Dubai’s Hospitality Sector – Market Performance in H1 2024

Dubai Tourism Overview

Despite or perhaps even partly because of ongoing geopolitical tensions, Dubai remains a leading tourist destination. In the first half of 2024, the city welcomed a record 9.31 million overnight guests, marking a 9% increase from the 8.55 million visitors during the same period last year. This impressive performance reflects the strategic vision outlined by Sheikh Mohammed Bin Rashid Al-Maktoum, the ruler of Dubai, as detailed in the Dubai Economic Agenda D33. This agenda aims to position Dubai as one of the top three global tourism destinations.

The emirate continues to experience robust growth in the tourism sector, surpassing prepandemic levels and positively contributing to economic growth. The tourism sector contributed to the UAE’s economy, registering an 11.7% increase in Gross Domestic Product (GDP) in 2023, amounting to AED220 billion. Government officials stressed that the sector is anticipated to contribute 12% to the UAE’s GDP, equating to AED236 billion in 2024.

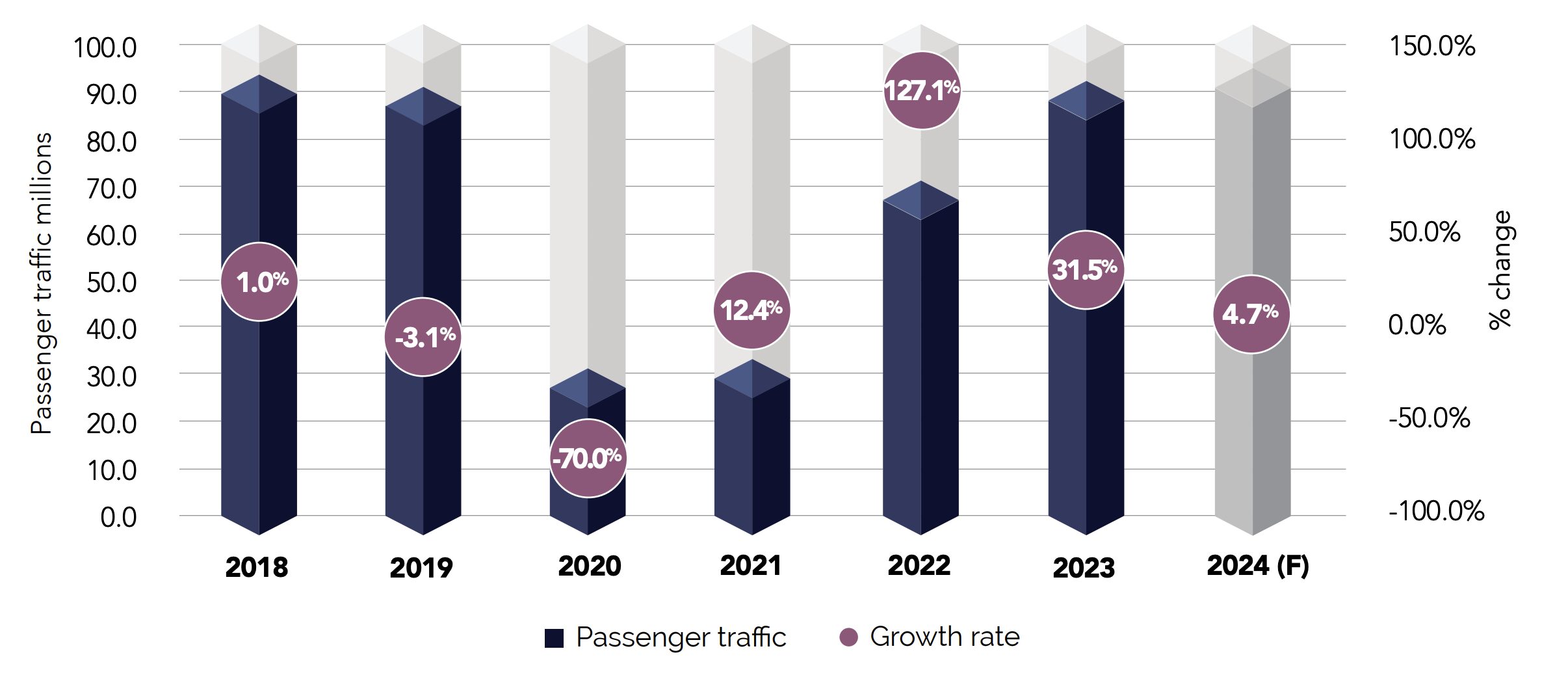

Airport Arrivals

Of Dubai’s two international airports, Dubai International Airport (DXB) and Al Maktoum International Airport (DWC), DXB handled nearly 87 million passengers in 2023, marking a 31.5% y-o-y increase and approaching the annual traffic record of 89.1 million set in 2018. In the first half of 2024, DXB welcomed a record 44.9 million guests, representing an 8% rise compared to the same period last year. DXB has revised its 2024 passenger forecast to 91 million, reflecting robust growth in the aviation sector. This update represents an increase from the earlier estimate of 88 million passengers.

In April 2024, the ruler of Dubai authorised a significant expansion project for DWC airport. This initiative includes building a new passenger terminal valued at 128 billion AED (approximately USD 35 billion). This expansion of DWC airport will put the emirate on the map for the world’s best, biggest, and busiest air passenger terminal to transport 260 million travellers a year once completed.

Airport Arrivals – Dubai International Airport (DXB)

Source: Dubai Airports, Department of Economy & Tourism, Cavendish Maxwell

Source Markets

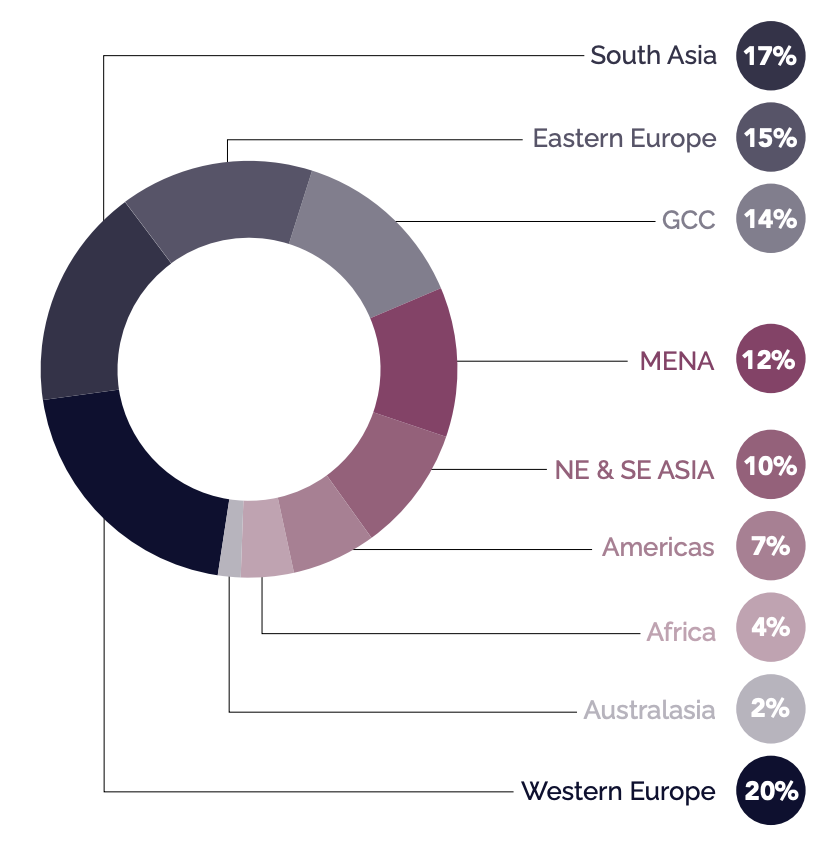

Source: Department of Economy & Cavendish Maxwell

From January to June 2024, Dubai welcomed a total of 9.31 million visitors. Western Europeans being the biggest tourist group in Dubai, accounting for 20% (or 1.9 million). South Asians, Eastern Europeans, and tourists from the GCC region followed closely behind at 17%, 15%, and 14%, respectively.

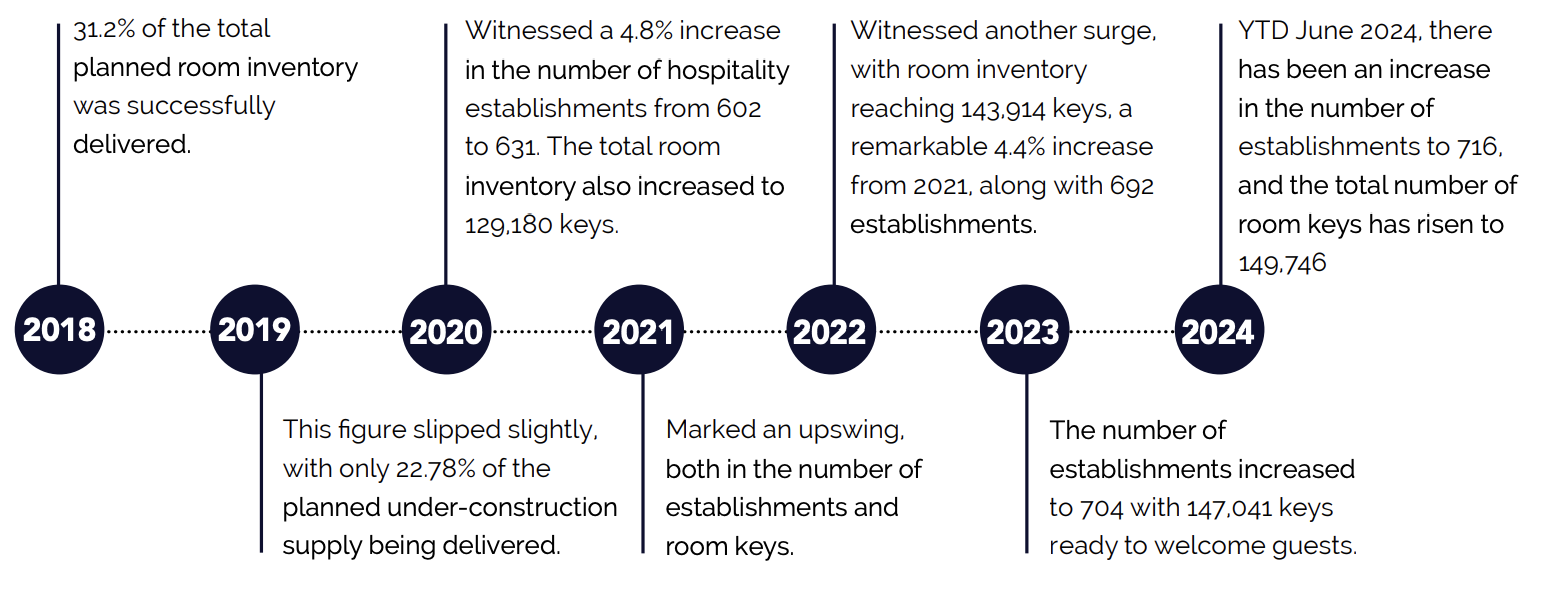

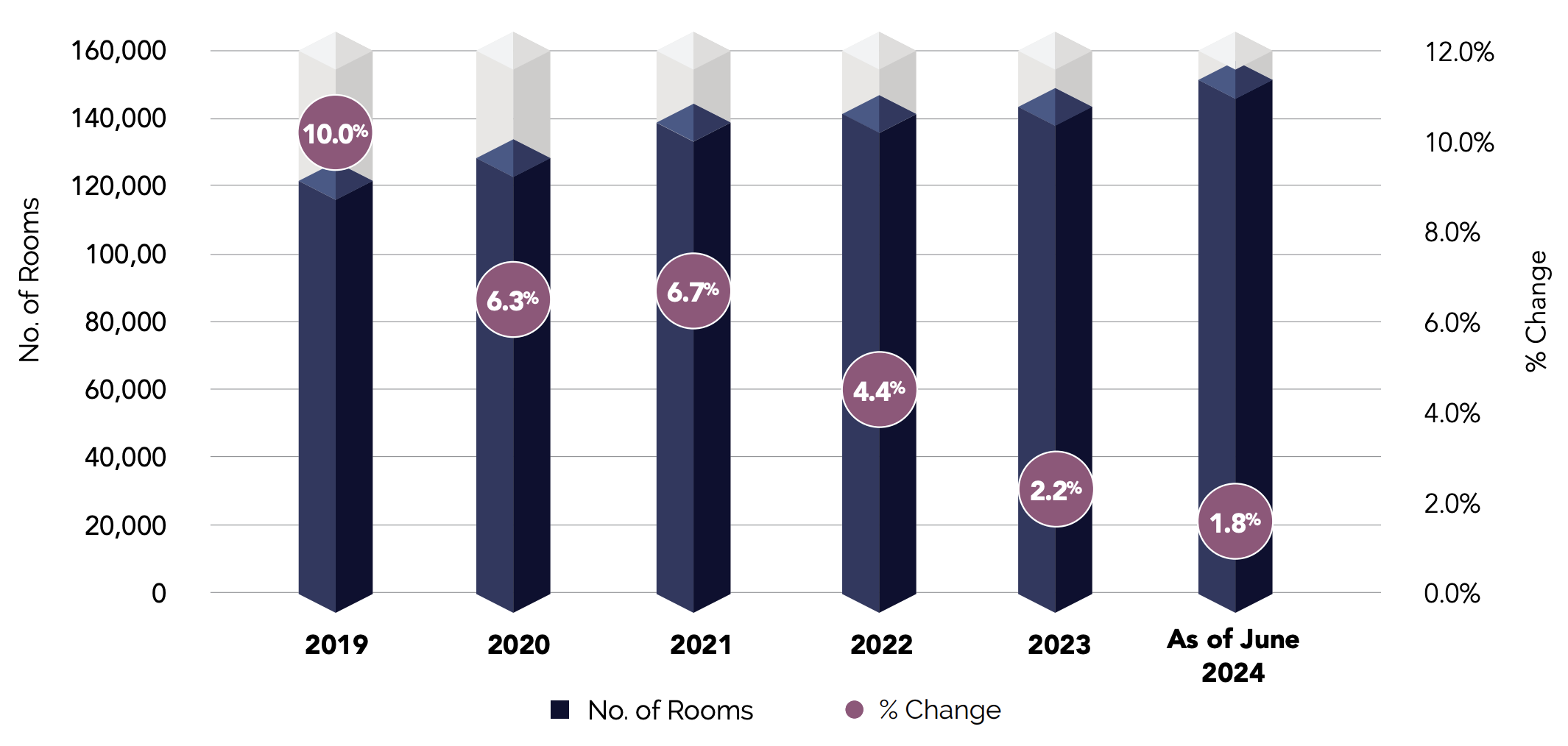

Current Supply

According to the latest figures from AM:PM Hotels, as of June 2024, the city boasts a total of 716 hospitality establishments, equating to 149,746 keys.

The supply side of the picture

The hospitality industry has been keeping up with tourism levels in Dubai, adjusting supply to meet demand.

Our insights reveal that:

Source: Dubai Tourism, AM:PM Hotels, Cavendish Maxwell

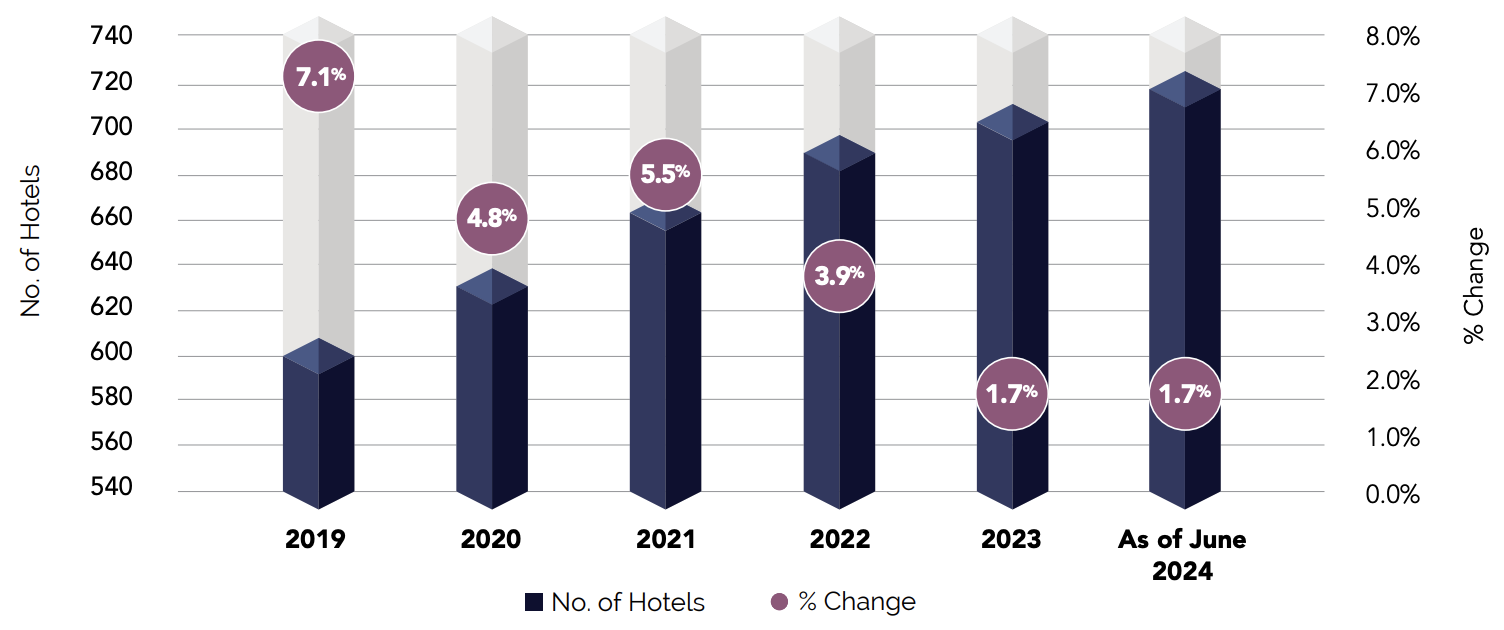

Dubai – Hospitality Building Supply | 2019 – as of June 2024

Dubai – Hospitality Building Supply | 2019 – as of June 2024

Source: AM:PM Hotels, Cavendish Maxwell

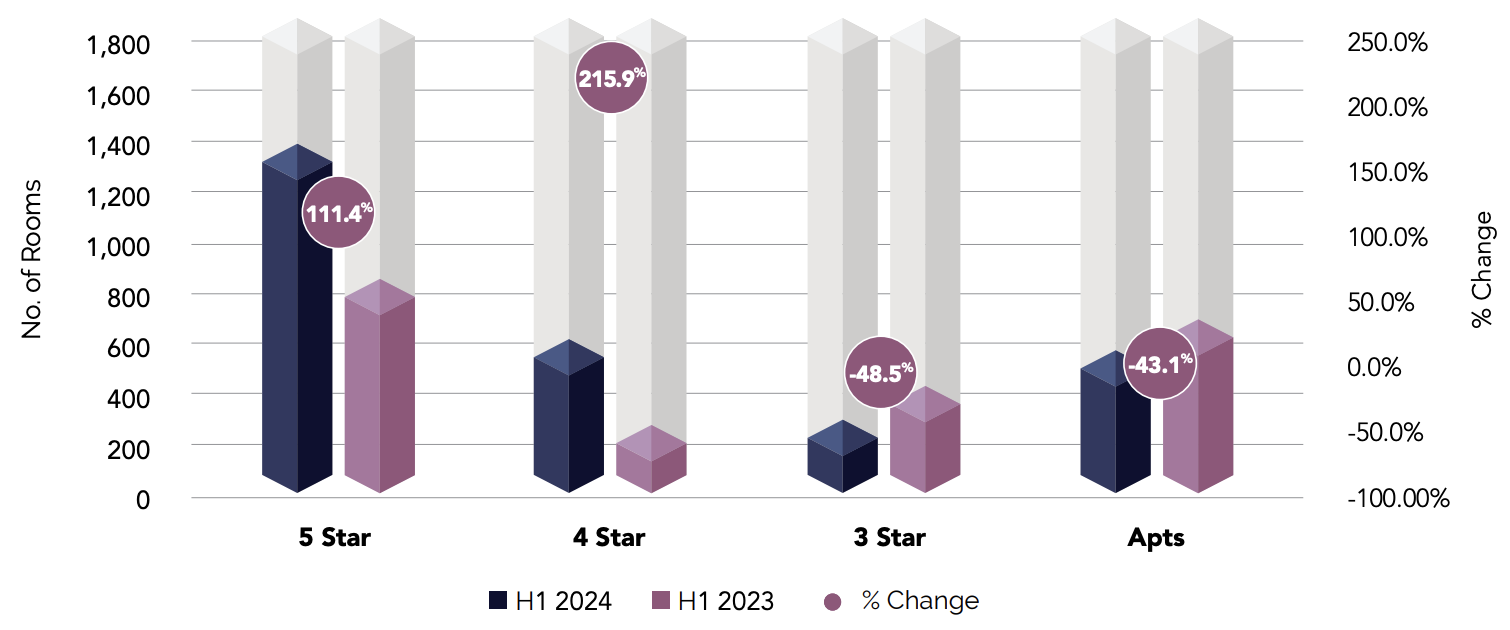

Analysing the first half of 2024, the addition of new hotel rooms reveals notable shifts compared to the same period in 2023. The 5-star category saw a dramatic increase of 111.4%, with new room additions rising to 1,681, up from 795 in the first half of 2023. The 4-star segment experienced an even more substantial growth of 215.9%, with 436 new rooms added compared to 138 last year. Conversely, the 3-star segment and serviced apartments saw a decline in new additions, with 3-star rooms decreasing by 48.5% and serviced apartments dropping by 43.1%.

Dubai – Hospitality Room Supply by Grade | H1 2024 v H1 2023

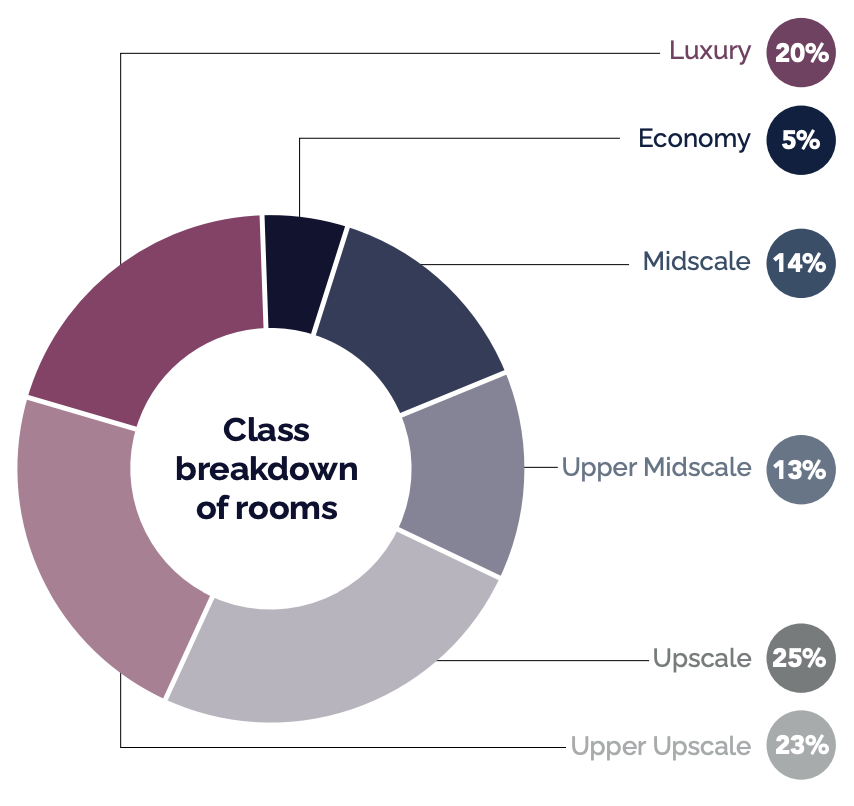

The chart shows that as of June 2024, 67% of the current room supply falls within the luxury, upper upscale and upscale classes, whilst the upper midscale and midscale segment account for approximately one third (27%) of the total inventory.

YTD June 2024, approximately 76% of the new supply was in the luxury and upper upscale segments. Remarkable openings in 2024 thus far included The Lana Dubai Dorchester Collection, SIRO One Za’abeel, One & Only One Za’abeel, FIVE Luxe JBR as well as Address Palace Dubai Creek Harbour. These new completions added approximately 1,090 new rooms to the existing supply.

Current Hospitality Room Inventory by Classification as of June 2024

Source: AM:PM Hotels, Cavendish Maxwell

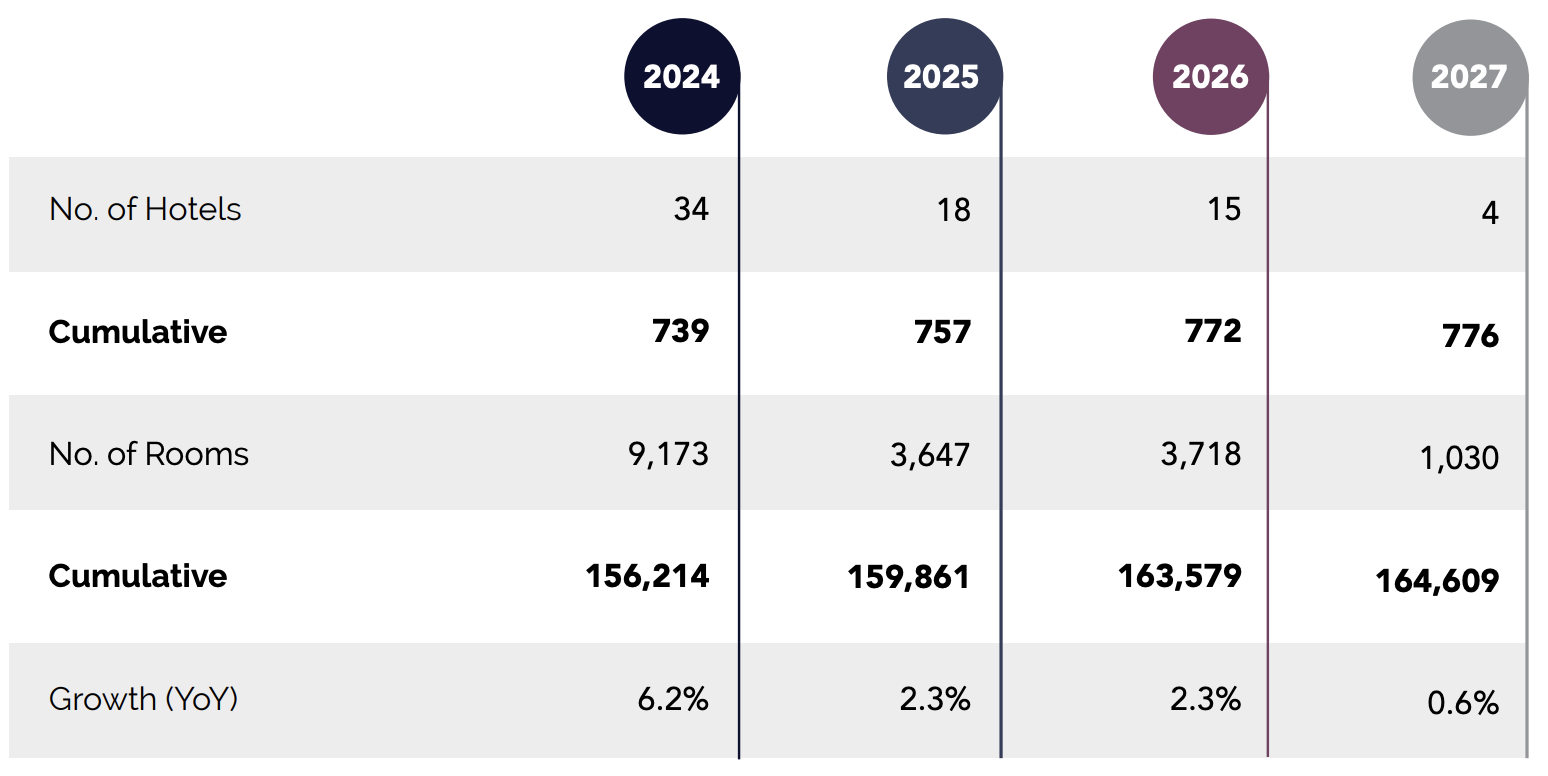

Future Supply

According to our research, 2024 is expected to bring a total of 34 new openings whilst 2025 is estimated to bring 18 new hotels. This translates to a cumulative total of 739 by end of 2024 and 757 by end of 2025.

Projects within the luxury segment anticipated for completion by 2024 include Ciel Dubai Marina with 1,209 keys, Viceroy Dubai Business Bay with 433 keys, Port De La Mer Hotel with 400 keys, Heart of Europe Marbella Hotel with 196 keys, and Heart of Europe Berlin Hotel with 200 keys. Additionally, luxury supply is projected to experience significant growth in 2025, with 8 new openings adding approximately 1,140 rooms.

Source: AM:PM Hotels, Cavendish Maxwell

Market Performance

Occupancy

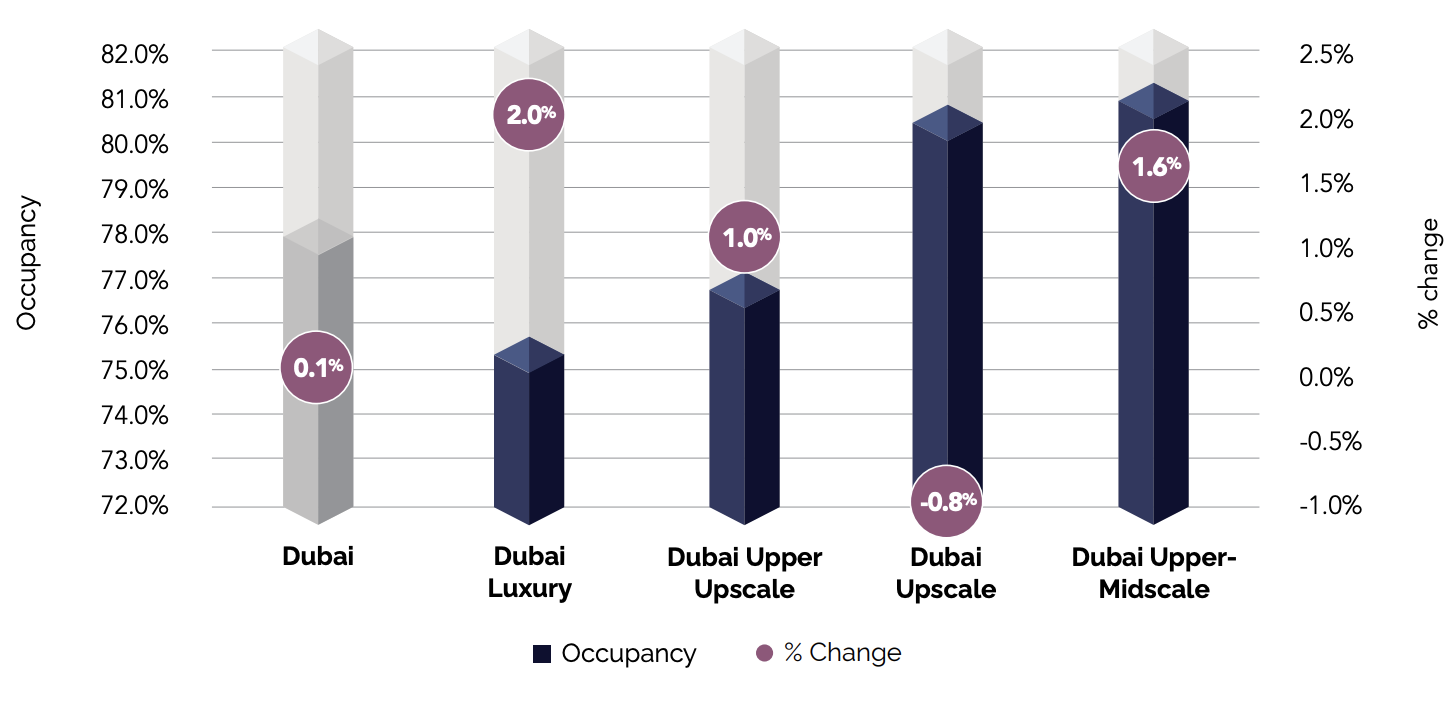

Despite an increase in visitor numbers, Dubai’s occupancy levels remained stable y-o-y, with only a modest rise of 0.1%, reaching 78%. The luxury and upper-midscale segments experienced the most significant gains, rising by 2.0% and 1.6%, respectively. However, the upscale sector saw a slight decline of 0.8% compared to 2023.

Occupancy by Classification | YTD June 2024

Average Daily Rate (ADR)

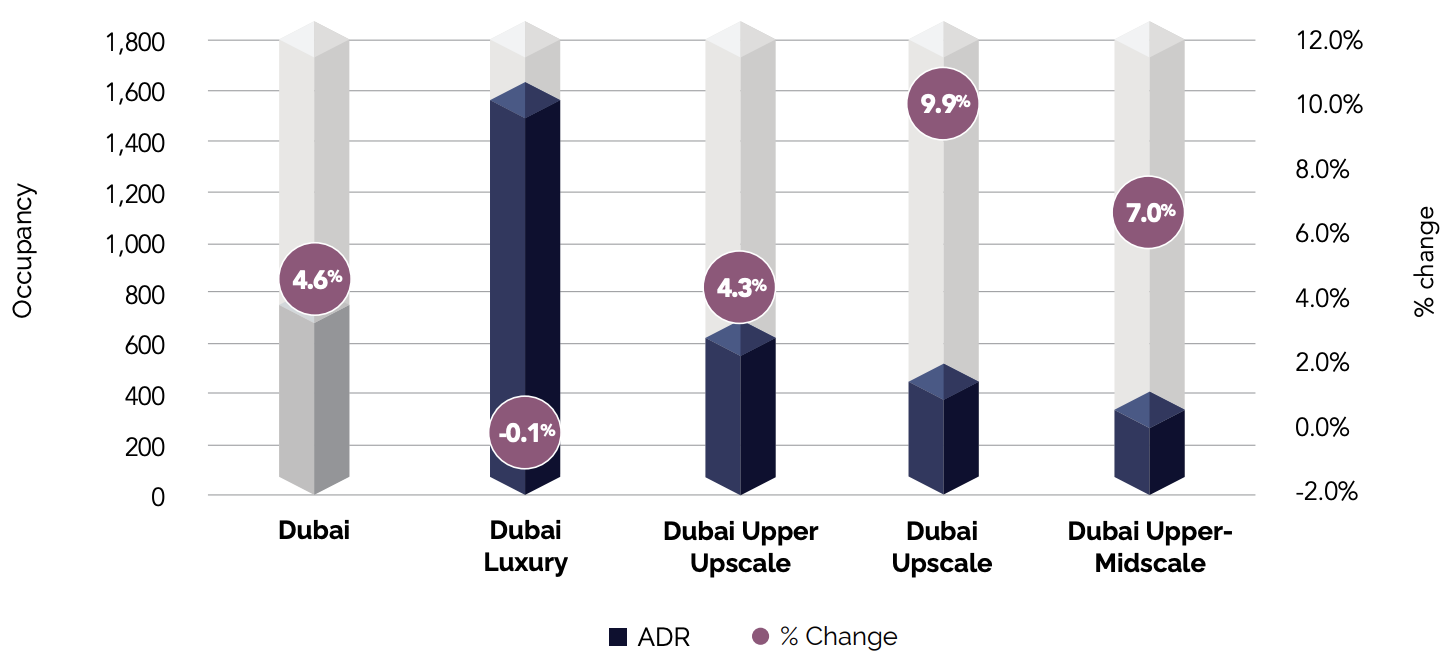

Overall, Dubai’s ADR stood at approximately AED 720, an increase of 4.6% in the first half of 2024 compared to same period last year. Breaking it down further, upscale and upper-midscale hotels saw the largest increases, with 9.9% and 7.0% growth, respectively. This was followed by upper upscale hotels, which grew by 4.3%, while luxury hotels experienced a slight yearover-year decline of 0.1%.

Average Daily Rate by Classification | YTD June 2024

Source: STR and Cavendish Maxwell

Forecast

In the first half of 2024, the Dubai market showed a notable recovery in top-line performance, with an average RevPAR growth of 4.7% compared to the same period last year. All segments achieved an increase y-o-y with the upscale sector experiencing the largest average growth of around 9.0% in RevPar.

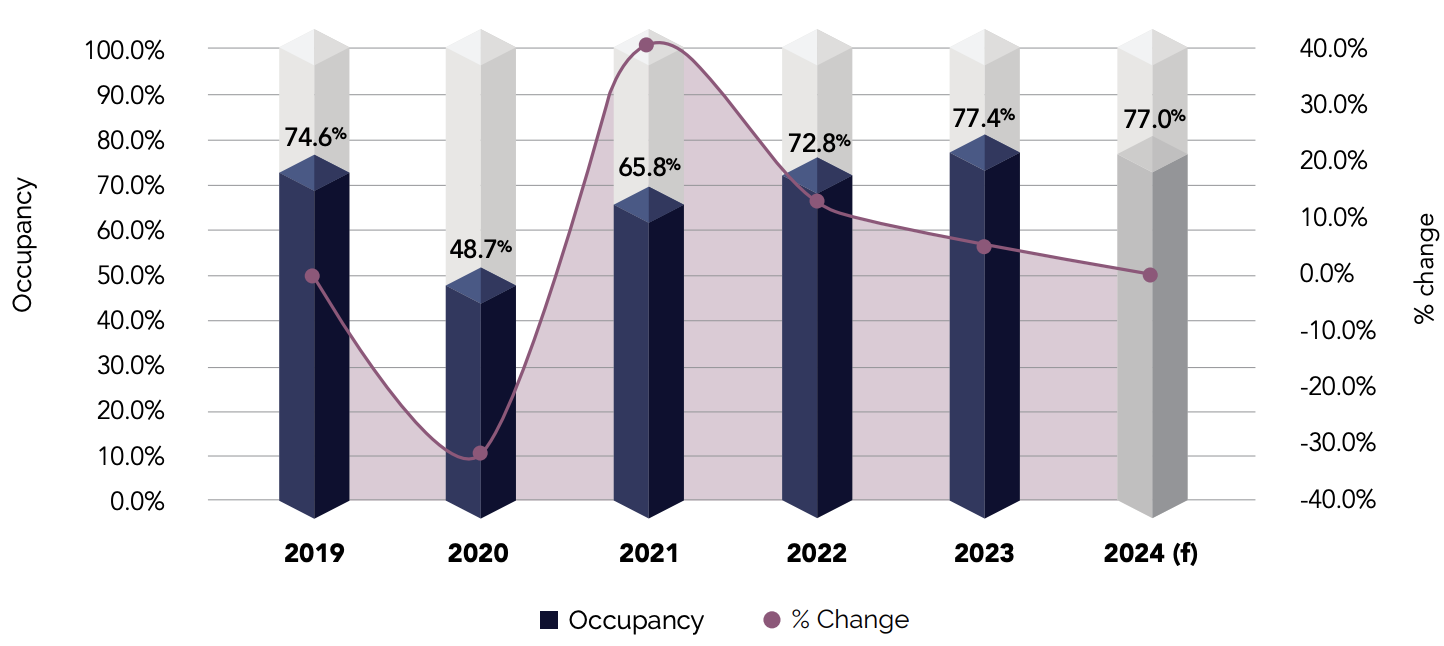

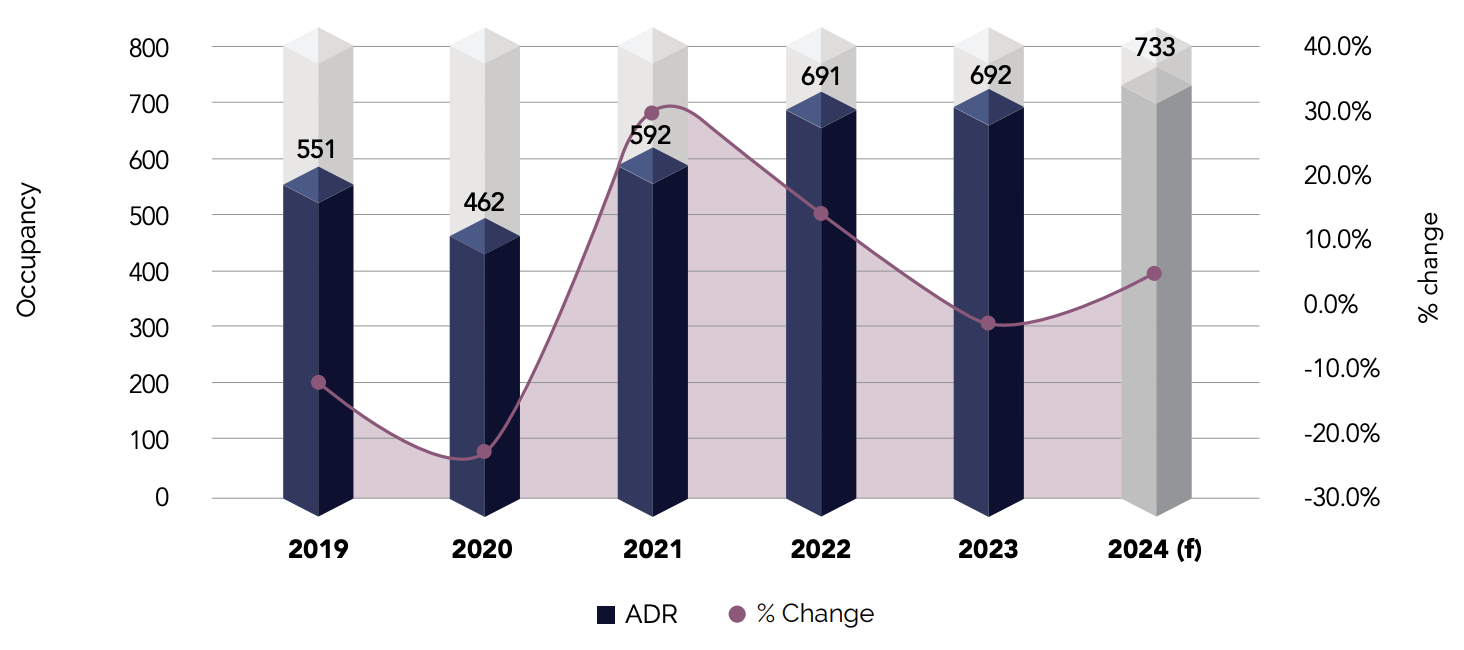

The below charts illustrate the forecasted occupancy and ADR for Dubai’s tracked hotel inventory.

Dubai – Occupancy | Historic & Forecast

Dubai – Average Daily Rate (ADR) | Historic & Forecast

Market Performance

Other Emirates

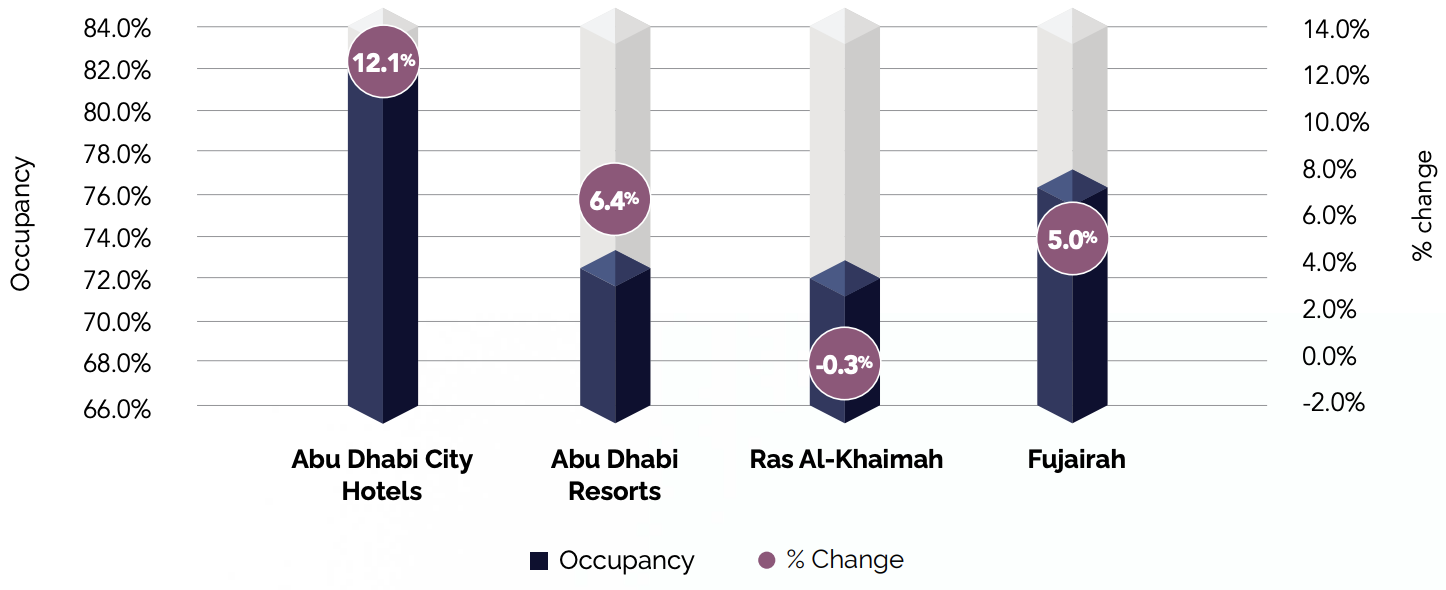

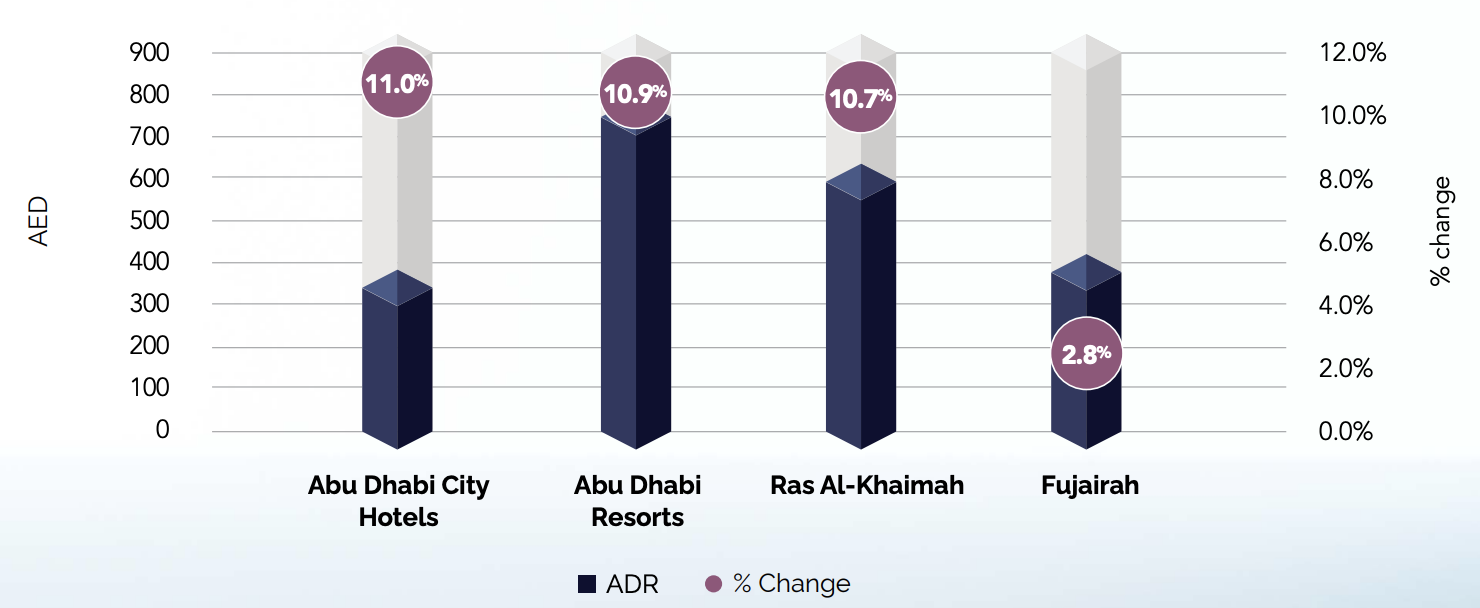

The robust economic momentum that began in 2023 carried into 2024, marked by a significant surge in demand-driven performance across the Emirates. All Emirates recorded an increase in occupancy, with rates significantly exceeding the 72% mark. Abu Dhabi City Hotels recorded the highest level of increase y-o-y at about 12%, with average occupancy reaching 83% (up from 76% in 2023) and surpassing pre-pandemic 2019 levels at 77%. Abu Dhabi’s hotel market recorded an upward trajectory in the first half of 2024 with ADR levels increasing by approximately 11% y-o-y.

Occupancy by Emirates | YTD June 2024

Average Daily Rate by Classification | YTD June 2024

Dubai’s Hospitality Sector

A Bright Future Ahead

Dubai’s hospitality sector has flourished, demonstrating remarkable growth in recent years. The city’s robust economy, increased infrastructure investment, and focus on experience-based tourism have been key drivers of this success.

As a global hub for business, events, and leisure, Dubai continues to attract visitors from around the world. However, the sector faces challenges such as rising costs and growing competition. To sustain its momentum, Dubai will prioritise innovation, unique experiences, and sustainability.

While the city’s hospitality sector has become a cornerstone of its economic diversification, there’s even more potential to unlock. By adapting to evolving trends, maintaining its reputation for unrivalled capacity for diversity and innovation, and leveraging emerging opportunities, Dubai can further advance its position as a world-leading hospitality destination.

Julian Roche

Chief Economist