Dubai Retail and Warehouse Market Performance Q3 2025

Executive Summary with Key Trends

Dubai’s retail and warehouse markets delivered a strong performance in Q3 2025, supported by resilient demand, constrained supply, and improving investor confidence. Retail sales activity accelerated sharply during the quarter, with transaction volumes rising quarter on quarter and total deal value surpassing the AED 1 billion mark for the first time in a single quarter, driven primarily by robust off-plan activity.

On the leasing side, limited availability of well-located retail space continued to shape market dynamics. While new rental transactions declined, renewal activity increased as tenants prioritised the retention of established locations, reinforcing upward pressure on rents. Retail rental rates recorded broad-based growth of 7% to 15% across key districts, reflecting sustained demand supported by population growth, record tourism levels, and rising occupancy across the city.

The warehouse sector remained one of Dubai’s strongest-performing asset classes. Although overall leasing volumes softened due to fewer new contracts, renewal activity surged as occupiers focused on securing existing facilities in a supply-constrained environment. This dynamic, combined with structural demand from e-commerce and Dubai’s expanding role as a regional logistics hub, drove double-digit rental growth averaging 16.8% year on year across industrial submarkets.

Looking ahead, persistent supply constraints across both the retail and warehouse sectors suggest that rental growth momentum is likely to continue over the near to medium term, with occupiers increasingly prioritising location security and operational continuity over cost considerations.

Retail Sales Transactions

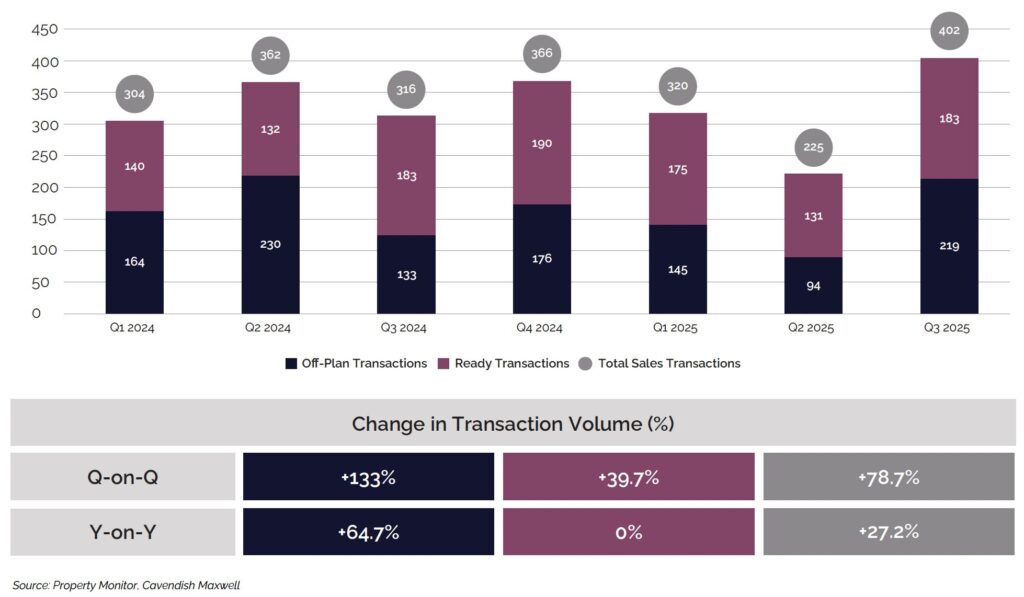

In the third quarter of 2025, Dubai’s retail market recorded approximately 400 sales transactions. Transaction volumes rose sharply, increasing by 78.7% quarter on quarter and 27.2% year on year, largely driven by strong off plan sales activity. Off plan transactions grew by 133% quarter on quarter and 64.7% year on year. In parallel, the total value of retail sales transactions reached AED 1.1 billion, surpassing the AED 1 billion mark for the first time in a single quarter, reflecting strong de mand for retail assets within the city.

Sales Transactions – By Volume

Retail Rental Transactions

With limited availability of well-located, high-footfall retail space, renewal contracts increased by 6.1% compared to Q3 2024, indicating that tenants continue to retain existing locations despite rising rental rates, reflecting both the strategic value of established retail assets and the strong competition for prime space. On the other hand, new contracts declined by 32.2% compared to Q3 2024.

Rental Transactions – By Volume

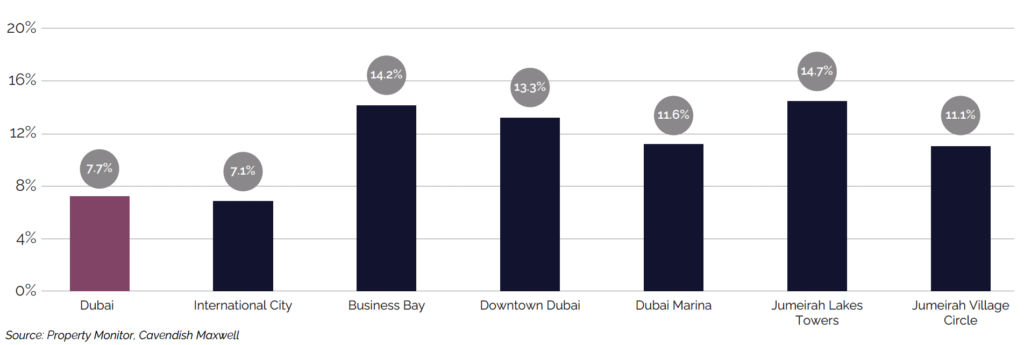

Retail Rental Performance

As occupancy levels continue to rise and supply remains constrained, retail rents across Dubai maintained an upward trajectory in Q3 2025, with year on year growth across key districts ranging from 7% to 15%, and an overall increase of 7.7% at the city level. The continued increase in rental rates reflects the ongoing imbalance between available retail space and tenant demand, further amplified by Dubai’s population growth and record tourism figures that continue to support consumer spending across the Emirate.

Rental Rates – Year-on-Year Change (%)

Warehouse Rental Transactions

In Q3 2025, Dubai’s warehouse market recorded approximately 4,200 rental transactions, down 8.3% compared to the same period last year, primarily due to a reduction in new contract registrations. However, renewal contracts increased by 62.2% during the same period, indicating that tenants are prioritising space retention over relocation in a constrained supply environment where securing alternative facilities has become increasingly challenging, even as rental rates continue to rise across the city.

Rental Transactions – By Volume

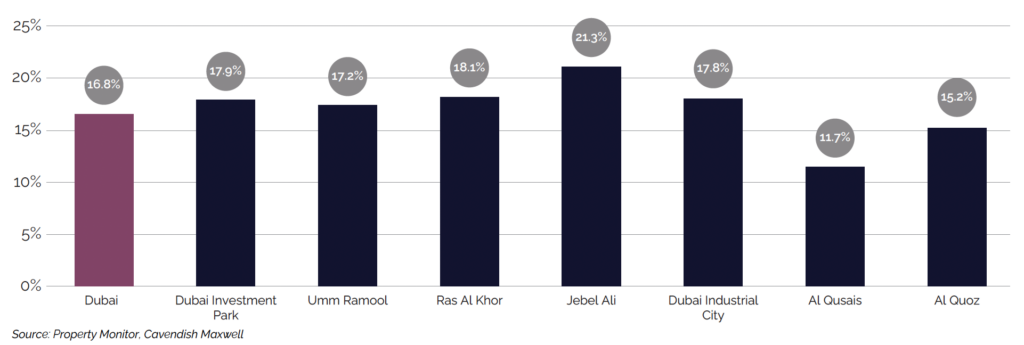

Warehouse Rental Performance

Dubai’s warehouse market experienced robust rental growth in Q3 2025, with average rates rising 16.8% year on year. This upward trajectory was consistent across all major industrial districts, with growth rates ranging from 12% to 21%, highlighting the strength of demand and persistent supply constraints affecting the sector. Rental appreciation remained broad-based across both established and emerging warehouse clusters, with occupiers competing for limited available space across Dubai’s industrial landscape.

Rental Rates – Year-on-Year Change (%)

Market Outlook

In Q3 2025, both Emaar and Majid Al Futtaim maintained an average occupancy of 98% across their mall portfolios, reflecting strong footfall and robust tenant demand at Dubai’s key retail locations. Iconic destinations such as Dubai Mall continue to achieve near-full occupancy, highlighting the enduring appeal of premium, experiential retail environments.

Looking ahead, the market is set to develop through the growth of smaller community malls focused on daily needs and convenience, alongside ongoing investment in large flagship destinations. The AED 5 billion planned expansion at Mall of the Emirates further illustrates this approach, with leading operators creating experiences centred on dining, entertainment, wellness, and luxury offerings that cannot be replicated through e-commerce. This strategy highlights an evolving retail landscape, where neighbourhood convenience and destination experiences coexist to meet the evolving preferences of consumers across the Emirate.

Dubai’s retail sector is marked by strong demand and limited prime space which is driving tenants to secure established locations as experiential destinations and community focused assets continue to mature. At the same time, the warehouse sector is defined by persistent demand and tight supply as occupiers prioritise operational continuity in a logistics driven economy. Together these dynamics underline a market where location security and long term stability carry greater strategic value than ever.

Siraj Ahmed

Director, Head of Strategy and Consulting

Beyond retail, Dubai’s warehouse sector shows no signs of slowing, with rental rates rising by nearly 17% year on year amid tightening supply conditions. With businesses predominantly choosing to renew existing leases rather than relocate, new available space has become increasingly scarce, creating a highly competitive environment for new entrants and expanding operators. This trend is further reinforced by the growth of e-commerce, Dubai’s expanding role as a regional logistics hub, and ongoing challenges in bringing new supply to market. As a result, occupiers are prioritising space retention and operational continuity over cost, absorbing double-digit rental increases to secure facilities in a market where alternatives are limited.