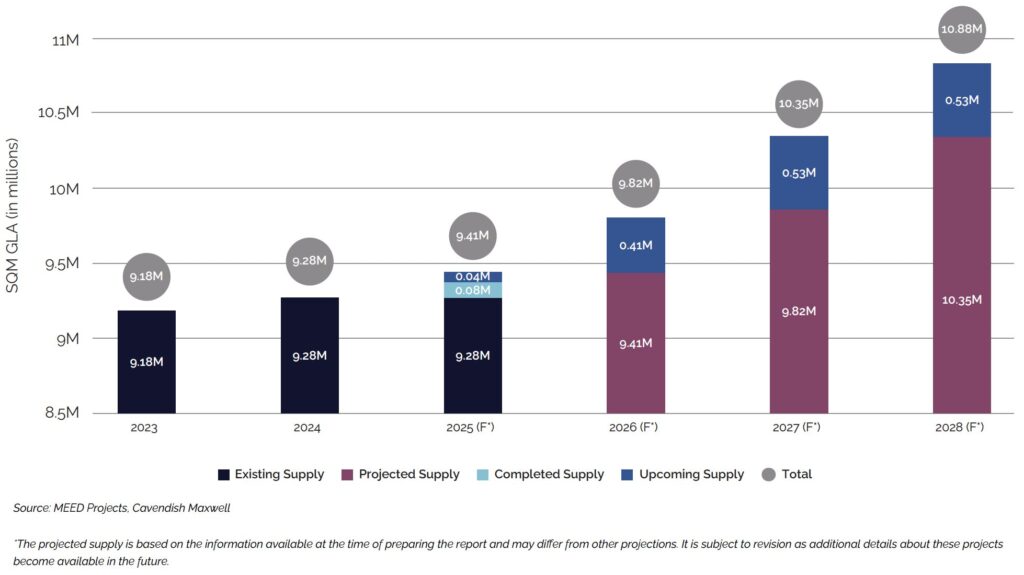

Existing and Future Office Supply

Dubai’s office market continued to expand in Q3 2025, with 80,000 sqm of new office space delivered in the first three quarters of the year, bringing total inventory to approximately 9.36 million sqm of GLA. An additional 40,500 sqm is expected to be completed before year-end, maintaining a moderate pace of growth in the near term. From 2026 onwards, supply is projected to accelerate, lifting total office stock to around 10.88 million sqm of GLA by 2028, reflecting a consistent pipeline of future completions.

Most of the upcoming supply is concentrated in established commercial hubs such as DIFC, JLT and Business Bay. These districts remain focal points for new office development, supported by strong connectivity, established business communities, and consistent demand for premium office space.

While the pipeline signals steady growth, actual delivery timelines may vary due to construction progress and broader market conditions. As a result, new office supply is expected to enter the market in phases rather than in a single surge. However, as additional supply comes online, the availability of new office space could potentially ease upward pressure on rental rates.

Office Supply (in SQM)

Sales Price Trend

Dubai’s office sales prices recorded strong growth in Q3 2025, rising 5.3% quarter-on-quarter and 25.2% year-on-year. Robust demand from both investors and end users, combined with limited supply and constrained sale inventory, fuelled continuous price appreciation across the market. High occupancy rates supported healthy rental returns, which, together with attractive capital appreciation, reinforced the investment appeal of Dubai’s office sector.

Sales Price Trend

Rental Rate Trend

Rising occupancy rates, driven by new business setups and expansions, kept the rental market firmly in landlords’ favour in Q3 2025. Despite the entry of new projects, demand continued to outpace supply, demonstrating the sector’s strong absorption capacity. As a result, rental rates in Dubai increased 6.3% quarter-on-quarter and 29.5% year-on-year, although performance varied across submarkets.

Rental Rate Trend

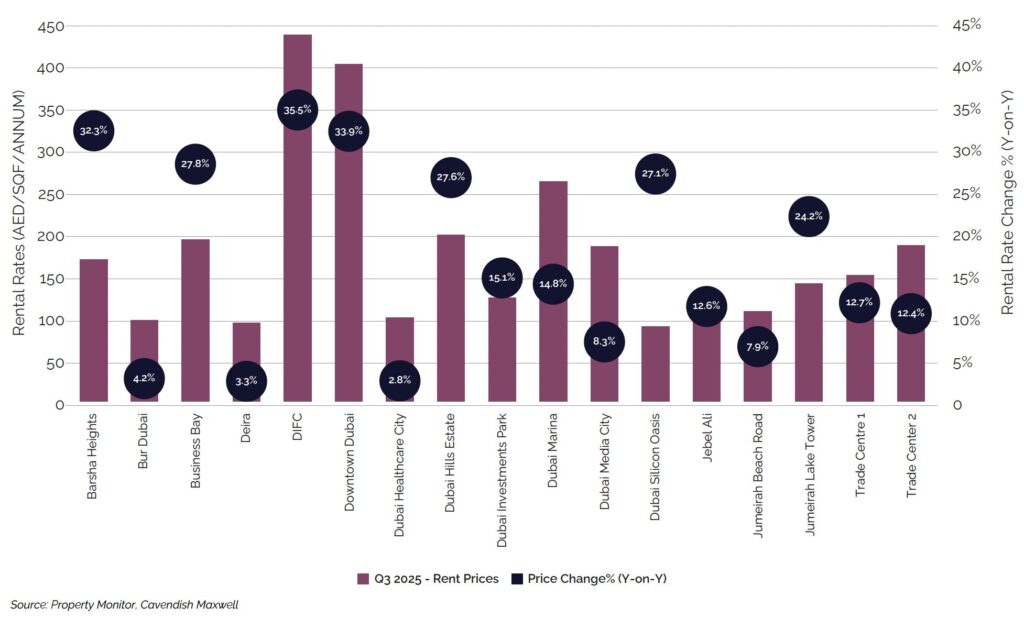

Rental Rate Change by Area (Q3 2024 vs. Q3 2025)

DIFC and Downtown Dubai recorded the highest office rental growth in Q3 2025, posting annual increases of 35.5% and 33.9% respectively, driven by strong demand for centrally located, high-quality office stock. Secondary locations such as Barsha Heights and Dubai Hills Estate also performed strongly, with year-on-year increases exceeding 27%, reflecting spillover demand as tenants sought alternatives to central business districts (CBDs). In contrast, mature submarkets with lower-quality assets, such as Bur Dubai and Deira, saw more modest rent growth of 4.2% and 3.3% respectively. This divergence highlighted a tiered market structure, where prime locations commanded premium growth due to limited supply and strong tenant demand, while well-positioned secondary areas benefited from displaced demand as value-oriented alternatives.

Rental Rate Movement in Q3 2025

2025 Real Estate Market Outlook

Dubai’s office market demonstrated strong momentum in Q3 2025, with transactional activity, occupancy rates, and rental rates all posting further gains. This performance is expected to continue through late 2025 and into early 2026, supported by steady economic growth and a favourable business environment. The formation of new businesses and the expansion of existing companies have increased the need for office space, while the Emirate’s appeal as a regional headquarters hub for multinational corporations has further reinforced structural demand.

Despite strong demand, supply conditions have remained tight. Of the approximately 224,000 sqm of new office space initially scheduled for delivery in 2025, only 36% had materialised by Q3. Although a further 40,500 sqm is expected before year-end, total completions are likely to fall short of projections. This limited pipeline, combined with steady absorption, is expected to continue placing upward pressure on occupancy levels and rental rates.

The market is also expected to remain bifurcated. Prime office stock, particularly in districts such as DIFC and Downtown Dubai, is positioned to experience the strongest rental growth, benefiting from strong occupier demand and limited new supply. Well-located secondary areas are also expected to capture spillover demand from tenants priced out of core commercial districts or seeking better value while maintaining accessibility and amenities. Older buildings in mature communities, however, are likely to see minimal appreciation as the flight to quality persists.

Looking ahead, the market is set to remain firmly landlord-favourable through early 2026. Rents are expected to continue rising, supported by strong demand, high occupancy, and a relatively modest supply outlook. However, landlords and investors should monitor the longer-term pipeline closely, as approximately 1.1 million sqm of new supply scheduled for 2027-2028 could begin to rebalance market dynamics if economic conditions soften.