Dubai Residential Market Performance Q3 2025

Executive Summary

Dubai’s residential market continued to grow in Q3 2025, supported by strong macroeconomic fundamentals, population growth, and sustained investor confidence. The residential sales market recorded approximately 55,300 transactions, up 17.1% year-on-year, driven predominantly by exceptional off-plan activity. Off-plan sales surged to a record 42,000 transactions, up 23.6% year-on-year and accounting for 76% of total market activity, despite a moderation in new project launches during the quarter. However, off-plan resales declined to 6.1% of off-plan activity, down from 9.7% a year earlier. In contrast, the ready property segment showed more subdued activity, with transaction volumes declining 5.4% quarter-on-quarter and rising only 0.6% year-on-year, potentially reflecting price sensitivity among buyers or a short-term market correction.

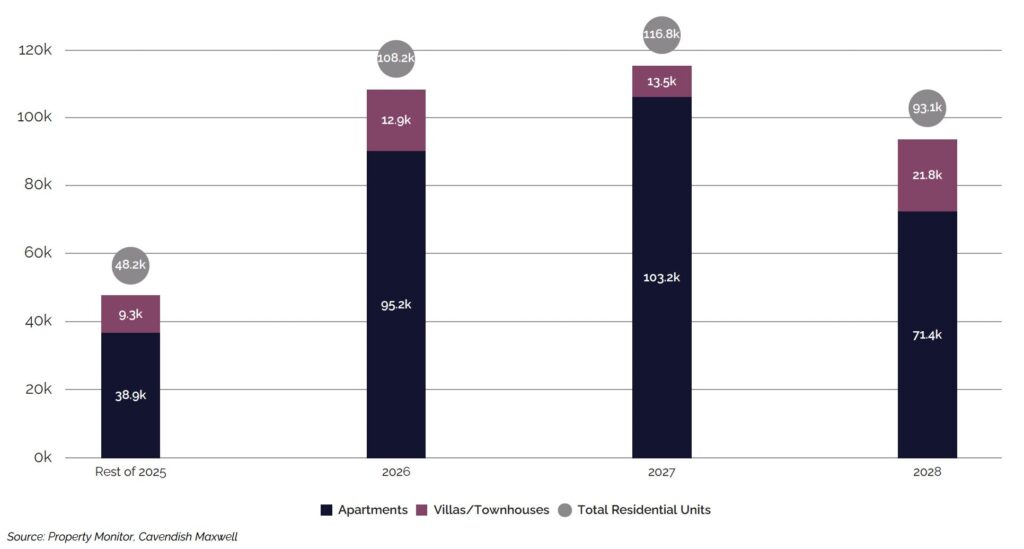

On the supply side, deliveries totalled approximately 9,400 units in Q3 2025, below the initial projection of 22,800 units, reflecting a materialisation rate of 41.3%. Total deliveries in the first nine months reached 28,100 units, up 6% year-on-year. Notably, construction cycles have shortened significantly to approximately 880 days in 2025, compared to 1,340 days in 2023, indicating accelerated project completion timelines. Looking ahead, around 48,200 units are projected for Q4 2025, with approximately 366,000 units expected through 2028, the majority phased for delivery in 2026 and 2027.

Residential sales prices continued their upward trajectory, rising 4.5% quarter-on-quarter and 16.1% year-on-year, driven by strong buyer demand from end-users and investors. However, price growth varied across locations, with some areas recording double-digit increases while others experienced more moderate single-digit growth. The rental market also grew 4.4% quarter-on-quarter and 10.9% year-on-year, though the pace of annual growth moderated compared to 2024, when increases consistently ranged between 13-15%. Recent months saw growth ease to 11-12%, driven by the Smart Rental Index’s regulatory influence and increasing supply deliveries.

Overall, Dubai’s residential market is entering a more mature phase. Off-plan sales are expected to remain strong in the near term if new launches continue, while the ready segment and rental market may show more measured activity. The market faces a critical test in 2026 and 2027 when approximately 225,000 units are scheduled for delivery, which will test absorption capacity. Nevertheless, market fundamentals remain robust, positioning the Emirate to navigate this transition while maintaining steady momentum.

This report examines the key drivers behind this momentum, analyses trends in property prices and transaction volumes, and offers an outlook for Dubai’s residential real estate sector.

Market Snapshot for Q3 2025

- Sales Transactions: 55,300 (+17.1% Y-on-Y)

- Residential Sales Value: AED 138.3 Billion (+17.9% Y-on-Y)

- Sales Price: +16.1% Y-on-Y

- Rental Rates: +10.9% Y-on-Y

- Residential Supply in 2025: 48,200 Units (Under-construction)

- Residential Supply in 2025: 28,100 Units (Completed)

Macroeconomic Overview and Outlook

Dubai’s macroeconomic momentum strengthened in Q3 2025, supported by solid non-oil activity, resilient business confidence, and continued investment flows. The Central Bank of the UAE revised its 2025 GDP forecast upward from 4.4% to 4.9%, while the The International Monetary Fund (IMF) also slightly adjusted its projection for Dubai to 3.4% growth, signalling broad confidence in the Emirate’s economic trajectory. Business activity indicators remained positive as well, with the S&P Global UAE & Dubai PMI rising to 54.2 for both in September.

Population growth continued to play a pivotal role in sustaining economic activity. Dubai’s population reached approximately 4 million in August 2025 and is on track to approach 5 million by late 2029 or early 2030. This expansion is supported by ongoing job creation, business formation, and steady expatriate and investor inflows. Tourism performance also remained a core pillar of economic growth during the quarter, with visitor arrivals on pace to exceed record 2024 levels, supported by an active events calendar and expanded airline connectivity.

Looking ahead, Dubai’s macroeconomic outlook remains positive. Strong fundamentals, including economic diversification, population expansion, and sustained investor confidence, are expected to provide a solid foundation for continued growth. Combined with investor-friendly regulations and strategic infrastructure investments, these factors position the Emirate to maintain steady momentum through 2026, despite potential global economic uncertainties.

Sales Transactions

Sales Transactions: By Volume

Residential sales transactions in Dubai continued to rise in the third quarter of 2025, reaching record levels, with around 55,300 transactions recorded. Overall volumes increased by 11.5% compared to Q2 2025 and 17.1% year-on-year. This growth was driven primarily by strong off-plan activity, which continued to set new records. Off-plan transactions reached approximately 42,000, the highest level in recent times, rising 18.1% quarter-on-quarter and 23.6% year-on-year. Notably, the surge in off-plan volumes occurred despite a reduction in the number of new launches, indicating that buyer demand for off-plan units remained strong in Q3 2025.

Meanwhile, ready property sales reached 13,300 transactions in Q3 2025. Volumes were down 5.4% compared to Q2 2025, though slightly higher by 0.6% year-on-year. The decline in activity could be due to a short-term correction or a result of price sensitivity among buyers. If this pattern continues, it could indicate a modest cooling in the ready property segment, though further quarters will be needed to determine whether this is a temporary adjustment or the beginning of a broader market shift.

Sales Transactions – By Volume

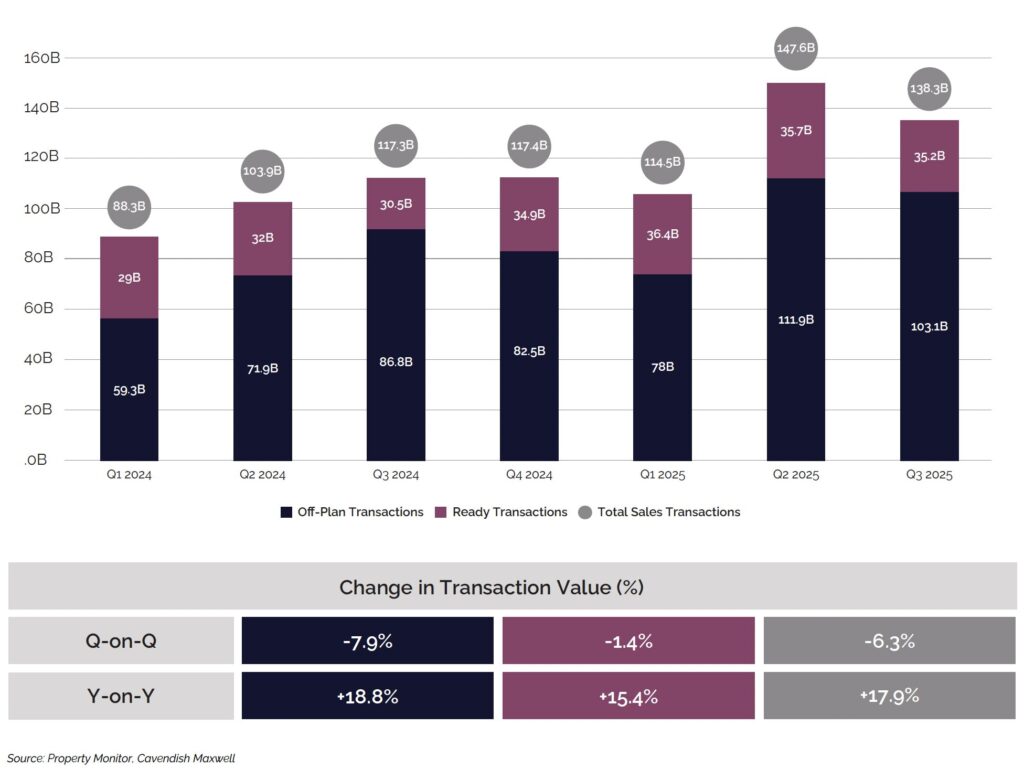

Sales Transactions: By Value

In the third quarter of 2025, the total value of sales transactions reached AED 138 billion, marking a 6.3% decline from Q2 2025, primarily due to a decrease in off-plan transaction values. Although off-plan sales volumes continued to rise, the total value fell by 7.9%, driven by a higher concentration of apartment sales, which typically have lower ticket prices than villas and townhouses. Despite the quarterly dip, the market showed strong year-on-year growth, with off-plan and ready transaction values increasing by 18.8% and 15.4%, respectively.

Sales Transactions – By Value (AED Billions)

While approximately 366,000 units are expected to enter the market through 2028, a figure that might at first glance raise concerns about oversupply, the reality is more measured. Rather than signalling imbalance, this pipeline points to a period of healthy normalisation in Dubai’s housing market. Although the upcoming supply wave may temper the recent pace of price growth, it ultimately reflects a maturing market, one characterised by steadier expansion, longer cycles and a growing emphasis on sustainable delivery rather than short-term spikes.

Ronan Arthur

Director, Head of Residential Valuation

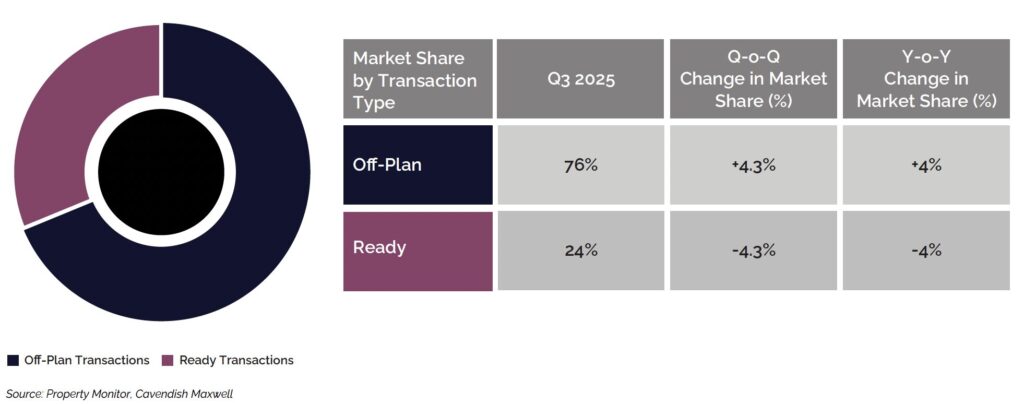

Sales Transactions: Off-Plan vs. Ready Property Transactions

Off-plan transactions reached 76% of sales market activity in Q3 2025, increasing from 72% year-over-year. This shift indicates that the market has become increasingly focused on future developments, driven largely by payment flexibility and developer incentives. However, as the gap with ready properties widens, questions around supply and demand balance have emerged. With off-plan dominance continuing to grow, attention is now turning to completion timelines, absorption rates, and how the supply and demand dynamics may evolve going forward.

Sales by Transaction Type – Q3 2025

Sales Transactions: By Sales Sequence (Off-Plan)

In Q3 2025, initial developer sales for off-plan properties rose to 93.9% of off-plan activity, up from 90.3% a year earlier. While most sales were for projects launched in 2025, transactions also continued for developments from 2023 and 2024. Off-plan resales, meanwhile, declined to 6.1%, suggesting that buyers are increasingly opting to purchase directly from developers due to favourable payment plans and incentives. If the decline in resale activity continues, it could affect demand from speculative investors who typically buy to flip properties before completion, as limited resale opportunities may reduce their willingness to purchase at launch.

Off-Plan Sales Transactions by Sales Sequence – Q3 2025

Sales Transactions: By Sales Sequence (Ready)

Among ready properties, resale activity continued to dominate; however, the share of resale transactions declined in Q3 2025 as initial developer sales increased, indicating that developers were actively selling ready units from their existing inventory.

Ready Sales Transactions by Sales Sequence – Q3 2025

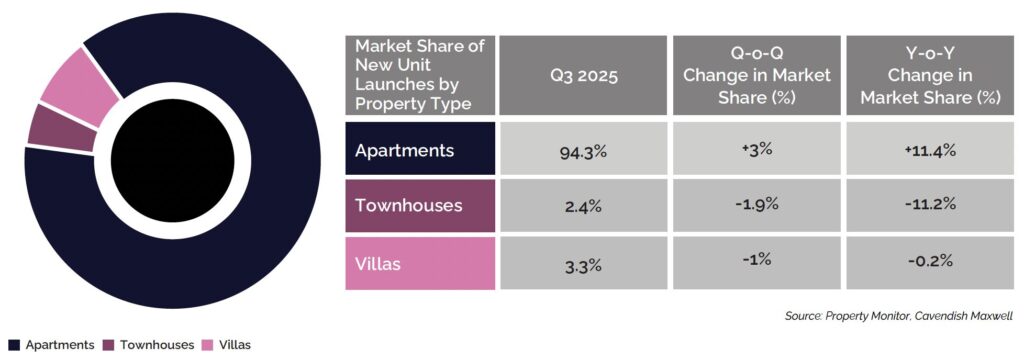

Sales Transactions: By Property Type (Off-Plan Properties)

In terms of property type, apartments continued to dominate off-plan sales in Q3 2025, with their share rising to 89.4%, up from 79% in Q3 2024. This increase was largely driven by launch activity, as approximately 88.7% of projects introduced this year were apartments. Conversely, the declining share of villas and townhouses was a consequence of softer launch momentum, as new releases for these property types slowed in both Q2 and Q3 2025.

Off-Plan Sales Transactions by Property Type – Q3 2025

Sales Transactions: By Property Type (Ready Properties)

Within the ready property segment, apartments continued to lead in transaction activity; however, their share fell to 79.2% as sales of villas and townhouses increased. This growth in sales activity for villas and townhouses was driven by high-net-worth individuals and families seeking more spacious living, with larger layouts, dedicated outdoor areas, and greater privacy.

Ready Sales Transactions by Property Type – Q3 2025

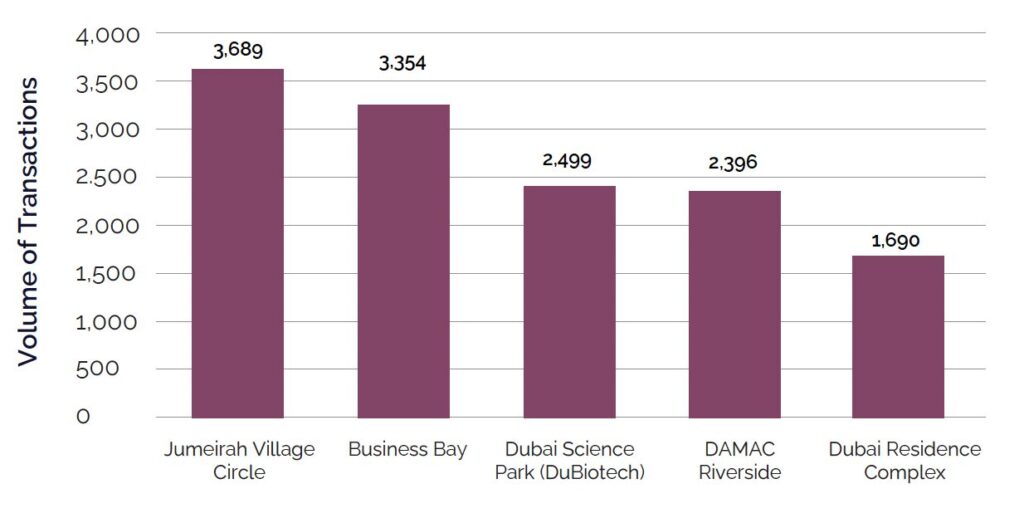

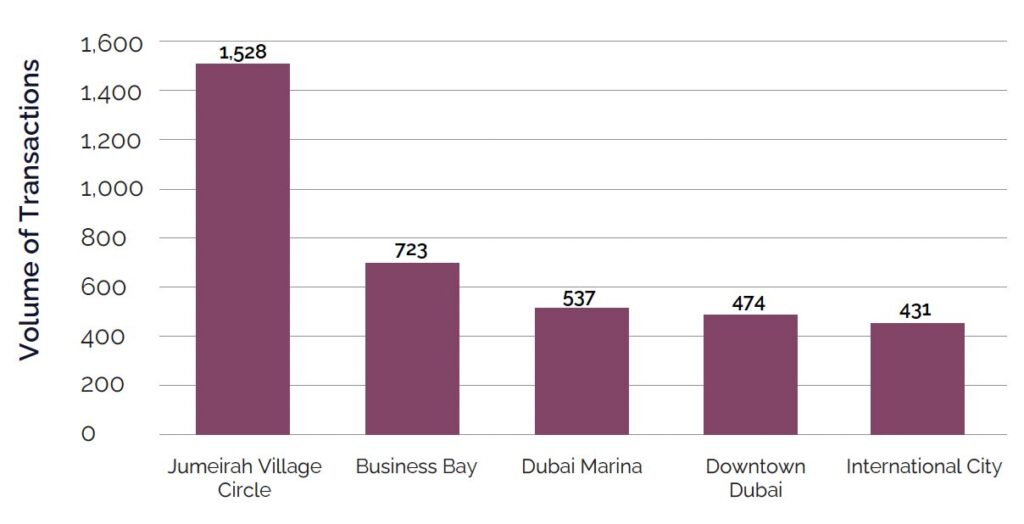

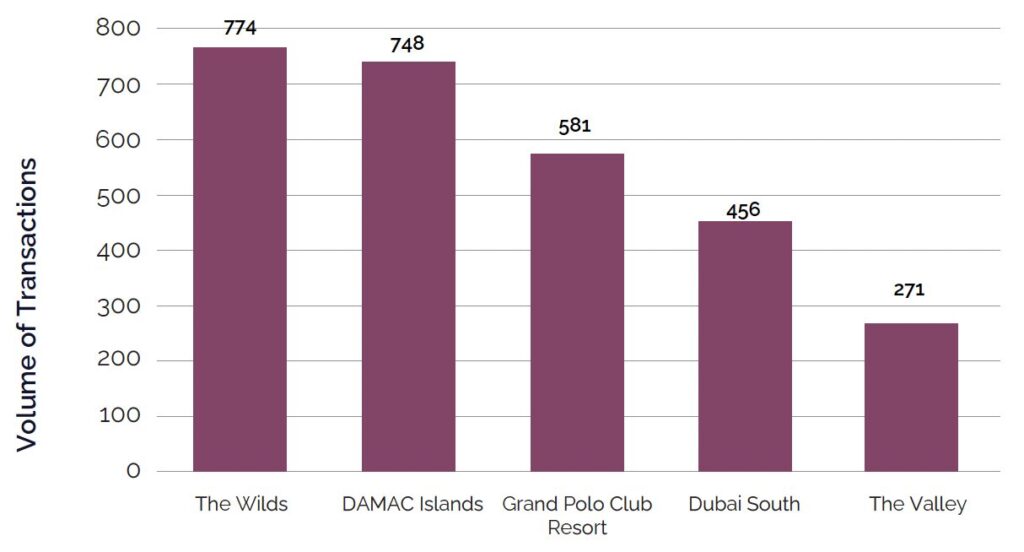

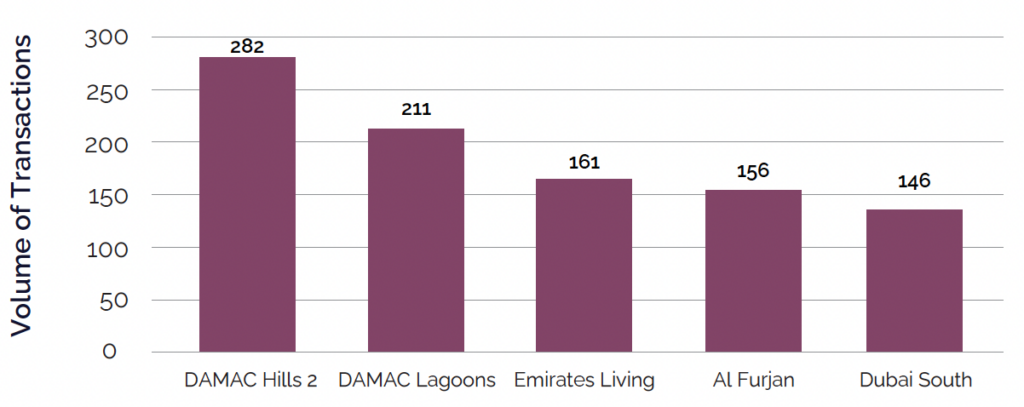

Sales Transactions: Top Five Locations

For Apartment Transactions by Volume – Q3 2025

Off-Plan Property Sales Transactions

Source: Property Monitor, Cavendish Maxwell

Ready Property Sales Transactions

Source: Property Monitor, Cavendish Maxwell

For Villa/Townhouse Transactions by Volume – Q3 2025

Off-Plan Property Sales Transactions

Source: Property Monitor, Cavendish Maxwell

Ready Property Sales Transactions

Source: Property Monitor, Cavendish Maxwell

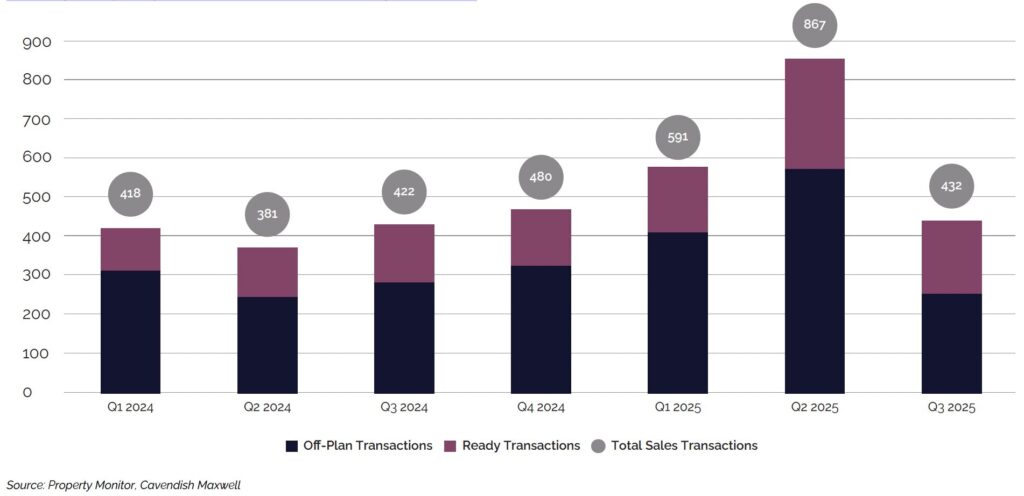

Sales Transactions: Luxury Properties (AED 20 million and above)

Dubai’s luxury property market recorded approximately 430 transactions in Q3 2025. Transaction volumes declined by 50.2% compared to the previous quarter, primarily due to a slowdown in off-plan luxury activity, however remained 2.4% higher than the same period last year.

Although the luxury segment accounted for only 0.8% of total market transactions, it contributed 11.6% to the overall transaction value, highlighting its outsized contribution to the market. With continued inflows of global wealth and Dubai’s reputation as a stable and attractive international hub offering world-class lifestyle amenities, demand for luxury properties is expected to remain resilient.

Luxury Property Sales Transactions – By Volume

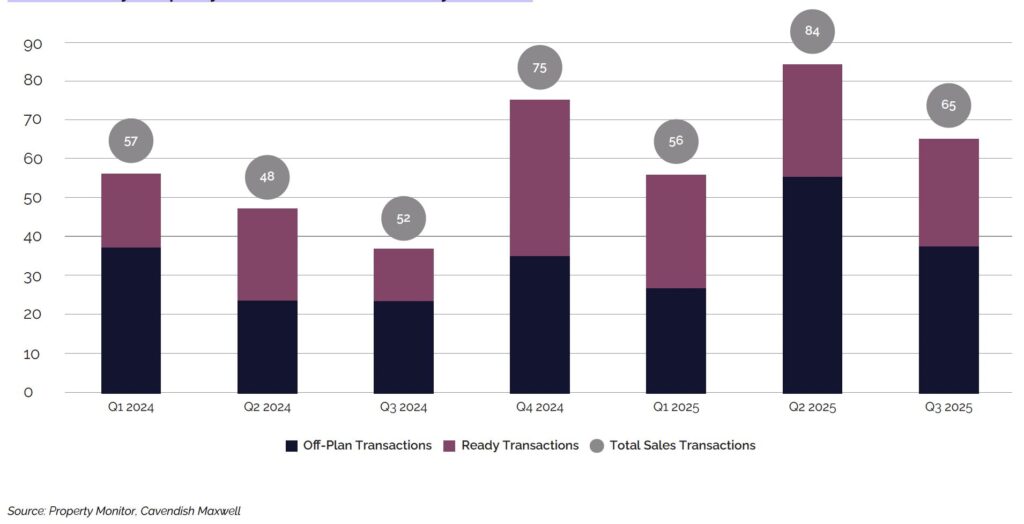

Sales Transactions: Ultra-Luxury Properties (AED 50 million and above)

Dubai’s ultra-luxury segment recorded 65 sales transactions valued at AED 5.9 billion in Q3 2025. Both transaction volumes and values rose year-on-year, by 25% and 45%, respectively.

Ultra-Luxury Property Sales Transactions – By Volume

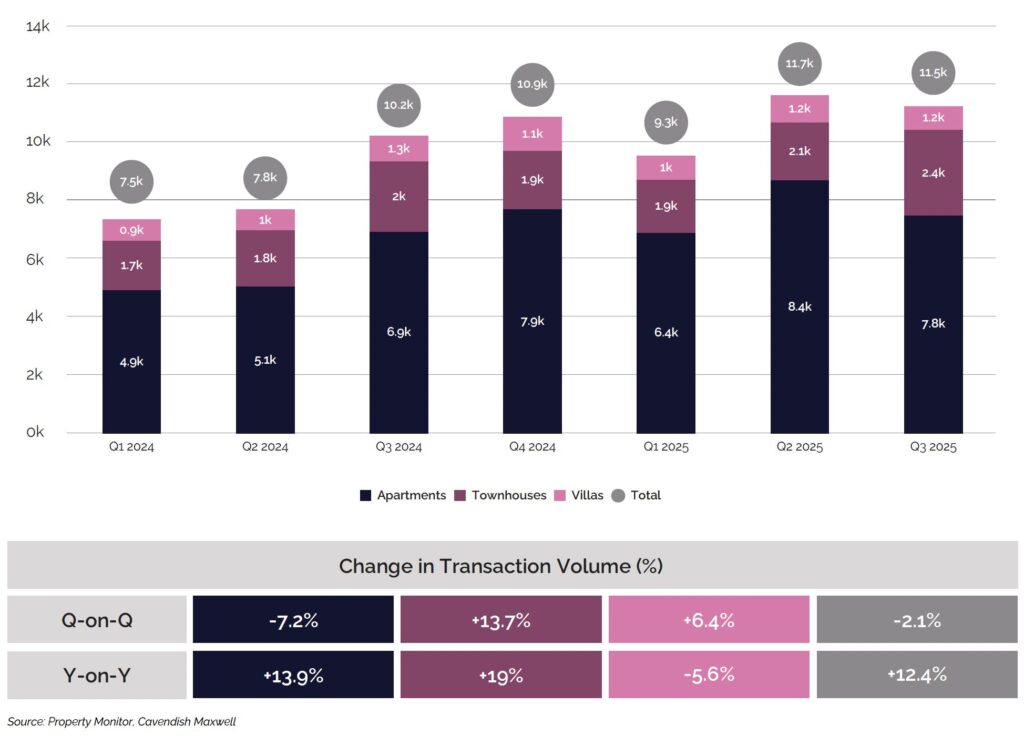

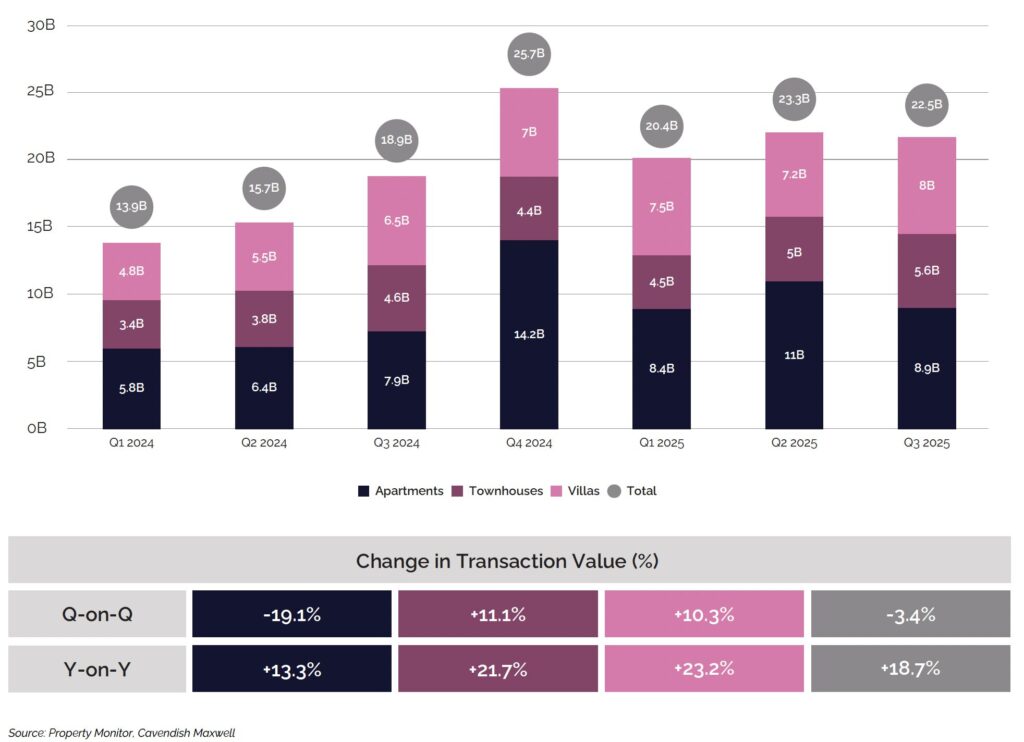

Mortgage Transactions

In Q3 2025, the residential market recorded approximately 11,500 mortgage transactions, down 2.1% from Q2 2025 and up 12.4% year-on-year. The quarterly decline was driven primarily by reduced mortgage activity in the apartment segment. In contrast, townhouses and villas showed strong momentum, with transaction volumes rising by 13.7% and 6.4%, respectively. Following the first interest rate cut of the year in September, mortgage activity is expected to strengthen, particularly as additional rate cuts are anticipated later in the year.

Mortgage Transactions – By Volume

Mortgage transaction values followed a similar trend, declining compared to Q2 2025, primarily due to a drop in the total value of 2-bedroom apartment transactions, a segment that represents a substantial share of the market. However, on a year-on-year basis, overall mortgage values rose by 18.7%.

Mortgage Transactions – By Value

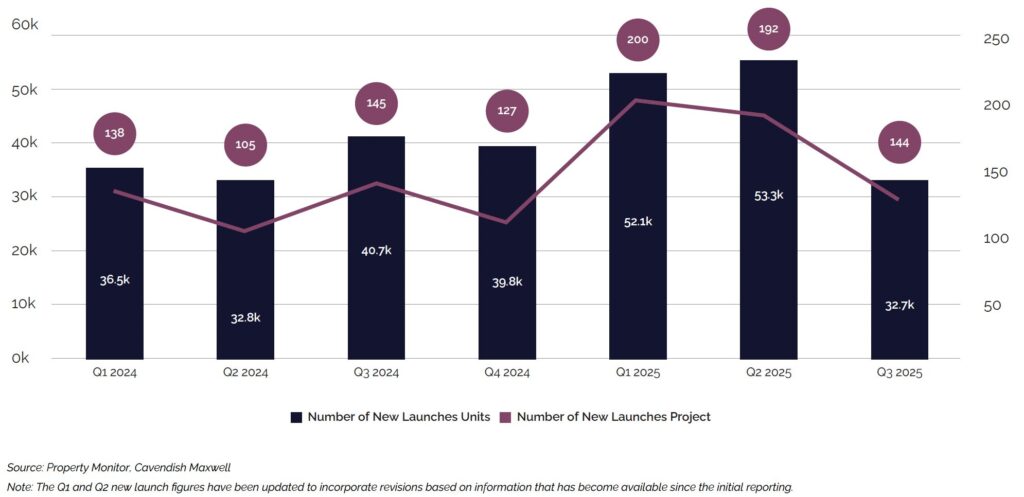

New Project Launches

After a surge in project launches during the first half of 2025, activity moderated in Q3, with 144 new residential projects introduced, adding over 32,700 units to the market. In the first three quarters, more than 500 residential projects were launched, bringing around 138,200 units in total, a 25.7% increase compared to approximately 110,000 units launched during the same period in 2024. On average, about 505 residential units were launched per day during this period, up from around 400 units per day in 2024. Despite the slowdown in Q3, off-plan transaction volumes continued to rise, supported by launches earlier in the year. While developers continue to move at record speed to capitalise on favourable market conditions, attention will now shift to how the volume of units scheduled for completion over the coming quarters will be absorbed by the market.

Number of Units and Projects

Of the 32,700 residential units launched in the third quarter of 2025, approximately 30,800 were apartments, followed by 1,100 villas and 800 townhouses. Taken together with earlier quarters, a total of 122,000 apartment units were launched in the first nine months of 2025, up from 93,000 units during the same period in 2024. This trend highlights the continued focus on apartments by developers, driven not only by strong demand from investors, young professionals, and smaller households, but also by the operational advantages and efficiency they offer.

New Launches by Property Type – Q3 2025

Supply: Number of Completed Units

Around 9,400 residential units were completed in Q3 2025, slightly below the initial projection of 22,800 units, reflecting a materialisation rate of 41.3%. This brought total deliveries in the first nine months of the year to 28,100 units, up from 26,500 units over the same period in 2024, a 6% increase. Most of these completions were concentrated in key areas, with Jumeirah Village Circle, Mohammed Bin Rashid City, Business Bay, Dubai Hills Estate, and Tilal Al Ghaf accounting for 41.5% of residential units delivered this year.

Notably, the average construction cycle for delivered units shortened significantly, standing at approximately 880 days in 2025, compared to 1,180 days in 2024 and 1,340 days in 2023. The combination of higher delivery volumes and faster construction timelines is expected to increase the supply of residential units in the market, helping to stabilise rental rates and ease pressure on tenants.

Completed Units (in Thousands)

Upcoming Supply

In the last quarter of 2025, around 48,200 residential units are projected to be delivered. However, based on historical trends, actual completions are likely to be lower, which could result in timeline shifts and delayed handovers. Looking ahead through 2028, approximately 366,000 residential units are expected to enter the market, with the majority phased for delivery in 2026 and 2027. Key areas such as Jumeirah Village Circle, Dubai South, Business Bay, Dubai Residence Complex, and Dubai Islands are expected to contribute the largest share of this upcoming supply, collectively accounting for 31.2% of all projected unit deliveries during this period.

Upcoming Supply (in Thousands)

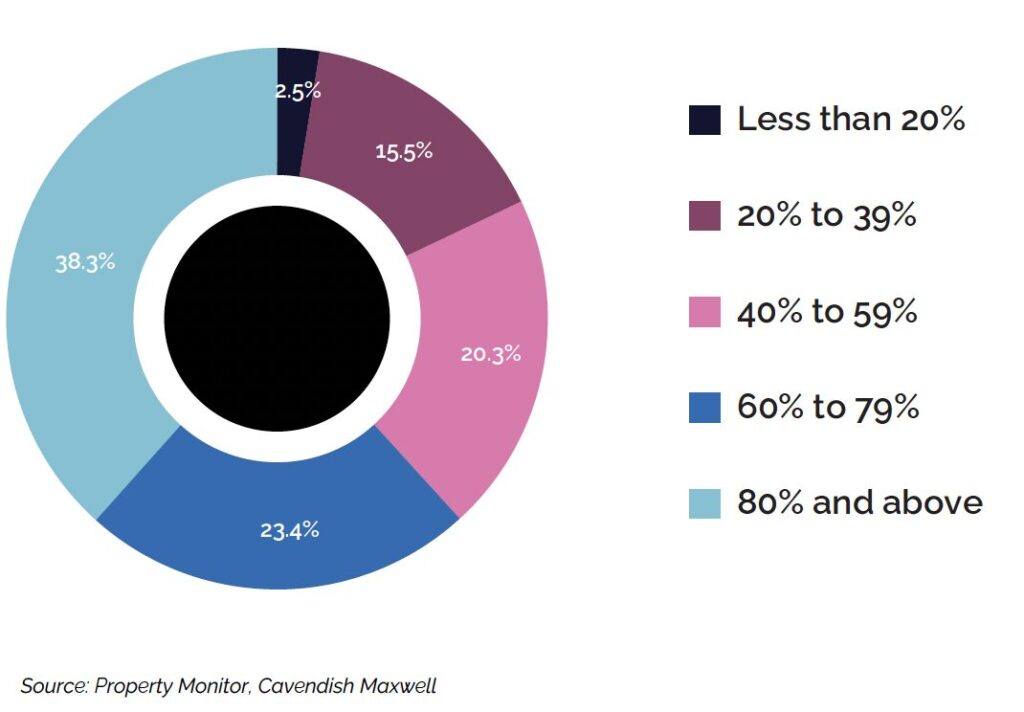

Notably, of the 48,200 residential units projected for delivery, only 38.3% have reached 80% or more in construction progress, highlighting the potential for slippages in delivery. That said, as projects approach their final stages, developers tend to accelerate construction activity to trigger post-handover payment schedules.

Construction Progress (% of Units)

Sales Price Trend

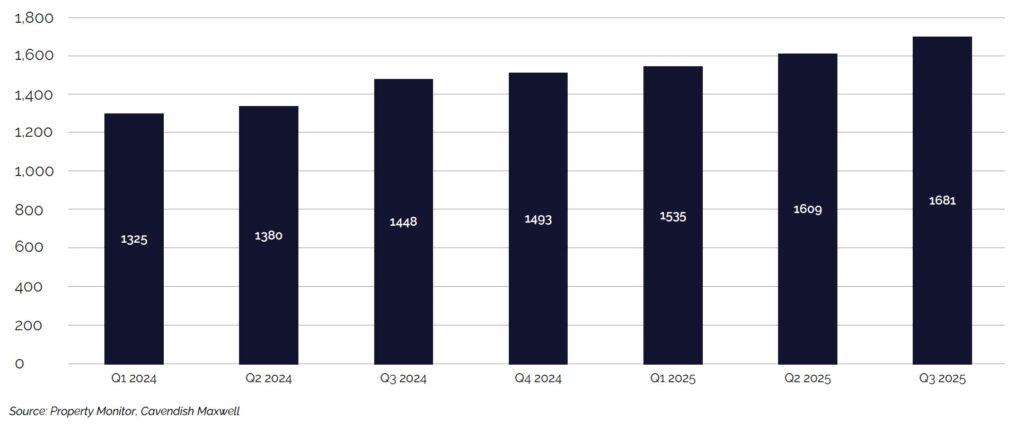

Residential prices in Dubai continued their upward trajectory in Q3 2025, rising by 4.5% quarter-on-quarter and 16.1% year-on-year. The increase was driven by strong market activity, supported by robust buyer demand from end-users as well as local and international investors, reflecting continued confidence in Dubai’s residential market. Demand was further supported by the city’s growing reputation as a regional real estate hub, along with the Dubai Land Department’s First-Time Home Buyer Programme, which improved accessibility for new purchasers and encouraged greater homeownership.

At the same time, developers continued to stimulate sales through attractive post-handover payment plans and other incentives. However, price growth was not uniform across the city. Areas such as Discovery Gardens, Dubai Marina, Arabian Ranches 2, and Dubai Hills Estate recorded double-digit annual price increases, while areas including Dubai South, Jumeirah Lakes Towers, Downtown Dubai, and Business Bay experienced more moderate single-digit growth.

Sales Price Trend (in AED/SQF)

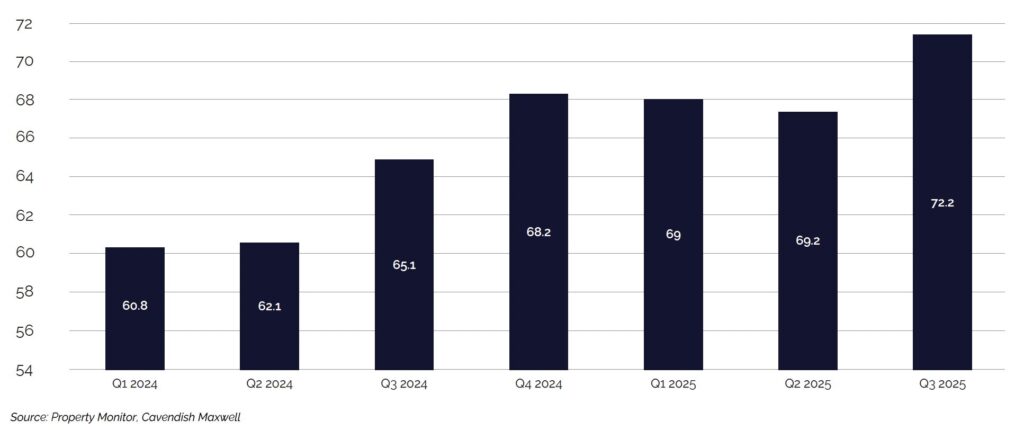

Rental Rate Trend

Based on rental contract data, residential rents in Dubai continued their upward trajectory in Q3 2025, rising 4.4% quarter-on-quarter and 10.9% year-on-year. However, the pace of annual growth was evident to have moderated compared to 2024, when year-on-year increases consistently ranged between 13% and 15%. Over the past few months, growth eased to 11-12% as additional supply entered the market, giving tenants more options and greater negotiating leverage with landlords. The Smart Rental Index further supported this moderation by helping prevent unfair rent hikes. This deceleration was also evident in quarterly comparisons: Q3 2025 recorded 10.9% year-on-year growth, down from 14.8% in Q3 2024 and 12.9% in Q3 2023.

Rental Rate Trend (in AED/SQF/YEAR)

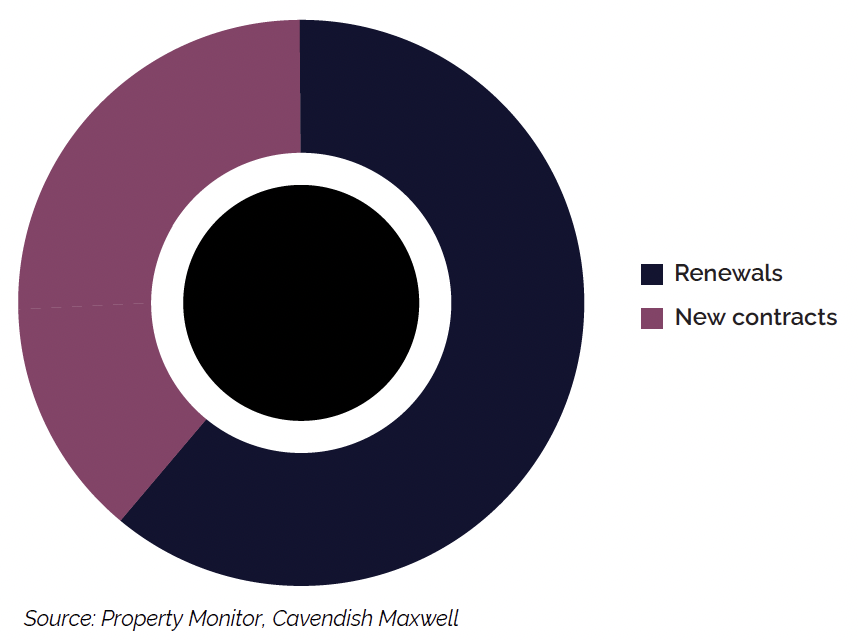

Share of New and Renewal Rental Contracts – Q3 2025

Gross Rental Yields: Apartments and Villas/Townhouses

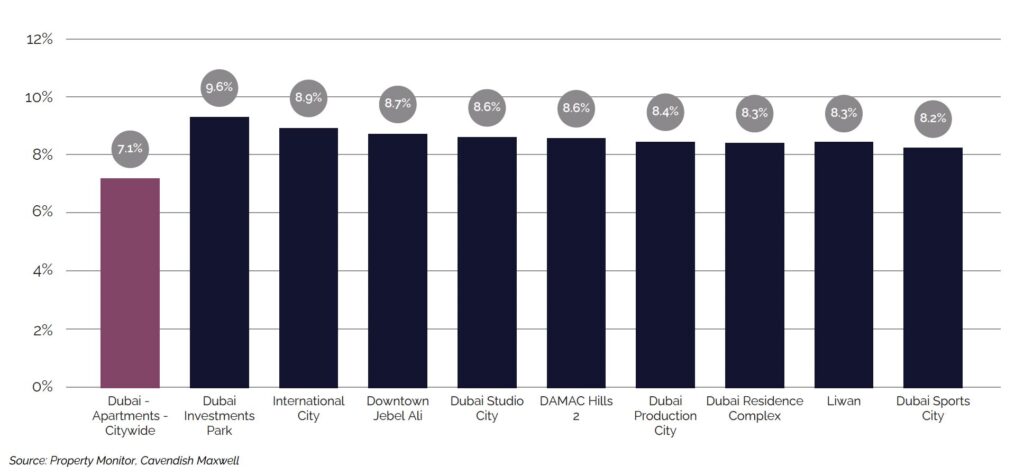

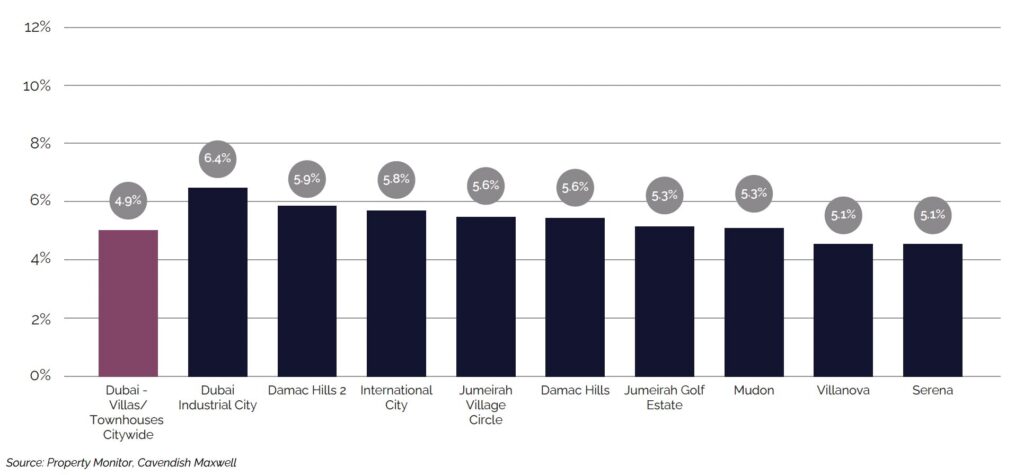

As of Q3 2025, gross rental yields in Dubai stood at 7.1% for apartments and 4.9% for villas and townhouses. With sales prices rising faster than rental rates, yields registered a slight decline compared to Q3 2024. Nevertheless, Dubai’s rental yields remain robust, continuing to outperform those in many major global markets.

Top 10 Areas by Gross Rental Yields – Apartments

Top 10 Areas by Gross Rental Yields – Villas/Townhouses

2025 Real Estate Market Outlook

Dubai’s residential sales market delivered a strong performance in Q3 2025, with 55,300 transactions recorded, up 17.1% year-on-year, driven by exceptional off-plan activity. Off-plan sales surged to a record 42,000 transactions, up 23.6% year-on-year, as demand remained robust despite a moderation in new project launches during the quarter. Notably, off-plan resales activity declined during the period. If this trend persists, it could temper demand from speculative investors, who typically purchase properties to flip before completion, as limited resale opportunities may reduce their willingness to buy at launch.

While off-plan activity remained buoyant, the ready property segment showed more subdued performance, with transaction volumes declining 5.4% quarter-on-quarter and rising only 0.6% year-on-year. This softening may reflect price sensitivity among buyers or represent a short-term correction. If the pattern persists, it could indicate modest cooling in the ready property segment, though further quarters will be needed to determine whether this represents a temporary adjustment or the beginning of a broader market shift.

Beyond the sales market, rental activity also showed signs of moderation. The rental market grew 4.4% quarter-on-quarter and 10.9% year-on-year, but the pace of annual growth has decelerated compared to 2024. Rental growth slowed from 13-15% in 2024 to 11-12% in recent months, driven by the Smart Rental Index’s regulatory influence and increasing supply deliveries. With approximately 28,100 units delivered in the first nine months of 2025 and 48,200 units projected for Q4 2025, this additional supply could provide meaningful relief to tenants by easing upward pressure on rents.

The debate over which force would shape the Dubai market, whether potential oversupply or rising global uncertainty prompting a flight to quality, appears, for now, to have been settled in favour of the latter. However, as our analysis highlights, the coming years will test the sustainability of price growth as a substantial pipeline of new supply is delivered.

With US interest rates expected to edge lower, capital is likely to rotate towards emerging markets. The key question, therefore, is whether Dubai can continue to attract a meaningful share of this FDI. If it can, even the projected increase in supply may not be enough to slow price growth in US dollar terms.

Julian Roche

Chief Economist, Cavendish Maxwell

This supply momentum sets the stage for a critical test in 2026 and 2027, when approximately 225,000 residential units are scheduled for delivery. With construction cycles shortening to 880 days from 1,340 days in 2023, the pace of supply delivery is accelerating. However, the materialisation rate of 41.3% in Q3 2025 suggests that while delays may provide temporary relief, the sheer volume of upcoming completions will test the market’s absorption capacity.

Overall, Dubai’s residential market is entering a more mature phase. Off-plan sales are expected to remain strong in the near term if new launches continue, while the ready segment and rental market may show more measured activity. Market fundamentals remain robust, supported by strong economic growth, continued population expansion, and sustained investor confidence. As the market matures, several key trends are expected to shape performance in the coming quarters, presenting both opportunities and considerations for stakeholders across the sector.