Abu Dhabi Residential Market Performance Q1 2025

Executive Summary

Abu Dhabi’s economy recorded robust growth in 2024, with real GDP rising by 3.8% year-on-year to reach an all-time high of AED 1.2 trillion, according to preliminary estimates from the Statistics Centre – Abu Dhabi (SCAD). This expansion was largely fuelled by the non-oil sector, which grew by a record 6.2%, increasing its share of total GDP to 54.7%. Building on this momentum, the International Monetary Fund (IMF) forecasts further acceleration, with GDP expected to grow by 4.2% in 2025 and 5.8% in 2026.

In line with the broader macroeconomic expansion, Abu Dhabi’s residential real estate market demonstrated resilience despite a temporary slowdown in transactional volumes during Q1 2025, driven by seasonal factors and limited new project launches. The emirate recorded approximately 1,300 residential sales, with continued strength in the ready property segment and rising average ticket prices.

Looking ahead, the residential market is expected to remain on a steady growth path, supported by population growth, increasing demand from end-users and investors, and Government policies promoting long-term residency and economic diversification. With approximately 11,900 residential units slated for delivery in the remainder of 2025, demand is likely to continue outpacing supply, placing upward pressure on both sales and rental rates.

Abu Dhabi Market Snapshot for Q1 2025

- Abu Dhabi GDP Forecast for 2025: +4.2%

- Overall Residential Sales Transactions Volume: 1,300 (-56.4% vs. Q1 2024)

- Ready Residential Sales Transactions Volume: 920 (+7.0% vs. Q1 2024)

- Off-Plan Residential Sales Transactions Volume: 380 (-82.0% vs. Q1 2024)

- Overall Residential Sales Transactions Value: AED 3.7 Billion (-44.5% vs. Q1 2024)

- Ready Residential Sales Transactions Value: AED 2.3 Billion (+70.4% vs. Q1 2024)

- Off-Plan Residential Sales Transactions Value: AED 1.4 Billion (-74.0% vs. Q1 2024)

- Overall Residential Mortgage Transactions Volume: 800 (-27.4% vs. Q1 2024)

- Overall Residential Mortgage Transactions Value: AED 1.7 Billion (-0.7% vs. Q1 2024)

- Number of Residential Units Delivered in Q1 2025: 600 Units

- Project Residential Supply for 2025: 11,900 Units

Macroeconomic Overview and Outlook

According to preliminary estimates from the Statistics Centre – Abu Dhabi (SCAD), the Emirate’s economy demonstrated strong growth in 2024, with real GDP rising by 3.8% year-on-year to reach a record AED 1.2 trillion. This growth was largely driven by the non-oil sector, which expanded by 6.2% — the highest growth rate recorded to date — increasing its share of total GDP to 54.7%, the largest annual contribution ever.

The strong performance of the non-oil sector across a wide range of sectors of the economy reflects Abu Dhabi’s successful diversification efforts to reduce reliance on hydrocarbons, and establish a resilient and sustainable growth model for the decades ahead. Manufacturing and construction led the charge, both reaching new levels of output and maintaining their share of GDP at AED 111.6 bn (9.1%) and AED 107.4 bn (9.1%) respectively. Supporting this trend, the Emirate also recorded a 16.0% increase in new economic licences issued on the mainland, highlighting its growing appeal as a hub for business and investment.

Looking ahead, the International Monetary Fund (IMF) projects Abu Dhabi’s economy to grow by 4.2% in 2025, accelerating to 5.8% in 2026, building on the strong foundation established in recent years and outperforming global benchmarks. All this is being accomplished at the same time as maintaining low levels of inflation, reining in Government debt, and maintaining a healthy trade balance.

This economic performance highlights the continuing effectiveness of Abu Dhabi’s business-friendly policies, transparent governance, and investor-focused regulatory framework.

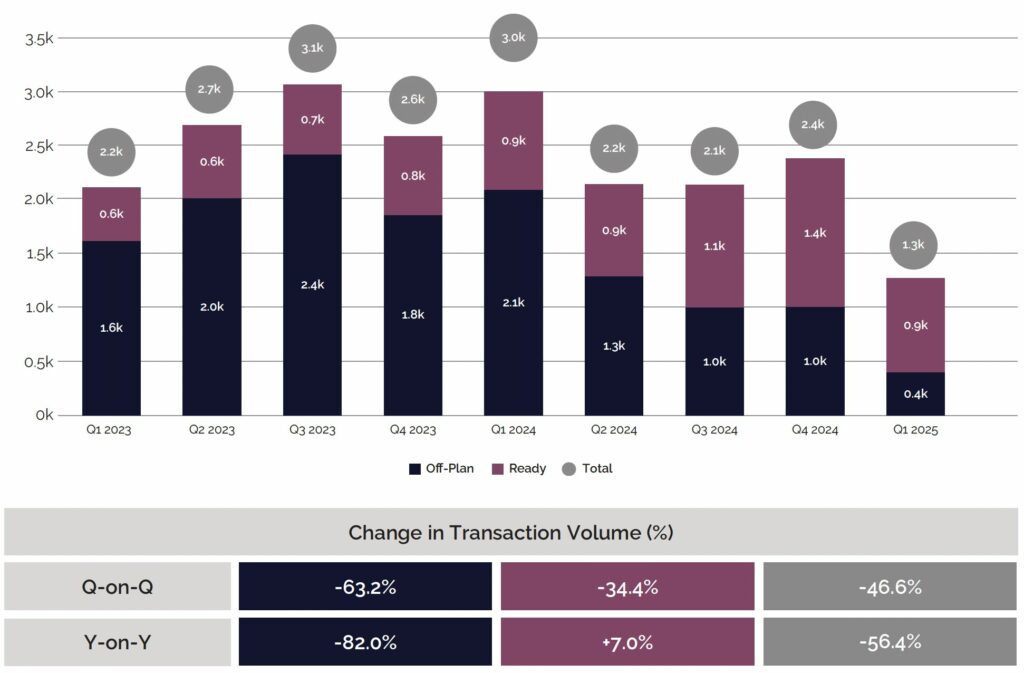

Sales Transactions

In the first quarter of 2025, Abu Dhabi City recorded approximately 1,300 residential sales transactions, consisting of around 900 ready sales and 400 off-plan sales. Off-plan activity declined both quarter-on-quarter and year-on-year, mainly due to fewer new project launches. While ready sales decreased compared to the previous quarter, they increased year-on-year, indicating continued demand for completed properties despite short-term fluctuations. The overall slowdown in activity may also be associated with the seasonal impact of reduced trading days during Ramadan and Eid, which fell within the reporting period.

Abu Dhabi City Transactions – By Volume

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

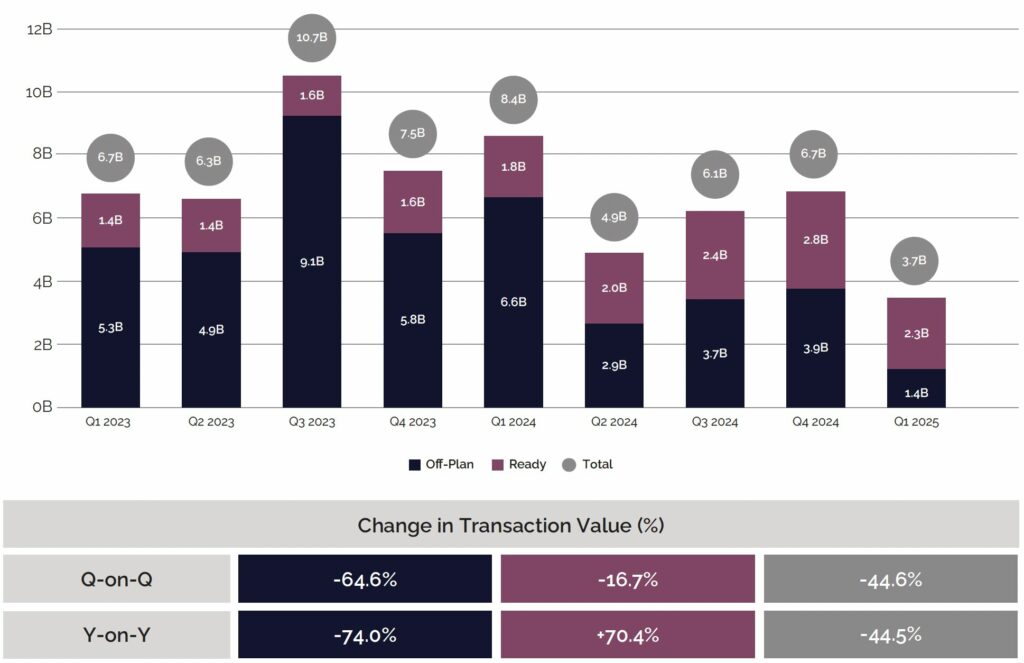

The decline in transaction volumes was mirrored in transactional value as well, which fell on both a quarterly and annual basis. In Q1 2025, the total transactional value of residential sales in Abu Dhabi City reached AED 3.7 billion, with ready properties accounting for the largest share at AED 2.3 billion.

Despite the slowdown, the average ticket price for ready transactions increased quarter-on-quarter and year-on-year, reaching AED 2.5 million in Q1 2025 — the highest level recorded in recent quarters.

Abu Dhabi City Apartment Transactions – By Volume

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

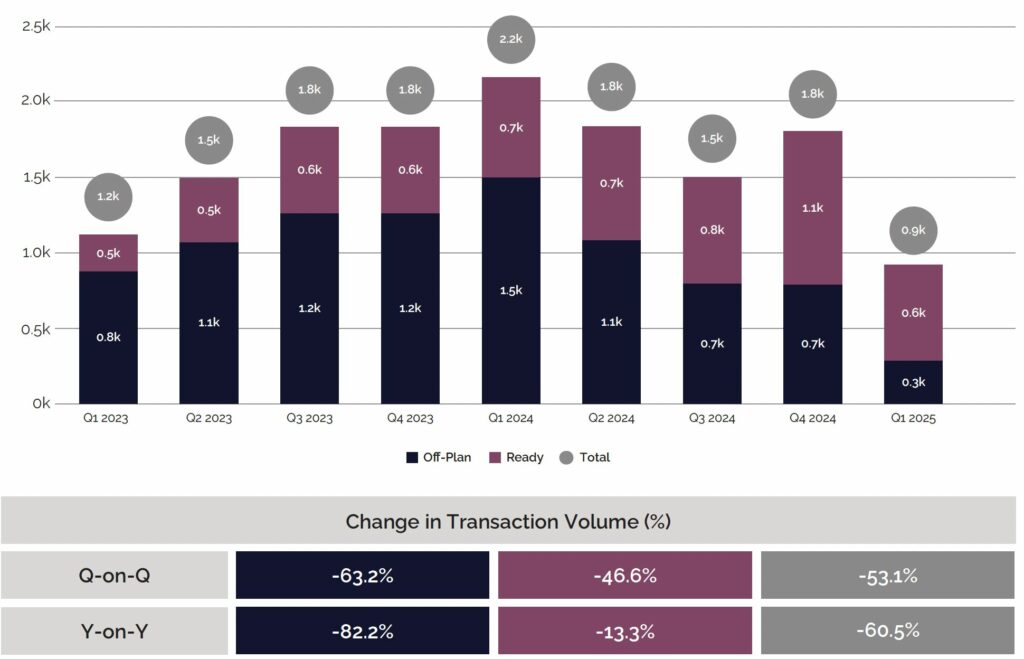

Sales Transactions by Property Type: Apartments

Residential market activity in Abu Dhabi City during Q1 2025 continued to be dominated by apartments, which accounted for 65.7% of all sales transactions. Although still the most prominent property type, their market share declined compared to the same period last year, alongside a drop in overall sales volume.

Apartment transaction volumes fell by 53.1% quarter-on-quarter and 60.5% year-on-year. Both the ready and off-plan segments saw reduced activity, with the off-plan market experiencing the sharpest decline.

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

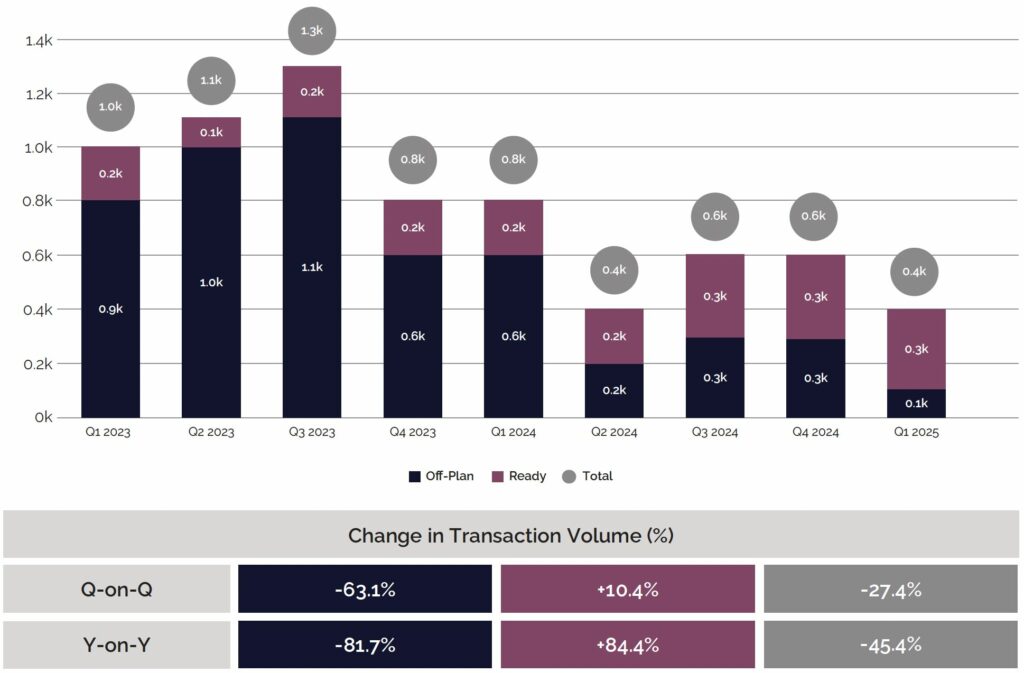

Sales Transactions by Property Type: Villas and Townhouses

In contrast to apartments, transaction volumes for ready villas and townhouses increased both quarter-on-quarter and year-on-year, reflecting steady demand from end-users, particularly families seeking more space and potentially looking to settle in the city for the long term. However, off-plan villa and townhouse transactions declined over the same period, largely due to a lower number of new project launches.

Abu Dhabi City Villa/Townhouse Transactions – By Volume

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

Mortgage Transactions

In line with the overall decline in sales transaction volumes, residential mortgage activity fell on both a quarterly and annual basis, primarily due to a reduction in mortgage transactions for apartments. Conversely, mortgage activity for villas and townhouses increased, indicating a shift in buyer composition this quarter towards end-users rather than investors. This trend highlights stronger end-user demand, which typically relies more on mortgage financing, particularly given the higher ticket prices associated with these property types.

Abu Dhabi City Mortgage Transactions – By Volume

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

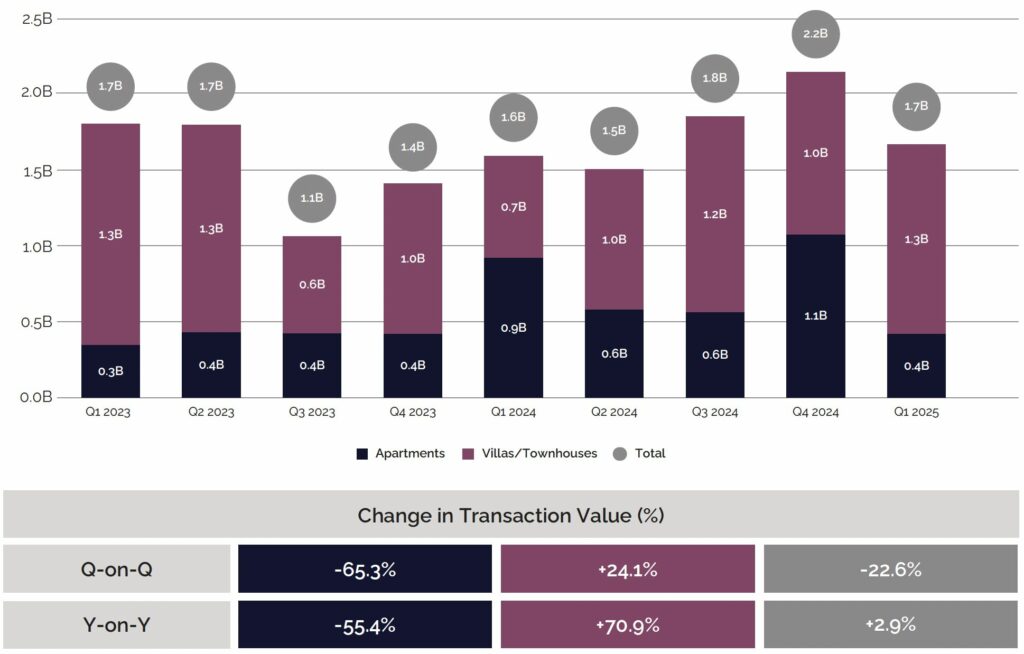

The total value of residential mortgage transactions reached AED 1.7 billion in Q1 2025, with villas and townhouses accounting for AED 1.3 billion. The quarter also saw increased activity in higher-value properties, as reflected in the notable rise in average mortgage ticket prices.

Abu Dhabi City Mortgage Transactions – By Value (AED)

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

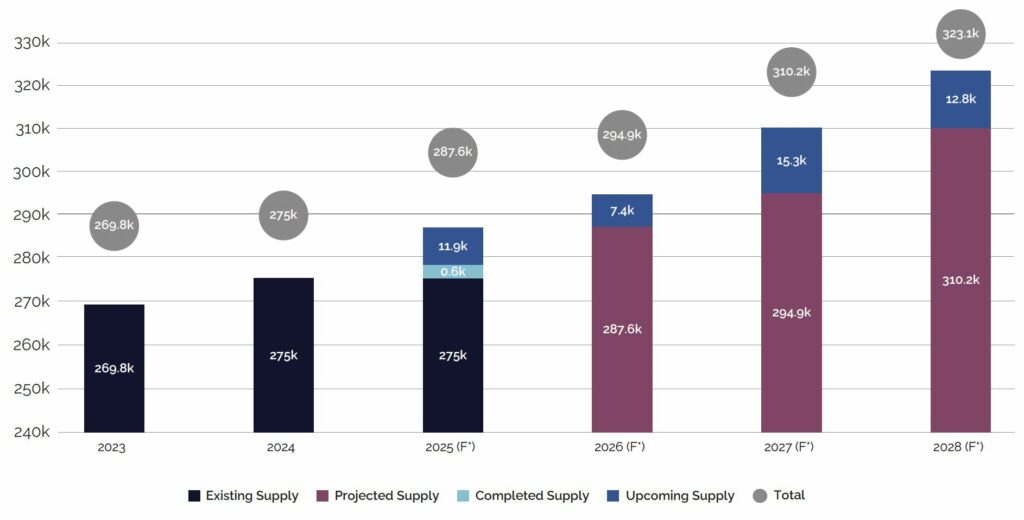

Existing and Future Supply

Around 600 residential units were delivered in Q1 2025, with approximately 11,900 more expected over the remainder of the year and a further 7,000 projected for 2026. While the upcoming supply pipeline appears robust, demand is expected to outpace supply in 2025, driven by population growth and increasing end-user interest. This demand is further supported by the Abu Dhabi Government’s efforts to attract and develop knowledge-based industries, a strategy aimed at drawing international talent and supporting long-term housing demand.

Moreover, residency pathways such as the Golden Visa and other long-term visa programmes are expected to support population growth by making it easier for skilled professionals and investors to live and work in Abu Dhabi, thereby strengthening demand for quality residential properties.

Abu Dhabi Supply – Number of Units

Source: MEED Projects, Cavendish Maxwell

*The projected supply is based on the information available at the time of preparing the report and may differ from other projections. It is subject to revision as additional details about these projects become available in the future.

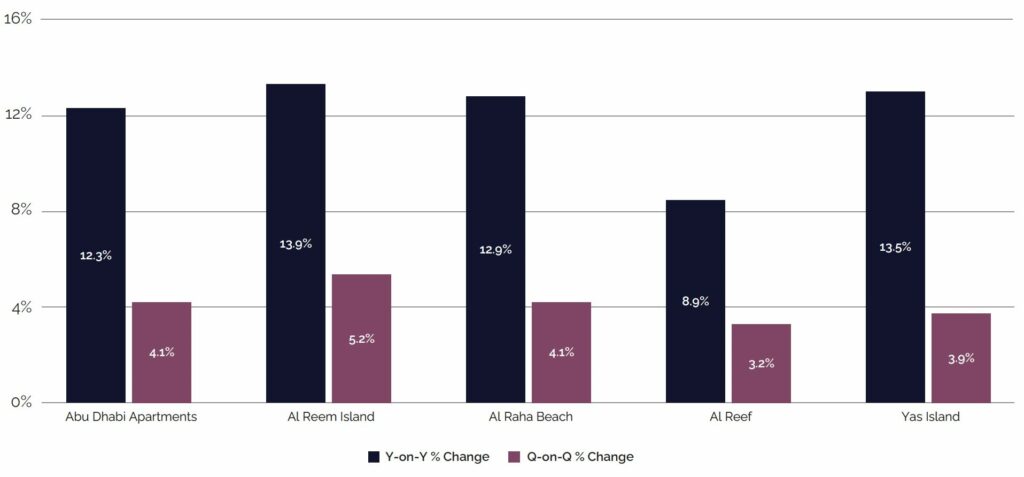

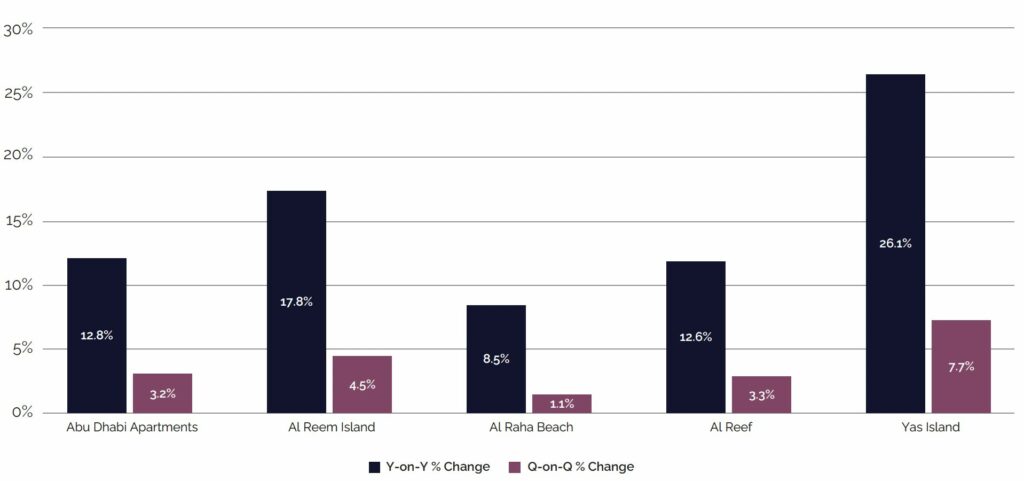

Abu Dhabi Sales Price Change

In terms of apartment sales, prices maintained their upward momentum, increasing by 4.1% quarter-on-quarter and 12.3% year-on-year in Q1 2025. While transactional volumes softened, demand remained strong, supported by both investor confidence and consistent end-user interest. This resilience is driven by a stable macroeconomic environment and competitive rental yields, particularly in prime locations.

Furthermore, efforts by both the Abu Dhabi Government and developers—such as flexible payment plans, infrastructure development, long-term residency options, and initiatives to enhance quality of life—have continued to stimulate buyer activity and support price growth.

Abu Dhabi Apartment Sales Price Change (%)

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

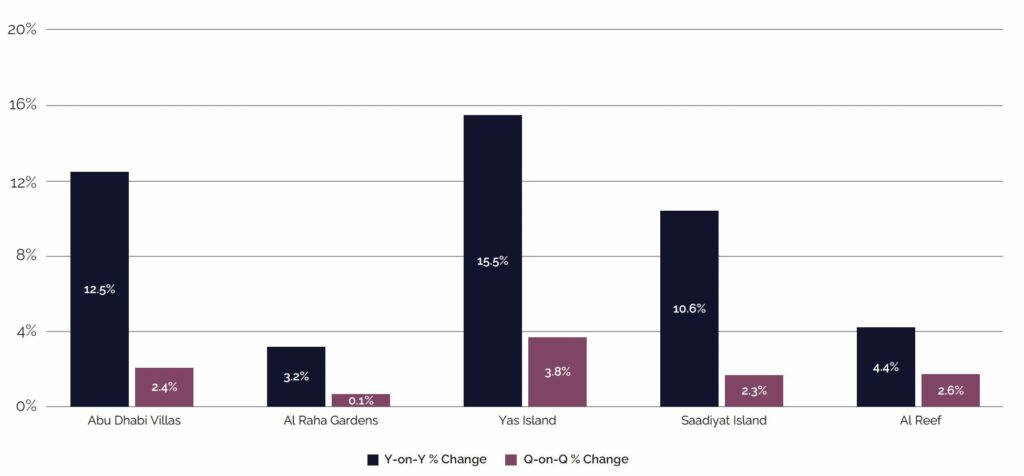

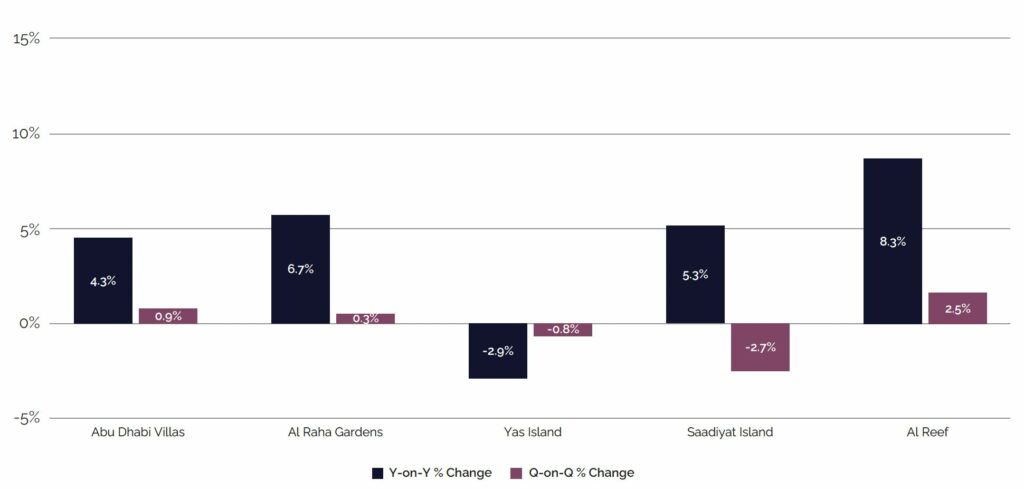

Demand for villas remained equally strong in Q1 2025, with sales prices increasing by 2.4% quarter-on-quarter and 12.5% year-on-year, alongside notable growth recorded in Yas Island and Saadiyat Island.

Abu Dhabi Villa Sales Price Change (%)

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

Abu Dhabi Rental Rate Change

As demand continues to outpace supply, occupancy rates have risen steadily, supported by population growth alongside an economic upturn and improvements in the job market that have encouraged a steady influx of expatriates. This combination has driven rental growth, with apartment rental prices increasing by 3.2% quarter-on-quarter and 12.8% year-on-year.

Abu Dhabi Apartment Rental Rate Change (%)

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

Villa rental prices rose by 0.9% quarter-on-quarter and 4.3% year-on-year. However, select communities such as Yas Island and Saadiyat Island recorded quarterly declines, likely reflecting a short-term seasonal adjustment in rental prices. Despite these dips, demand for villas is expected to remain strong, driven by the rising number of family households seeking larger living spaces.

Abu Dhabi Villa Rental Rate Change (%)

Source: DARI (Abu Dhabi Real Estate Centre), Cavendish Maxwell

2025 Real Estate Market Outlook

Despite the slowdown in activity during Q1, largely attributed to limited new project launches and seasonal factors such as reduced trading days during Ramadan and Eid, the outlook for the remainder of 2025 remains stable and positive. This is supported by strong investor and end-user demand, ongoing economic diversification, proactive Government policies, and a steady stream of relocations driven by employment growth, long-term residency initiatives, and overall improvements in quality of life. While ready transaction activity is expected to remain steady throughout the year, the performance of the off-plan segment will depend on the scale and timing of new project launches.

In terms of upcoming supply, approximately 11,900 residential units are expected to be delivered over the remainder of 2025. However, actual completions are likely to fall short of this projection. As a result, demand is expected to continue outpacing supply, adding upward pressure on both sales and rental rates. While this imbalance may contribute to further price growth, the pace is likely to remain steady and measured, supported by ongoing end-user demand and a more disciplined market environment.

Overall, the outlook for Abu Dhabi’s residential market in 2025 remains resilient, supported not only by demographic and economic fundamentals but also by ongoing infrastructure development across the emirate.

During the first quarter of 2025, the Abu Dhabi residential market has notably shifted its focus towards the secondary market, with fewer new off-plan project launches compared to previous quarters. Despite the limited number of new launches, there has been sustained demand for ready products. The latter part of the quarter has shown encouraging signs of broader price appreciation, a trend we anticipate will continue into Q2 2025. Bank activity remains robust, and project delivery has been strong throughout early 2025, underscoring the resilience and dynamism of Abu Dhabi’s real estate sector.

Andrew Laver

Associate Director, Commercial Valuation – Abu Dhabi