Oman Hospitality Market Performance Q3 2025

Executive Summary with Key Trends

Oman’s hospitality sector demonstrated robust performance in the first nine months of 2025, supported by strong domestic and international demand. Airport traffic reached 11.2 million passengers, while guest volumes in 3-5 star hotels rose to 1.7 million, representing a 9% increase compared with the same period last year. Occupancy levels strengthened further, reaching 52.8%, a notable 13.1% growth over 2024, signalling that the market is effectively absorbing demand even during shoulder months. Meanwhile, average room rates (ARR) remained broadly stable, indicating that hotels are focusing on maximising occupancy and optimising inventory utilisation rather than pursuing aggressive rate increases to drive revenue growth.

Alongside these trends, the Ministry of Heritage and Tourism (MHT) has accelerated development by signing 36 tourism-sector usufruct contracts valued at RO 100 million. These agreements, which include the development of hotels, resorts, and integrated complexes across the governorates, support a nationwide push to increase hotel capacity and diversify tourism offerings. Simultaneously, ongoing marketing campaigns and activation programmes continue to strengthen Oman’s positioning as a year-round destination, supporting both domestic and international demand.

Oman’s hospitality sector is entering a period of steady, sustainable growth driven by stronger domestic demand, rising international arrivals and a well-paced supply pipeline. The market is absorbing new capacity efficiently which reflects a more diversified demand base and a stronger foundation for year-round performance.

Khalil Al Zadjali

Head of Oman

Tourism Sector Overview and Performance

Airport Passenger Volume Trends

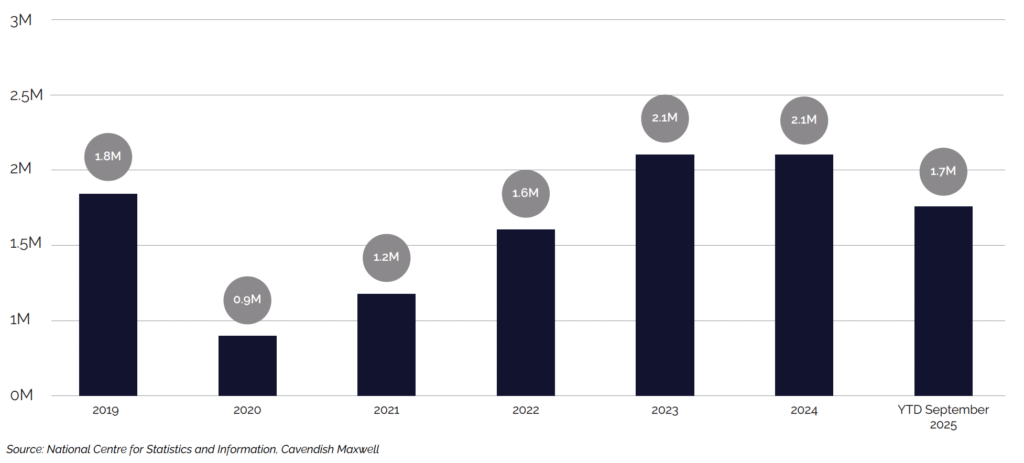

Oman’s airport network handled approximately 11.2 million passengers during the first nine months of 2025, representing a modest year-on-year increase of 0.7%. Despite reduced operations at Suhar International Airport, total passenger volumes in 2025 are expected to exceed the 14.5 million passengers recorded in 2024, potentially reaching between 14.6 and 14.9 million by year-end, supported by steady growth in international travel and improved connectivity.

Airport Passenger Volume (in Millions)

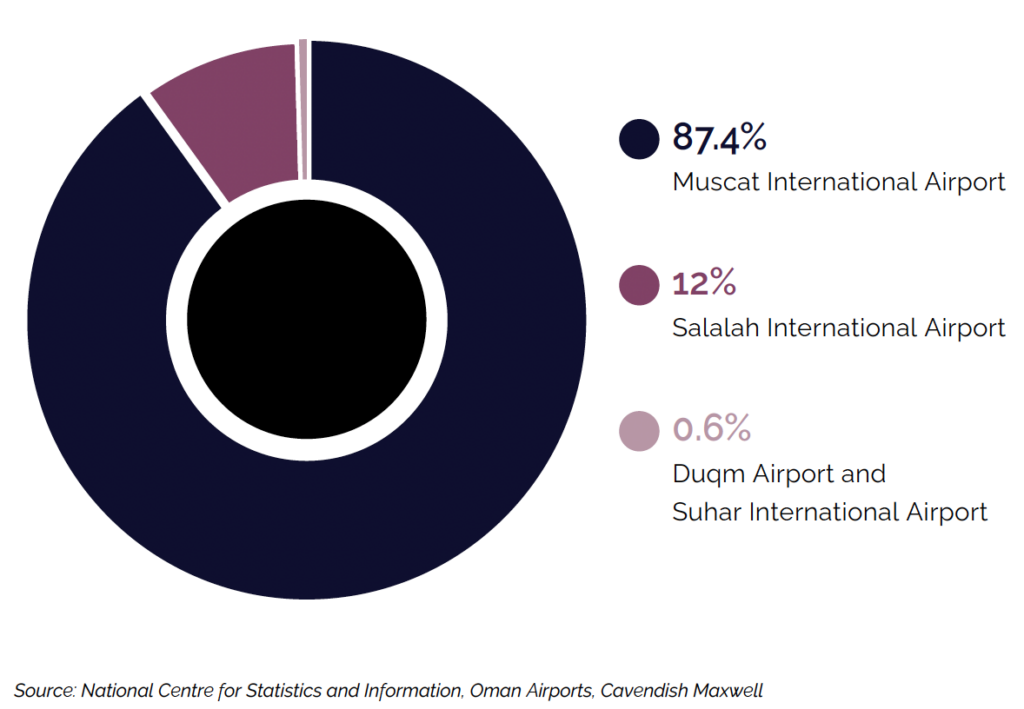

Passenger traffic across Oman’s airports remained heavily concentrated at Muscat International Airport, which handled approximately 9.8 million passengers (87.4%), reaffirming its role as the Sultanate’s primary international gateway for both business and leisure travel. Beyond Muscat, Salalah International Airport emerged as the key secondary hub, accounting for around 1.4 million passengers (12%), driven by its strong leisure appeal, particularly during the Khareef season, which generated around 21.3% of the airport’s total passenger volumes.

Airport Passenger Volume by Airports (YTD September, %)

Number of Guests (3-5 Star Hotels)

Oman’s 3–5 star hotel segment maintained its upward trajectory in 2025, welcoming approximately 1.7 million guests by the end of September, compared to 1.5 million during the same period in 2024, representing a 9% year-on-year increase. Growth was supported by increased arrivals from both domestic and international guests, with the Khareef season providing an additional boost to the overall guest numbers.

Total Number of Guests in 3-5 Stars Hotel (in Millions)

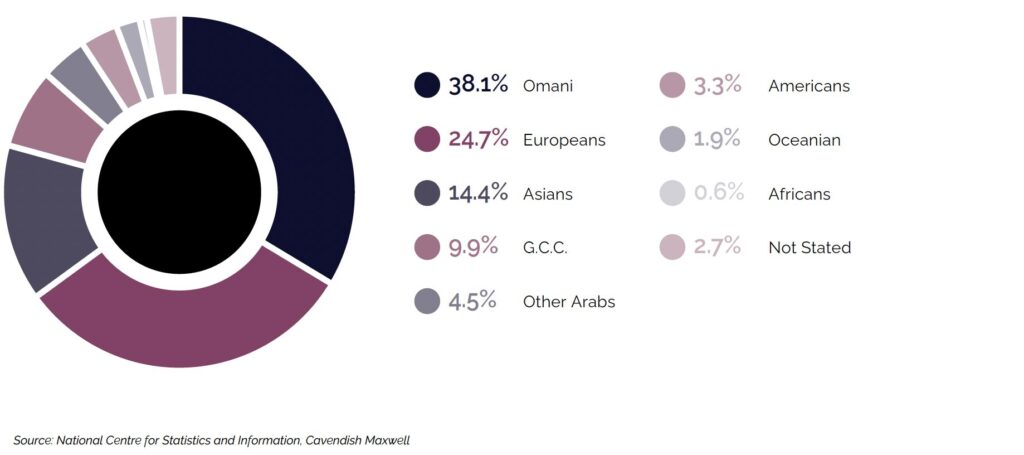

Omani nationals remained the primary driver of demand in the 3–5-star hotel segment, accounting for 38.1% of total guest stays and highlighting the role of domestic tourism. European guests ranked second at 24.7%, while Asian travellers accounted for a further 14.4%. Guests from GCC countries represented 9.9% of total stays, supported by regional connectivity and short-haul travel, while other Arab nationals contributed 4.5%. Americans comprised 3.3% of guests, followed by Oceanians at 1.9% and Africans at 0.6%.

Total Number of Guests in (3-5 Stars) Hotel by Nationality

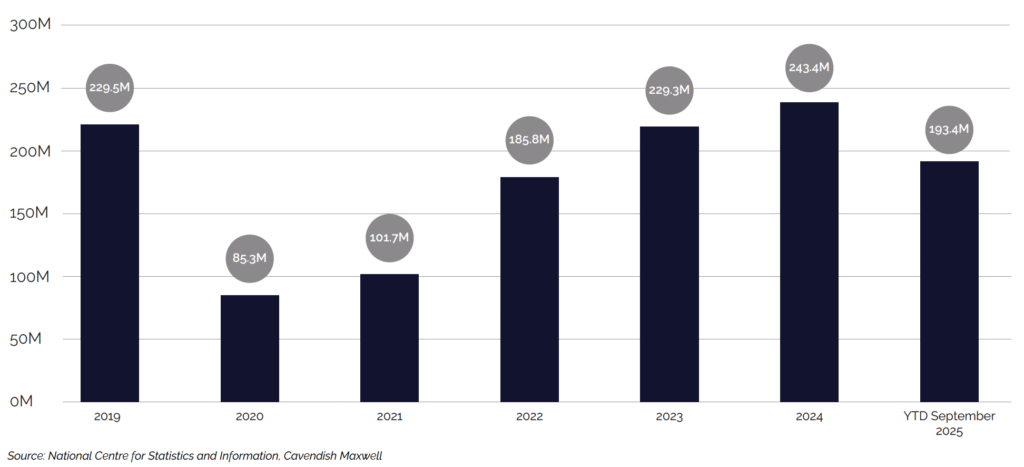

Hotel Revenues (3-5 Star Hotels)

Hotel revenues in the 3–5 star segment continued to grow in 2025, with total revenues reaching OMR 193.4 million during the first nine months of the year, representing an 18.2% increase compared to the same period last year. This growth was supported by a 20.9% rise in room revenues, reflecting stronger returns per occupied room alongside higher occupancy levels. Employment within the segment also increased by 5.3%, indicating that hotels expanded their workforce to accommodate rising guest volumes and increased service requirements.

Total of 3-5 Stars hotel revenue (in Omani Riyal Millions)

Existing and Future Hotel Room Supply

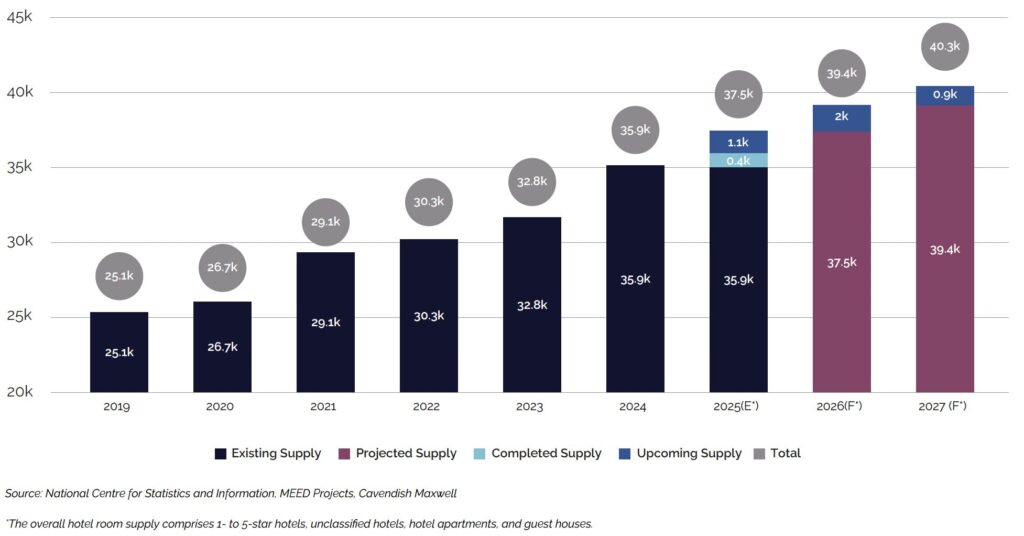

Oman’s hotel supply remained largely stable at around 36,300 rooms by the end of September 2025, with an additional 1,000 rooms expected to be completed by year-end, although some may spill over into 2026. By 2027, total hotel stock is projected to reach approximately 40,300 rooms, in line with anticipated growth in tourism driven by new attractions, improved infrastructure, and Government initiatives aimed at boosting visitor numbers. This gradual increase in supply is expected to keep pace with growing tourism demand. It will also provide visitors with a wider range of accommodation options, helping to maintain a balanced market.

Hotel Room Supply – Number of Rooms (in Thousands)

Occupancy Rates (3-5 Star Hotels)

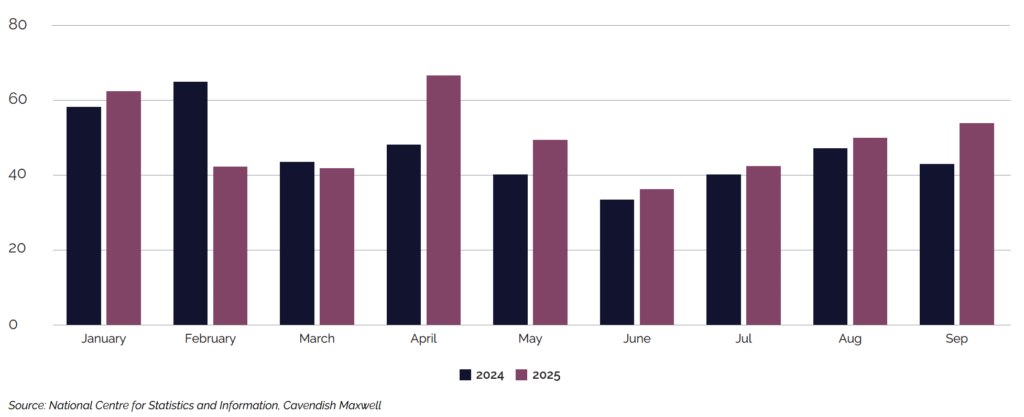

In the first nine months of 2025, hotel occupancy in Oman rose to 52.8%, marking a 13.1% year on year increase. This strong performance was driven by several factors, including a notable rise in leisure demand and favourable calendar effects. Occupancy was further supported by an improved summer season, supported by the ‘#WithinOman’ tourism initiative, as well as the Khareef season, which saw visitor numbers increase by 2.2% compared with the previous year.

Monthly Occupancy Rates for 3–5 Star Hotels (%)

Average Room Rates in Omani Riyals (3-5 Star Hotels)

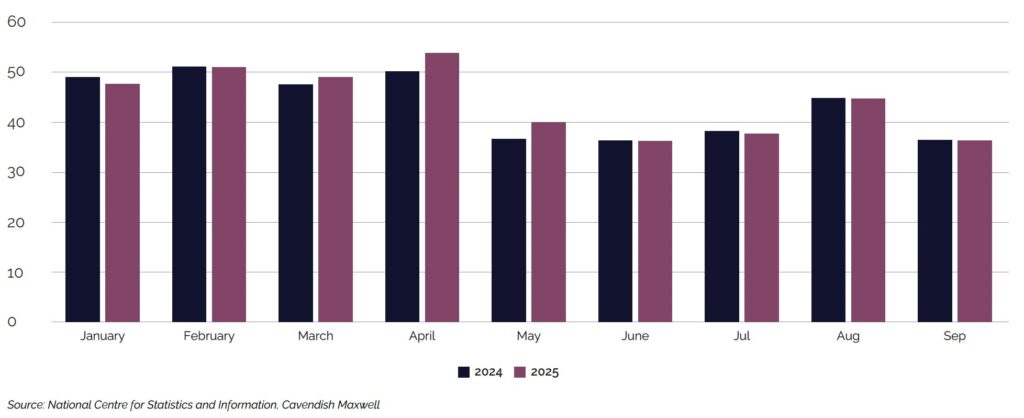

Average Room Rates (ARR) remained largely stable at OMR 45.3, up just 1.3% compared to the same period last year. This demonstrates that hotels are focusing on driving occupancy and optimising inventory utilisation, rather than pursuing aggressive rate increases to achieve revenue growth.

Monthly Average Room Rates for 3–5 Star Hotels (in Omani Riyals)

Hospitality Market Outlook

Oman’s hospitality sector continues to demonstrate resilient and balanced growth, supported by a combination of structural factors and seasonal demand drivers. Hotels across the Sultanate have achieved higher revenue without relying on aggressive rate increases, reflecting a deeper and more diversified demand base across domestic, regional, and international markets. While seasonal patterns continue to influence monthly performance, the sector benefits from a broad range of offerings, including urban business hotels, coastal resorts, and experiential destinations. This diversification reduces reliance on any single location, season, or traveller segment, providing a stable foundation for sustainable, year-round growth.

The sector is further supported by Government-led promotional initiatives, such as ‘#WithinOman’, which was aimed at stimulating domestic tourism, and the ‘Experience Our Winter’ programme, which seeks to position Oman as a winter destination across GCC, European, and Asian markets. These strategic efforts continue to strengthen the Sultanate’s destination positioning and appeal across key source markets.

Looking ahead, the hotel supply pipeline will play an important role in shaping market performance. Approximately 4,000 keys are currently under development, with over 2,900 keys scheduled for delivery between 2026 and 2027. The primary risk remains the timing and concentration of new supply; however, as long as deliveries are phased and efforts to enhance international awareness of Oman continue, the market is expected to absorb new capacity, supporting continued growth in both occupancy and revenues over the medium term.