Dubai Residential Market Performance FY 2025

Executive Summary

Dubai’s residential real estate market concluded 2025 on a record-breaking note, with transaction volumes surpassing 200,000 and total values reaching AED 541.5 billion. Both off-plan and ready property segments outperformed 2024 levels, supported by robust investor appetite, strong end-user demand, and a steady stream of new project launches. Off-plan transactions accounted for 72.9% of total market activity, up from 69.3% in 2024, reflecting the market’s increasing focus toward future developments. While this trend has driven growth, it has also created concentration risks, as the market has become heavily reliant on continued launch momentum and sustained buyer sentiment.

At the same time, supply dynamics are becoming more prominent. Around 40,400 residential units were completed in 2025, below the initial projection of 82,600 units, resulting in a materialisation rate of 48.9%. Even though total completions were below projections, the 2025 figure was 16.4% higher compared with the 34,700 units delivered in 2024. Looking ahead, approximately 110,500 residential units are projected for delivery in 2026, though historical completion rates suggest actual deliveries may range between 33,000 and 50,000 units. In terms of prices, residential prices rose 12.1% in 2025, decelerating from 16.5% in 2024, while rental growth slowed to 11-12% by year-end, down from 13-15% earlier in the year.

Despite these emerging trends, the broader macroeconomic and demographic fundamentals remain supportive. UAE GDP growth is projected at 5.2% in 2026, with Dubai expected to expand by 4.5%, supported by ongoing infrastructure investment, population growth, and sustained tourism momentum. These factors are expected to continue supporting demand across housing, retail, and commercial sectors, providing a buffer against potential external headwinds such as global trade tensions or volatility in financial and energy markets.

Looking ahead, Dubai’s real estate market is expected to remain relatively stable in 2026 as it transitions toward a more balanced phase. While sharp corrections appear unlikely given the Emirate’s solid macroeconomic foundation and continued population growth, price appreciation is expected to moderate as the market digests increasing supply and adjusts to rising costs. The coming quarters will be critical in gauging how effectively the market adjusts to these dynamics.

This report examines the key drivers behind 2025’s exceptional performance, analyses trends in property prices and transaction volumes, and provides an outlook for Dubai’s residential real estate sector in 2026.

Market Snapshot for FY 2025

- Sales Transactions: 200,800 (+18.8% Y-on-Y)

- Sales Value: AED 541.5 Billion (+26.9% Y-on-Y)

- Sales Price: +12.1% Y-on-Y

- Rental Rates: +11.1% Y-on-Y

- Residential Supply in 2025: 40,400 Completed

- Apartments: 32,500

- Villas/Townhouses: 7,900

Macroeconomic Overview and Outlook

While official 2025 GDP figures have yet to be released, the Central Bank of the UAE projects the economy to expand by 5% in 2025, with the hydrocarbon sector growing by 5.4% and the non-hydrocarbon sector by 4.9%. Looking ahead to 2026, the Central Bank forecasts overall GDP growth of 5.2%, driven by a 6.7% increase in hydrocarbon output and 4.7% growth in the non-hydrocarbon economy. The World Bank broadly aligns with this outlook, projecting GDP growth of 5% in 2026 despite ongoing global trade tensions.

At the Emirate level, Emirates NBD expects Dubai’s economy to expand by 4.5% in 2026, supported by continued strength across both the private and public sectors, continued momentum in tourism, ongoing infrastructure investment, and rising population and visitor numbers. Business activity indicators remained firmly positive in December, with the S&P Global UAE and Dubai PMI readings holding at 54.2 and 54.3, respectively.

Population growth is expected to continue playing a central role in supporting economic activity, driven by job creation, new business registrations, and steady inflows of expatriates and investors. This demographic expansion will continue to support demand across housing, retail, education, healthcare, and transport sectors. Tourism is also expected to remain a key growth pillar, with visitor volumes projected to remain above prior-year levels, supported by a strong events calendar, increased airline capacity, and Dubai’s position as a global transit and leisure hub.

Looking ahead, Dubai’s macroeconomic outlook remains positive. Economic diversification, population expansion, investor-friendly regulations, and strategic infrastructure investment position the Emirate to maintain steady momentum through 2026. While potential headwinds such as softer external demand or volatility in global financial and energy markets could pose challenges, Dubai’s strong domestic fundamentals are expected to provide resilience against these external risks.

After a record-breaking 2025, Dubai’s residential market is showing early signs of normalisation. Rising supply and slowing price growth point toward more balanced conditions in 2026, with performance increasingly dependent on absorption rates, buyer sentiment, and the market’s ability to digest upcoming completions.

Ronan Arthur

Director, Head of Residential Valuation

Sales Transactions

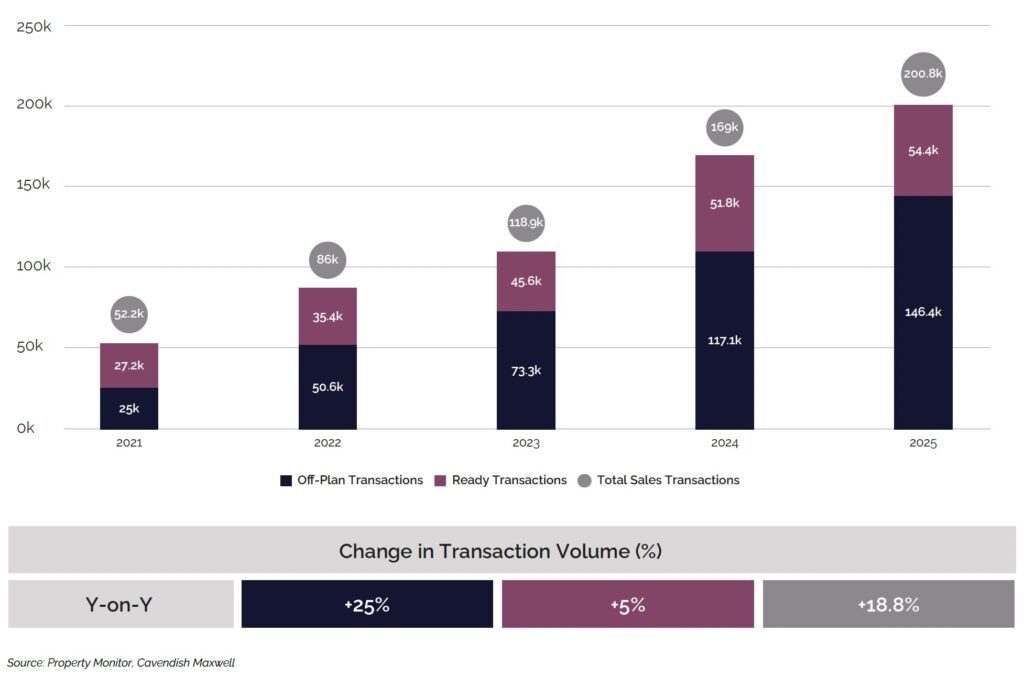

Sales Transactions: By Volume

Dubai’s residential market maintained its upward momentum in 2025, with both the off-plan and ready segments surpassing their 2024 transaction records. The market recorded over 200,000 sales transactions during the year, marking an 18.8% increase in volume compared to 2024. The off-plan segment was the primary driver of growth, with transaction volumes reaching 146,400 units, representing a 25% year-on-year increase. This performance was driven by a series of new project launches during the year, reflecting developer confidence and continued investor appetite for future developments. With the off-plan segment accounting for the majority of the growth, the market remains heavily reliant on future project delivery and investor sentiment, making it potentially vulnerable to shifts in demand or market conditions.

In contrast, ready property sales recorded more modest but steady growth, with volumes reaching 54,400 transactions, up 5% compared to 2024, supported by stable demand from end-users and investors seeking immediate occupancy or rental income opportunities. While transaction volumes dipped slightly in Q3 2025, activity rebounded in Q4, indicating that demand for ready properties remained resilient.

Sales Transactions – By Volume

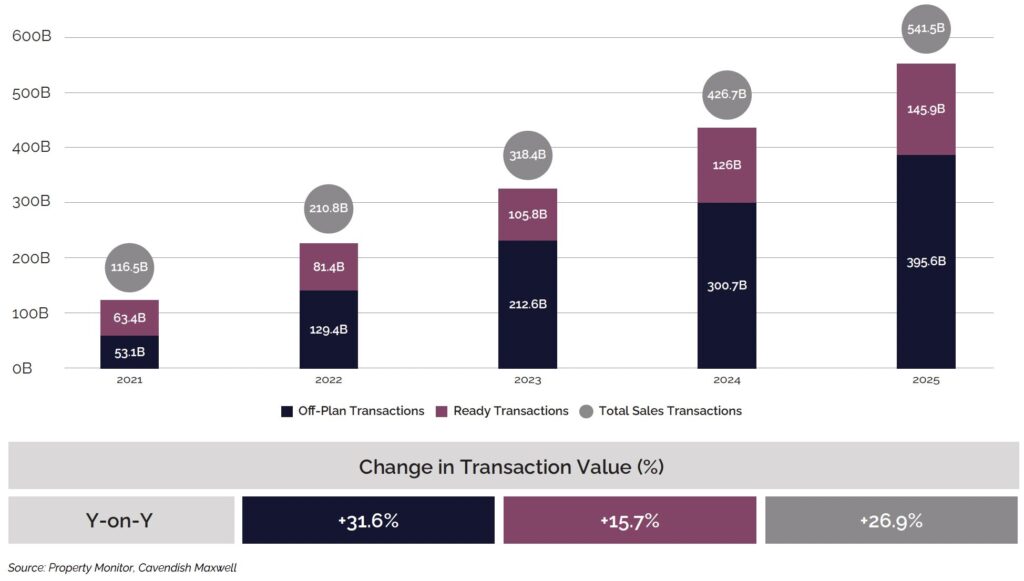

Sales Transactions: By Value

In 2025, total sales transaction values reached AED 541.5 billion, a 26.9% increase compared to 2024. This growth was primarily driven by off-plan transactions, which contributed AED 395.6 billion, representing a 31.6% year-on-year rise. Average off-plan ticket prices climbed from AED 2.57 million to AED 2.7 million during this period. Meanwhile, ready property transaction values reached AED 145.9 billion, marking a 15.7% increase, with average ticket prices rising from AED 2.43 million to AED 2.68 million.

Sales Transactions – By Value (AED Billions)

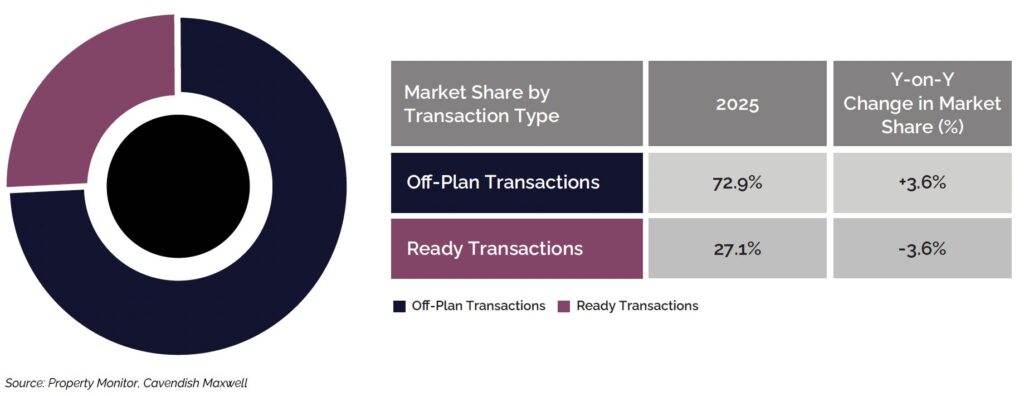

Sales Transactions: Off-Plan vs. Ready Property Transactions

Off-plan transactions accounted for 72.9% of total sales activity in 2025, up from 69.3% in 2024 and 61.7% in 2023, highlighting a market increasingly oriented toward future developments. This continued growth has been supported by flexible payment structures, attractive developer incentives, and strong investor participation. However, as off-plan dominance continues to rise, focus is shifting toward completion timelines and the market’s capacity to absorb newly delivered units. Questions are emerging around the balance between supply and demand, the resilience of pricing levels, and the potential implications for overall market stability as a substantial pipeline of inventory approaches completion over the coming period.

Sales by Transaction Type – 2025

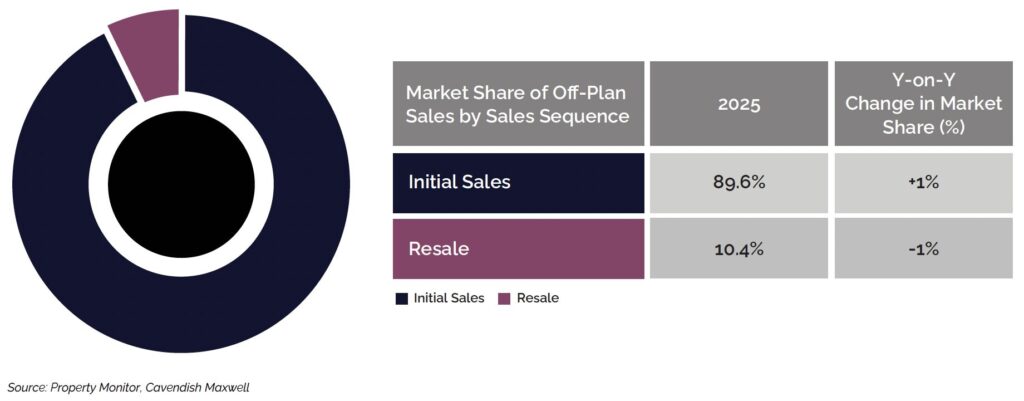

Sales Transactions: By Sales Sequence (Off-Plan)

In 2025, initial developer sales accounted for 89.6% of off-plan transaction activity, up from 88.6% in 2024. While the majority of sales were concentrated in projects launched in late 2024 and throughout 2025, transactions also continued in developments from earlier launch periods, indicating ongoing absorption beyond the initial launch phase.

Over the same period, off-plan resales declined to 10.4%, down from 11.4% in 2024 and 14.3% in 2023. This suggests that buyers are increasingly opting to purchase directly from developers, supported by flexible payment plans and launch incentives. Should this downward trend in resale activity persist, it could begin to weigh on demand from speculative investors who typically rely on the ability to exit positions prior to project completion.

Off-Plan Sales Transactions by Sales Sequence – 2025

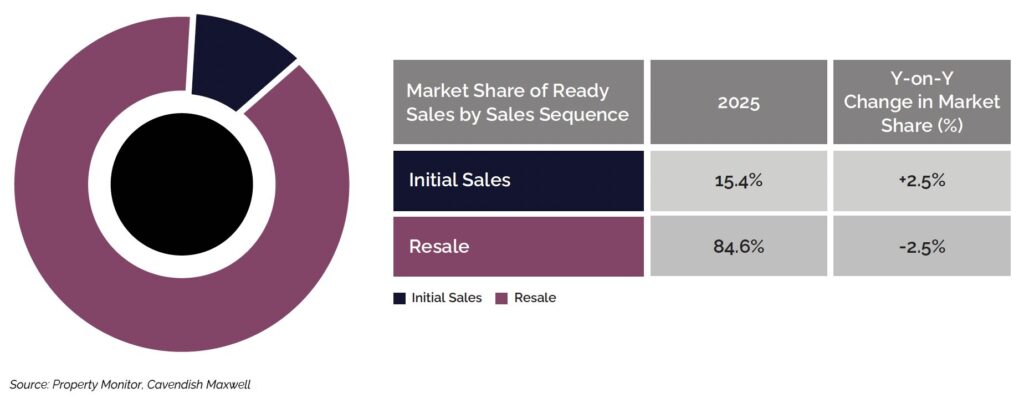

Sales Transactions: By Sales Sequence (Ready)

Among ready properties, resale activity continued to dominate the market; however, the share of resale transactions declined in 2025 as initial developer sales increased, driven primarily by heightened activity in the second half of the year. This shift indicates that developers were actively clearing ready units from their existing inventory.

Ready Sales Transactions by Sales Sequence – 2025

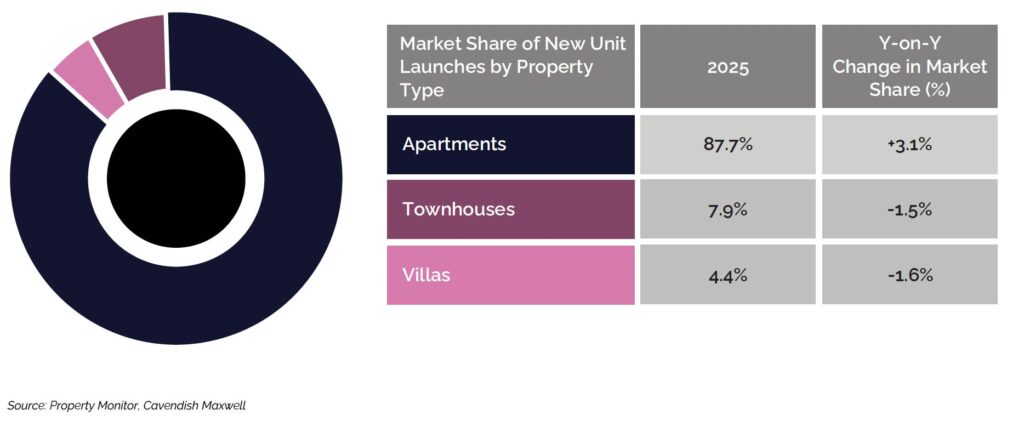

Sales Transactions: By Property Type (Off-Plan Properties)

Apartments maintained their dominance in the off-plan market, with their share climbing from 80.7% in 2024 to 83.3% in 2025. This growth was fuelled primarily by strong launch activity, as approximately 87.7% of all new projects introduced this year were apartment developments. Townhouse and villa transactions, while showing growth in absolute numbers, saw their combined market share contract from 19.3% to 16.7% over the same period, driven by a slowdown in new releases for these property types during Q2 and Q3 2025.

Off-Plan Sales Transactions by Property Type – 2025

Sales Transactions: By Property Type (Ready Properties)

In the ready segment, apartments remained the dominant property type, with transactions increasing slightly from 42,400 in 2024 to 44,400 in 2025, while their share of total activity remained steady at around 81.7%. Townhouse transactions also rose modestly to 6,400 in 2025, maintaining an 11.7% share, unchanged from 2024. Villa transactions recorded a slight increase to 3,600 in 2025, keeping their share stable at 6.6%, similar to the previous year.

Ready Sales Transactions by Property Type – 2025

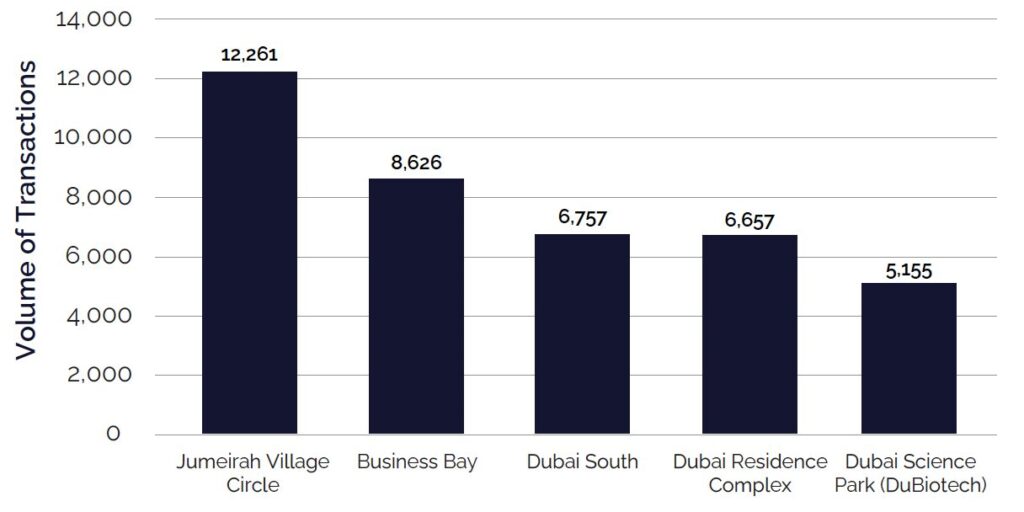

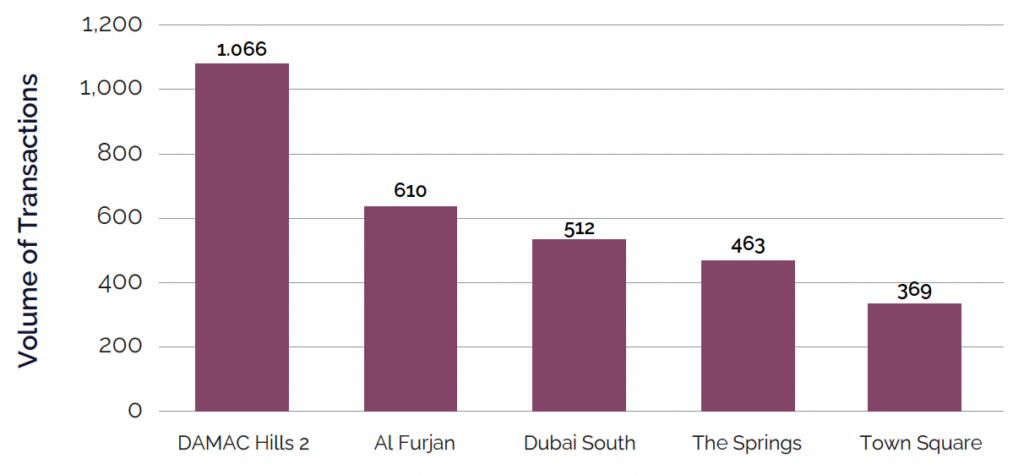

Sales Transactions: Top Five Locations

For Apartment Transactions by Volume –2025

Off-Plan Property Sales Transactions

Source: Property Monitor, Cavendish Maxwell

Ready Property Sales Transactions

Source: Property Monitor, Cavendish Maxwell

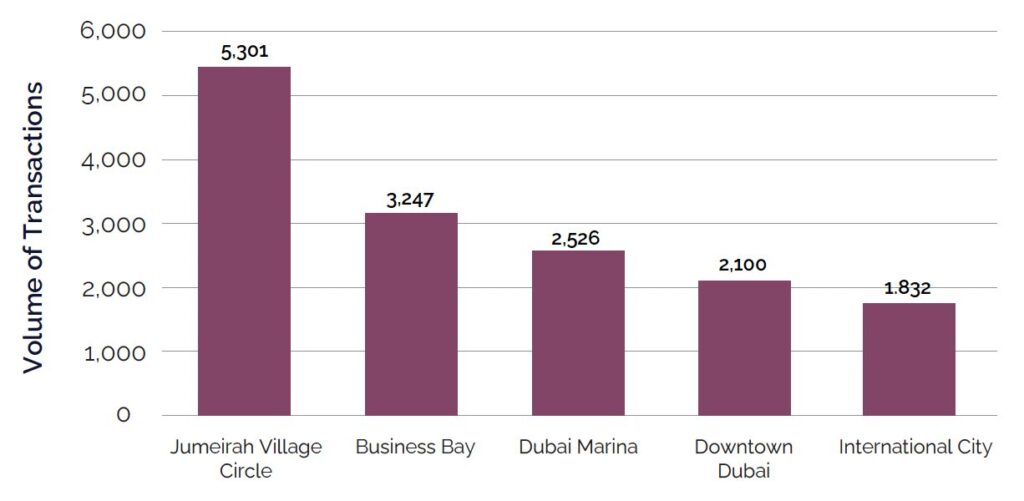

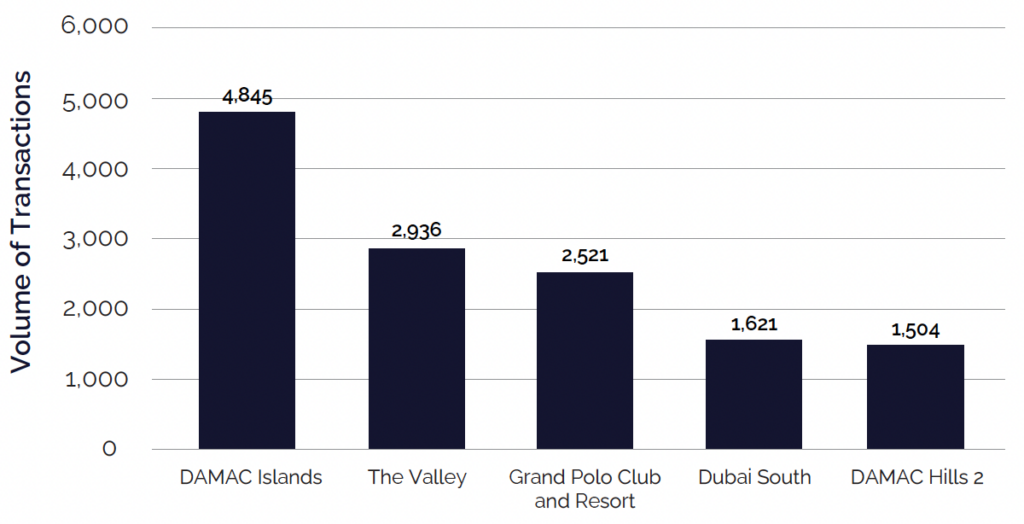

For Villa/Townhouse Transactions by Volume – 2025

Off-Plan Property Sales Transactions

Source: Property Monitor, Cavendish Maxwell

Ready Property Sales Transactions

Source: Property Monitor, Cavendish Maxwell

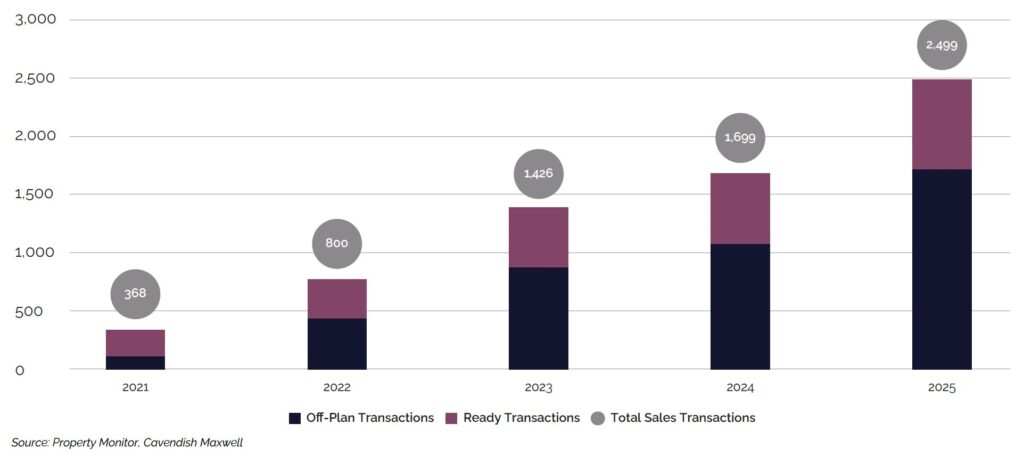

Sales Transactions: Luxury Properties (AED 20 million and above)

Dubai’s luxury property segment recorded approximately 2,500 transactions in 2025, marking a 47.1% increase in transaction volumes compared to the previous year. While both off-plan and ready property segments demonstrated growth, off-plan sales led with a 52.6% year-on-year increase, accounting for 70.5% of all luxury transactions. The surge in demand was supported by a combination of attractive lifestyle and fiscal advantages provided by the city, including safety and political stability, a favourable tax environment, strategic connectivity, high-quality infrastructure, and investor-friendly visa programmes.

Luxury Property Sales Transactions – By Volume

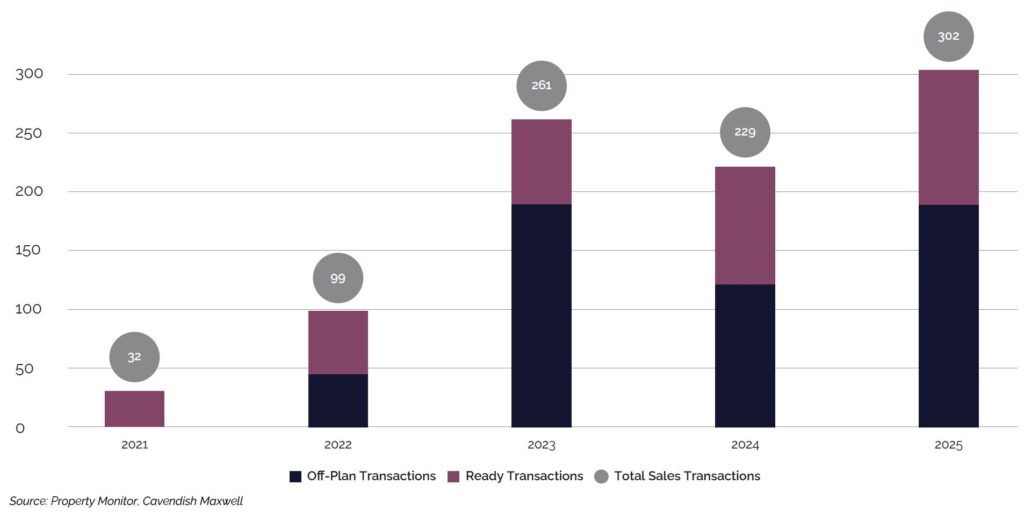

Sales Transactions: Ultra-Luxury Properties (AED 50 million and above)

The ultra-luxury segment, though niche, exhibited robust performance in 2025 with 302 transactions totalling AED 27.9 billion, representing increases of 31.9% in transaction volume and 53.7% in value compared to 2024. This momentum highlights the growing preference among HNWIs and UHNWIs for Dubai as both a residential and investment destination.

Ultra-Luxury Property Sales Transactions – By Volume

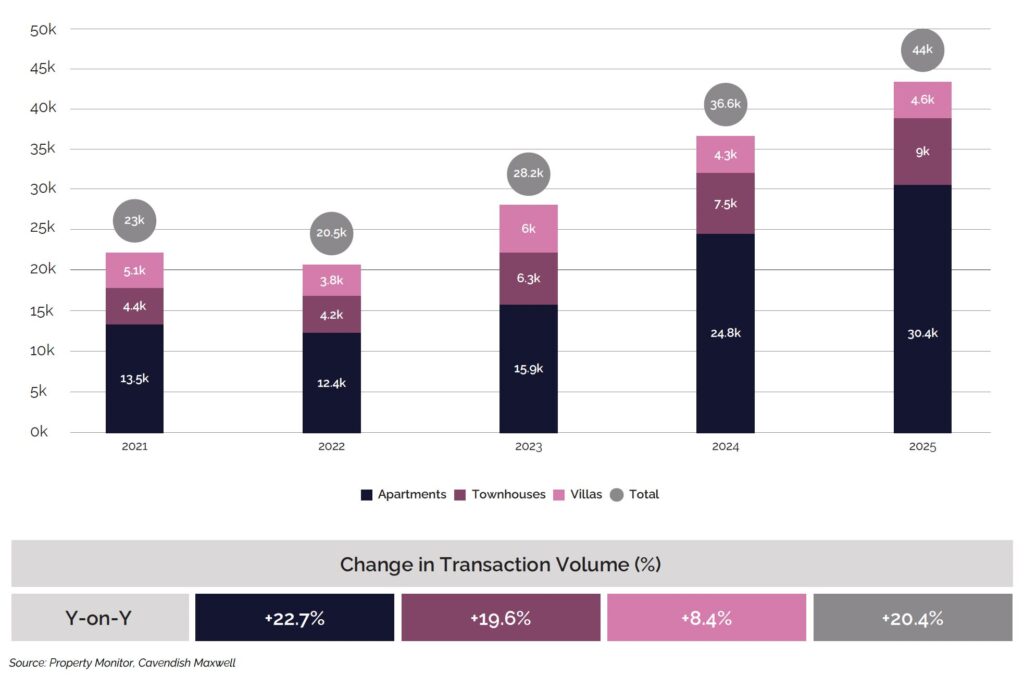

Mortgage Transactions

Residential mortgage activity continued to expand in 2025, rising to around 44,000 transactions, driven by strong demand from both end-users and investors. As the market grows, an increasing number of buyers are relying on financing to access the market, pushing mortgage activity higher across key segments. Overall, mortgage volumes increased 20.4% year-on-year, with the majority of growth coming from heightened activity in the apartment and townhouse segments.

Mortgage Transactions – By Volume

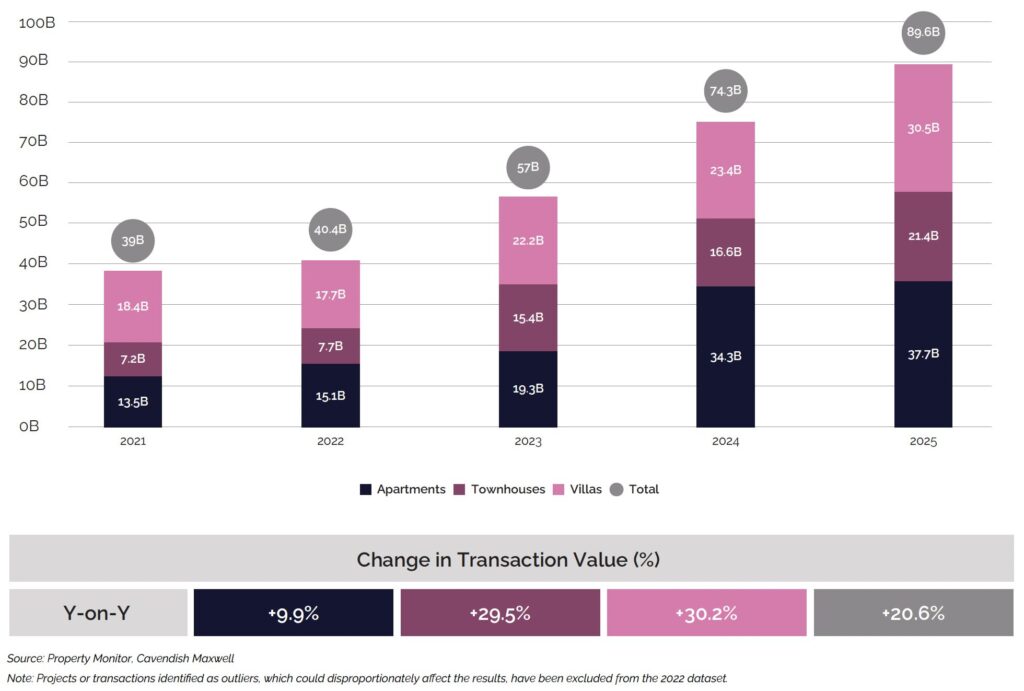

Mortgage transaction values showed a similar upward trend reaching AED 89.6 billion in 2025 an increase of 20.6% compared to last year. Most of this growth came from villa and townhouse mortgages which recorded the strongest rise in value and together accounted for about 57.9% of total residential mortgage activity by value.

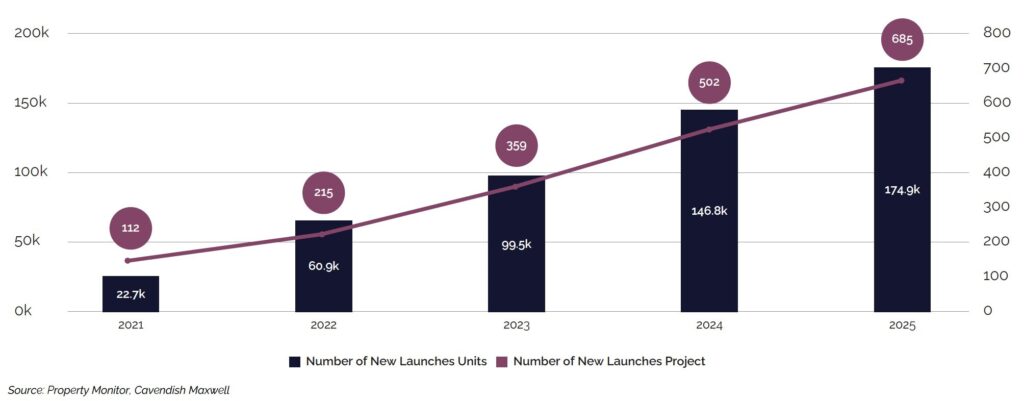

New Project Launches

In 2025 Dubai’s residential market continued its strong momentum in new launches with the number of projects rising from 502 in 2024 to 685 and launched units increasing from roughly 146,800 to 174,900. This translated into an average of about 479 units launched per day compared with around 401 the year before. Looking ahead the off-plan segment will continue to rely heavily on the pace of new project releases. If developers continue to launch projects with the same intensity the off-plan segment is expected to maintain its momentum. However, as new launches increase the existing supply pipeline will expand further which will test the market’s absorption capacity and potentially weigh on pricing once these units come to market.

New Launches: Number of Units and Projects

Apartments continued to dominate new launch activity in 2025, accounting for 87.7% of total units, up from 84.5% in 2024. During the same period, villa launches declined from 6.0% to 4.4%, while townhouses fell from 9.4% to 7.9%. This trend highlights developers’ ongoing preference for apartments, driven by faster sales cycles and their appeal to a broader range of buyers, including both investors and end-users. However, the increasing concentration of apartments highlights the need to closely monitor supply dynamics, as a large volume of these units are scheduled to enter the market over the coming years.

Supply: Number of Completed Units

Approximately 40,400 residential units were completed in 2025, below the initial projection of 82,600 units, resulting in a materialisation rate of 48.9%. Even though total completions were below projections, the 2025 figure was 16.4% higher compared with the 34,700 units delivered in 2024.

Apartments accounted for the majority of completions, with 32,500 units delivered, marking a 24% year-on-year increase. In contrast, villa and townhouse completions declined by 6.9% year on year to 7,900 units. Deliveries were largely concentrated in key locations, with Jumeirah Village Circle, Arjan, Business Bay, Sobha Hartland, and Dubai Creek Harbour together accounting for 42% of total residential completions in 2025. Looking ahead, if completions continue to rise at the same pace, the market’s absorption capacity could be tested, potentially putting pressure on prices.

Completed Units (in Thousands)

Supply: Upcoming Supply

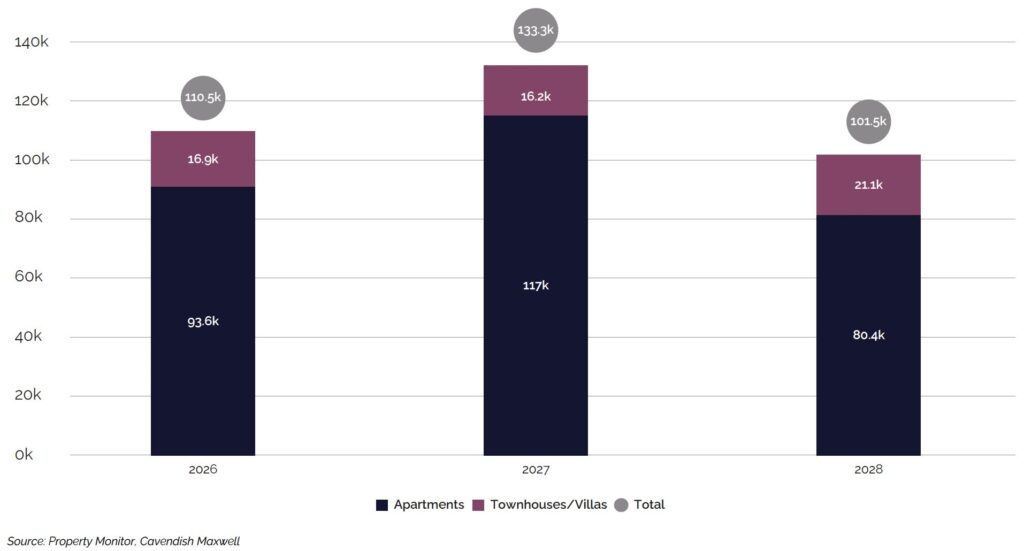

Around 110,500 residential units are projected for delivery in 2026, with the last quarter expected to account for the highest concentration of project completions. However, based on historical trends, actual deliveries in 2026 are likely to be lower, ranging between 33,000 and 50,000 units, with some of the projected supply potentially spilling over into 2027.

Looking further ahead, approximately 133,300 units are anticipated in 2027, followed by 101,500 units in 2028. Apartments are expected to dominate the upcoming completions, representing 84.3% of projected units through 2028, while townhouses and villas make up the remainder. Key locations, including Jumeirah Village Circle, Dubai South, Business Bay, Dubai Residence Complex, and DAMAC Lagoons, are forecast to contribute the largest share of supply, collectively accounting for 30.7% of all projected deliveries during this period.

Upcoming Supply (in Thousands)

Supply: Construction Dynamics

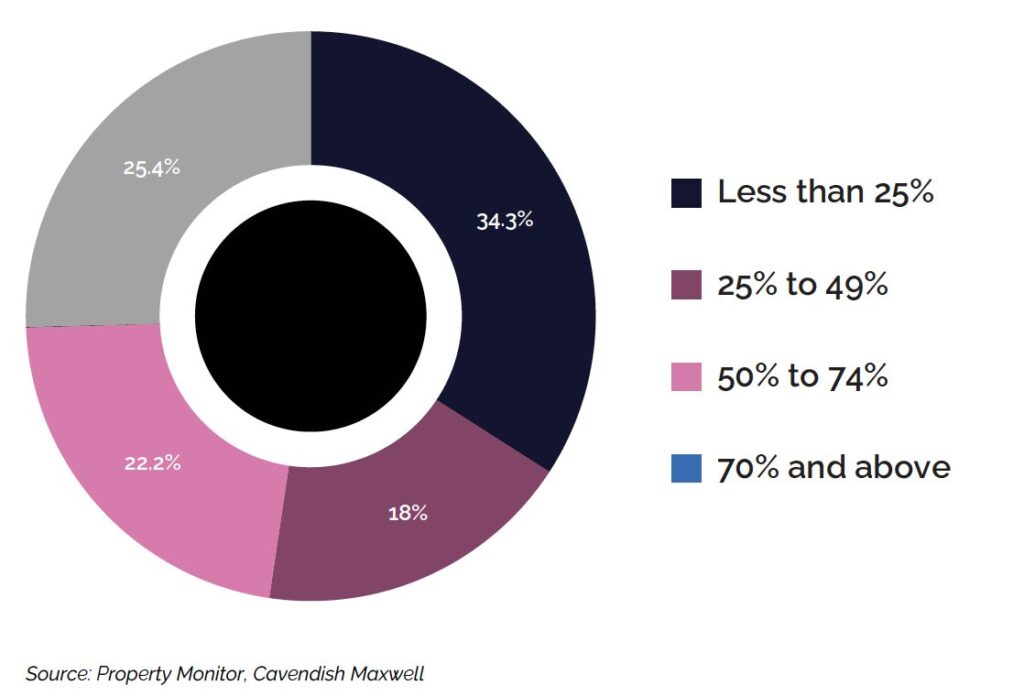

Around 34.3% of the 110,500 units projected for 2026 remain in early-stage construction, with less than 25% completion. Meanwhile, only 25.4% of the units have reached 75% or more construction progress, further highlighting the risk of delivery slippages.

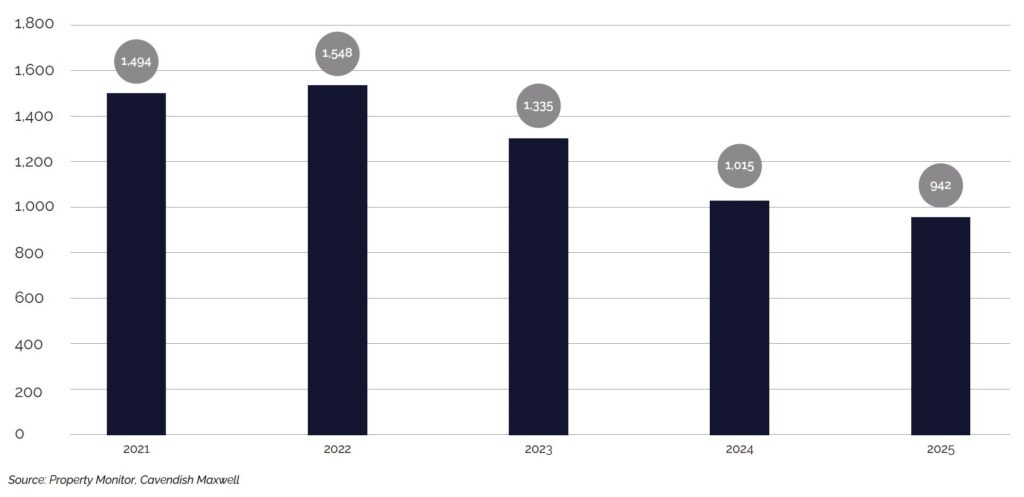

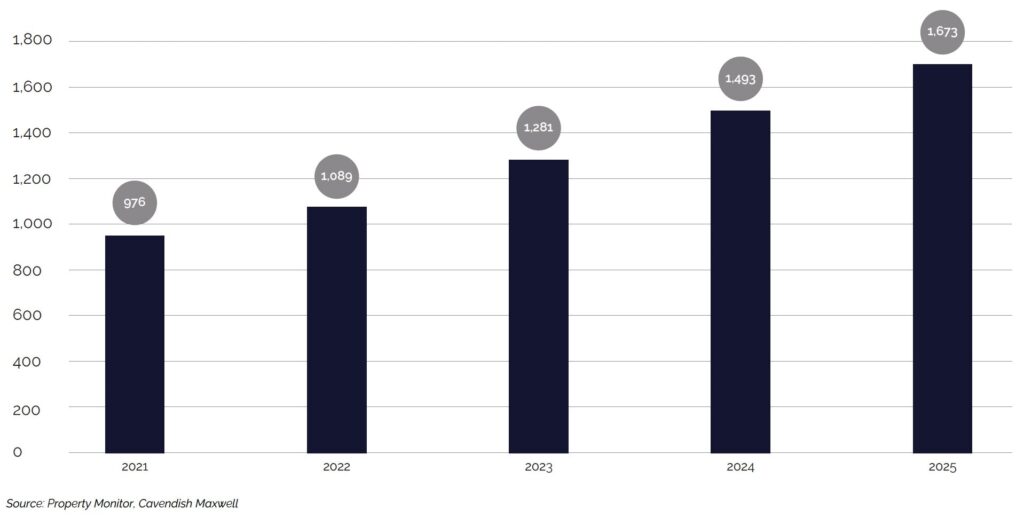

Interestingly, construction timelines for completed units in Dubai have accelerated significantly. Units delivered in 2021 took an average of 1,494 days (approximately 4.1 years) to complete, while those delivered in 2024 averaged 1,015 days (2.8 years). By 2025, construction duration had fallen further to 942 days (2.6 years), representing a 7.2% reduction compared to 2024 and a 36.9% reduction compared to 2021.

Average Construction Cycle for Completed Units (Days)

Sales Price Trend

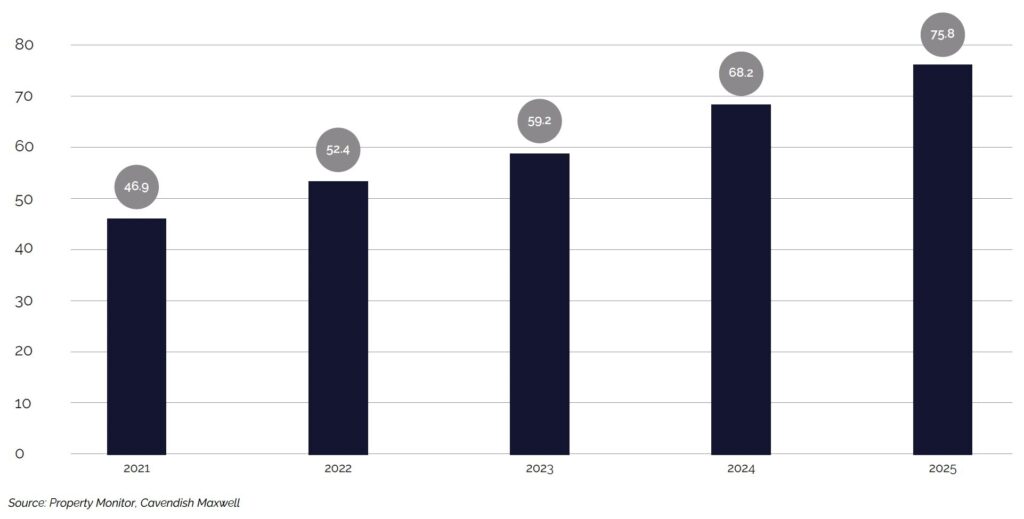

Residential prices in Dubai continued their upward trajectory in 2025, rising by 12.1% year-on-year as sales transactions reached record highs. While growth remains robust, the pace has moderated from 16.5% in 2024 and 17.6% in 2023, signalling a gradual cooling from the market’s peak momentum.

This moderation, however, was not uniform across the city. Areas such as Discovery Gardens, Dubai Marina, Arabian Ranches 2, and Dubai Hills Estate recorded double-digit annual price increases, while locations including Jumeirah Lakes Towers, Downtown Dubai, Dubai Creek Harbour, and Business Bay experienced more moderate single-digit growth.

Overall, strong buyer demand, supported by solid economic fundamentals, population growth, and investor appetite, has continued to support price increases despite rising supply. Yet the slower rate of appreciation suggests that the market is entering a more mature phase. The coming months will be critical in determining whether this trend represents a brief cooling or a more structural shift in Dubai’s residential market.

Sales Price Trend (in AED/SQF)

Rental Rate Trend

Supported by continued population growth and a steady inflow of talent, rental prices in Dubai rose 11.1% in 2025 compared to 2024. However, the pace of growth has eased, declining to 11–12% in recent months from the 13–15% range recorded earlier in the year. This reflects the market’s gradual rebalancing, as new residential supply in key areas increases tenant options and reduces upward pressure on rents. Looking ahead, the rental market is expected to remain relatively stable, with further moderation likely as deliveries accelerate.

Rental Rate Trend (in AED/SQF/YEAR)

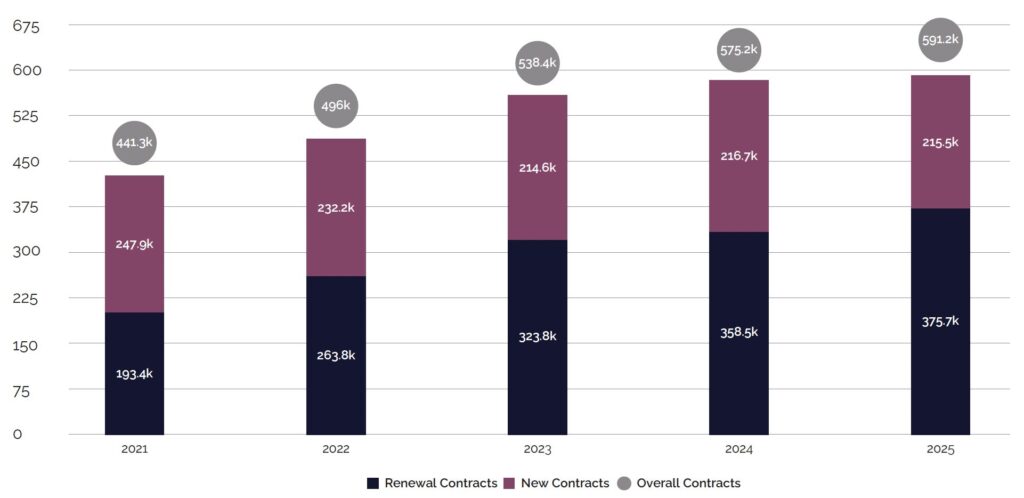

In 2025, more than 590,000 rental contracts were registered, with renewals continuing to dominate the market and accounting for around 63.5% of all contracts. Overall, rental contract volumes rose by 2.8% year-on-year, a slower pace compared with the 6.8% increase recorded in 2024.

Gross Rental Yields: Apartments and Villas/Townhouses

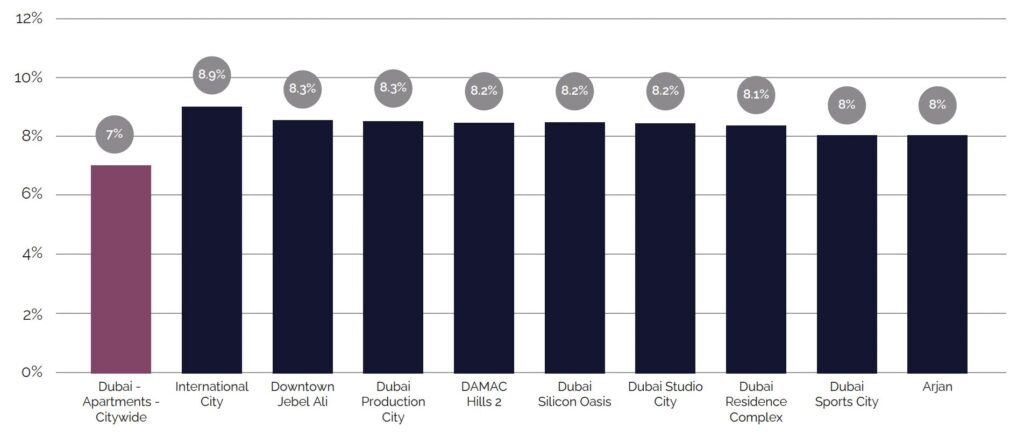

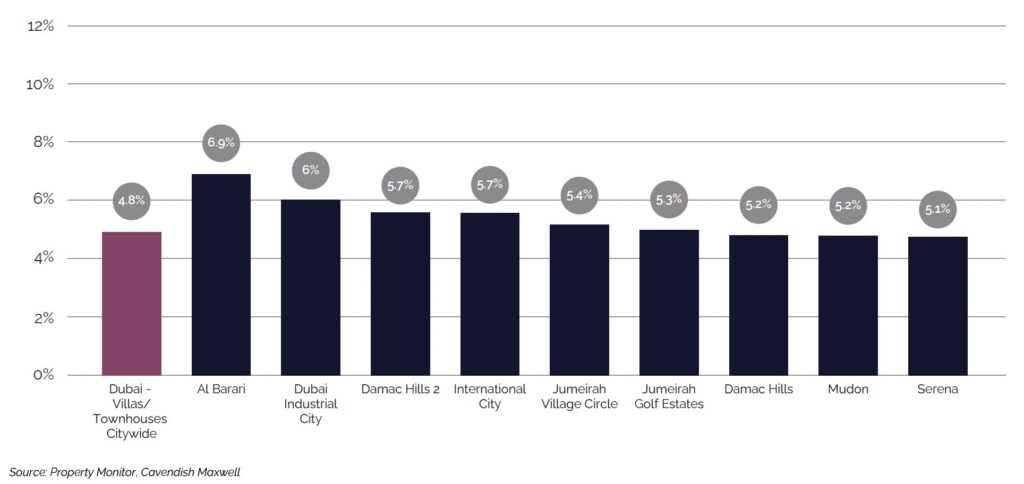

As of 2025, gross rental yields in Dubai stood at 7.0% for apartments and 4.8% for villas and townhouses. Among apartment communities, International City, Downtown Jebel Ali, and Dubai Production City recorded the highest yields, while for villas and townhouses, Al Barari, Dubai Industrial City, and Damac Hills 2 led the market.

Top 10 Areas by Gross Rental Yields – Apartments

Top 10 Areas by Gross Rental Yields – Villas/Townhouses

2026 Real Estate Market Outlook

Dubai’s residential real estate market enters 2026 following a record-breaking 2025, which saw transaction volumes exceed 200,000 transactions and total transaction values reaching AED 541.5 billion. Both off-plan and ready property segments outperformed prior-year levels, driven by strong investor appetite, robust end-user demand, and a steady influx of new project launches throughout the year. However, beneath this exceptional performance, certain structural shifts are emerging that require careful attention. The off-plan segment now accounts for 72.9% of total residential market activity, up from 69.3% in 2024 and 61.7% in 2023, reflecting a market increasingly focused toward future developments rather than completed inventory. While flexible payment plans, developer incentives, and continued new launches are expected to drive off-plan momentum in 2026, this growing concentration introduces potential vulnerabilities. Any slowdown in launch activity or weakening of buyer sentiment could have amplified effects given the segment’s dominant market share.

Adding to this dynamic is the supply pipeline, with approximately 110,500 units projected for delivery in 2026. While historical completion rates suggest actual deliveries may fall between 33,000 and 50,000 units, even at the lower end this represents a significant influx of new inventory. The impact of increasing supply is already visible in moderating price and rental growth across the Emirate. Residential prices rose 12.1% in 2025, decelerating from 16.5% in 2024 and 17.6% in 2023, signalling a gradual cooling from the market’s peak momentum. This moderation has been uneven, with some areas recording double-digit annual increases while certain locations posted only single-digit appreciation. This divergence suggests certain segments may be reaching pricing ceilings or facing localised supply pressures. At the same time, rising construction costs and elevated land prices are adding upward pressure to development expenses. In an environment of moderating price growth and expanding supply, this may compress margins and encourage more disciplined pricing.

The rental market reflects a similar trajectory, with growth slowing from 13-15% earlier in 2025 to 11-12% by year-end as new completions increased tenant options and reduced upward pressure on rents. Rental contract volumes rose just 2.8% year-on-year in 2025, down from 6.8% growth in 2024, further indicating market rebalancing. As additional units enter the market in 2026, this moderating trend is likely to continue, putting further pressure on both sales prices and rental rates.

Beyond domestic supply-demand dynamics, external headwinds add another layer of consideration to the 2026 outlook. Global trade tensions, volatility in financial and energy markets, and potential shifts in investor sentiment could weigh on transaction activity, particularly among international buyers who have been instrumental in driving recent growth. Any deterioration in global economic conditions or changes in competing markets could impact momentum more quickly than anticipated.

Amidst a generally supportive geopolitical and macro-economic environment Dubai has now seen almost five straight years of sustained price growth. As 2026 begins, market signals such as falls in other markets, rapid rises in local land prices, the dominance of off-plan sales, and continued strong supply pipelines, have now become more mixed. In the background, regional tensions may also give overseas investors pause for thought. Now more than ever understanding the broader economic picture has become the hallmark of successful investment in this market.

Julian Roche

Chief Economist, Cavendish Maxwell

Looking ahead, Dubai’s real estate market is expected to remain relatively stable in 2026, supported by strong economic fundamentals, continued population expansion, and ongoing infrastructure investment. Tourism is projected to maintain momentum with visitor volumes expected to surpass prior-year levels, while business activity indicators remain positive. However, the market is entering a critical transition phase where supply pressures, moderating growth trajectories, and potential external headwinds require heightened vigilance. While a sharp correction appears unlikely given Dubai’s solid macroeconomic foundation, diversified economy, and sustained population growth, stakeholders in the market should prepare for a more balanced environment characterised by moderate appreciation and heightened selectivity. Careful monitoring of actual completion volumes, off-plan resale activity trends, price performance in high-supply locations, and rental growth trajectories will be essential for identifying early warning signals.