Dubai Office Market Performance Q1 2025

Executive Summary

Dubai’s office market maintained strong momentum in Q1 2025, driven by solid economic fundamentals and rising investor confidence. The Dubai International Chamber reported a 39.0% year-on-year increase in new foreign company registrations, including 11 multinational corporations and 42 SMEs. At the same time, the Dubai Chamber of Commerce supported the international expansion of 28 local firms. This dual dynamic further reinforced Dubai’s position as a global business hub.

The office sales market reflected this positive sentiment, with approximately 900 transactions completed in Q1 2025, a 23.7% year-on-year increase, driven by strong activity in both ready and off-plan segments. Notably, off-plan transactions surged, accounting for 18.9% of all deals compared to just 8.1% in Q1 2024, highlighting growing buyer confidence in future developments. Meanwhile, office sales prices rose 24.5% year-on-year, while rental rates increased by 24.0%, fuelled by limited availability and sustained demand, especially in Grade A accomodations. Additionally, ongoing shortages of Grade A space are driving spillover demand, pushing prices higher in the Grade B and C segments.

Looking ahead, the office market is expected to remain landlord-driven throughout 2025, as strong demand continues to outpace supply. To meet this demand, approximately 215,000 sqm of additional gross leasable area is expected to be delivered by year-end.

This report delves into the key factors fuelling the momentum of the Dubai office market, examines trends in office property prices and transaction volumes, and provides an outlook for the sector.

Dubai Market Snapshot for Q1 2025

- Overall Office Sales Transactions Volume: 920 (+23.7% vs. Q1 2024)

- Ready Office Sales Transactions Volume: 750 (+9.2% vs. Q1 2024)

- Off-Plan Office Sales Transactions Volume: 170 (+188.5% vs. Q1 2024)

- Overall Office Sales Transactions Value: 2.8 Billion (+83.1% vs. Q1 2024)

- Ready Office Sales Transactions Value: AED 2.0 Billion (+39.9% vs. Q1 2024)

- Off-Plan Office Sales Transactions Value: AED 0.8 Billion (+741.1% vs. Q1 2024)

Dubai’s Economic Growth and Investment Highlights – Q1 2025

Dubai further reinforced its position as a global hub for international business in the first quarter of 2025, with the latest data from the Dubai International Chamber reporting the addition of approximately 53 new international companies, a 39.0% increase compared to the same period last year. Among these were 11 multinational corporations (MNCs) and 42 small and medium-sized enterprises (SMEs), highlighting the Emirate’s broad appeal to businesses of all sizes.

At the same time, the Dubai Chamber of Commerce supported the international expansion of 28 local companies, demonstrating the city’s dual role as both a magnet for global investment and a launchpa d for outward growth.

This combination of new companies entering Dubai and local businesses expanding abroad strengthens Dubai’s position as a global hub. It also contributes to a more diverse and stable economy connected to international markets. Reflecting this growth, exports and re-exports by Dubai Chamber of Commerce members reached AED 86 billion in the first quarter of 2025, a 16.8% increase compared to the previous year.

With strong Government backing and solid investor confidence, Dubai is firmly cementing its position as a global business hub. The momentum is real — we’re seeing multinationals and SMEs alike set up shop, and Q1 2025 office market numbers speak for themselves: record-high transactions, sales, and rents.

Vidhi Shah

Director, Head of Commercial Valuation

Office Sales Transactions

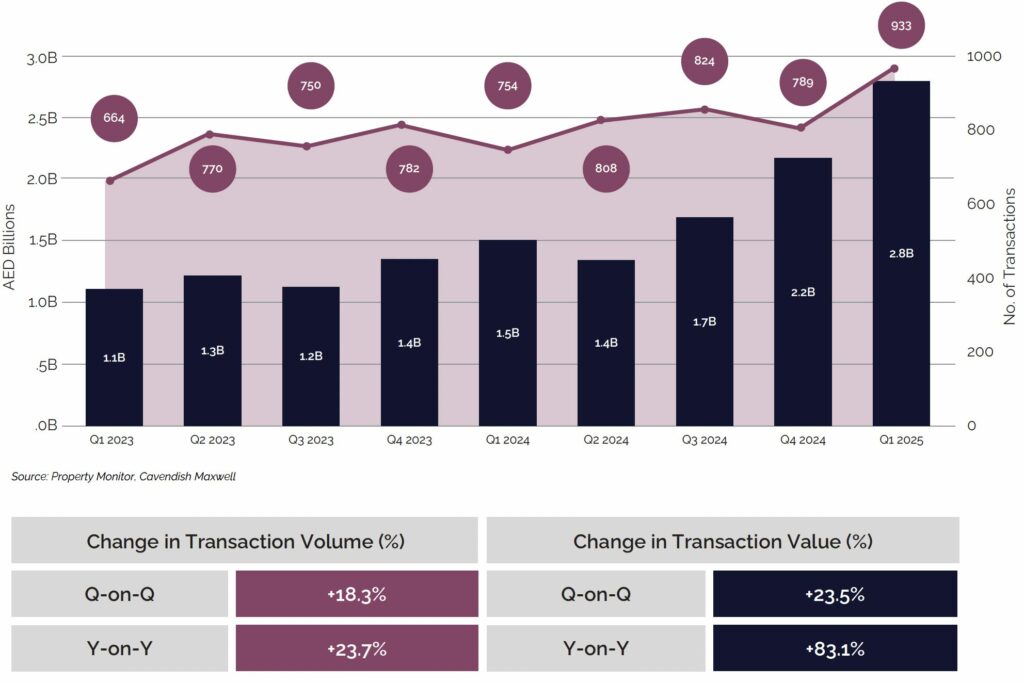

The sales market in Dubai maintained strong momentum in the first quarter of 2025, with both transaction volume and value reaching record levels. Approximately 900 sales transactions were completed during the quarter, reflecting a 23.7% year-on-year increase. Meanwhile, total transaction value reached around AED 2.8 billion, marking an 83.1% rise compared to the same period last year.

This growth in demand was fuelled by proactive Government initiatives and the Emirate’s strong commitment to innovation, sustainability, and world-class connectivity. Additionally, ongoing infrastructure improvements and investor-friendly regulations further supported the market, reinforcing Dubai’s office sector as a dynamic and resilient hub in a rapidly evolving global economy.

Dubai Office Transactions – By Volume and Value

Source: Property Monitor, Cavendish Maxwell

Office Sales Transactions by Type: Ready & Off-Plan

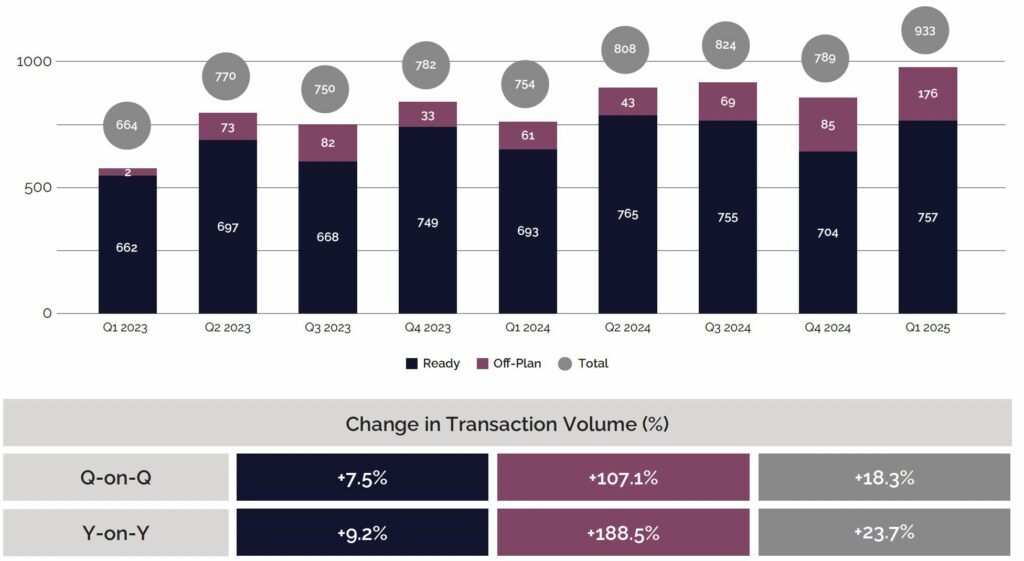

The growth in office transaction volume and value in Q1 2025 was driven by strong activity across both the ready and off-plan segments. While demand remained healthy across the board, the off-plan segment recorded the highest increase, accounting for 18.9% of all office transactions in Q1 2025, up from just 8.1% in Q1 2024. This surge reflects increasing buyer confidence in future commercial developments, supported by competitive launch prices, flexible payment plans, and expectations of long-term capital appreciation.

Meanwhile, ready office transactions continued to dominate the market, with approximately 750 deals recorded in Q1 2025, representing a 9.2% year-on-year increase. This segment remains especially attractive to end-users, many of whom are shifting from leasing to ownership due to rising rental costs, while also appealing to investors seeking favourable conditions for rental yields and long-term capital appreciation.

Dubai Office Transactions – By Volume

Source: Property Monitor, Cavendish Maxwell

Dubai’s commercial real estate market in Q1 continues to reflect the city’s strategic vision — resilient, adaptive, and globally connected. As demand evolves, opportunities emerge for investors ready to align with the Emirates’ growth strategy.

Kieran Burley

Director, Head of Investment and Commercial Agency

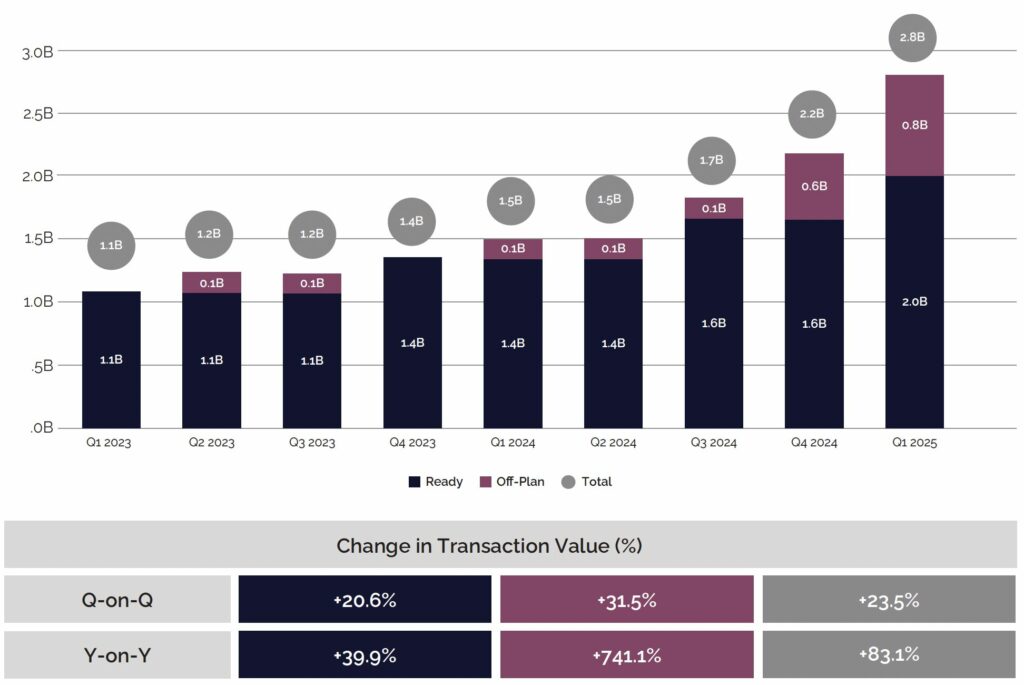

In terms of value, ready office transactions rose by 39.9% compared to Q1 2024, while the value of off-plan transactions surged by 741.1%, largely due to transactions concentrated in the ultra-luxury office segment. This highlights the growing significance of the off-plan segment within Dubai’s evolving office market.

Dubai Office Transactions – By Value (AED Billions)

Source: Property Monitor, Cavendish Maxwell

Office Sales Transactions: Top 5 Areas by transactional volume

Combined Ready and Off-Plan Transactions

- Business Bay

316 Transactions - Jumeirah Lakes Towers

222 Transactions - Motor City

130 Transactions - Barsha Heights (Tecom)

88 Transactions - Dubai Silicon Oasis

41 Transactions

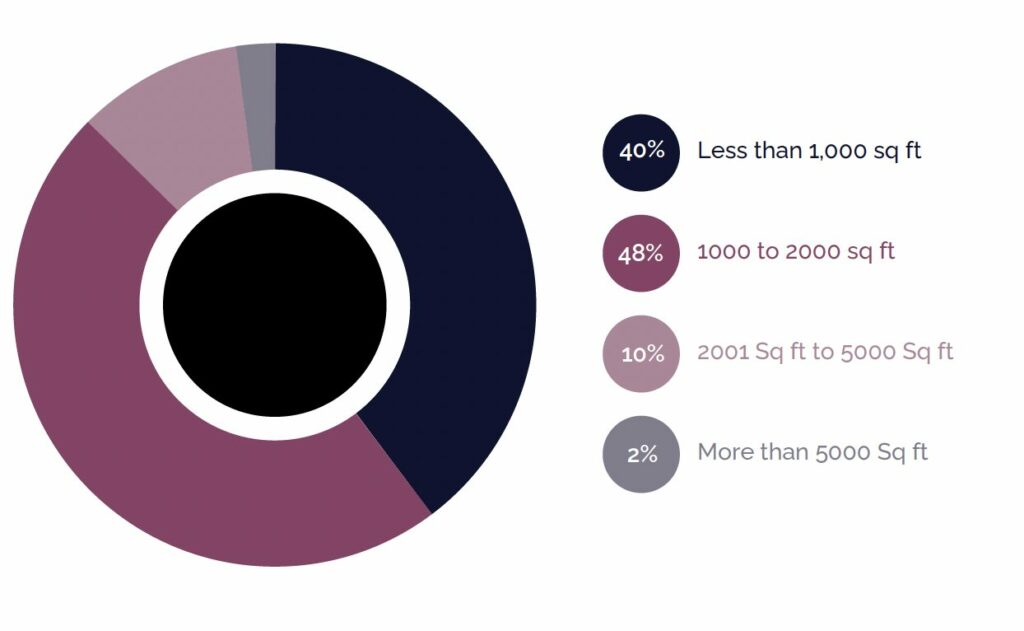

Office Sales Transactions by Unit Size

Office Sales Transactions by Unit Size (%)

Source: Property Monitor, Cavendish Maxwell

Existing and Future Office Supply

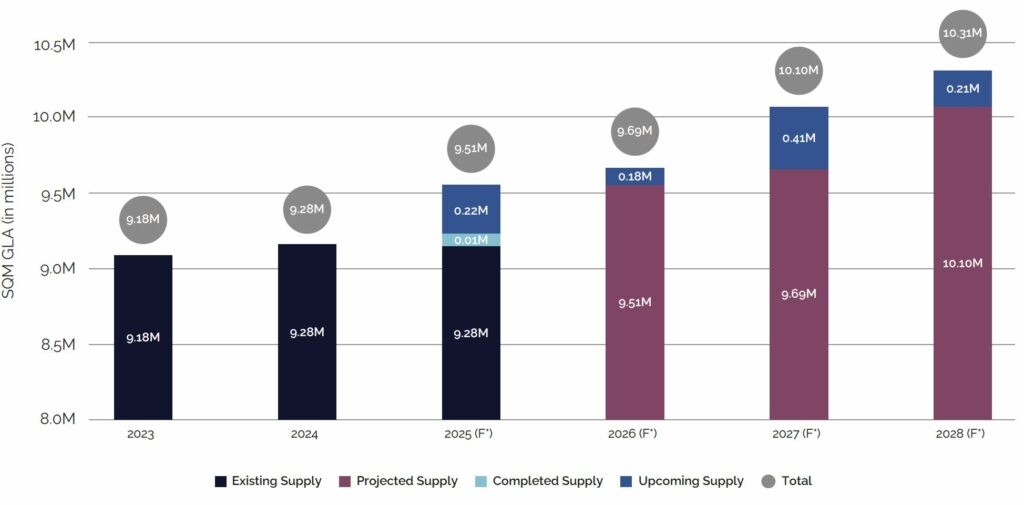

As of Q1 2025, Dubai’s total office supply reached approximately 9.29 million square metres of gross leasable area (GLA). Despite this, demand for office space continues to outpace supply, driven by increased business activity, including new company formations and the expansion of existing operations.

Looking ahead, nearly 215,000 sqm of additional office space is expected to be delivered in the remainder of 2025, followed by a further 181,000 sqm in 2026. Much of this upcoming supply is concentrated in core business districts, with a significant portion consisting of Grade A space. With a strong development pipeline extending into 2027, the demand-supply imbalance is projected to gradually narrow, offering some relief to tenants and easing upward pressure on prices.

Dubai Office Supply

Source: MEED Projects, Cavendish Maxwell

*The projected supply is based on the information available at the time of preparing the report and may differ from other projections. It is subject to revision as additional details about these projects become available in the future.

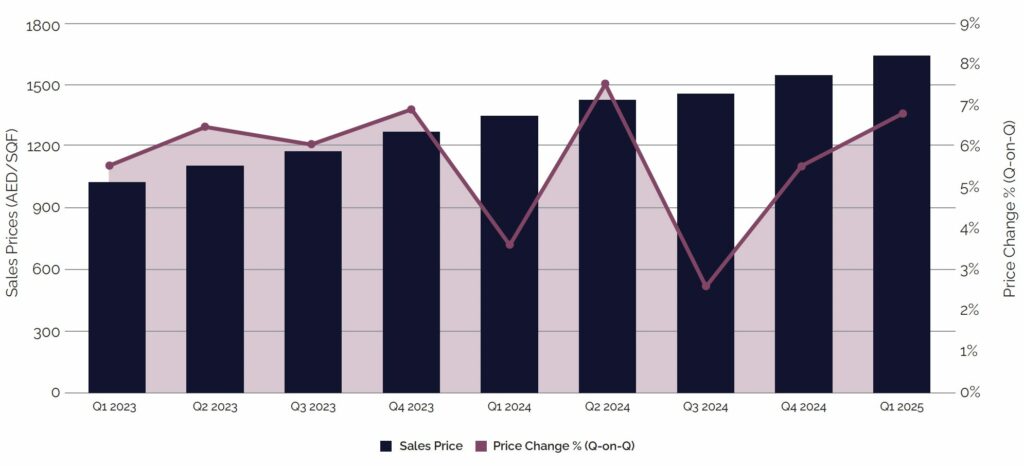

Office Sales Price Trend

Sales prices in Dubai continued their upward trajectory in Q1 2025, increasing by 6.5% quarter-on-quarter and 24.5% year-on-year. With limited supply and rising rental costs, a growing number of office tenants are choosing to purchase office space as a strategic, long-term cost-saving measure, which is pushing demand higher and contributing to the continued price growth.

In addition to demand from new and expanding businesses, investor appetite also remains strong, driven by confidence in the office market’s long-term growth potential and consistent rental yields.

Dubai Office Sales Price Trend

Source: Property Monitor, Cavendish Maxwell

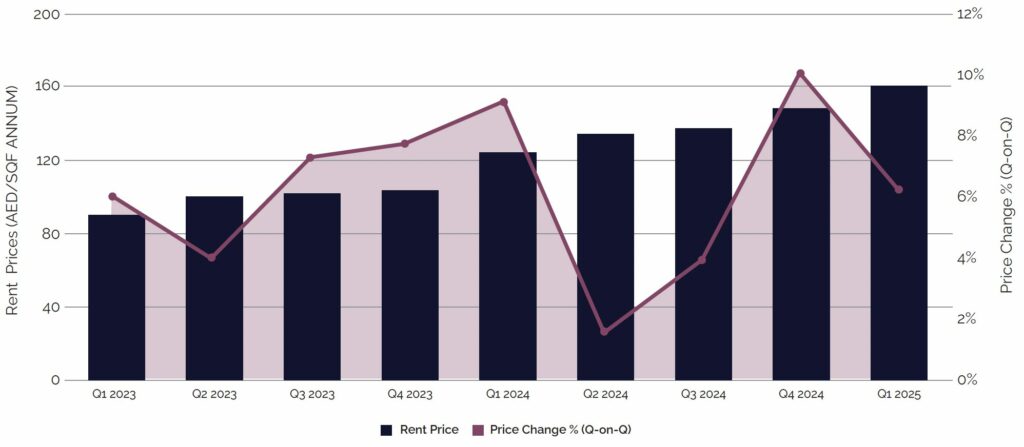

Office Rental Rate Trend

With limited supply, occupancy rates climbed further in Q1 2025, exerting upward pressure on rental rates across Dubai. The market continued to favour landlords, particularly those with offering Grade A space, who commanded premium rents due to limited availability and high demand. Overall, rental prices in Dubai rose by 6.7% quarter-on-quarter and 24.0% year-on-year.

Dubai Office Rental Price Trend

Source: Property Monitor, Cavendish Maxwell

Office Rental Rate Change by Area (Q1 2024 vs. Q1 2025)

Rental rates continued to rise across Dubai’s office districts in Q1 2025, with increases observed across all quality tiers—Grade A, B, and C. The rise in rents for Grade B and C offices was largely driven by the limited availability of Grade A space, pushing some tenants to consider lower-grade alternatives to meet their requirements. Premium office locations, such as Downtown Dubai and DIFC, recorded the highest annual rental growth, at 39.6% and 38.9%, respectively.

Dubai Office Rental Price Movement in Q1 2025

Source: Property Monitor, Cavendish Maxwell

2025 Real Estate Market Outlook

Dubai’s office market entered 2025 with strong momentum, supported by steady economic growth, high levels of business formation, and resilient trade performance, all within a stable macroeconomic environment. This foundation is further strengthened by strategic infrastructure development, world-class connectivity, and a pro-business regulatory framework. Together, these factors have driven robust performance in the first quarter of 2025, reaffirming Dubai’s status as a leading destination for regional and international capital despite ongoing geopolitical and economic uncertainties.

In the remainder of 2025, the office supply pipeline remains robust and may offer some relief to tenants. Approximately 215,000 sqm of new office space is expected to enter the market; however, actual completions are often lower than projected due to market factors, while pre-booking of units further reduces immediate availability. As a result, occupancy rates are expected to remain elevated throughout 2025, supported by strong and sustained demand that continues to outpace supply.

Given this supply-demand dynamic, the market is expected to remain landlord-driven, with landlords maintaining significant leverage. Both sales and rental prices are projected to rise further throughout 2025, primarily due to ongoing supply constraints. It will be interesting to see how tenants respond, as some may downsize or relocate, while others might embrace flexible workspaces or pre-commit to pipeline projects.