Dubai Hospitality Sector – Market Performance 2024

Dubai Tourism Overview

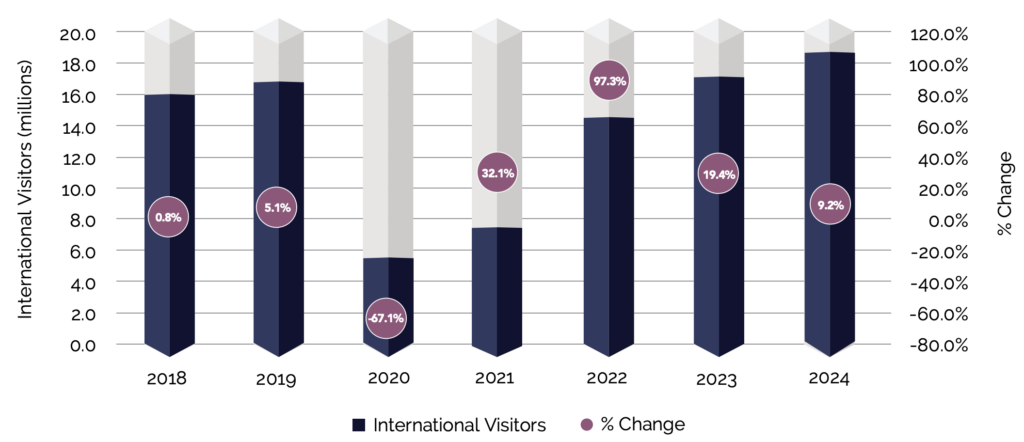

In 2024, Dubai set a new tourism record, welcoming 18.7 million overnight guests—a 9.1% increase from the 17.1 million visitors recorded the previous year. This growth aligns with the strategic vision of Sheikh Mohammed Bin Rashid Al Maktoum, as outlined in the Dubai Economic Agenda D33, which aims to position Dubai among the world’s top three global tourism destinations.

This momentum was further validated by Dubai’s outstanding performance at the 31st Annual World Travel Awards in late 2024. The city was named the world’s leading shopping and exhibition destination, while Mina Rashid earned the title of the world’s leading cruise port, and Dubai International Airport (DXB) was recognised as the world’s leading airport. This continued international recognition strengthens investor confidence and cements Dubai’s status as a premier global hub for hospitality and real estate development.

The emirate continued to experience robust growth in the tourism sector as well, surpassing pre-pandemic levels and positively contributing to economic growth. In 2024, tourism contributed Dh236 billion (up from Dh220 billion in 2023) to the UAE’s economy, representing 12% of the nation’s GDP. This growth highlights the sector’s significant impact, reinforcing its vital role in the country’s economic expansion.

The chart below illustrates the growth of international visitors in Dubai over recent years.

Total International Visitors – Dubai

Source: Department of Economy & Tourism, Cavendish Maxwell

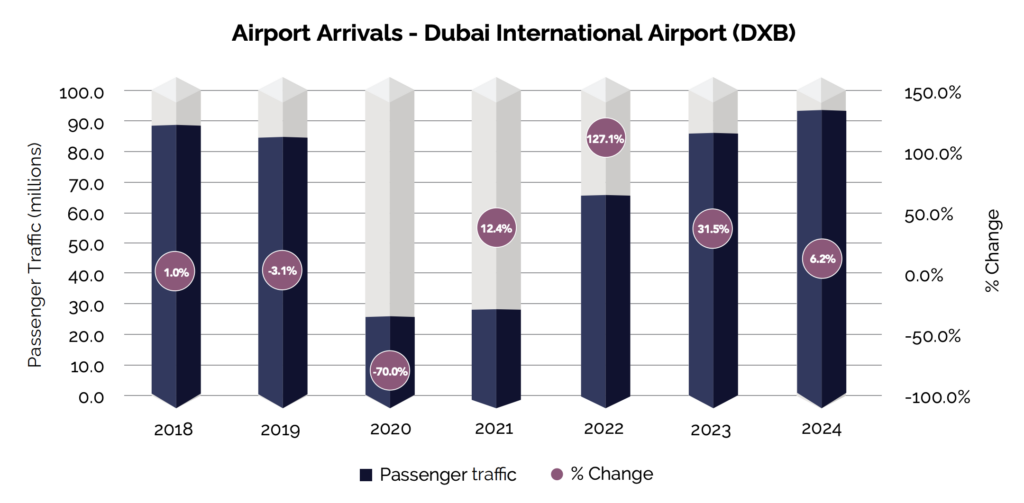

Airport Arrivals

Dubai International (DXB) has set a new benchmark in global aviation, welcoming 92.3 million passengers in 2024—its highest annual traffic on record. This milestone surpasses the previous high of 89.1 million set in 2018 and reflects a 6% increase over 2023 (86.9 million passengers).

The record-breaking performance was fuelled by consistent growth throughout the year. December stood out as the busiest month of 2024, with 8.2 million travellers passing through DXB.

Source: Dubai Airports, Department of Economy & Tourism, Cavendish Maxwell

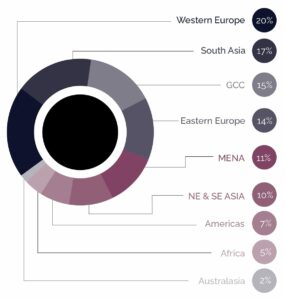

Source Markets

In 2024, Dubai welcomed 18.7 million visitors, with Western Europeans leading at 20% (3.7 million). South Asians (17%), GCC tourists (15%), and Eastern Europeans (14%) followed closely. On the other hand, low-performing regions like Africa and Australasia, which currently contribute only 7% combined, have significant potential for future growth.

Northeast and Southeast Asia saw the highest year-on-year growth (+24.2%), largely driven by the resurgence of Chinese outbound tourism. The 40th anniversary of UAE-China diplomatic relations in 2024 further bolstered travel ties, with Emirates increasing flight frequencies to China and enhancing interline agreements with China Southern, Air China, and China Eastern. As a result, DXB witnessed a significant rise in Chinese arrivals, benefiting both the hospitality and retail sectors.

Building on this momentum, in June 2024, Dubai’s Department of Economy and Tourism (DET) hosted a roadshow in Jakarta to attract Indonesian visitors. Additionally, flydubai introduced daily flights to Penang and Langkawi in Malaysia, further driving inbound tourism.

Africa (+19.8%) also saw a significant increase, partially driven by the launch of four weekly flights between Dar es Salaam and Dubai in March 2024, flydubai’s expansion with four weekly flights from Dubai to Mombasa (Kenya), and Emirates’ increased operations from October 2024, adding Entebbe (Uganda), Addis Ababa (Ethiopia), and Johannesburg (South Africa).

Meanwhile, sustained growth in Western (+13.5%) and Eastern Europe (+16.3%) highlights strong demand, reinforcing their importance in Dubai’s tourism mix.

Dubai Tourism Distribution By Region (Jan – Dec 2024)

Source: Department of Economy & Tourism, Cavendish Maxwell

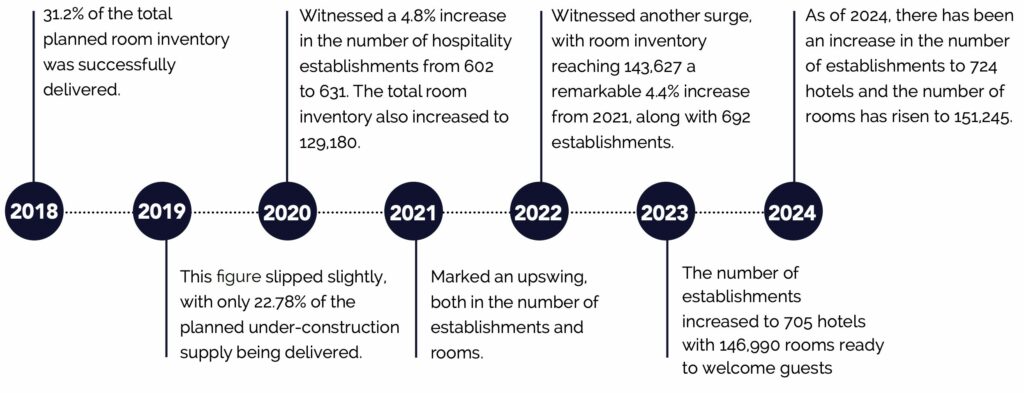

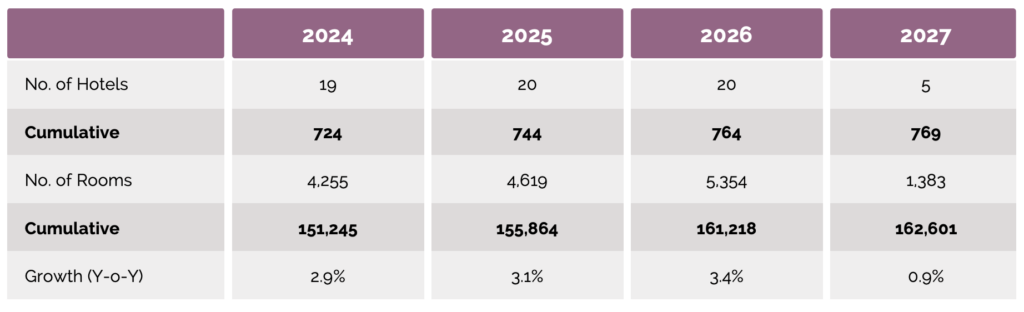

Current Supply

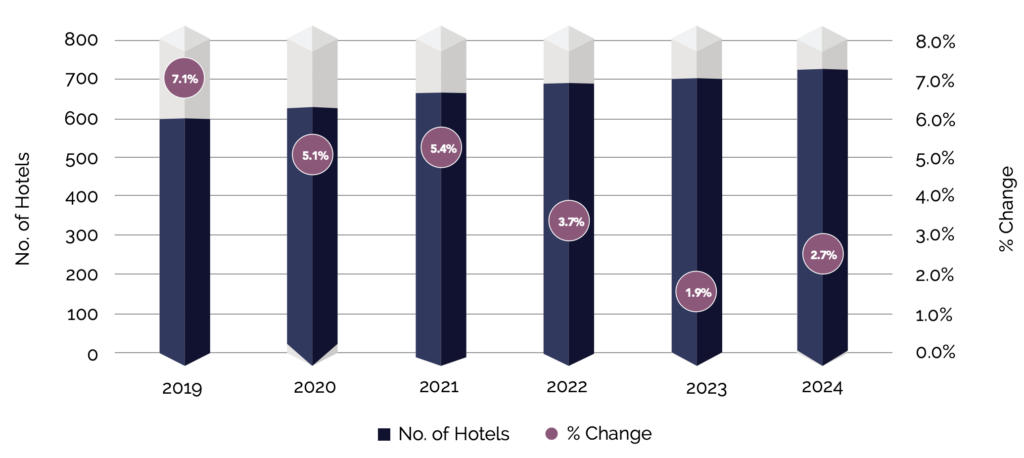

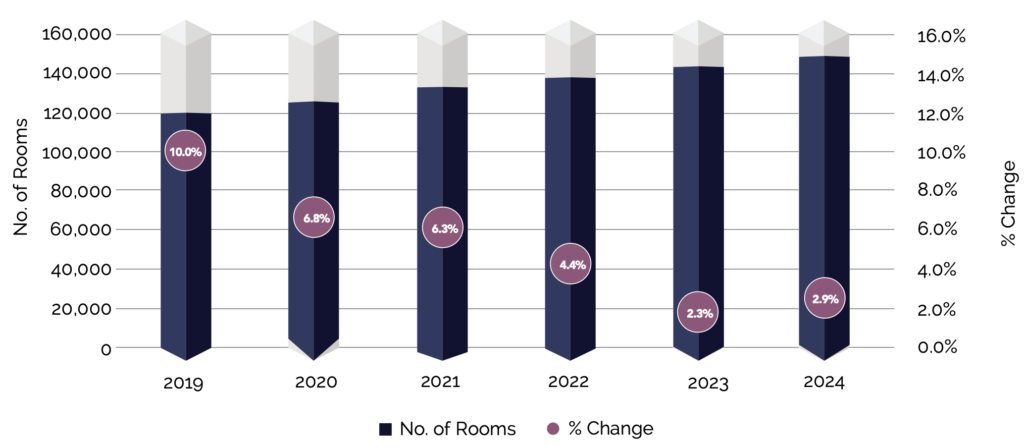

According to the latest figures from AM:PM Hotels, as of December 2024, the city boasts a total of 724 hospitality establishments, equating to 151,245 rooms.

The supply side of the picture

The hospitality industry has been keeping up with tourism levels in Dubai, adjusting supply to meet demand.

Our insights reveal that:

Source: Dubai Tourism, AM:PM Hotels, Cavendish Maxwell

Dubai Hospitality Building Supply – 2019 to 2024

Dubai Hospitality Room Supply – 2019 to 2024

In 2023, a total of 3,363 new rooms were added, while 2024 saw an increase of 4,255 new rooms, reflecting a 26.5% annual net growth in new rooms added.

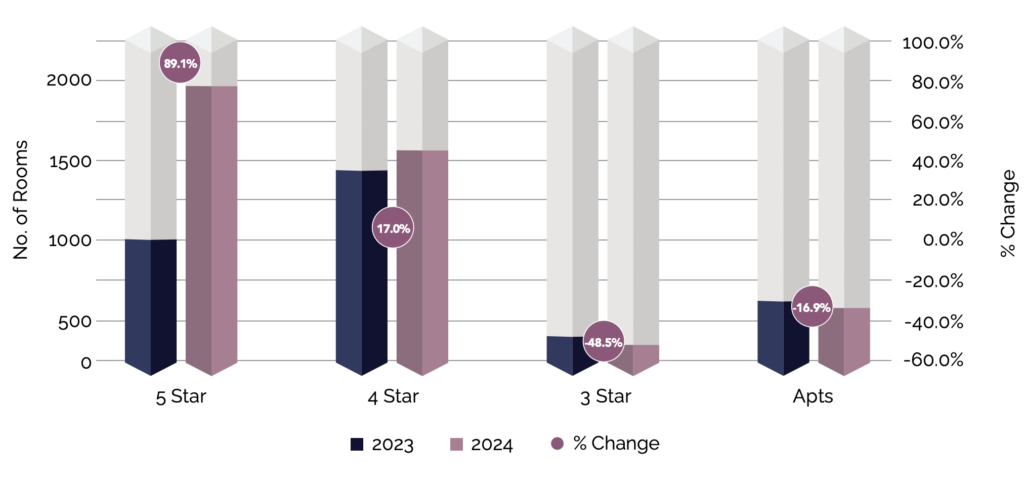

The most notable year-on-year growth occurred in the 5-star category, which added 7 new hotels comprising 1,933 rooms in 2024, compared to 3 hotels comprising 1,022 rooms in 2023, nearly doubling the category’s annual net growth in new rooms added.

The 4-star category experienced moderate growth, adding 9 hotels with 1,621 rooms in 2024, up from 7 hotels and 1,385 rooms in 2023. This steady expansion highlights the focus on mid-range offerings to attract a wider audience.

Conversely, the 3-star segment and serviced apartments experienced a decline in new room additions. The 3-star category saw a 48.5% drop, while serviced apartments recorded a 17.0% decrease compared to the new rooms added in 2023.

Dubai Hospitality Room Supply by Grade | 2023 vs 2024

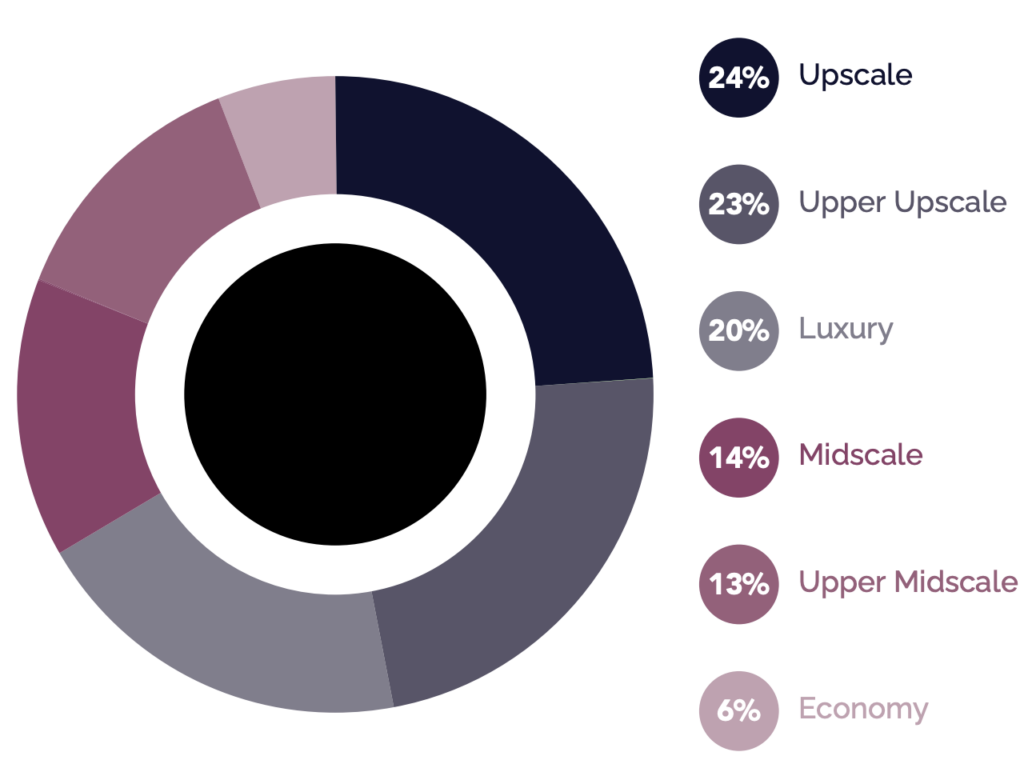

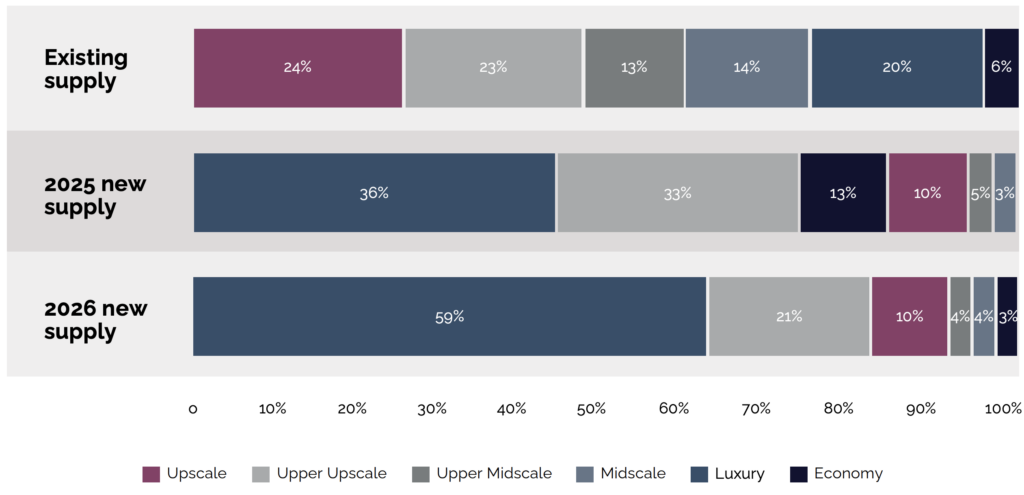

The chart below shows that as of 2024, 67.3% of the current room supply falls within the Luxury, Upper Upscale and Upscale classes, whilst the Upper midscale and Midscale segments account for approximately one third (27.1%) of the total inventory.

In 2024, approximately 64.8% of the new supply was in the Luxury and Upper Upscale segments. Some of the standout openings in 2024 included The Lana Dubai Dorchester Collection, SIRO One Za’abeel, One & Only One Za’abeel, FIVE Luxe JBR as well as the Delano Dubai. These new completions (Luxury and Upper Upscale) added approximately 2,757 new rooms to the existing supply.

Current Hospitality Room Inventory by Classification – As of 2024

Source: AM:PM Hotels, Cavendish Maxwell

Future Supply

According to our research, 2025 and 2026 are expected to each see a total of 20 new hotel openings. This translates to a cumulative total of 744 and 764 new rooms by the end of 2025 and 2026 respectively.

Source: AM:PM Hotels, Cavendish Maxwell

Total new supply for 2025 is 4,619 rooms across 20 hotels with the largest additions in the Luxury segment with 1,685 rooms (8 hotels) – 36% of new supply. This is followed by the Upper Upscale segment with 1,520 rooms (6 hotels) – 33% of new supply.

Projects within the Luxury segment anticipated for completion by 2025 include the Mandarin Oriental Downtown Dubai with 259 rooms, Jumeirah Mars Al Arab with 387 rooms and the Anantara Seven City JLT with 78 rooms.

Additionally, Luxury supply is projected to experience significant growth in 2026, with 11 new openings adding approximately 3,141 rooms – 59% of new supply. Some notable openings will include The Dorchester Collection Ela, Kempinski Floating Sea Palace Resort and the Six Senses Dubai the Palm.

Hospitality Room Inventory by Classification – Upcoming Supply

Source: AM:PM Hotels, Cavendish Maxwell

Market Performance

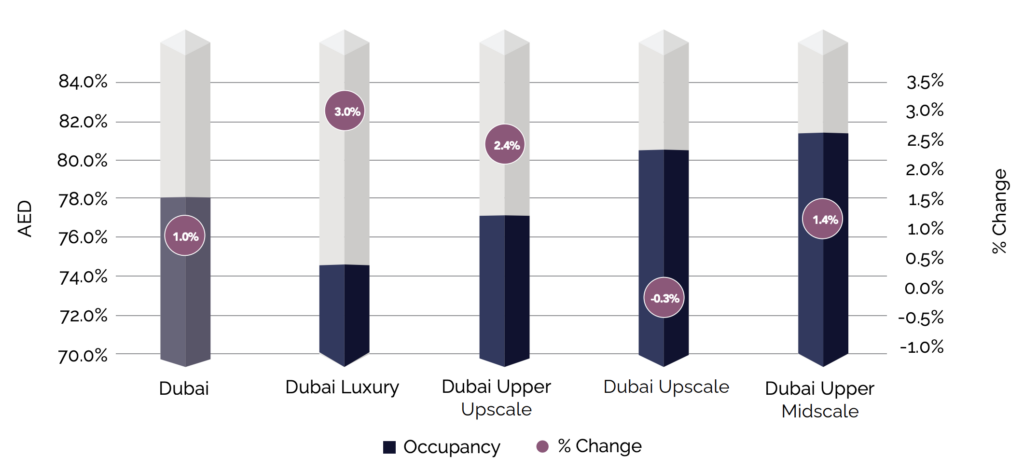

Occupancy

Dubai’s occupancy levels remained relatively stable year-on-year, with only a modest rise of 1.0%, reaching 78%. The luxury and upper-midscale segments experienced the most significant gains, rising by 3.0% and 2.4%, respectively. However, the upscale sector saw a slight decline of 0.3% compared to 2023.

Occupancy by Classification – 2024

Source: STR and Cavendish Maxwell

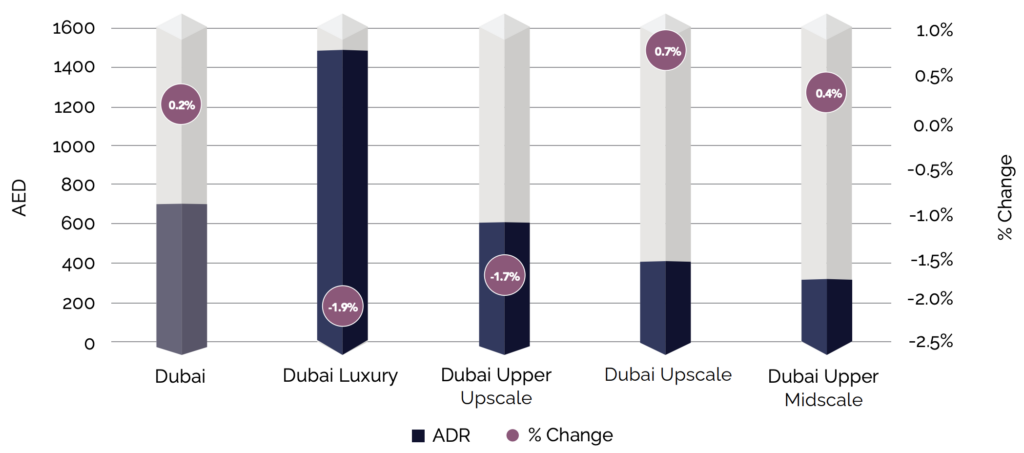

Average Daily Rate (ADR)

Dubai’s average daily rate (ADR) reached around AED 690, reflecting a modest year-on-year increase of 0.2%. It suggests a continuation of relatively stable pricing in Dubai’s hospitality market, with only a slight increase from the retroactive 2023 figure of AED 688. When examined by hotel category, Upscale and Upper-Midscale properties saw growth, with increases of 0.7% and 0.4%, respectively. In contrast, Upper Upscale hotels experienced a 1.7% decline, while Luxury hotels saw a 1.9% drop in their ADR year-on-year despite a strong 3.0% increase in occupancy, indicating that demand growth came at the expense of pricing. The segment may have faced competitive pricing pressure with travellers opting for deals rather than accepting higher ADRs or hotels likely prioritised occupancy rate over daily rates.

With 1,685 new luxury rooms in 2025 (36% of total new supply) competition will intensify, likely keeping ADR subdued.

Source: STR and Cavendish Maxwell

“Dubai’s hospitality sector continues its upward trajectory, setting new benchmarks in tourism growth and hotel performance. With a record 18.72 million visitors in 2024 and a steady pipeline of luxury and upper-upscale developments, the market is evolving to meet increasing global demand. However, as supply expands—particularly in the luxury segment—occupancy and ADR growth may face short-term pressures. Strategic positioning, competitive pricing, and sustained demand from key source markets will be crucial in maintaining Dubai’s status as a premier hospitality hub.”

Gergely Balint

Associate Partner, Commercial Valuation and Hospitality

Forecasts

In 2024, the Dubai market experienced a slight increase in top-line performance, with average Revenue per Available Room (RevPAR) rising by 1.3% year over year. All segments saw growth, with the Upper Midscale sector leading at approximately 1.9%. The overall RevPAR improvement was primarily driven by higher occupancy levels across most segments, except for the Upscale sector, which saw a slight decline of 0.3%.

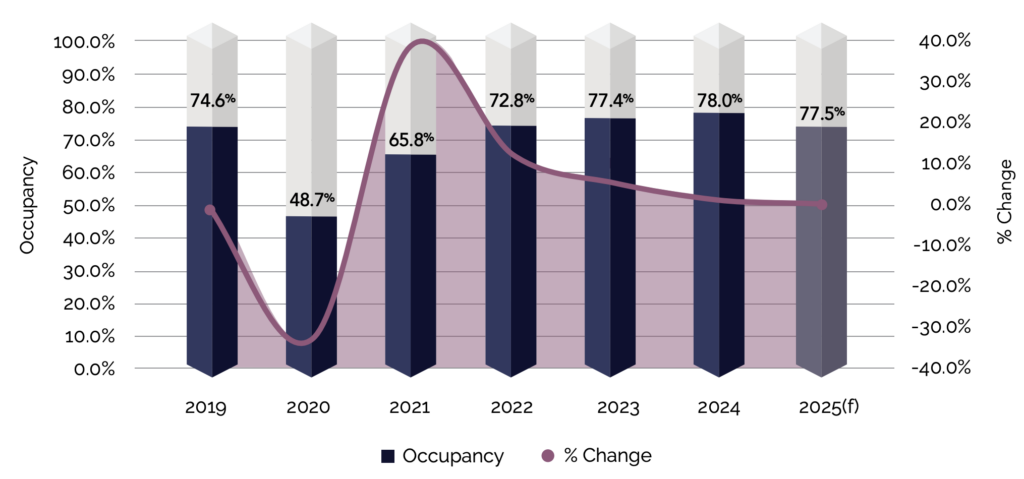

Dubai – Occupancy – Historic and Forecast

Source: STR and Cavendish Maxwell

Given that Dubai Luxury saw the highest occupancy increase (3.0%) but is also expecting approximately 36% of the new supply in 2025, it is likely that occupancy in this segment will face downward pressure. New supply typically takes time to be absorbed, leading to lower occupancy levels in the short term. Growth in Upper Upscale (+2.4%), and Upper Midscale (+1.4%) segments suggests demand remains strong outside the Luxury segment, potentially stabilising overall occupancy.

We anticipate a slight moderation with overall occupancy likely at 77.5% due to supply driven pressure in the Luxury segment. If demand remains robust and international visitor numbers continue to rise, the occupancy level may hold at 78%.

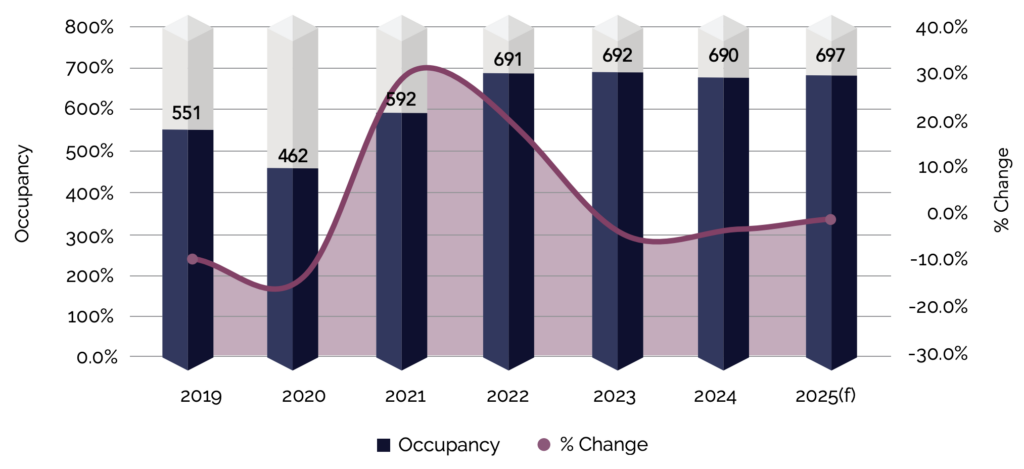

Dubai – Average Daily Rate (ADR) – Historic and Forecast

Source: STR and Cavendish Maxwell

Based on ADR trends from 2022 to 2024 and the dynamics of Dubai’s hospitality market, the estimated ADR for 2025 is projected to reach AED 698, reflecting a modest growth of just over 1.0% from the 2024 figure of AED 690.

Dubai’s hospitality sector is maturing, with pricing becoming more stable. Significant increases in ADR are unlikely unless there is a surge in high-spending tourism or a notable reduction in room supply—both of which seem improbable given the city’s steady pipeline of new hotel openings.

The relative stability in 2024 may indicate a “normalisation” following the demand spikes driven by Expo 2020 (Oct, 2021 – Mar, 2022). Dubai’s ability to attract large-scale events and affluent travellers will remain a key factor in ADR growth. However, with no major events planned for 2025, growth is expected to follow a more gradual, organic trajectory driven by baseline tourism and business travel.

That said, 2024 saw record airport arrivals, signalling strong demand that could carry momentum into 2025. Even in the absence of major events, a consistent influx of visitors should help maintain healthy occupancy rates, indirectly supporting ADR growth. Additionally, the expansion of Dubai’s luxury hotel segment generally drives ADR upward, as high-end properties command premium rates and cater to affluent clientele. However, with luxury ADR declining for a second consecutive year due to an influx of new supply, the impact on overall market ADR remains to be seen.

Disclaimer:

It is important to note that the Average Daily Rate (ADR) figure for 2023, as reported by STR, varies between their 2023 and 2024 datasets. The 2023 report listed an ADR of 692.07, while the 2024 report retroactively lists it as 688.5. For consistency with our previous reporting standards, we have opted to use the figure of 692.07.

STR data is subject to annual revisions due to the dynamic nature of the hospitality industry, including new hotel openings, closures, and updated data collection. For year-on-year comparisons, STR utilises consistent datasets to ensure alignment.

Market Performance

Other Emirates

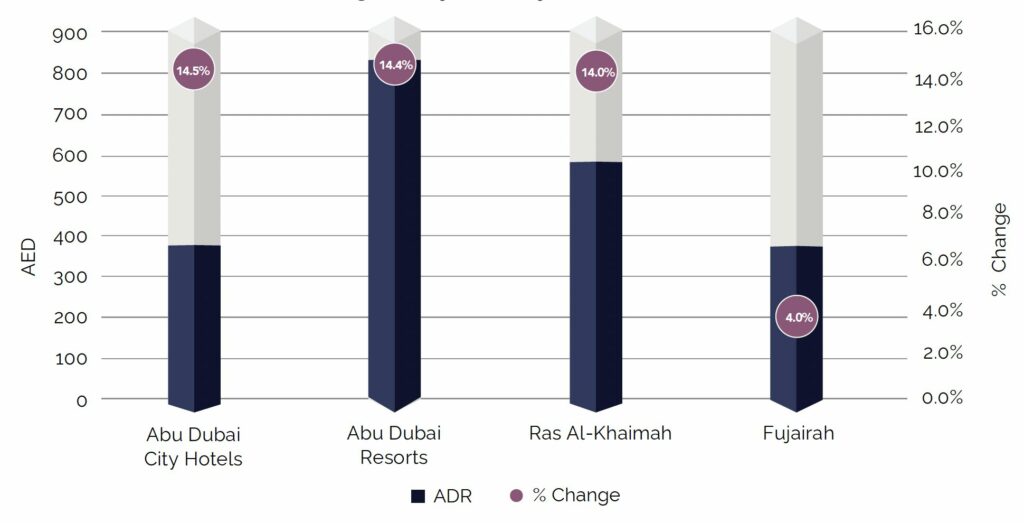

The strong economic momentum from 2023 continued into 2024, driving a notable surge in rate-driven performance across the Emirates. All Emirates experienced an increase in ADR, with Abu Dhabi City Hotels and Resorts leading the growth at +14.5% and +14.4%, respectively. Ras Al Khaimah recorded a remarkable 14% year-on-year ADR increase, though from a relatively low base. In 2023, ADR had declined by 4.5% due to the renovation of the Waldorf Astoria, which impacted overall market performance. Fujairah saw the lowest ADR growth at 4.0%, potentially reflecting competitive pricing pressures.

Average Daily Rate by Emirates – 2024

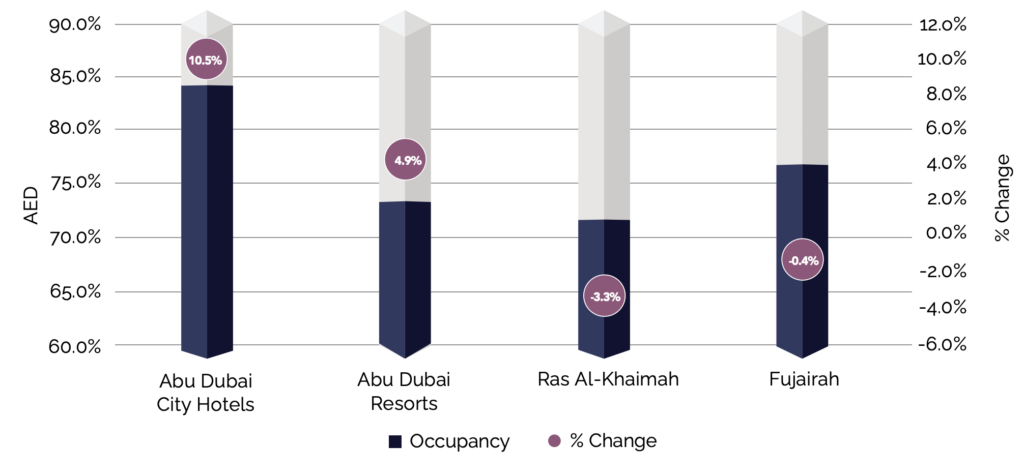

Abu Dhabi City Hotels experienced the strongest occupancy growth (+10.5%), driven by increased demand from corporate travel, MICE (Meetings, Incentives, Conferences and Events), and government-backed tourism initiatives. The city has reinforced its status as a global events hub by hosting major international events such as UFC Fight Night, the Abu Dhabi International Chess Festival, and the Abu Dhabi International Hunting and Equestrian Exhibition, all of which significantly boosted hotel demand. Additionally, Etihad Airways expanded its network with new and increased flight routes, including four weekly flights to Jaipur, India, as well as additional frequencies to Amman, Jordan (+3 weekly flights) and Karachi, Pakistan (+3 weekly flights), enhancing accessibility for international travellers. The hospitality sector also saw a limited growth with the opening of three new hotels, adding approximately 450 rooms to the city’s inventory.

Ras Al-Khaimah saw a slight drop in occupancy, which may indicate market challenges. In 2024, Ras Al Khaimah expanded its hospitality offerings with the opening of luxury properties such as the Anantara Mina Al Arab Resort and the Sofitel Al Hamra Beach Resort. These additions introduced more rooms into the market, seemingly led to a temporary dip in occupancy rates as the supply outpaced immediate demand.

While the emirate achieved a record 1.28 million visitors in 2024, this represented a 4.9% increase from the previous year, marking the smallest growth in recent years. This modest rise in visitors, coupled with the increase in hotel capacity, have contributed to the observed decline in occupancy rates. The upcoming Wynn Al Marjan Island resort, set to open in 2027 with the Gulf’s first gaming resort, has spurred significant hotel development in the area. While these projects are expected to boost tourism in the long term, the current construction and anticipation phase might have caused a temporary imbalance between supply and demand.

In 2024, Fujairah’s hospitality sector expanded with the opening of a new hotel, contributing an additional 44 rooms to the emirate’s accommodation supply. Despite the growth in offerings across other Emirates, Fujairah’s occupancy levels have remained stable. To enhance tourism demand, the Fujairah Government has introduced several initiatives, including the promotion of key archaeological sites such as Al Bidya Mosque. As part of its strategic objectives, the Government aims to attract 500,000 visitors to the emirate.

Occupancy by Emirates – 2024

Dubai’s Hospitality Sector: Sustaining Growth Amidst New Opportunities

Dubai’s hospitality sector continues to experience robust growth, reaching a new milestone in 2024 with 18.72 million overnight visitors—an increase of 9.15% from the previous year. This growth trajectory places Dubai on track to reach the goal of the Dubai Economic Agenda D33, which aims to position the city among the top three global tourism destinations. Along with this expansion, global accolades, such as being named the world’s leading tourism destination and having a top-ranked airport, further reinforce Dubai’s status as a key hub for both leisure and business. Dubai’s emphasis on innovation, unique experiences, and sustainability will continue to drive growth. Continued success will depend on attracting high-spending tourists and hosting major events.

From an investor’s perspective, however, the sector is finely balanced between demand and supply, particularly with the influx of new luxury hotel rooms. This could exert pressure on average daily rates (ADR). Tourists will be the beneficiaries, but investors need to choose their hospitality investments wisely.

Looking ahead, Dubai’s hospitality market is well-positioned for continued growth, but it will need to adapt to emerging trends and maintain its competitive edge to ensure long-term success.

Julian Roche

Chief Economist