Dubai Office Market Performance H1 2025

Executive Summary

Dubai’s investment landscape continued to flourish in the first half of 2025, reinforcing its status as the UAE’s leading economic hub. The Emirate attracted 526 greenfield foreign direct investment (FDI) projects, representing 86% of the national total and securing USD 3.03 billion in capital inflows. This growth was further supported by the Dubai International Financial Centre (DIFC), which recorded a 32% year-on-year increase in new business registrations, with 1,081 companies established.

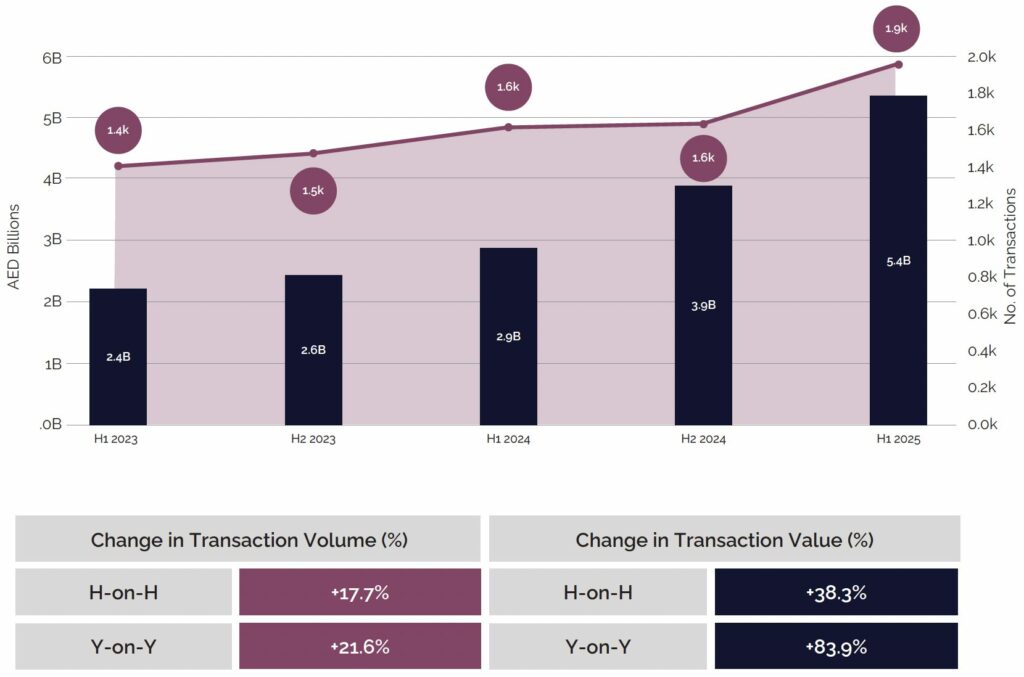

The Dubai office market also delivered an outstanding performance in H1’2025, reaching its highest sales activity in recent years. Approximately 1,900 transactions were completed, reflecting a 21.6% increase year-on-year. Meanwhile, the total value of office sales surged to AED 5.4 billion, marking an 83.9% rise compared to H1’2024.

Office supply expanded by around 34,000 sqm during the first half of 2025, raising the total gross leasable area (GLA) to approximately 9.32 million sqm. An additional 110,000 sqm is anticipated by the end of 2025, followed by a further 340,000 sqm in 2026. While the development pipeline remains healthy, potential variations in completion timelines are expected to keep occupancy rates elevated in the short term. Consequently, office sales prices continued their upward trajectory, increasing by 22.2% year-on-year, while rental rates rose by 26.4% over the same period, driven by strong demand and limited availability. However, the influx of new supply from 2026 onwards is expected to ease price pressures and improve availability in the market.

This report delves into the key factors fuelling the momentum of the Dubai office market, examines trends in office property prices and transaction volumes, and provides an outlook for the sector.

Dubai Market Snapshot for H1 2025

- Sales Transactions: +1850 (+21.6% Y-on-Y)

- Office Sales Value: AED 5.4 Billion (+83.9% Y-on-Y)

- Office Sales Price: +22.2% Y-on-Y

- Office Rental Rates: +26.4% Y-on-Y

- Office Supply in 2025: ~110,000 SQM (Under-construction)

- Office Supply in 2025: 34,000 SQM (Completed)

Dubai’s Investment Growth Accelerates in H1’2025

According to the latest data from Emirates NBD Research, the UAE attracted 613 greenfield foreign direct investment (FDI) projects in the first half of 2025, with total capital inflows reaching USD 5.42 billion. Dubai continued to lead as the country’s primary investment hub, accounting for 526 projects, representing 86% of the national total, and securing USD 3.03 billion in capital during the period.

This momentum was further supported by strong activity within the Dubai International Financial Centre (DIFC). In the first six months of 2025, DIFC recorded a notable surge in new business registrations, with 1,081 new active companies established, up 32% from the same period in 2024. As a result, the total number of active registered firms rose to 7,700, reflecting a 25% year-on-year increase. The professional workforce within DIFC also expanded to 47,901, marking a 9% rise from H1’2024.

The continued influx of capital highlights Dubai’s strong appeal to international investors and businesses. With global firms prioritising stable, transparent, and innovation-led environments, Dubai’s effective governance, strategic location, and commitment to economic diversification are set to continue attracting foreign investment going forward.

Office Sales Transactions

Dubai’s office market continued its strong performance in the first half of 2025, recording the highest level of sales activity seen in recent years. Approximately 1,900 transactions were completed during the period, reflecting a 17.7% increase compared to H2’2024 and a 21.6% rise year-on-year. Simultaneously, the total value of office sales transactions reached AED 5.4 billion, which was 38.3% higher than the previous half and 83.9% above the level recorded in H1’2024.

This exceptional activity was fuelled by continued economic confidence, the steady expansion of regional and international businesses, and a growing preference among occupiers to secure ownership of office space amid rising rental pressures. Additionally, limited availability of high-quality stock in core business districts is pushing both investors and end users to act quickly, further boosting market activity.

Sales Transactions – By Volume and Value

Source: Property Monitor, Cavendish Maxwell

Office Sales Transactions by Type: Ready and Off-Plan

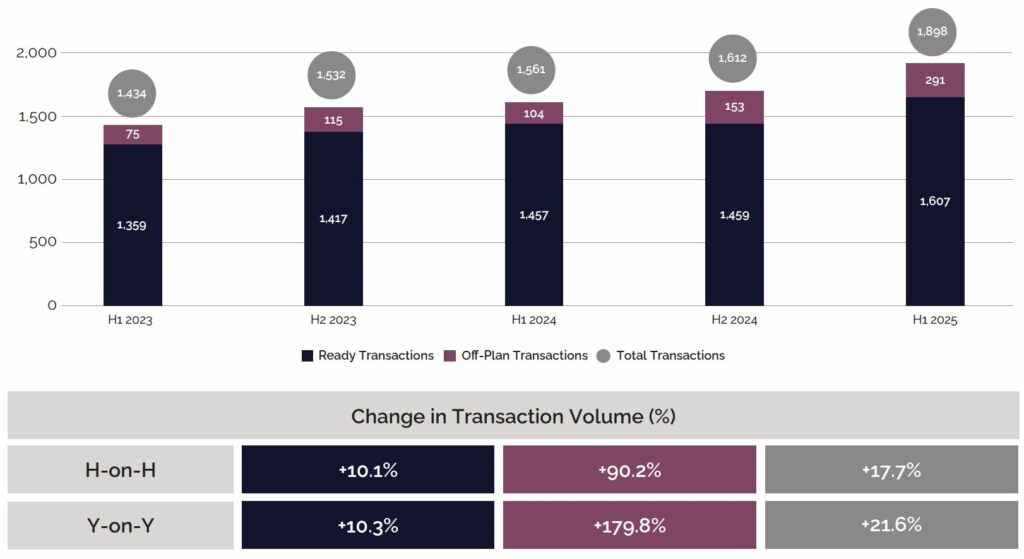

Both the ready and off-plan segments played a significant role in driving the positive momentum of the office sales market. While ready offices continue to dominate, accounting for 84.7% of total office transactions, their share dipped slightly in H1’2025 as off-plan sales surged to 15.3%. However, off-plan sales experienced a modest slowdown in Q2’2025, largely due to a limited number of new project launches.

In terms of transaction volume, ready office sales grew by 10.1% compared to H2’2024 and 10.3% compared to H1’2024, driven by buyers seeking immediate ownership and tenants aiming to hedge against rising rental costs. Meanwhile, the off-plan segment experienced a significant surge, with volume increasing by 90.2% from H2’2024 and 179.8% year-on-year compared to H1’2024, fuelled by strong demand for upcoming office spaces featuring modern and innovative designs.

Sales Transactions – By Volume

Source: Property Monitor, Cavendish Maxwell

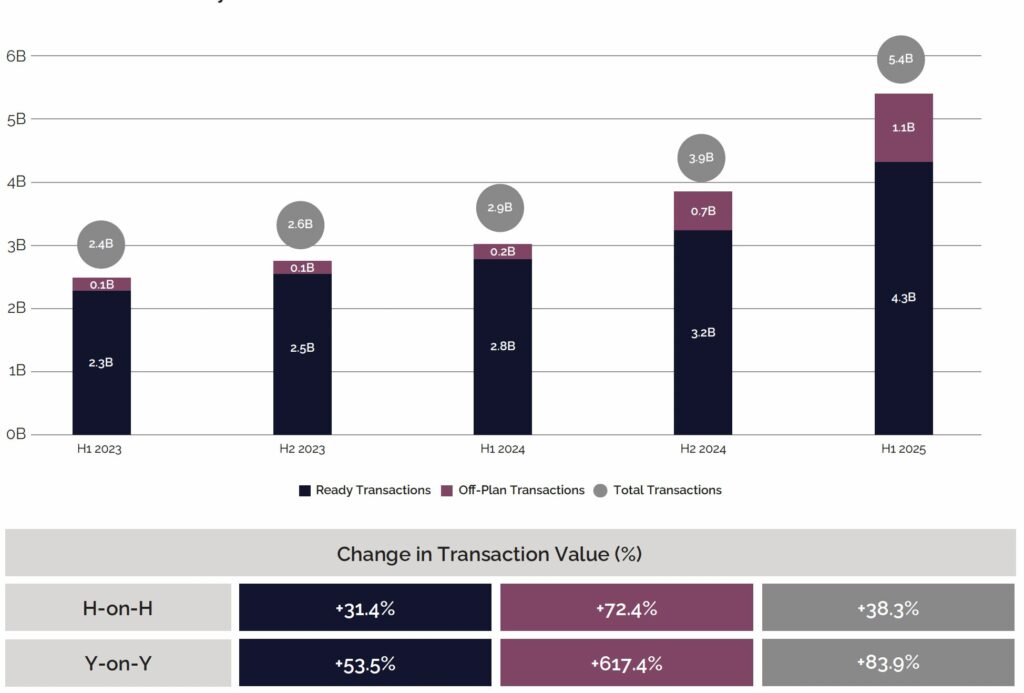

In terms of transaction value, ready office sales grew by 53.5% c ompared to H1’2024, with the average ticket price rising from AED 1.9 million to AED 2.7 million over the same period. Meanwhile, the off-plan segme nt experienced a significant increase of 617.4%, driven largely by transactions concentrated in luxury-grade office space.

Sales Transactions – By Value (AED Billions)

Source: Property Monitor, Cavendish Maxwell

Sales Transactions: Top 5 Areas by transactional volume

Combined Ready and Off-Plan Transactions

- Business Bay

672 Transactions - Jumeirah Lakes Towers

534 Transactions - Motor City

216 Transactions - Barsha Heights (Tecom)

160 Transactions - Dubai Silicon Oasis

77 Transactions

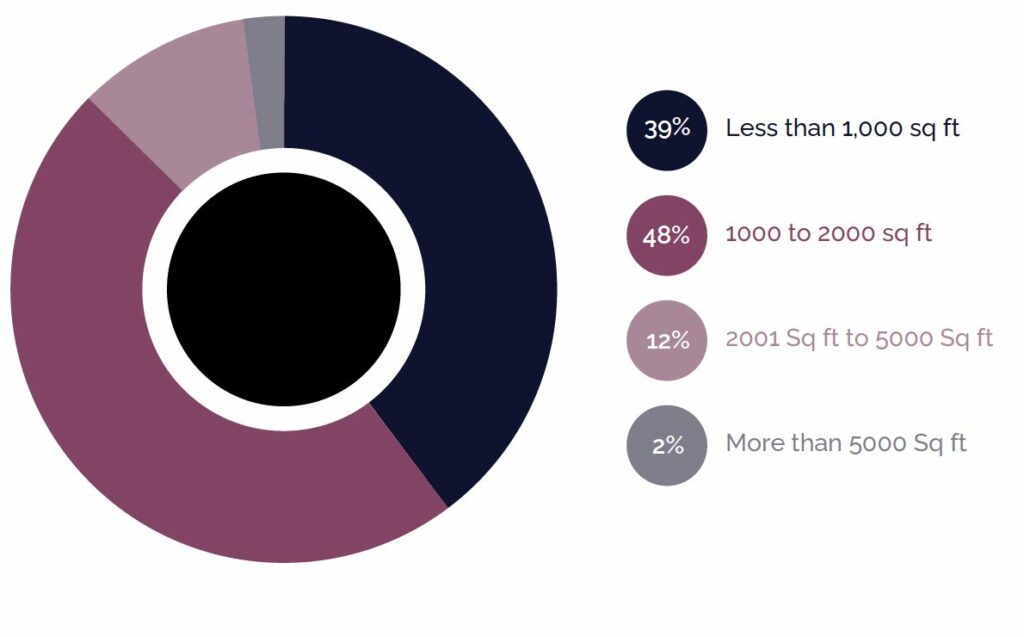

Sales Transactions by Unit Size

Sales Transactions by Unit Size (%)

Source: Property Monitor, Cavendish Maxwell

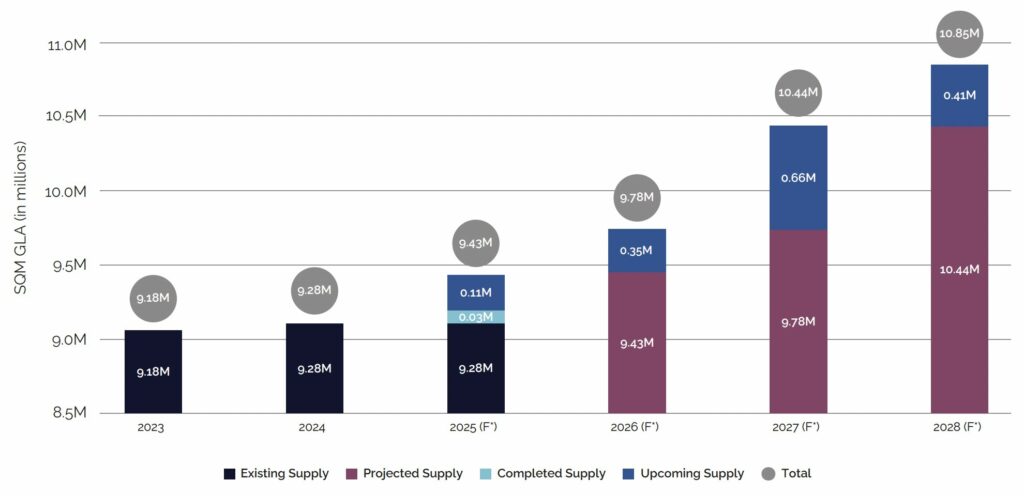

Existing and Future Office Supply

So far this year, approximately 34,000 sqm of new office space has been added to the market, bringing Dubai’s total office supply to around 9.32 million sqm of gross leasable area (GLA). Following a period of limited completions, the market is now positioned for a steady increase in new deliveries, with an estimated 110,000 sqm expected over the remainder of the year, followed by an additional 340,000 sqm in 2026.

While the development pipeline appears robust, actual completion timelines may vary. As a result, occupancy rates are likely to remain elevated in the short term. However, the majority of upcoming supply is projected to enter the market between 2026 and 2028, which is expected to ease pressure on prices as availability improves. At the same time, developers are responding to the growing demand for office space, with an increase in new project launches in recent times.

Dubai Office Supply

Source: MEED Projects, Cavendish Maxwell

*The projected supply is based on the information available at the time of preparing the report and may differ from other projections. It is subject to revision as additional details about these projects become available in the future.

Sales Price Trend

Dubai’s office sales prices maintained their upward trajectory in H1’2025, rising by 12.8% compared to H2’2024 and by 22.2% year-on-year from H1’2024. With strong investor and occupier appetite coupled with relatively constrained short-term supply, prices are expected to continue trending upwards in the near term.

Source: Property Monitor, Cavendish Maxwell

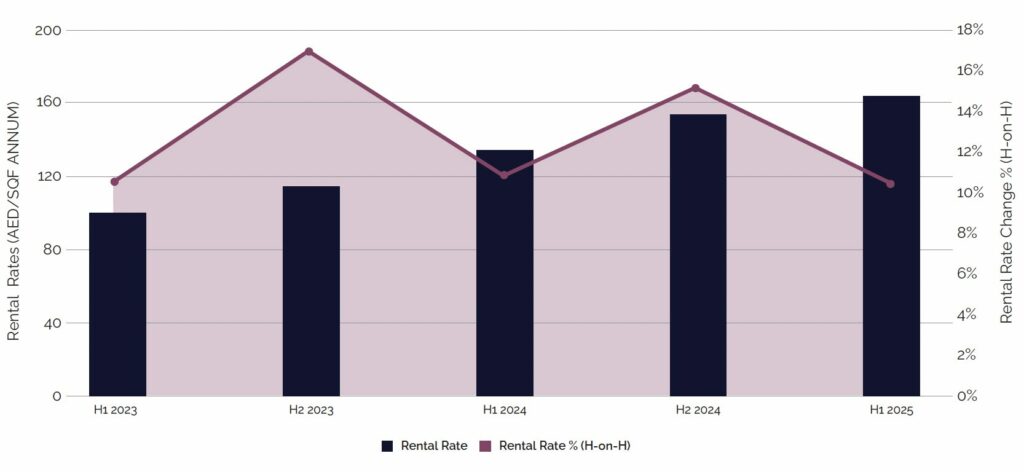

Rental Rate Trend

Rental rates in Dubai continued their upward trend in H1’2025, rising by 10.4% compared to H2’2024 and 26.4% year-on-year from H1’2024. As occupancy levels continue to rise, pressure on tenants has grown, driven by strong demand and limited availability. Even with new supply entering the market, a large portion is already pre-leased, a trend that continues to gain traction in the current market cycle.

Rental Rate Trend

Source: Property Monitor, Cavendish Maxwell

Rental Rate Change by Area (H1’2024 vs. H1’2025)

Rental rates across key office submarkets in Dubai showed varied year-on-year growth in H1’2025, reflecting differences in demand dynam-ics and the relative maturity of each location. Prime business districts such as DIFC and Downtown Dubai led the market, registering substantial rental growth of 34.9% and 33.5% respectively, fuelled by strong tenant demand for premium, modern office spaces.

Conversely, more mature and established areas such as Bur Dubai (+3.8%), Deira (+2.6%), and Dubai Healthcare City (+2.2%) recorded only modest increases. The subdued performance in these areas can be attributed to factors such as ageing infrastructure, limited new supply, and an increasing tenant preference for newer Grade A spaces in emerging business hubs offering enhanced amenities and accessibility.

Office Rental Rate Movement in H1 2025

Source: Property Monitor, Cavendish Maxwell

2025 Real Estate Market Outlook

Dubai’s office market momentum is set to continue through the remainder of 2025, supported by robust investment inflows, strong occupier demand, and a healthy development pipeline. Office sales activity has surged to levels not seen in recent years, reflecting heightened demand driven by expanding regional and international businesses as well as tenant preferences shifting towards ownership amid rising rental costs.

On the supply side, while approximately 34,000 sqm of new office space was added in H1’2025, and a further 110,000 sqm is expected by year-end, the bulk of new deliveries is projected between 2026 and 2028. Although potential variations in project completions may keep occupancy rates elevated in the short term, the anticipated influx of supply from 2026 onwards should ease current pressures on rents and prices.

The UAE’s commercial real estate market delivered a resilient performance in H1 2025, driven by robust investor confidence, sustained demand in prime office and logistics segments, and growing preference for ESG-aligned assets. As global markets remain cautious, the UAE continues to position itself as a stable and attractive destination for institutional capital. Looking ahead, the upcoming wave of quality supply expected in 2026 is set to further strengthen market depth and offer occupiers greater flexibility, particularly in core business districts such as DIFC and emerging logistics hubs.

Kieran Burley

Director, Head of Investment and Commercial Agency

Office sales prices and rental rates are expected to maintain their upward trajectory in the near term, driven by strong investor and occupier appetite amid relatively constrained short-term supply. However, as new supply comes online and economic diversification progresses, the market should gradually see easing in price pressures, promoting a healthier balance between buyers and tenants.

Overall, Dubai’s office real estate market outlook for 2025 remains positive, supported by consistent demand, measured supply growth, and strong investment fundamentals. These factors, taken together, position Dubai to uphold its appeal as a leading office hub, offering attractive opportunities for investors and occupiers seeking quality, connectivity, and innovation-driven spaces.