Dubai Residential Market Performance H1 2025

Executive Summary

According to the latest statistics from the Dubai Land Department (DLD), Dubai attracted approximately 94,700 investors in the first half of 2025, marking a significant 26% increase compared to the same period last year. Of these, around 59,000 were new investors, representing a 22% rise year-on-year. Notably, UAE residents accounted for 45% of these new investors, highlighting strong local participation in the market.

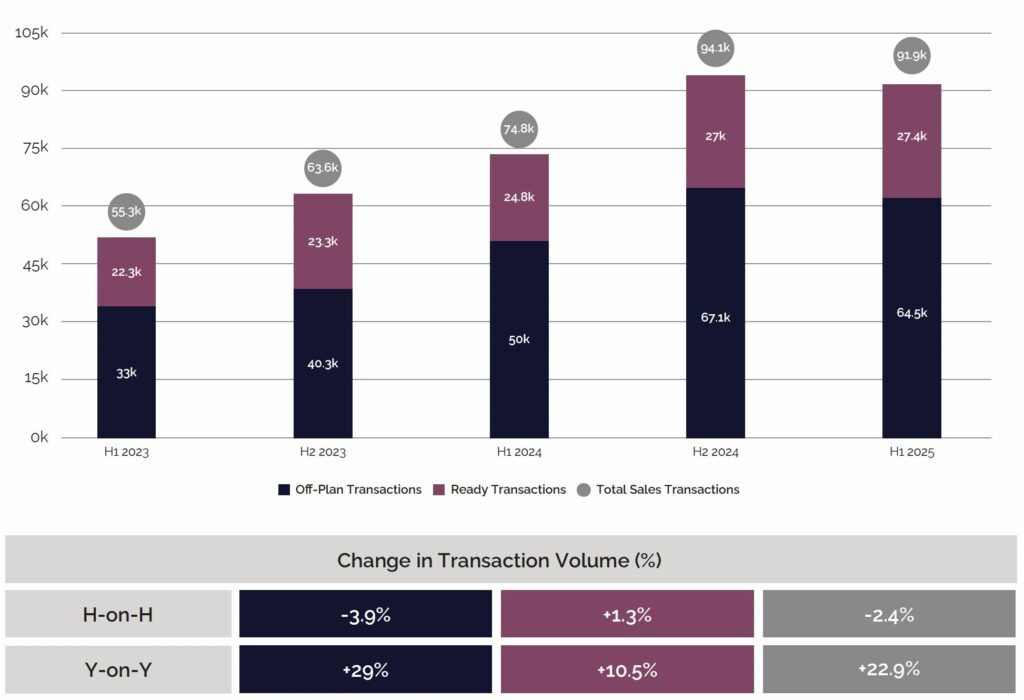

As a result, the residential sector recorded 91,900 transactions valued at AED 262.1 billion, reflecting growth of 22.9% in volume and 36.4% in value compared to H1’2024. However, transaction volumes declined slightly by 2.4% compared to H2’2024, primarily due to subdued activity in the first quarter. Nevertheless, the market rebounded strongly in the second quarter, driven by robust demand from both local and international investors as well as end-users.

Alongside increased transaction activity, the residential supply has also grown. Approximately 17,200 residential units were completed in the first half of 2025, with nearly 42.4% of handovers concentrated in Jumeirah Village Circle, Sobha Hartland, and Mohammed Bin Rashid City. Looking ahead, Dubai’s development pipeline remains significant, with over 61,800 units currently under construction for the remainder of the year. However, only 21% of the projects scheduled for completion in 2025 have reached 75% or more construction progress, indicating potential delays in delivery.

In terms of prices, strong transactional activity continued to drive sales price growth, with residential prices increasing by 7.8% compared to H2’2024 and 16.6% year-on-year from H1 2024. Over the same period, rental rates rose by 9.9% compared to H1’2024 but recorded a marginal decline of 0.6% compared to H2 2024, suggesting early signs of moderation in the leasing market.

Dubai’s real estate market is projected to remain robust throughout the remainder of 2025. Momentum is expected to continue if the pace of new project launches is maintained, alongside support from initiatives such as the First-Time Buyer Programme and a steady pipeline of residential completions, factors that could help guide the market towards a mature and balanced phase.

This report examines the key drivers behind this momentum, analyses trends in property prices and transaction volumes, and offers an outlook for Dubai’s residential real estate sector.

Market Snapshot for H1 2025

- Sales Transactions: 91,800 (+22.9% Y-on-Y)

- Residential Sales Value: AED 262.1 Billion (+36.4% Y-on-Y)

- Sales Price: +16.6% Y-on-Y

- Rental Rates: +9.9% Y-on-Y

- Residential Supply in 2025: 61,000 Units (Under-construction)

- Residential Supply in 2025: 17,200 Units (Completed)

Macroeconomic Overview and Outlook

Macroeconomic Overview

Dubai’s economic landscape remained resilient in the first half of 2025, with key macro indicators reflecting moderate yet consistent growth. The Emirate continues to leverage its status as a regional hub for tourism, business, and long-term residency, factors that consistently drive demand across multiple sectors. The S&P Global Dubai PMI stayed above the 50-point expansion threshold, though it dipped to 51.8 in June, marking its lowest reading in nearly four years. This moderation was largely attributed to competitive pressures and softer tourism amid heightened regional tensions. With tensions now easing, there is optimism that new orders will rebound in the coming months.

Nevertheless, Dubai’s population grew to 3.97 million by mid-2025, representing a 5.5% year-on-year increase. Simultaneously, the city welcomed 8.68 million overnight visitors between January and May 2025, a 6.9% rise compared to the same period in 2024. These consistent inflows of residents and tourists are expected to support demand across the residential, hospitality, and retail sectors.

Macroeconomic Outlook

Looking ahead, Dubai is positioned for another year of growth in 2025, with GDP, population, and tourism all forecasted to rise steadily. This outlook is supported by the Emirate’s dynamic economic sectors, strategic infrastructure projects, and expanding global connectivity. As Dubai continues to invest in world-class developments and attract international talent and visitors, the city is set to reinforce its reputation as a vibrant, innovative, and resilient global destination, offering unparalleled opportunities for businesses, investors, and residents alike.

Residential Sales Transactions

Sales Transactions: By Volume

Dubai’s residential market remained resilient in the first half of 2025, with around 91,900 transactions recorded. Although this reflected a slight decline from the second half of 2024, the decrease was largely due to reduced off-plan activity, influenced by a slower rate of new project launches and seasonal factors. In contrast, ready property transactions saw a modest rise, driven by end-users seeking immediate occupancy amid rising rental costs as well as investors attracted to income-generating opportunities. The market slowdown was primarily concentrated in Q1’2025; however, momentum rebounded notably in Q2, with both off-plan and ready segments posting robust, record-breaking transaction volumes. Notably, off-plan transactions reached approximately 35,300 in Q2, while ready property sales hit 14,200, marking the highest levels seen in recent years.

On a year-on-year basis, total transaction volumes rose by 22.9% compared to the first half of 2024. Both the ready and off-plan segments contributed to this growth, with off-plan properties leading the way. This upward trend reflected resilient buyer appetite and continued investor interest in Dubai’s residential sector, despite short-term market fluctuations.

Sales Transactions – By Volume

Source: Property Monitor, Cavendish Maxwell

Sales Transactions: By Value

Despite a slight decline in transaction volumes compared to H2’2024, the total value of residential transactions increased by 11.7% to reach AED 262.1 billion in H1’2025. The off-plan segment led with AED 187.9 billion in transactions, while the ready segment contributed AED 74.2 billion. This divergence reflects a shift towards higher-value transactions, as average ticket prices rose across all property types — with off-plan properties averaging AED 2.9 million and ready properties averaging AED 2.7 million.

Notably, villas accounted for just 6.9% of total transaction volume but represented nearly 29.9% of the total transaction value, highlighting their premium pricing and strong appeal.

Sales Transactions – By Value (AED Billions)

Source: Property Monitor, Cavendish Maxwell

Sales Transactions: Off-Plan vs. Ready Property Transactions

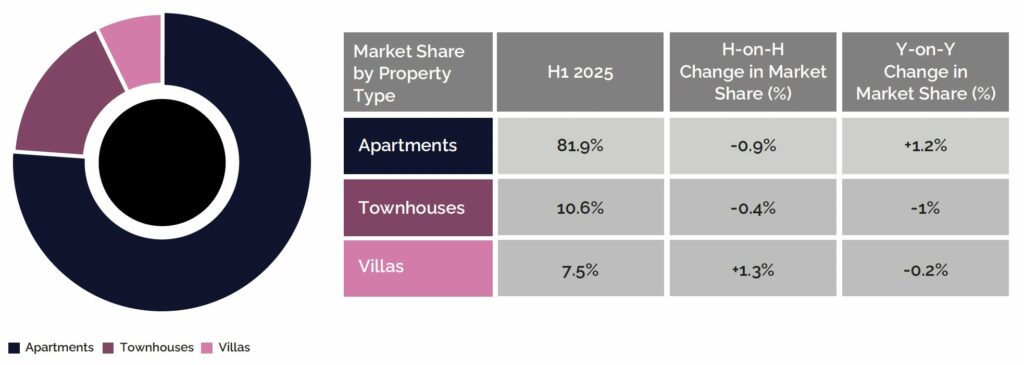

Off-plan properties continued to dominate Dubai’s residential sales landscape, accounting for 70.2% of total residential transactions in H1’2025. While off-plan activity recorded a slight decline compared to H2’2024, the segment remained firmly in the lead, supported by ongoing launches, active developer engagement and continued buyer appetite, particularly driven by attractive payment plans.

Sales by Transaction Type – H1 2025

Source: Property Monitor, Cavendish Maxwell

Sales Transactions: By Property Type (Off-Plan)

In terms of property type, apartments accounted for the majority of off-plan sales transactions at 76.7% in the first half of 2025. However, compared to the same period last year, there was an increase in townhouse and villa transactions, driven mainly by demand from end users and families seeking larger living spaces, as well as investors capitalising on the growing appeal of master-planned villa and townhouse communities. This trend was further supported by the relatively more affordable entry point offered by off-plan units, along with flexible payment plans that have made larger properties more accessible.

Sales Transactions by Property Type – H1 2025

Source: Property Monitor, Cavendish Maxwell

Sales Transactions: By Property Type (Ready)

Even within the ready property segment, apartments continued to lead transaction activity, accounting for over 80% of total sales in H1’2025. While apartment transactions remained relatively stable, villa sales saw a modest uptick compared to H2’2024, reflecting steady demand for larger homes. This trend was driven by interest from high-net-worth individual (HNWI) end users and investors seeking immediate occupancy, rental income and reduced exposure to uncertainties, compared to off-plan purchases, which are often subject to construction delays.

Sales Transactions by Property Type – H1 2025

Source: Property Monitor, Cavendish Maxwell

Sales by Number of Bedrooms (Apartments)

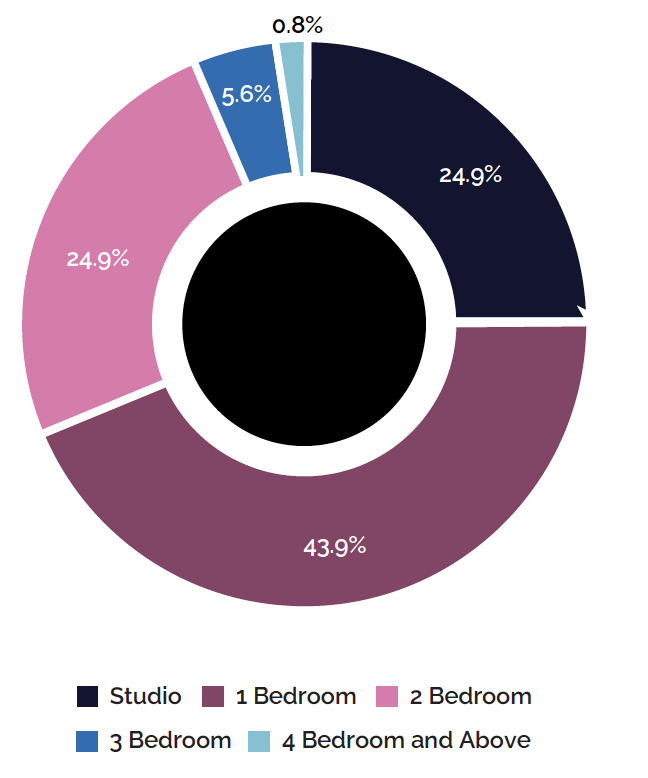

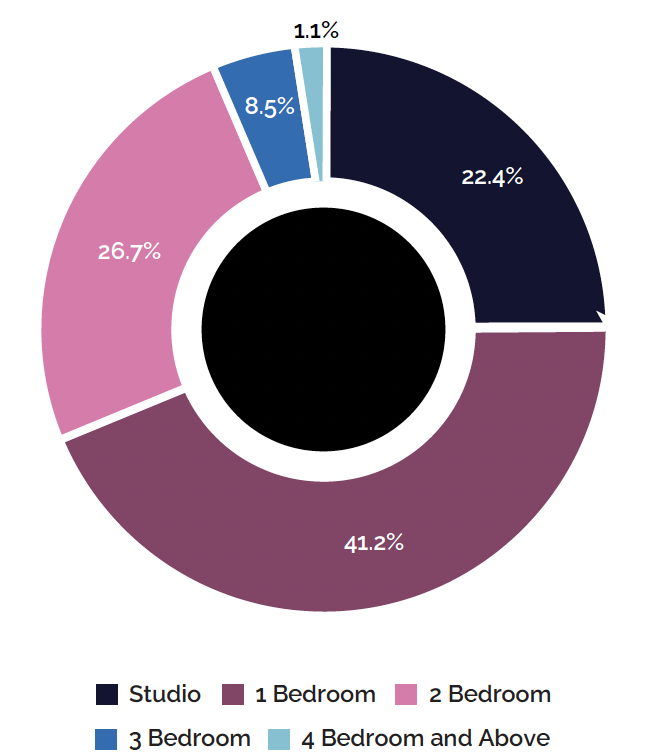

In the first half of 2025, one-bedroom apartments continued to be the most transacted unit type across both the off-plan and ready segments, accounting for 43.9% and 41.2% of sales respectively. However, studio apartments gained notable traction in the off-plan segment, with their share rising from 20.2% in H2’2024 to 24.9% in H1’2025, driven by their lower entry price points and strong buyer interest. Meanwhile, two-bedroom units experienced a marginal decline in transaction share across both segments.

Sales by Number of Bedrooms Off-Plan Apartments

Sales by Number of Bedrooms Ready Apartments

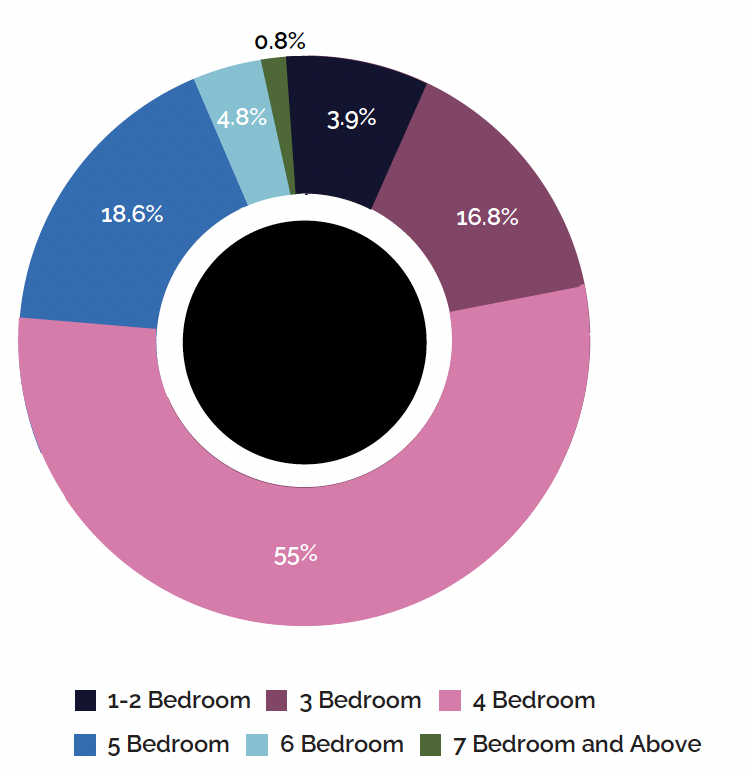

Sales by Number of Bedrooms (Villas/Townhouses)

In the villa and townhouse segment, four-bedroom homes continued to dominate off-plan sales, accounting for 55.0% of transactions in H1’2025, reflecting strong demand for family-sized homes. Notably, the share of five- and six-bedroom units also increased, signalling a growing appetite for larger properties.

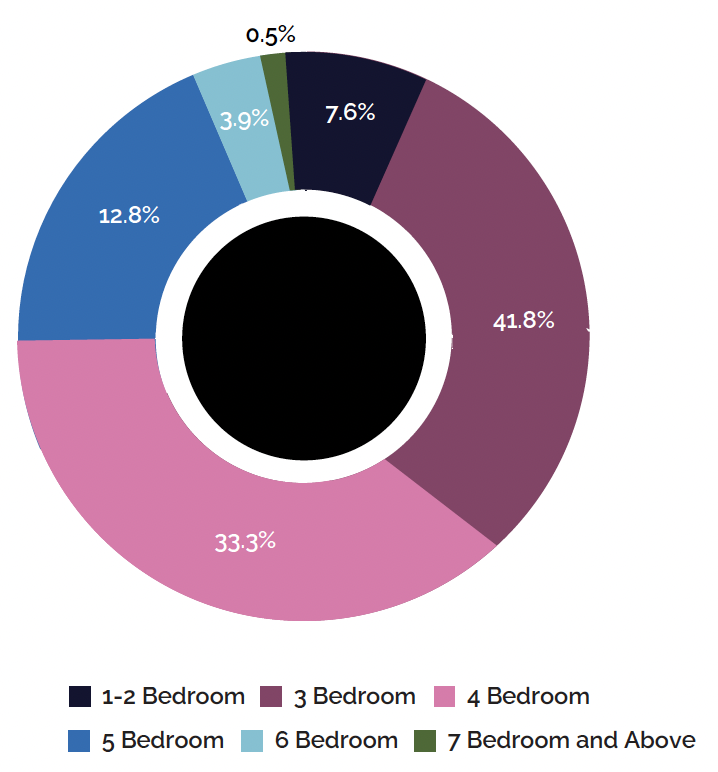

In the ready segment, three- and four-bedroom villas and townhouses remained the most transacted bedroom types. Meanwhile, five-bedroom sales increased to 12.8%, highlighting a rising preference for spacious, ready-to-move-in homes—a trend also observed in the off-plan segment.

Sales by Number of Bedrooms Off-Plan Villas/Townhouses

Sales by Number of Bedrooms Ready Villas/Townhouses

Sales Transactions: Top Real Estate Developers by Volume

Emaar, DAMAC Properties, and Sobha Group continued to dominate the Dubai real estate market, retaining their positions in the first half of 2025. Emaar’s performance was supported by strong sales in The Valley and Emaar South, while DAMAC recorded robust volumes from DAMAC Islands and DAMAC Hills 2. Sobha Group, meanwhile, benefitted from steady demand for Sobha Solis and Sobha Orbis in Motor City.

Other developers like Binghatti and Danube Properties also delivered solid performances, maintaining their positions among the leading contenders. Beyond made a notable debut in the top 10, driven by rising demand for its developments in Dubai Maritime City.

The shifts in rankings reflect growing diversification in buyer preferences and a strong appetite for new entrants with unique offerings. Ultimately, when developers launch high-quality, well-located projects with competitive pricing and flexible payment plans, buyer demand naturally follows.

Top 10 Real Estate Developers by Volume (Initial Sale)

| Developers | Rank – H1 2025 | Rank – H1 2024 | Rank change from H1 2024 |

| Emaar | 1 | 1 | 0 |

| Damac Properties | 2 | 2 | 0 |

| Sobha Group | 3 | 3 | 0 |

| Binghatti | 4 | 6 | +2 |

| Danube Properties | 5 | 4 | -1 |

| Samana Developers | 6 | 7 | +1 |

| Nakheel | 7 | 10 | +3 |

| Azizi | 8 | 5 | -3 |

| Beyond | 9 | 222 | +213 |

| Wasl | 10 | 23 | +13 |

Source: Property Monitor, Cavendish Maxwell

The first half of 2025 has highlighted the strength of Dubai’s real estate market, with robust buyer demand and rising sales prices reflecting a thriving sector. At the same time, emerging supply dynamics are beginning to moderate rental growth, which is a positive sign for a city focused on attracting talent and expanding its population. Looking ahead, the market is expected to remain resilient, supported by new project launches and inclusive initiatives such as the First-Time Buyer Programme. With a steady pipeline of residential completions, Dubai’s property sector is poised to evolve into a more mature and balanced phase, offering both opportunity and accessibility.

Ronan Arthur

Director, Head of Residential Valuation

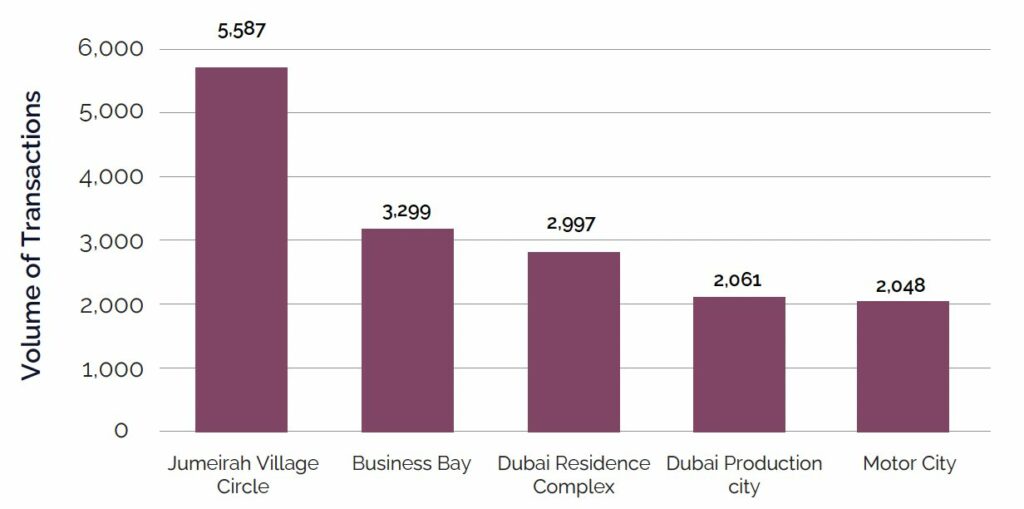

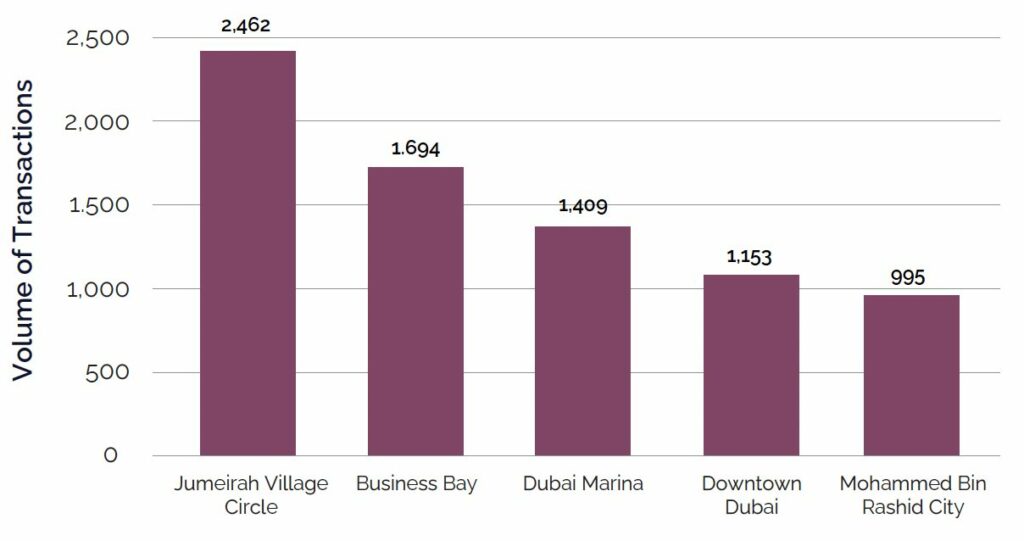

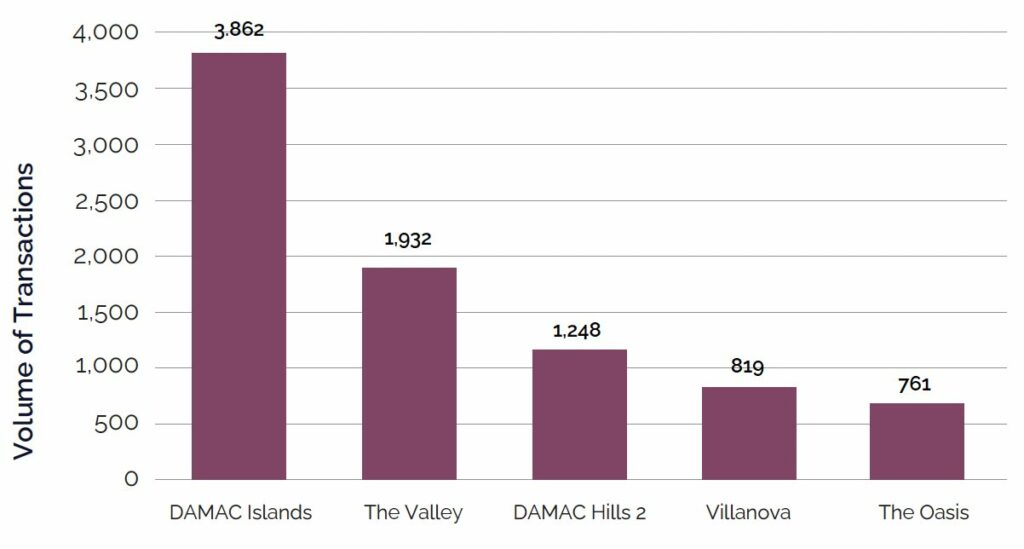

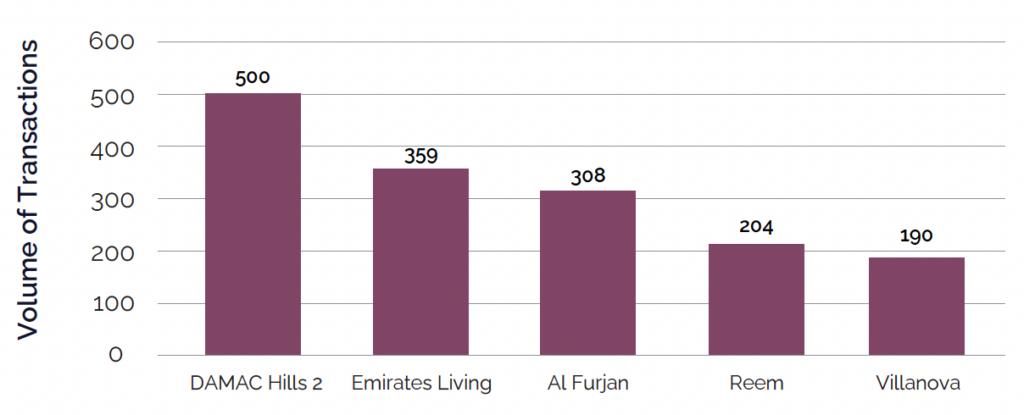

Sales Transactions: Top Five Locations

For Apartment Transactions by Volume – H1 2025

Off-Plan

Source: Property Monitor, Cavendish Maxwell

Ready

Source: Property Monitor, Cavendish Maxwell

For Villa/Townhouse Transactions by Volume – H1 2025

Offplan

Source: Property Monitor, Cavendish Maxwell

Ready

Source: Property Monitor, Cavendish Maxwell

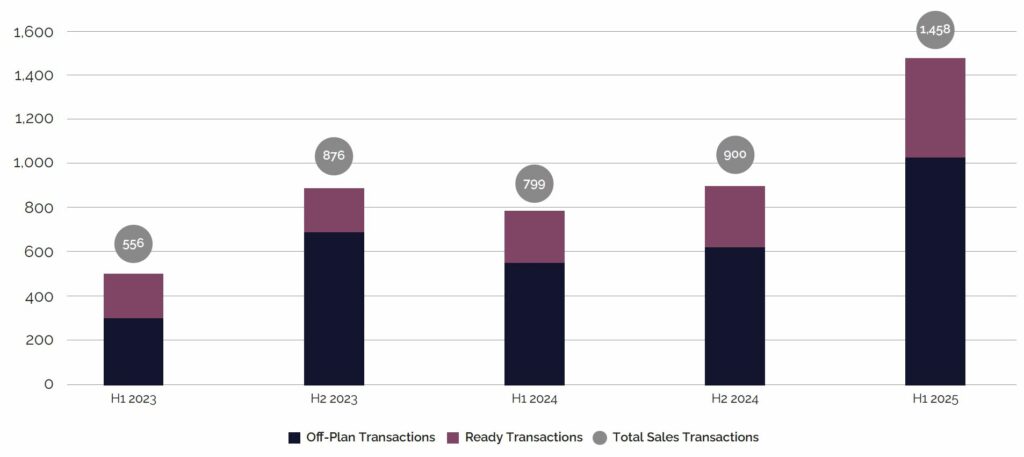

Sales Transactions: Luxury Properties (AED 20 million and above)

As Dubai continues to attract high-net-worth individuals (HNWIs), its luxury real estate market demonstrated impressive momentum, with approximately 1,400 luxury property transactions recorded in H1’2025, representing an increase of 62% from H2’2024 and 82.5% from H1’2024. The surge in demand is supported by a combination of attractive lifestyle and fiscal advantages, including safety and political stability, a favourable tax environment, high-quality infrastructure, and investor-friendly visa programmes. These factors, combined with Dubai’s strategic global positioning, world-class amenities, and expanding portfolio of luxury properties, continue to cement the city’s reputation as a premier destination for global wealth.

Source: Property Monitor, Cavendish Maxwell

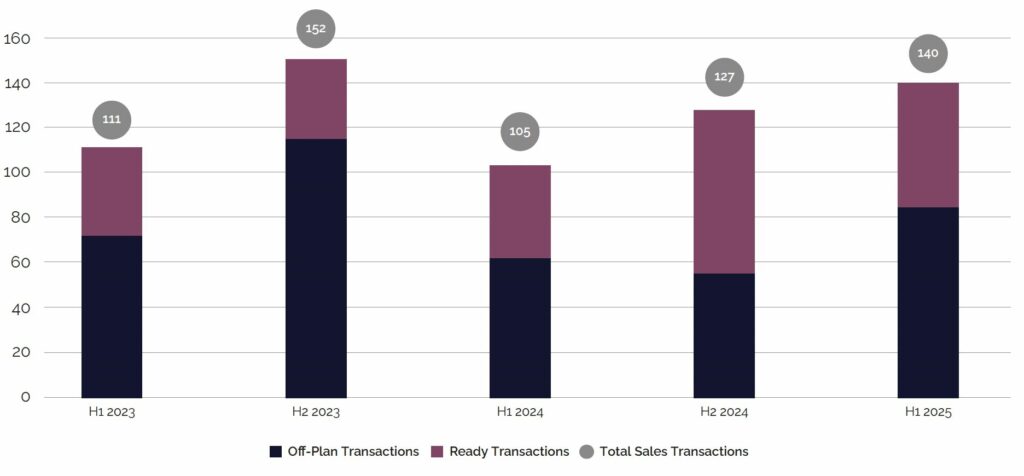

Sales Transactions: Ultra-Luxury Properties (AED 50 million and above)

Even the ultra-luxury segment recorded an uptick in performance, with transaction volumes rising by 10.2% and 33.3% compared to H1’2024 and H2’2024, respectively. Although this segment remains niche and caters primarily to elite buyers, it has shown strong momentum, driven by a growing number of HNWIs and UHNWIs relocating their primary residences or establishing a base in Dubai.

Source: Property Monitor, Cavendish Maxwell

Mortgage Transactions

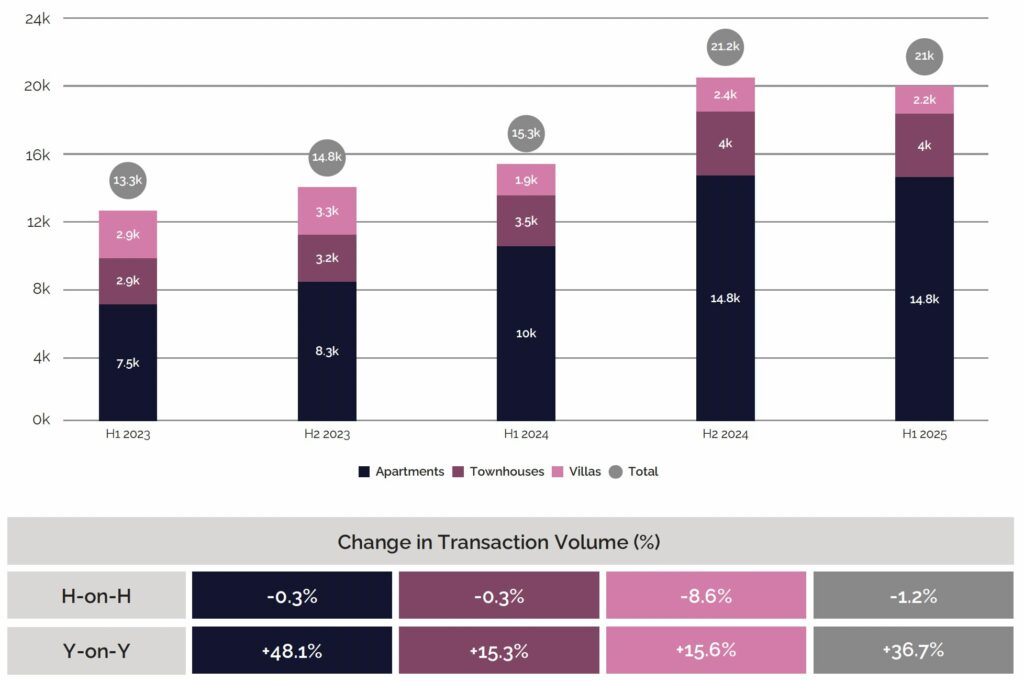

In H1’2025, the residential market recorded 20,900 mortgage transactions, reflecting a 1.2% decline compared to H2’2024, primarily due to a slower Q1 performance and a drop in villa mortgage volumes. However, the total value of villa mortgages increased, indicating a shift towards higher-value, larger-sized villa purchases. Despite the slight short-term decline, mortgage activity grew strongly compared to the same period last year, rising by 36.7% across all property types.

Mortgage Transactions – By Volume

Source: Property Monitor, Cavendish Maxwell

Mortgage transaction values followed a similar trend, declining compared to H2’2024, primarily due to a drop in the average value of 2-bedroom apartment transactions, a segment that represents a substantial share of the market. However, compared to the same period last year, overall mortgage values rose by 46.9%.

Mortgage Transactions – By Value

Source: Property Monitor, Cavendish Maxwell

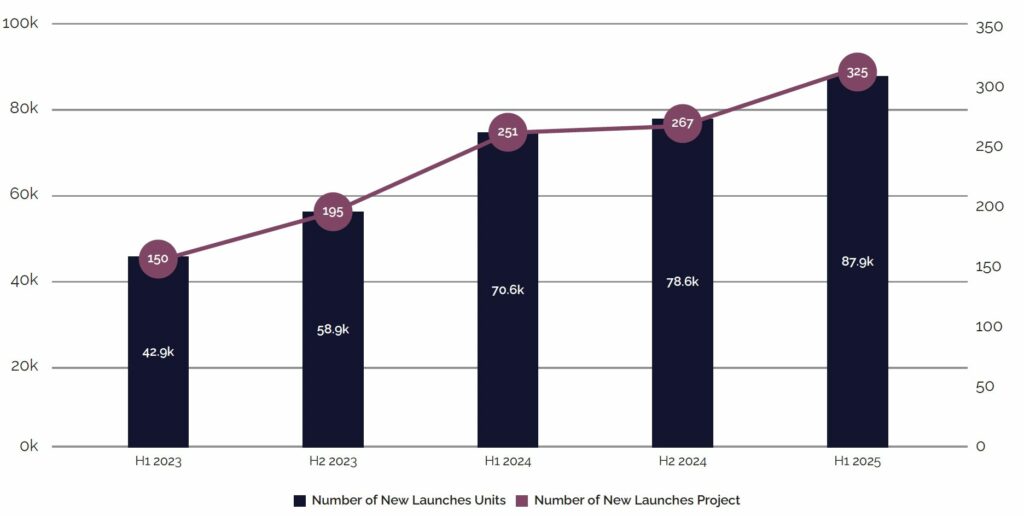

New Project Launches

The number of new launches continued to rise in the first half of 2025, with approximately 300 new projects bringing over 87,900 residential units to the market, which amounts to nearly 490 units launched per day. This increase highlights the ongoing strength of Dubai’s real estate sector, driven by strong end-user and investor demand. Supported by growing market confidence and increased capital inflows, developers are speeding up project rollouts to take advantage of favourable market conditions and maximise absorption while demand remains strong.

Number of Units and Projects

Source: Property Monitor, Cavendish Maxwell

Source: Property Monitor, Cavendish Maxwell

Note: The H1 new launches data includes revisions to some Q1 launches, based on information that has since become available.

Apartments continued to account for the largest share of new launches in H1’2025, highlighting continued buyer interest in this segment. While villas and townhouses remain relevant for buyers seeking larger family-oriented homes, their share of new supply has declined slightly. Developers appear to be closely tracking market trends and adjusting their offerings to align with shifting buyer preferences.

New Unit Launches by Property Type – H1 2025

Source: Property Monitor, Cavendish Maxwell

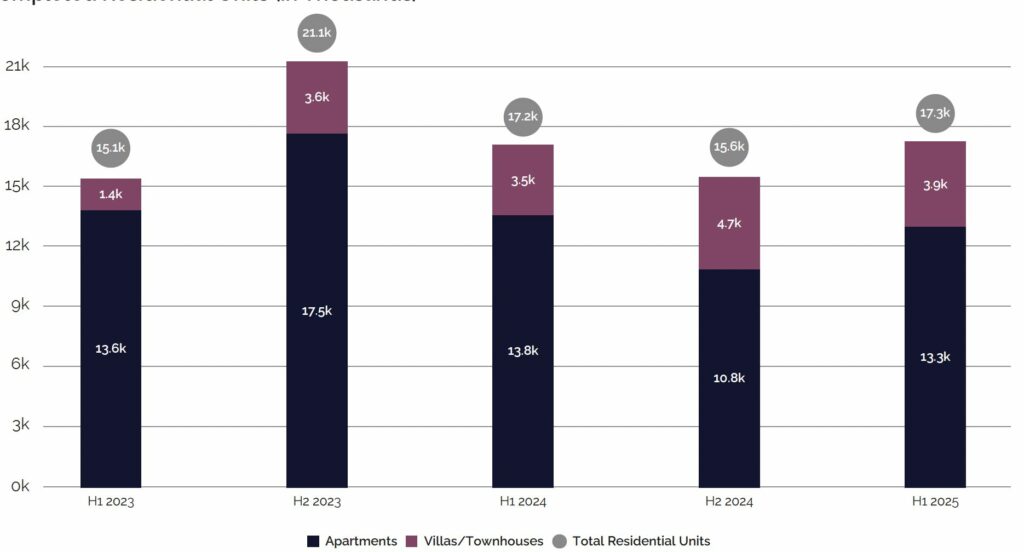

Supply: Number of Completed Units

Around 17,300 residential units were completed in the first half of 2025, with nearly 42.4% of handovers concentrated in Jumeirah Village Circle, Sobha Hartland, and Mohammed Bin Rashid City. Out of the total deliveries, apartments accounted for 77.3%, while villas and townhouses made up the remaining share. As more units are handed over, the additional supply could ease pressure on the rental market by offering tenants a wider range of options.

Completed Residential Units (in Thousands)

Source: Property Monitor, Cavendish Maxwell

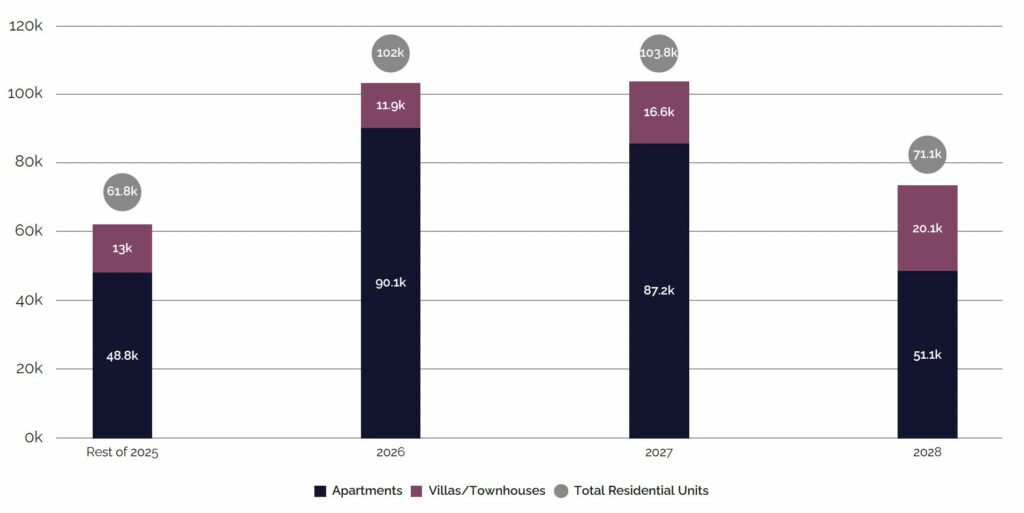

Upcoming Supply

Dubai’s residential development pipeline remains significant, with over 61,800 units currently under construction for the remainder of 2025, and more than 100,000 units projected for delivery in both 2026 and 2027. While projections suggest an average of 9,000 units could be delivered each month through 2027, actual completion rates are expected to be lower, which may lead to timeline shifts and delayed handovers. Notably, only 21% of residential projects scheduled for completion in 2025 have reached a construction progress of 75% or more, highlighting the potential for slippages in delivery.

Upcoming Supply (in Thousands)

Dubai Residential Market Performance H1 2025

Sales Price Trend

Driven by strong transactional activity, sales prices in Dubai’s residential market increased by 7.8% compared to H2’2024 and recorded a notable 16.6% rise compared to H1’2024. This continued upward trend reflects strong demand from both local and international investors, as well as end users. Several communities, including Discovery Gardens, Al Furjan, Dubai Marina, Motor City, Arabian Ranches 2, and Dubai Hills Estate, posted double-digit price growth compared to H2’2024. In contrast, areas such as Barsha Heights (Tecom), Palm Jumeirah, Meydan, and DAMAC Hills saw slight price declines during the same period.

Driven by strong transactional activity, sales prices in Dubai’s residential market increased by 7.8% compared to H2’2024 and recorded a notable 16.6% rise compared to H1’2024. This continued upward trend reflects strong demand from both local and international investors, as well as end users. Several communities, including Discovery Gardens, Al Furjan, Dubai Marina, Motor City, Arabian Ranches 2, and Dubai Hills Estate, posted double-digit price growth compared to H2’2024. In contrast, areas such as Barsha Heights (Tecom), Palm Jumeirah, Meydan, and DAMAC Hills saw slight price declines during the same period.

Sales Price Trend (in AED/SQF)

Source: Property Monitor, Cavendish Maxwell

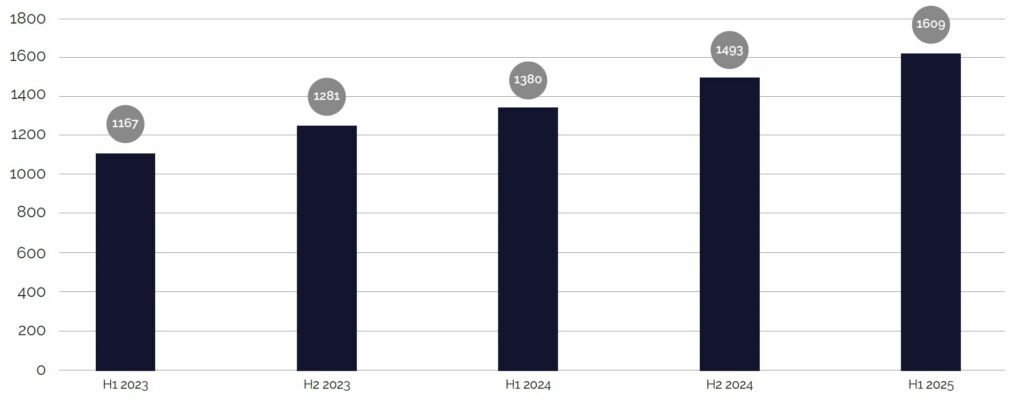

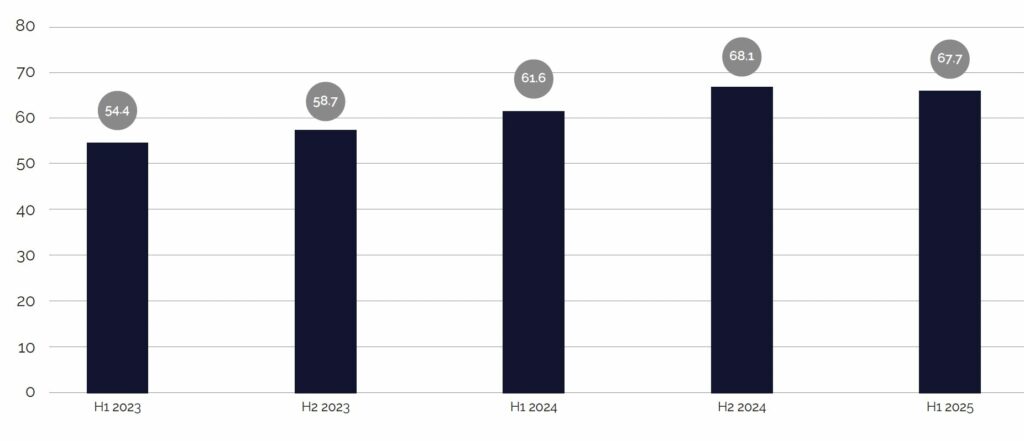

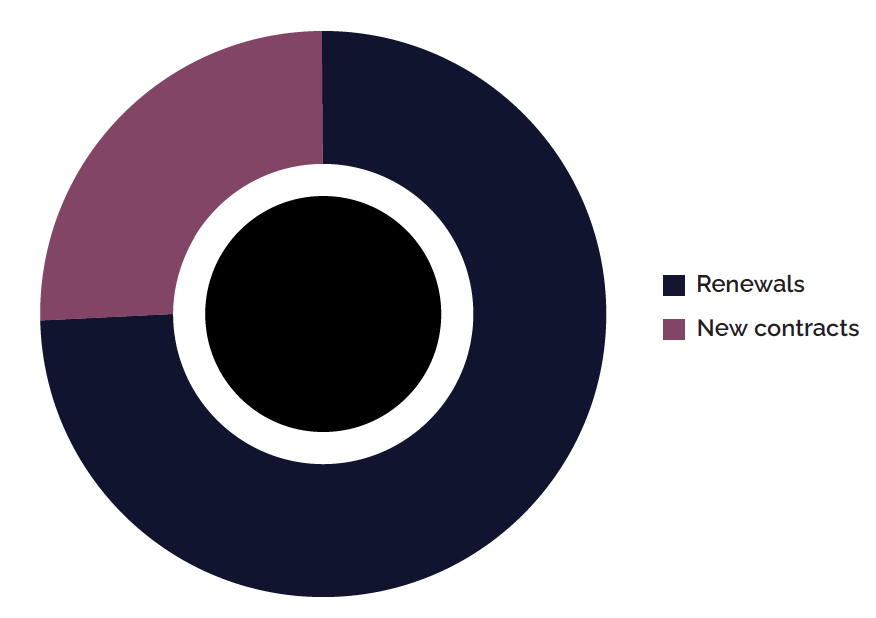

Rental Rate Trend

Based on rental contract data from the Dubai Land Department (DLD), residential rents saw a slight decline of 0.6% in H1’2025 compared to H2’2024. This dip was mainly due to a fall in renewal contract rental rates, as more units have come onto the market, giving tenants more options and greater room to negotiate with landlords. This reflects growing tenant confidence, with many choosing to renegotiate lease terms or move, especially in areas with increased new supply. However, compared to H1’2024, rents are still up, showing an annual growth of 9.9%.

Rental Rate Trend (in AED/SQF/YEAR)

In the first half of 2025, over 244,000 rental contracts were registered, with renewal contracts continuing to dominate the market and accounting for approximately 66.8% of all agreements.

Source: Property Monitor, Cavendish Maxwell

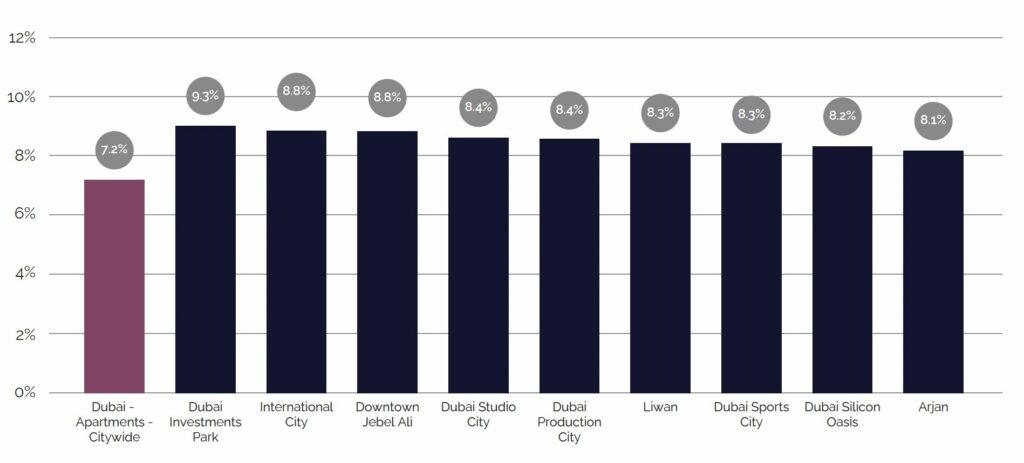

Gross Rental Yields: Apartments and Villas/Townhouses

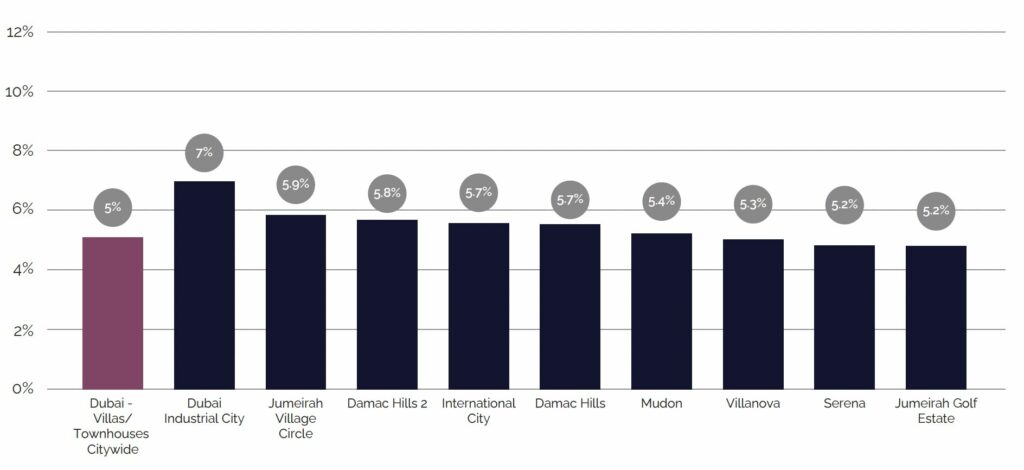

As of the end of H1 2025, gross rental yields in Dubai stood at 7.2% for apartments and 5% for villas and townhouses. With sales prices continuing to rise at a faster pace than rental rates, yields recorded a slight decline compared to H2’2024. Despite this, Dubai’s rental yields remain strong and continue to outperform those in many major global markets.

Top 10 Areas by Gross Rental Yields – Apartments

Source: Property Monitor, Cavendish Maxwell

Top 10 Areas by Gross Rental Yields – Villas/Townhouses

Source: Property Monitor, Cavendish Maxwell

2025 Real Estate Market Outlook

The first half of 2025 delivered mixed results, with approximately 91,900 transactions recorded, reflecting a 2.4% decline compared to H2’2024. This dip was largely due to a subdued first quarter. However, the market rebounded strongly in the second quarter, with transaction volumes reaching record highs. H1’2025 also witnessed one of the highest levels of new launch activity, translating into strong off-plan sales compared to the same period in 2024. Given the robust performance of the off-plan segment so far this year, developers are expected to capitalise on the momentum. If the pace of new launches accelerates in the second half, overall transaction activity could surpass previous records.

In terms of sales prices, strong transactional activity was matched by upward price momentum. Sales prices rose by 7.8% compared to H2’2024 and 16.6% year-on-year from H1’2024, reflecting continued market strength. The recent introduction of the First-Time Buyer Programme is also expected to further boost demand by improving accessibility for new entrants. The initiative aims to support a more inclusive and balanced housing market by encouraging broader participation and easing the path to homeownership.

Dubai’s residential market continues to benefit from what is now becoming an identifiably almost unique combination of positive factors. First, global uncertainties are prompting investors to look for more stable environments, with the UAE emerging as a preferred destination for capital. Second, positive macroeconomic indicators across the board, including both economic growth and inflation. Third, and as a result of all these factors, population growth driven by job opportunities and political stability. The evidence of continued market strength as a result of the combination of all of these factors is now evident.

Whilst all real estate markets are cyclical and Dubai can ultimately be no exception to a point of inflection driven by increasing supply, it is important to remember that by comparison to international benchmarks Dubai remains competitive across the range of residential property, including luxury.

Julian Roche

Chief Economist, Cavendish Maxwell

On the rental side, rental rates increased by 9.9% compared to H1’2024, although a slight decline was observed compared to H2’2024. This moderation is largely due to new supply entering the market, giving tenants more options and greater negotiating power with landlords. The trend reflects tenant confidence, with many choosing to renegotiate lease terms or relocate, especially in areas with recent supply additions. While around 61,800 residential units are expected to be completed in the second half of the year, actual deliveries are likely to fall short, as only 21% of these projects have surpassed 75% construction progress. Should upcoming supply materialise faster than current market absorption, it could offer significant relief to tenants by easing upward pressure on rents.

Overall, robust buyer demand and rising sales prices are balanced by early signs of moderation in the rental market, driven by increased supply. Looking ahead, continued momentum in new project launches, alongside initiatives such as the First-Time Buyer Programme and a steady pipeline of residential completions, is expected to help the market evolve into a mature and well-balanced environment.