Oman Hospitality Market Performance H1 2025

Hospitality Market Dynamics

The growth of Oman’s hospitality market rests on three key pillars. First, population growth: Oman’s population expanded by 4.5% in 2024, following 5% growth in 2023, and analysts expect this momentum to continue through the decade. Even without changes in spending patterns or additional boosts from tourism, such demographic growth alone ensures steady annual demand for new hotel keys. Second, economic expansion and rising domestic tourism. Overall domestic trips increased in line with population growth, from 12.9 million in 2023 to 13.6 million in 2024, but Omanis are also travelling differently. An 8% rise in reported hospitality days indicates they are taking longer trips and spending more per visit, reinforcing demand across the sector. Third, international tourism, where Government policy and investment can have the greatest impact. Gulf visitors still account for more than a quarter of arrivals, but Oman is increasingly attracting travellers from farther afield, including Europe, India, and China.

As a result, tourism is expected to steadily increase its contribution to GDP, rising to 5% by 2030 and reaching 10% by 2040. This trajectory positions tourism to overtake transport and logistics as Oman’s second most important industry after hydrocarbons. At the same time, global hotel standards are advancing rapidly, particularly in the Gulf, where European and Asian travellers increasingly seek not only high-quality accommodation but also distinctive, experience-led leisure. To keep pace with projected growth in visitor numbers, Oman will need to combine hotel sector rejuvenation, new construction, and the diversification of tourism beyond Muscat. By 2040, the Sultanate will require a substantial number of new hotels and resorts across the country. This represents a significant opportunity for development and construction in Oman.

Oman’s hospitality sector is entering a new era, driven by population growth, evolving travel patterns, and strategic Government investment.

By diversifying tourism offerings and expanding infrastructure, Oman is well positioned to attract a broader range of visitors and create lasting value for the economy and local communities.

Khalil Al Zadjali

Head of Oman

Tourism Sector Overview and Performance

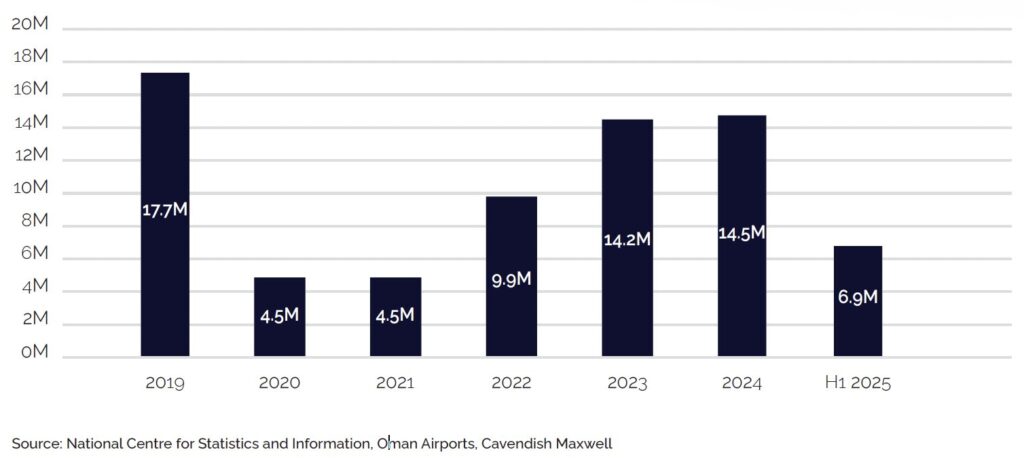

Oman Airport Passenger Volume Trends

In the first half of 2025, Oman’s four airports handled just over 6.9 million passengers, a 2.2% decline compared to the same period last year. This decrease was primarily driven by lower traffic at Muscat International Airport and Sohar Airport, where passenger volumes fell due to reduced operations. Additionally, temporary airspace disruptions in May and June further contributed to the decline. In contrast, Salalah International Airport recorded an increase in passenger volumes during the same period, supported by strong tourism demand.

Oman Airport Passenger Volume (in Millions)

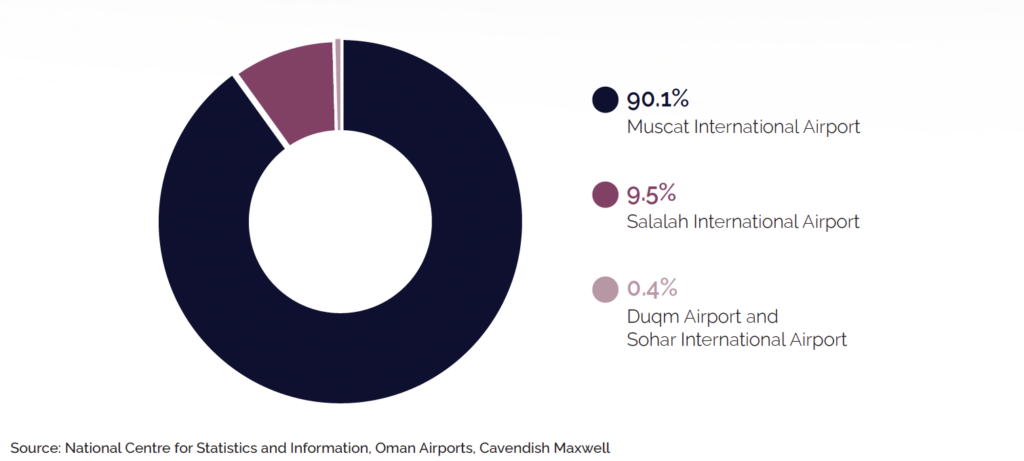

Muscat International Airport remained Oman’s main gateway, handling nearly 9 in 10 passengers. Salalah International Airport was the second-busiest hub and is expected to see an increase in traffic during the upcoming Khareef season.

Looking ahead, total passenger volumes across the Sultanate’s airports are projected to reach 50 million by 2040. To accommodate this growth, Oman plans to open new airports, increasing the total number of airports to 13, which will strengthen both domestic connectivity and the tourism sector.

Oman Airport Passenger Volume by Airports in H1 2025 (%)

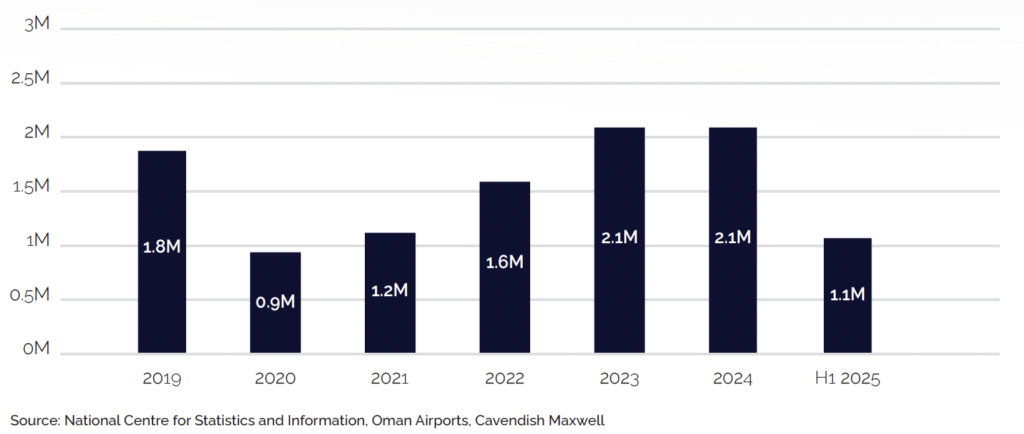

Number of Guests (3-5 Star Hotels)

Oman continued to attract a diverse mix of visitors in the first half of 2025 through its range of tourism offerings, from adventure tourism and Meetings, Incentives, Conferences, and Exhibitions (MICE) to rich cultural heritage experiences. These experiences were further supported by Government-led initiatives, including activation programmes and events. As a result, the country’s 3-5-star hotels welcomed approximately 1.1 million guests in H1’2025, up 9.2% from the same period last year, with total guest numbers for 2025 projected between 2.2 and 2.3 million.

Total Number of Guests in 3-5 Stars Hotel (in Millions)

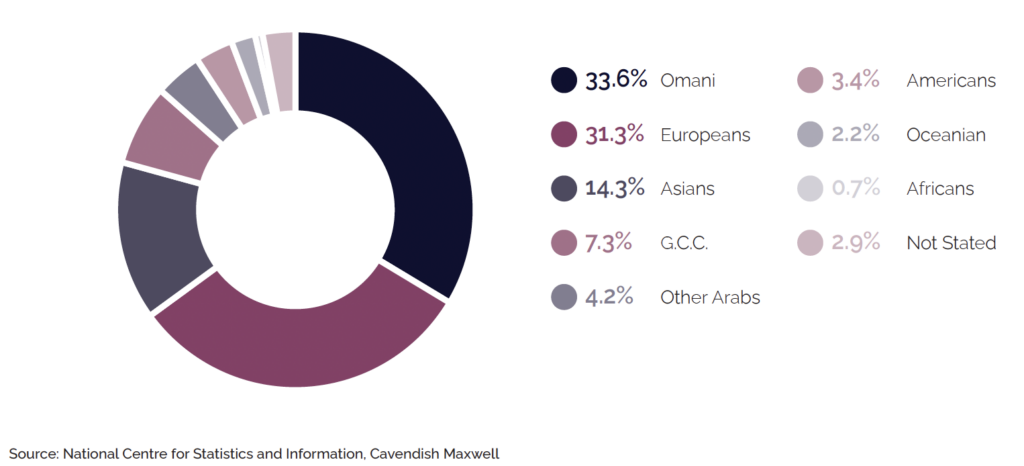

Omani nationals remained the backbone of the hospitality sector, holding the largest share of guests. Europeans and Asians also ranked among the top three nationality groups in 3-5 star hotels, with European visitors up 20.1% compared to the same period last year. Although Oceanians accounted for a smaller share, they posted the highest growth rate among all nationalities.

Total Number of Guests in (3-5 Stars) Hotel by Nationality

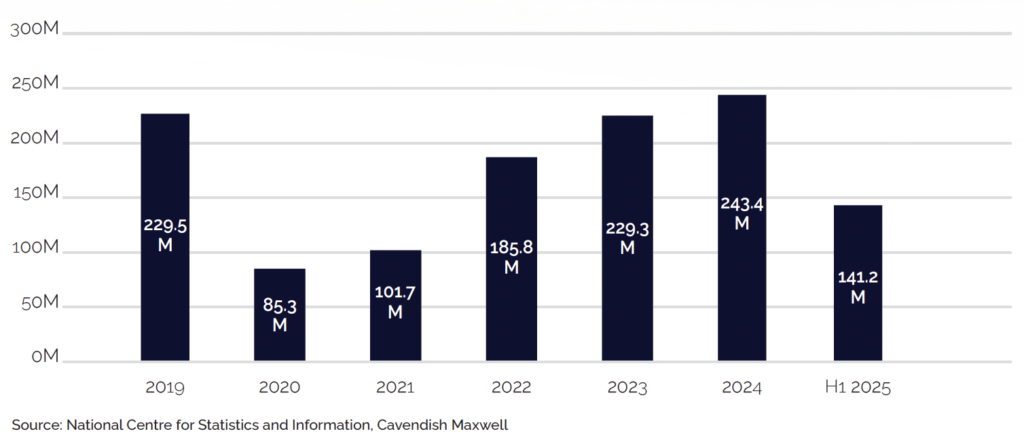

Hotel Revenues (3-5 Star Hotels)

Hotel revenues in Oman’s 3-5 star hotels reached OMR 141.2 million in H1’2025, up 18.2% year-on-year. Room revenues rose 21.7% to OMR 83.7 million, while other revenues contributed OMR 57.5 million, up 13.3%. The strong growth in room revenues reflects robust demand across the hotel market driven by higher occupancy. This positive performance has supported job creation, with employment in 3-5-star hotels rising 4.8% to approximately 10,800 employees.

Total Number of Guests in 3-5 Star Hotels (in Millions)

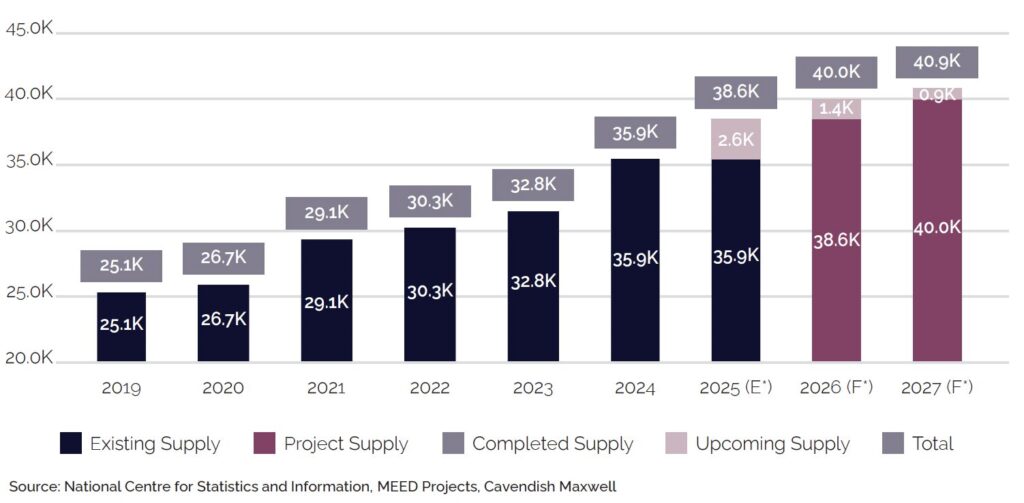

Existing and Future Hotel Room Supply

As of H1’2025, Oman’s hotel room supply stood at roughly 36,000 keys, with an additional 2,600 rooms scheduled for completion by year-end, although some are expected to spill over into 2026. Looking further ahead, around 7,000 rooms are in the pipeline between 2026 and 2030. While delivery timelines may shift, the eventual addition of this capacity could temporarily weigh on occupancy levels, particularly in segments with concentrated supply.

However, these new projects also reflect continued investor confidence in Oman’s tourism sector, aligning with national strategies to diversify the economy and attract higher visitor volumes. If demand growth keeps pace with supply, especially through Government initiatives and international partnerships, the market should be able to gradually absorb this influx without prolonged pressure on performance.

Oman Hotel Room Supply – Number of Rooms (in Thousands)

*The overall hotel room supply comprises 1-5 star hotels, unclassified hotels, hotel apartments, and guest houses.

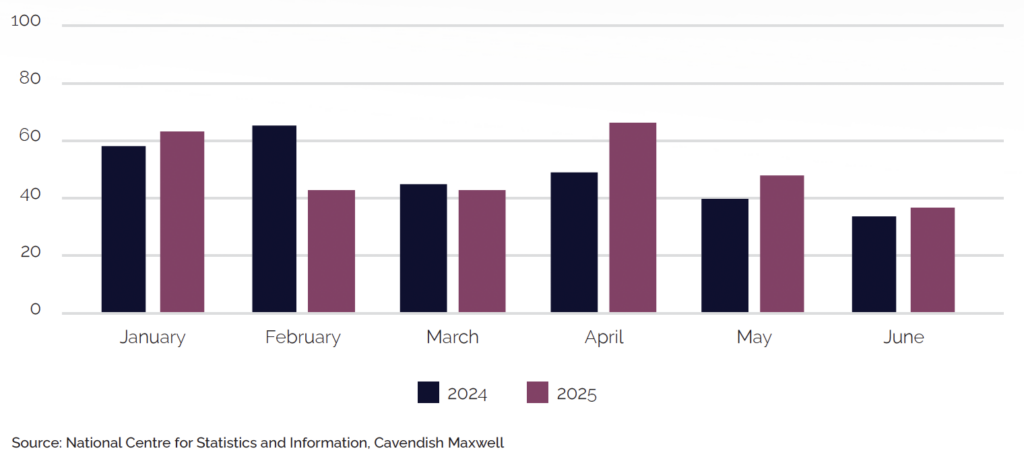

Occupancy Rates (3-5 Star Hotels)

In the first half of 2025, hotel occupancy rates in Oman reached 54.7%, a notable 14.4% increase compared to the same period last year. The rise was driven by higher guest numbers from both domestic and international markets, further reinforced by Government efforts to position Oman as a year-round destination. This positive momentum highlights the sector’s growing appeal, supported by stronger demand fundamentals.

Monthly Occupancy Rates for 3–5 Star Hotels (%)

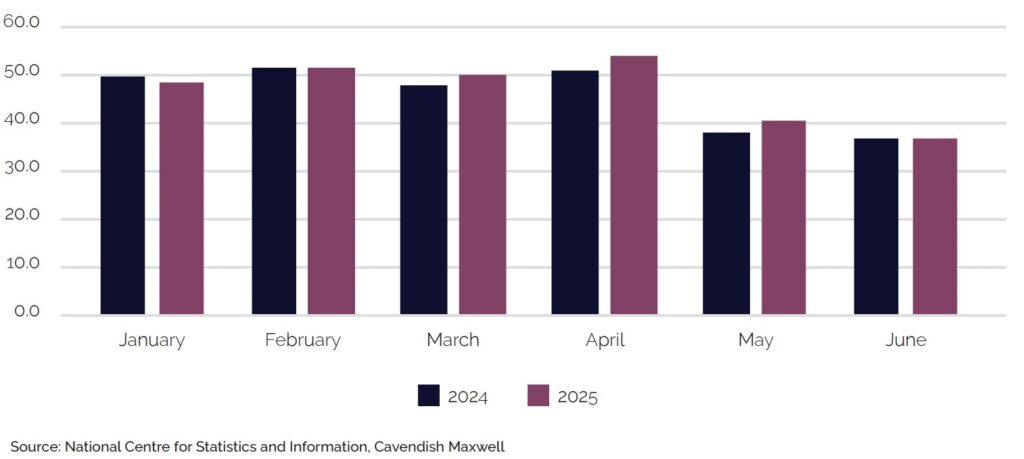

Average Room Rates in Omani Riyal (3-5 Star Hotels)

Meanwhile, average room rates (ARR) stood at OMR 47.7, showing a slight increase compared to H1 2024. While both occupancy rates and guest numbers had risen, the modest growth in ARR suggested that pricing power remained stable, with hotels benefiting from higher volumes rather than significant rate increases.

Monthly Average Room Rates for 3–5 Star Hotels (in Omani Riyal)

Tourism Development: Government Initiatives and New Attractions

Strategic Government Initiatives

In 2025, the Ministry of Heritage and Tourism launched its External Promotional Campaigns Programme to position Oman as a leading global tourism destination through targeted initiatives in key international markets. As part of this effort, Oman plans to open new tourism representative offices in strategic source markets, including China, Russia, Spain, Latin America, and several other Asian countries. The ministry also aims to collaborate with 80 international tourism companies to run joint promotional campaigns, raising awareness of Oman’s diverse tourism offerings.

To further support growth, Oman is planning six new regional airports by the end of the decade, with three located in Al Jabal Al Akhdar, Masirah Island, and Sohar. This expanded airport network is expected to increase passenger traffic to 50 million by 2040, enhancing connectivity and reinforcing Oman’s position as both a travel and logistics hub.

Major Tourism Developments

Muscat, Salalah, and Jabal Akhdar are set to see significant tourism developments that will enhance Oman’s appeal for both domestic and international travellers.

In Muscat, the Muttrah Cable Car project is emerging as a major new attraction in the historic old town, with construction underway and expected completion in early 2026. The project will feature a three-station cable car route spanning approximately 3–5 kilometres, connecting Muttrah Port to the mountaintop and offering 360-degree views of the city, making it a unique addition to the GCC’s tourism landscape. Complementing this, the new Oman Botanic Garden, located about 35km from Muscat International Airport, is scheduled for handover by late 2025. The garden will showcase Oman’s diverse natural environments, native plants, and trees in a single, immersive setting.

Moving south, Salalah continues to strengthen its position as a prominent GCC tourist hub, combining natural beauty with modern infrastructure. The region benefits from year-round tourism, particularly during the Khareef season, which transforms the surrounding mountains into lush, cool landscapes. The Boulevard Raza project, spanning over 47,000sqm, will offer a wide range of leisure and entertainment attractions. Central to this development will be a water channel and the Salalah Eye, providing visitors with panoramic views of Dhofar’s picturesque terrain.

In the interior, Jabal Akhdar, which is known for its cooler summer climate, dramatic landscapes, and cultural experiences, continues to attract both local and international visitors. The Jabal Akhdar Park, which opened in 2025 in the Al Dakhiliyah Governorate, forms part of a broader strategy to enhance the region’s tourism infrastructure. Further expanding its appeal, the Ministry of Housing and Urban Planning unveiled plans in 2025 for a major mountain destination at an altitude of 2,400 metres. This development is set to include over 2,500 residential homes, 2,000 hotel rooms, and a purpose-built health and wellness village, reinforcing Jabal Akhdar’s status as a key tourism hub in Oman.

Hospitality Market Outlook

Oman’s hospitality sector performed strongly in H1’2025, with guest numbers, occupancy rates, and average room rates all rising compared to the same period last year. This growth was supported by both domestic and international travellers, reflecting strong demand from a variety of visitor segments, which was further reinforced by the Sultanate’s diverse tourism offerings, from adventure tourism and MICE to rich cultural heritage experiences. At the same time, significant Government investment in tourism infrastructure, marketing campaigns, and activation programmes strengthened Oman’s positioning as a year-round destination, while its ranking as the 6th safest country globally creates a powerful value proposition that resonates particularly well amongst security-conscious travellers.

Looking ahead to H2’2025, the positive momentum is expected to continue, supported by Salalah’s Khareef season and expanding air connectivity through Oman Air and Salam Air, which are increasing routes and flight frequencies to key destinations. These initiatives, combined with ongoing Government support and sustained tourism demand, position Oman’s hospitality market for steady growth, with healthy occupancy and revenue performance expected through the remainder of 2025.