Abu Dhabi Residential Market Performance 2024

Executive Summary

Abu Dhabi’s economy has experienced solid growth, with a 3.9% GDP increase in the first nine months of 2024, largely driven by the non-oil sector, which now contributes more than half of the economy. With growth projected at 5.0-6.0% in 2025 and inflation remaining stable, the outlook remains optimistic, supporting confidence in the real estate market as well.

Abu Dhabi recorded 9,700 residential sales transactions worth AED 26 billion in 2024. While total transactions declined compared to the previous year, the ready property segment surged by 49.0% in volume, reflecting strong interest in the residential market. Sales prices for apartments increased by 11.4%, while villa prices rose by 12.6%. During the same period, rental prices also saw growth, with apartment rents rising by 12.7% and villa rents increasing by 8.0%.

Looking ahead, the market is expected to continue growing in 2025, with 10,800 units set for delivery. Demand for prime locations and Government incentives will further support this growth. Mortgage activity is also projected to rise, driven by favourable financing conditions, particularly for apartments and villas.

This report explores the key drivers fuelling this momentum, analyses trends in property prices and transactional volumes, and provides an outlook for Abu Dhabi’s residential sector.

Abu Dhabi Market Snapshot for 2024

- Abu Dhabi GDP Growth in 2024 (First 9 Months): +3.9%

- Abu Dhabi GDP Forecast for 2025: +5.0% to +6.0%

- Overall Residential Sales Transactions Volume: 9,700 (-13.0% vs. 2023)

- Ready Residential Sales Transactions Volume: 4,250 (+49.0% vs. 2023)

- Off-Plan Residential Sales Transactions Volume: 5,450 (-34.0%% vs. 2023)

- Overall Residential Sales Transactions Value: AED 26 Billion (-26.0% vs. 2023)

- Ready Residential Sales Transactions Value: AED 9 Billion (+31.0% vs. 2023)

- Off-Plan Residential Sales Transactions Value: AED 17 Billion (-40.0% vs. 2023)

- Overall Residential Mortgage Transactions Volume: 4,900 (+34.0% vs. 2023)

- Overall Residential Mortgage Transactions Value: AED 7 Billion (+5.0% vs. 2023)

- Number of Residential Units Delivered in 2024: 5,200 Units

- Number of New Residential Launches in 2024: 11,000 Units

- Projected Residential Supply for 2025: 10,800 Units

Macroeconomic Overview and Outlook

Macroeconomic Overview

Abu Dhabi’s economy remains firmly on a growth trajectory, outperforming expectations in 2024. Real GDP expanded by 3.9% over Q1-Q3’24, accelerating to 4.5% in Q3’24—surpassing initial forecasts. This growth was driven primarily by the non-oil sector, which grew by 4.5% over the first three quarters and surged to 6.6% in Q3’24. Non-oil activities now contribute more than half of the Emirate’s economy, reinforcing Abu Dhabi’s diversification strategy.

The financial sector has played a key role in supporting this expansion, with bank deposits rising by 13.0% year-on-year by the end of Q2’24. Strategic investments by the Abu Dhabi Government, in collaboration with the private sector, have fuelled growth in education, transport and logistics, tourism, healthcare, and natural resources. These sectors have stimulated employment and wage growth, generating a surge in demand for specialised real estate, including schools, warehouses, hotels, hospitals, clinics, and office spaces.

Economic activity indicators highlight this momentum, with Zayed International Airport handling 13.7 million passengers in H1’24—a year-on-year increase of over 33.0%. Meanwhile, the construction sector, Abu Dhabi’s largest non-oil GDP contributor at 8.8%, recorded 10.0% year-on-year growth in Q3’24, reinforcing its crucial role in the Emirate’s economic transformation.

Macroeconomic Outlook

Abu Dhabi’s economic outlook also remains strong, with GDP growth forecasted to reach 5.0-6.0% in 2025, keeping the Emirate ahead of major global economies. Inflation is expected to remain stable at 2.2%, creating a favourable environment for sustained expansion. These projections reinforce confidence in the continued stability and growth of the real estate market.

From a currency perspective, real estate values in global terms remain well-supported by the strong US dollar, which is bolstered by US economic performance, policy settings, and ongoing geopolitical uncertainty. Interest rates are expected to stay higher than in the Eurozone, where economic growth remains subdued.

Additionally, the UAE’s liberalisation of business investment, trade, and economic policies positions it to benefit from the higher growth projected in emerging markets. Trade, investment, and real estate remain deeply interconnected, with Iraq, India, and Türkiye now ranking as the UAE’s top non-oil trading partners. As a result, we may see increased investment from these countries in the real estate sector as well. These trends will continue to shape Abu Dhabi’s macroeconomic landscape, reinforcing its position as a diversified and resilient economy.

“The residential market in Abu Dhabi is currently experiencing steady growth, driven by increased demand and strategic Government initiatives. Looking ahead, the market is poised for further expansion, with sustainable development and innovative housing solutions set to shape its future. The diversification of deliverables is supporting continued demand and price appreciation. This is being elevated by the expansion of infrastructure and community offerings adjacent to projects, creating more attractive living environments.

With a positive economic outlook and ongoing urban development, Abu Dhabi’s residential market is well-positioned for sustained growth and resilience.”

Andrew Laver

Associate Partner, Commercial Valuation – Abu Dhabi

Residential Sales Transactions

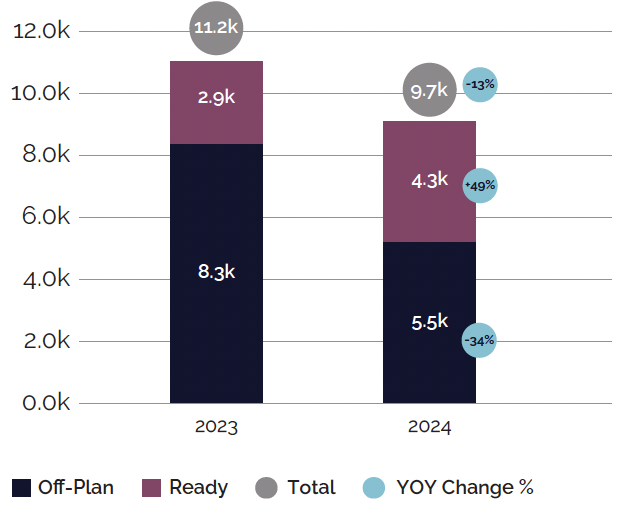

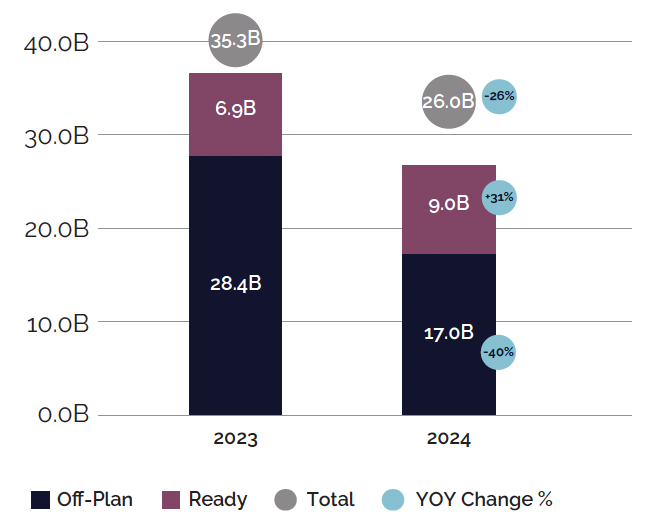

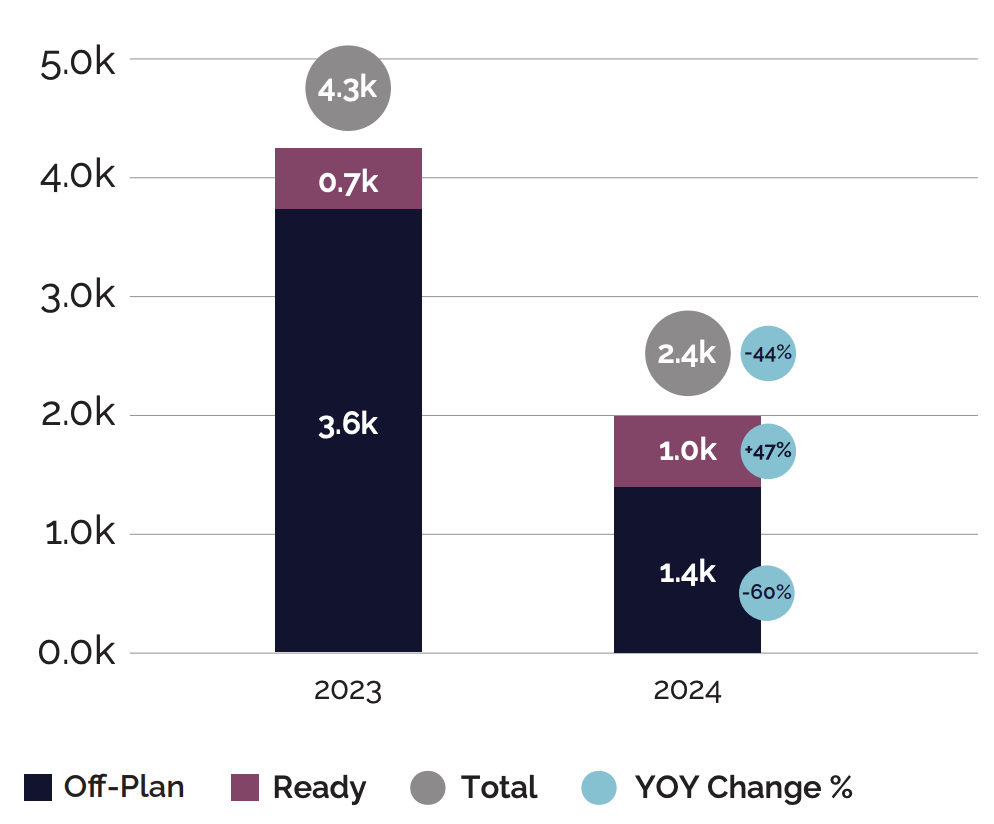

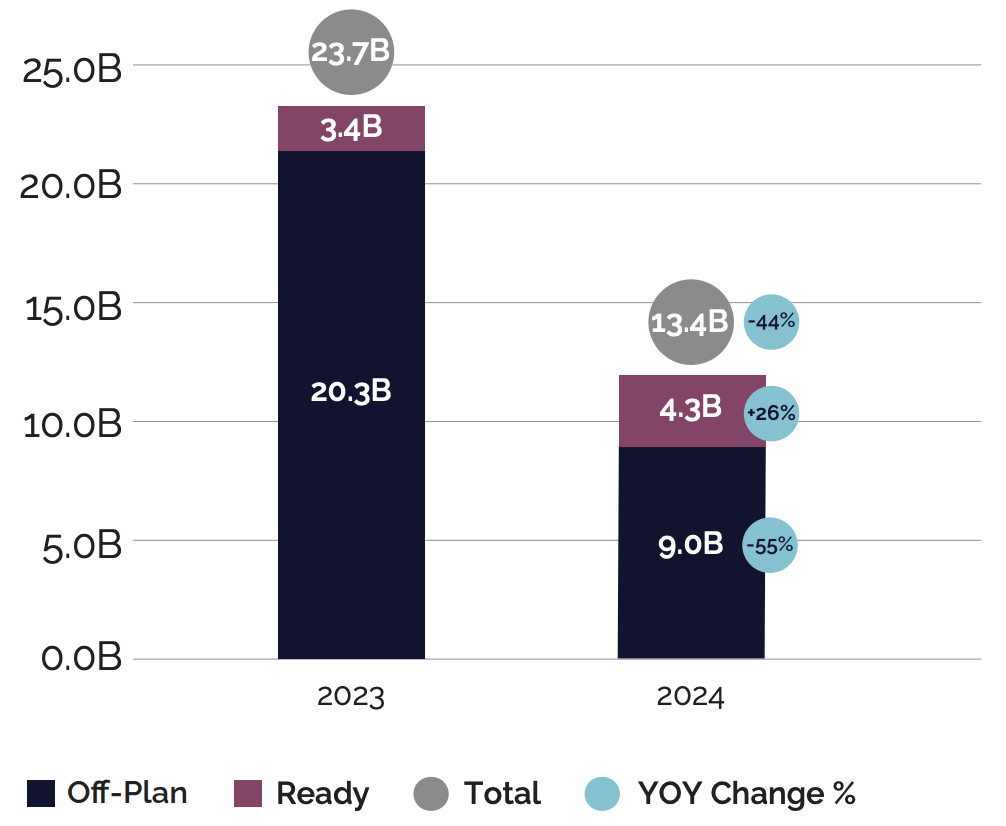

In 2024, Abu Dhabi city recorded approximately 9,700 residential sales transactions, totalling AED 26 billion. Compared to the previous year, transaction volume declined by 13.0%, while total value saw a higher drop of 26.0%.

The decline in the transactional activity was primarily driven by a reduction in off-plan property sales, largely due to a reduction in new project launches. In contrast, ready property transactions saw an uptick, likely fuelled by growing interest in homeownership, increased investor confidence supported by positive Government initiatives, greater availability of completed units, and the scarcity of new off-plan launches.

Abu Dhabi City Residential Transactions – By Volume

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

Abu Dhabi City Residential Transactions By Value (AED Billions)

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

Residential Sales Transactions by Property Type

Residential Sales Transactions for Apartments

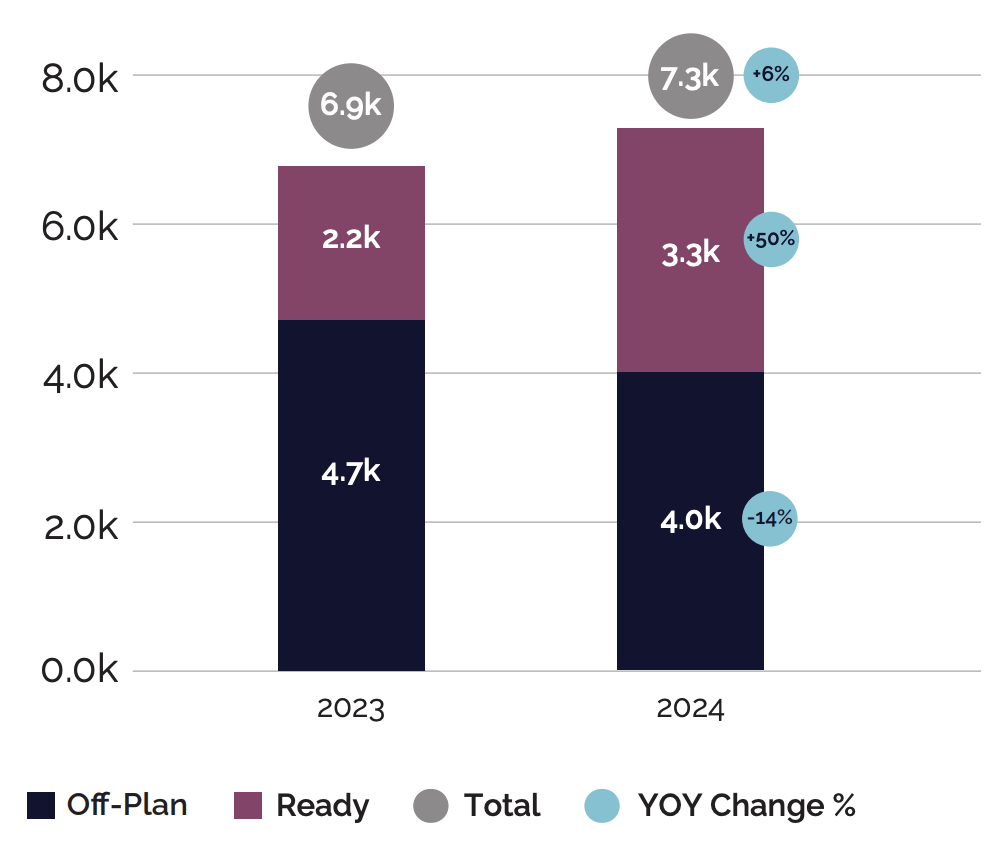

The volume and value of apartment sales transactions in 2024 increased by 6.0% and 9.0%, respectively, compared to 2023. Apartments now represent 75.0% of all residential sales transactions, up from 62.0% the previous year. This growth was primarily driven by ready apartments, which saw a 50.0% increase in transactions year-over-year. In contrast, off-plan transactions experienced a decline of 14.0% during the same period.

Abu Dhabi City Apartment Transactions By Volume

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

Abu Dhabi City Apartment Transactions By Value (AED Billions)

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

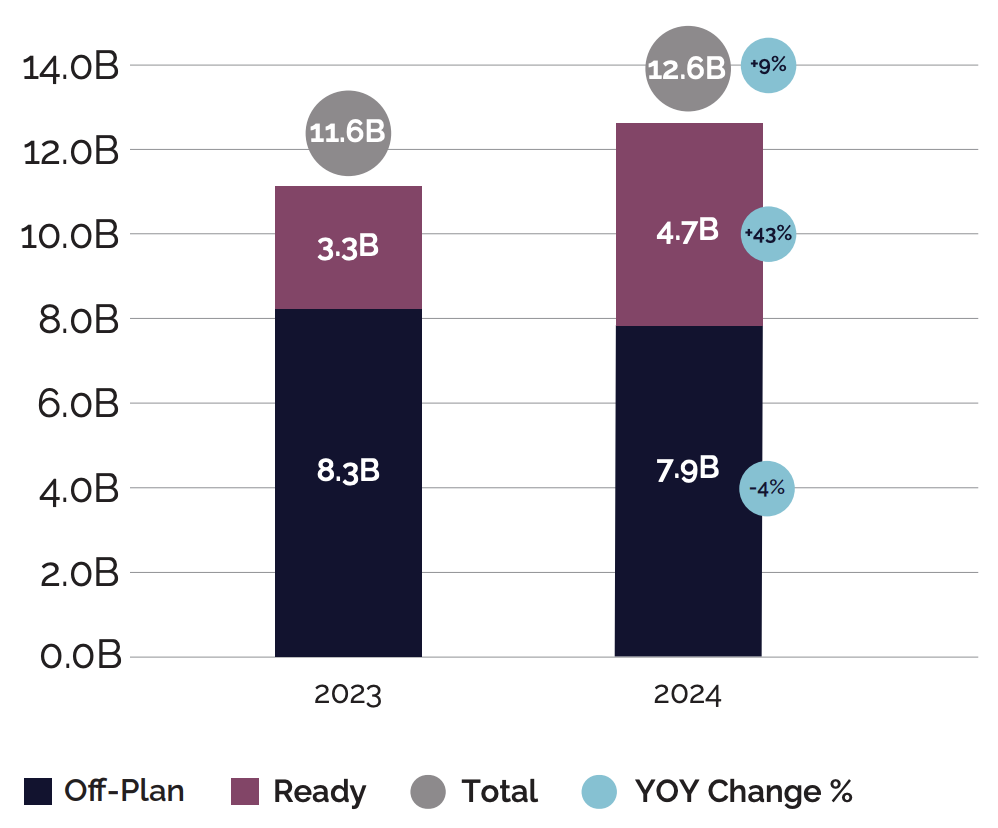

Residential Sales Transactions for Villas and Townhouses

While apartment transactions showed an overall increase, villa and townhouse transactions saw a significant decline compared to the previous year, with both volume and value dropping by 44.0%.

This decline in villa and townhouse sales transactions is primarily attributed to a reduction in off-plan sales, driven by limited new project launches in the Emirate. However, during the same period, the volume and value of ready property transactions increased by 47.0% and 26.0%, respectively, reflecting growing investor and homebuyer confidence in the market for completed properties.

Abu Dhabi City Villa/Townhouse Transactions – By Volume

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

Abu Dhabi City Villa/Townhouse Transactions – By Value (AED Billions)

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

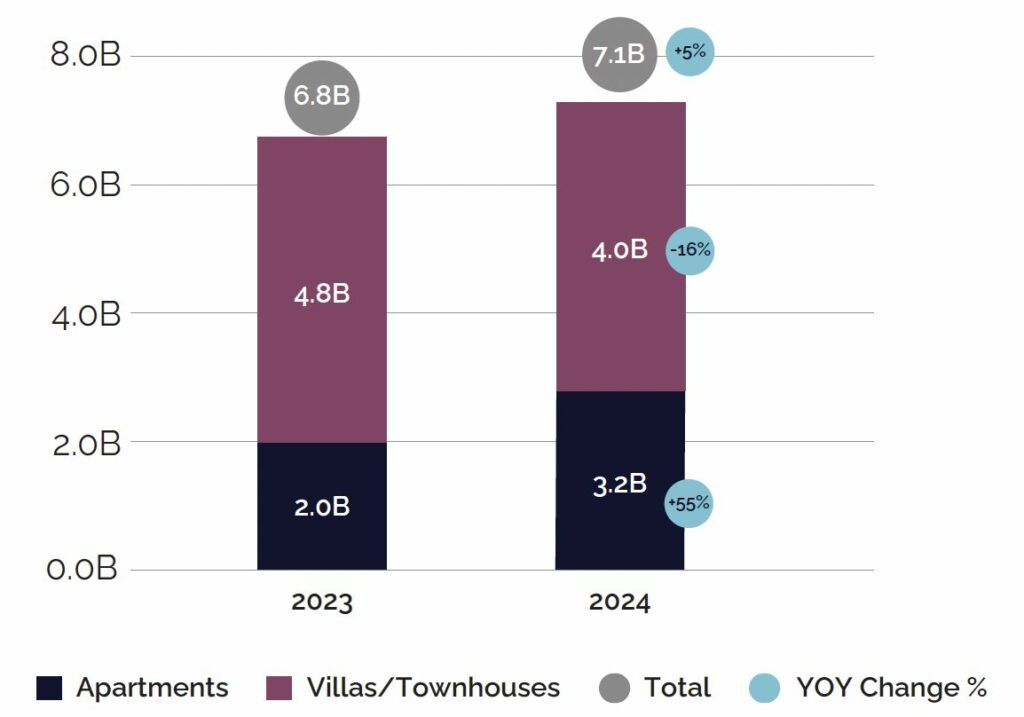

Residential Mortgage Transactions

With falling interest rates, increasing investor confidence, and attractive mortgage offers from banks, Abu Dhabi has seen a significant surge in mortgage transactions. This growth comes even as overall sales transactions have slightly declined, reflecting a clear shift from cash purchases to financing, alongside a notable rise in refinancing activity. The increased availability of financing options has also made homeownership more accessible to a wider range of buyers, further driving the growth in mortgage transactions.

In 2024, the volume and value of residential mortgage transactions rose by 34.0% and 5.0%, respectively. The increase was largely driven by apartment mortgage transactions, which saw a substantial 66.0% growth in volume and 55.0% in value. On the other hand, villa/townhouse mortgage transactions grew by 7.0% in volume, but their value decreased by 16.0%.

If the US Federal Reserve maintains its cautious approach to interest rates in 2025, as it did in 2024, low borrowing costs could continue, further stimulating mortgage demand in Abu Dhabi’s real estate market, particularly in the villa/townhouse and apartment segments.

Abu Dhabi City Residential Mortgage Transactions – By Volume

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

Abu Dhabi City Residential Mortgage Transactions – By Value (AED Billions)

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

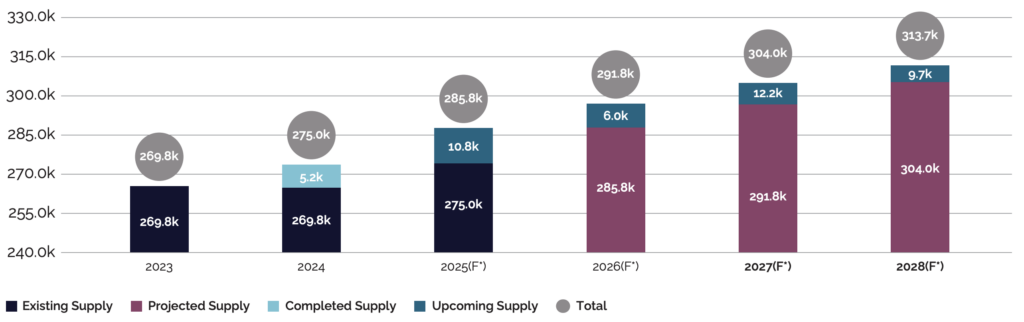

Existing and Future Residential Supply

In Abu Dhabi, around 5,200 residential units were delivered in 2024, bringing the total supply to approximately 275,000 units by the end of the year. Majority of these new units were delivered in key areas such as Al Raha Beach, Yas Island, Masdar City, and Saadiyat Island, among others. Looking ahead, around 10,800 residential units are expected to be delivered in 2025, followed by nearly 6,000 units in 2026. However, actual deliveries may fall short of projections due to factors such as market conditions and development timelines, which could slow the pace of completion.

The growing demand for prime locations and modern developments, coupled with the Government’s initiatives to attract both international investors and skilled professionals, is expected to support a steady increase in demand for residential units. As Abu Dhabi continues to enhance its infrastructure and quality of life, it is likely to attract a broader range of buyers and renters, further shaping the dynamics of the real estate market.

Abu Dhabi Residential Supply – Number of Units

Source: MEED Projects, Cavendish Maxwell

*The projected supply is based on the information available at the time of preparing the report and may differ from other projections. It is subject to revision as additional details about these projects become available in the future.

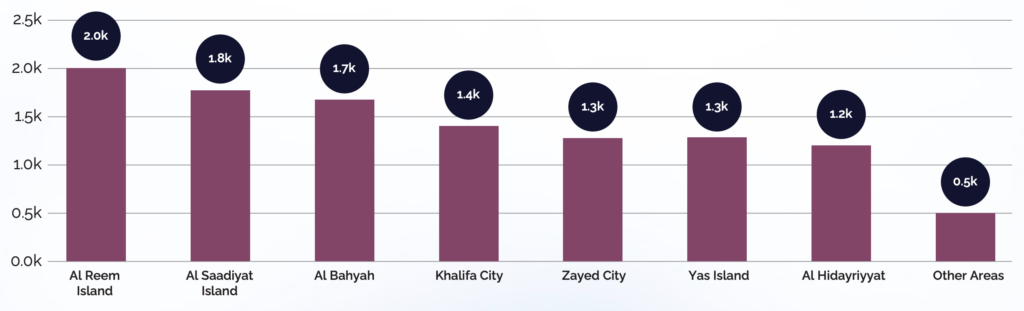

New Project Launches

Nearly 40 residential projects were launched in Abu Dhabi in 2024, adding approximately 11,000 units to the market. Al Reem Island and Al Saadiyat Island witnessed the highest number of new launches, reflecting strong demand in these prime locations.

Among developers, Aldar Properties dominated the market in 2024, launching approximately 4,000 units across 12 projects—the highest among all developers, further strengthening its position as a leading player in Abu Dhabi’s real estate sector.

The performance of the off-plan market in 2025 will largely depend on the number of new launches. If new launches decrease, both the volume and value of off-plan transactions may decline further. It will be crucial to see if developers increase new launches in 2025 to support the off-plan market, which accounted for nearly 56.0% of all residential sales transactions in 2024.

Number of Units Launched in 2024 by Area

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

Abu Dhabi Residential Sales Price Change (2023 vs. 2024)

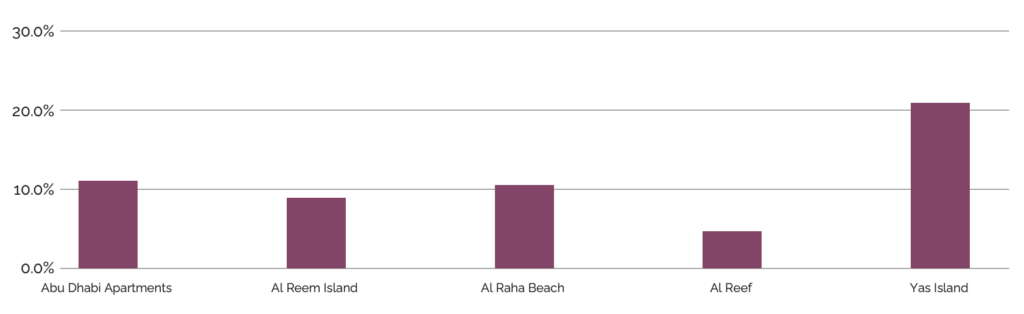

Apartment Sales Price Change

Abu Dhabi’s average apartment prices have increased by 11.4% year-over-year, fuelled by strong demand, stable supply, and growing investor confidence. The growth is further supported by a growing number of end-user buyers, particularly expatriates and first-time homebuyers, who are benefiting from favourable mortgage rates and government’s long-term residency incentives aimed at enhancing homeownership accessibility. Developers have also played a key role by offering affordable housing options and flexible payment plans, making it easier for buyers to enter the market.

Abu Dhabi Apartment Sales Price Change (Year-on-Year %)

Source: Cavendish Maxwell

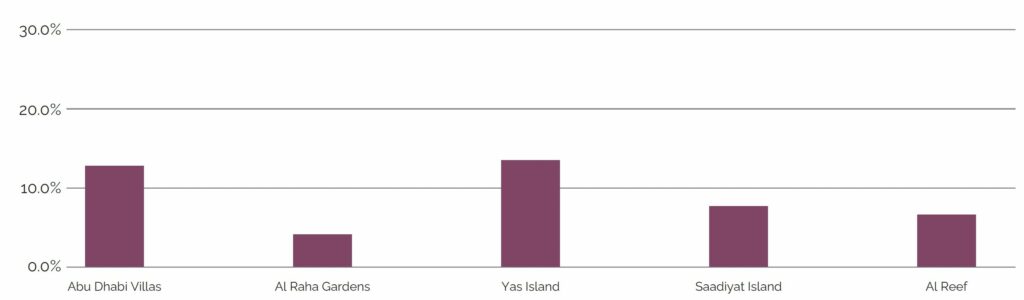

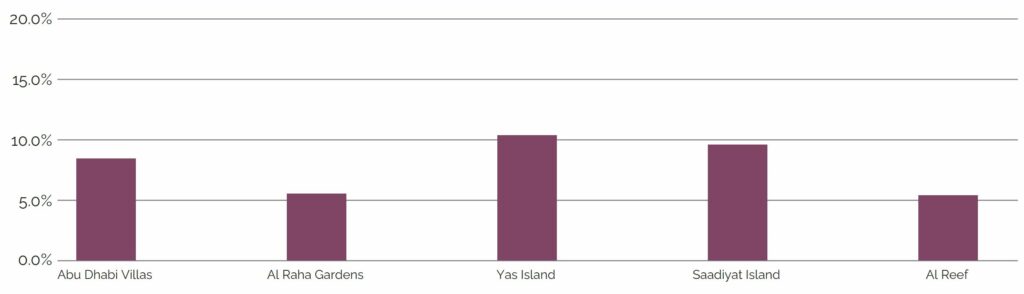

Villa Sales Price Change

In addition to apartments, Abu Dhabi’s villa sales prices have seen a notable increase of 12.6%. This uptick is driven by a growing preference for larger, more private homes, especially among families and high-net-worth individuals seeking properties that offer enhanced comfort and luxury.

Abu Dhabi Villa Sales Price Change (Year-on-Year %)

Source: Cavendish Maxwell

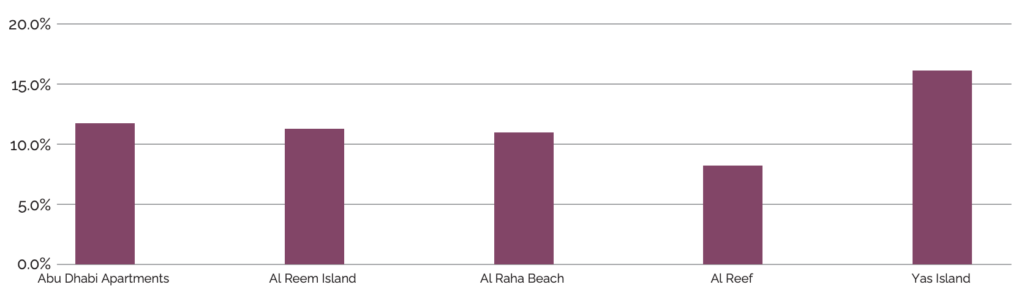

Abu Dhabi Residential Rental Price Change (2023 vs. 2024)

Apartment Rental Price Change

In terms of rental prices, apartment rents in Abu Dhabi have risen by 12.7% compared to 2023. This increase is largely driven by high occupancy rates, fuelled by population growth, a steady influx of skilled professionals, and strong demand from expatriates seeking long-term residency options.

Furthermore, the city’s ongoing economic diversification, expanding job opportunities, and government initiatives to attract foreign talent have further strengthened demand for rental properties.

Abu Dhabi Apartment Rental Price Change (Year-on-Year %)

Source: Cavendish Maxwell

Villa Rental Price Change

A similar trend has been observed in the villa rental market as well, with rental prices increasing by 8.0% over the past year, driven by growing demand for spacious and high-quality homes.

Abu Dhabi Villa Rental Price Change (Year-on-Year %)

Source: Cavendish Maxwell

2025 Real Estate Market Outlook

In 2025, Abu Dhabi’s real estate market is expected to maintain its growth, with both sales and rental prices anticipated to continue their positive momentum. The sales market, driven by ongoing interest from investors and end-users, is expected to continue its upward trajectory, with sales prices likely to see gradual increases. Additionally, Government initiatives, such as residency incentives, may further boost confidence among investors and end-users. As for the off-plan market, its performance will largely depend on the number of new launches throughout the year and how well these projects are absorbed by the market.

On the rental side of the market, the addition of new properties, along with population growth, is expected to keep rental rates in Abu Dhabi largely stable, with some areas potentially experiencing upward movement. Furthermore, areas with improved amenities and transportation links may see higher rental demand. However, landlords with older properties may face increased competition, as tenants may prefer to move into newer, more modern residential units.

Overall, the Abu Dhabi market is projected to experience sustained growth, driven by strong demand, stable supply and a continued influx of capital from a diverse range of investors, both local and international. The government’s ongoing efforts to enhance infrastructure and align development with Abu Dhabi Vision 2030, which emphasises economic diversification and sustainability, will further enhance the city’s appeal. With a focus on building a modern, resilient economy, Abu Dhabi is set to remain an attractive destination for residents and investors seeking long-term opportunities.