Saudi Arabia Residential Market Performance Q3 2025

Executive Summary

Saudi Arabia’s economy continued to deliver robust performance in 2025, with real GDP expanding by 4.3% in the first nine months of the year, driven primarily by the non-oil sector, which grew by 5.1% year on year. Reflecting this strong momentum, the International Monetary Fund (IMF) revised its 2025 growth forecast for the Kingdom upward to 4%, with a similar expansion projected for 2026.

The Kingdom’s residential real estate market, however, exhibited varied performance across its major cities during Q3 2025, reflecting differing supply and demand dynamics. In Riyadh, transaction volumes rebounded by 18.7% quarter on quarter to reach approximately 13,000 sales, though they remained 44.3% lower compared to the same period last year due to affordability pressures following the rapid price appreciation seen in 2024. Rental rates also climbed sharply, rising 11.8% for apartments and 10.7% for villas year on year, prompting the Government to introduce a five-year rental freeze in late September 2025 to address affordability concerns.

In Jeddah, the residential market showed signs of recovery, with transaction volumes rising 10.3% quarter on quarter to approximately 7,500 sales, though they remained 19.3% lower compared to Q3 2024. Price growth remained moderate, with apartment and villa prices averaging SAR 4,360 per sqm and SAR 5,140 per sqm respectively, reflecting annual increases of 1.6% and 3.1%.

Dammam emerged as one of the Kingdom’s most dynamic residential markets in Q3 2025, recording approximately 3,000 transactions, its highest level in recent years. Transaction volumes surged 37% quarter on quarter and 58.5% year on year, driven by the city’s relative affordability and robust demand from both end users and investors.

On the supply side, Riyadh delivered approximately 10,000 residential units in the first nine months of 2025, with a further 6,000 expected by year end. Jeddah added roughly 3,000 units, with 2,000 more anticipated by year end, while Dammam’s supply grew modestly by 500 units with 1,300 units expected in Q4 2025.

Looking ahead, Saudi Arabia’s residential market is expected to expand further in 2026, supported by strong macroeconomic fundamentals, continued Government investment, and the rollout of Vision 2030 initiatives. A key catalyst for growth will be the introduction of foreign/ non-Saudi ownership rules, which are expected to unlock significant demand from foreign residents and regional investors, particularly in Riyadh and other major cities.

Market Snapshot for Q3 2025

Changes in Sales Prices

Riyadh

- Apartments: +7.5% Y-on-Y

- Villas: +10.1% Y-on-Y

Jeddah

- Apartments: +1.6% Y-on-Y

- Villas: +3.1% Y-on-Y

Dammam

- Apartments: +5.8% Y-on-Y

- Villas: +3.2% Y-on-Y

Residential Supply in Riyadh, Jeddah, and Dammam 2025

-

8,800 (Under-Construction)

-

13,100 (Completed)

Macroeconomic Overview and Outlook

Saudi Arabia’s economy continued to demonstrate strong performance, with real GDP expanding by 4.3% in the first nine months of 2025, supported largely by the non-oil sector, which grew by 5.1% year on year. Reflecting this momentum, the IMF once again revised its outlook for the Kingdom, raising its 2025 growth forecast from 3.6% to 4%, with a similar 4% expansion projected for 2026.

The Kingdom’s broader economic activity is also reflected in its expanding transport and tourism sectors. In the first three quarters of 2025, 103.1 million passengers travelled through Saudi airports, while total flight movements reached 713,000, marking annual increases of 9% and 5%, respectively. Saudi Arabia currently connects to over 170 international destinations, highlighting the rapid development of its aviation and tourism infrastructure.

Labour market conditions have continued to strengthen as well, with unemployment rates declining further, driven by strong private sector hiring and the ongoing labour market reforms aimed at increasing participation and mobility.

Looking ahead, the macroeconomic outlook for Saudi Arabia remains positive, supported by both oil and non-oil activity. Additionally, the continued rollout of Vision 2030 initiatives, major international events, and extensive investment in infrastructure, logistics, and public services will be key contributors to medium term economic expansion.

Real GDP by Activities

| Real GDP | SAR 3.63 Trillion +4.3% (Y-on-Y) |

| Oil Activities | SAR 0.95 Trillion +3.9% (Y-on-Y) |

| Non-Oil Activities | SAR 2.02 Trillion +5.1% (Y-on-Y) |

| Government Activities | SAR 0.47 Trillion +1.7% (Y-on-Y) |

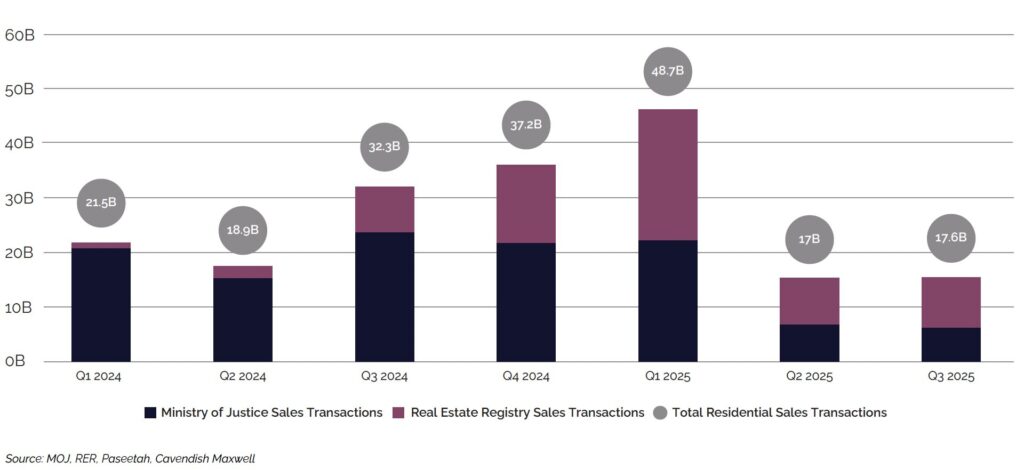

Riyadh Sales Transactions: By Volume and Value

Riyadh recorded approximately 13,000 residential sales transactions in Q3 2025, marking an 18.7% increase from Q2 2025, signalling a short-term rebound in market activity. However, compared to the same period last year, transaction volumes declined by 44.3%. The year-over-year decline was primarily driven by affordability pressures following the rapid price appreciation seen during 2024’s exceptional growth phase, coupled with higher financing costs.

Despite these challenges, the quarter-on-quarter improvement indicates that demand continues to persist; buyers, however, are becoming increasingly selective and price-sensitive as the market continues to adjust to elevated pricing levels.

Riyadh Transactions – By Volume

Residential sales transaction values in Riyadh reached SAR 17.6 billion in Q3 2025, up 3.5% from the previous quarter. However, compared to the same period last year, values fell by 45.4%, consistent with the year-on-year decline in sales activity.

Riyadh Transactions – By Value (SAR)

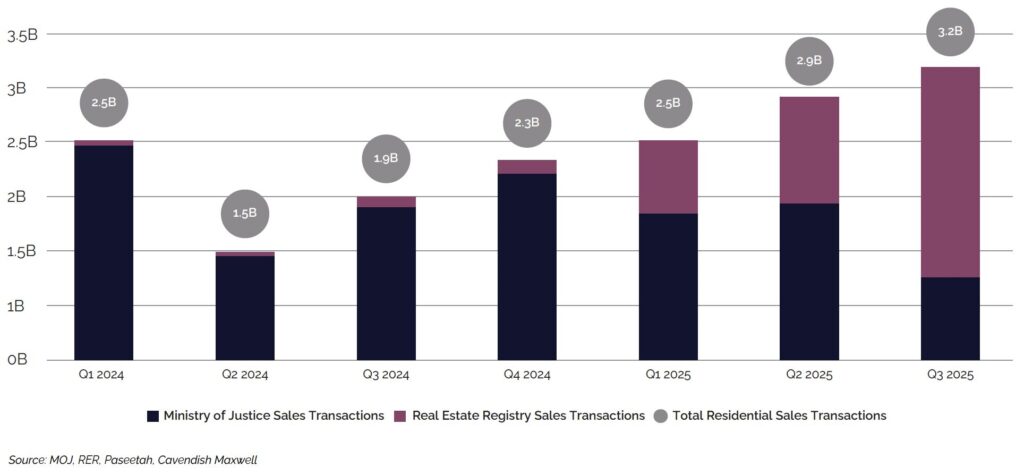

Jeddah Sales Transactions: By Volume and Value

Jeddah’s residential market demonstrated an uptick in Q3 2025, with transaction volumes increasing 10.3% to reach approximately 7,500 sales transactions. This recovery coincided with stabilising price conditions, which appeared to support renewed buyer activity as affordability pressures eased slightly.

However, when compared to the same period last year, transaction volumes declined 19.3%, albeit at a more moderate pace than Riyadh’s 44.3% contraction. If sales prices continue to stabilise further, this could provide support for transaction activity in the coming quarters.

Jeddah Transactions – By Volume

In terms of sales value, Jeddah recorded approximately SAR 8.7 billion in residential transactions during Q3 2025, reflecting a 9% increase from Q2 2025 and a modest 1.7% rise compared to the same period in 2024.

Jeddah Transactions – By Value (SAR)

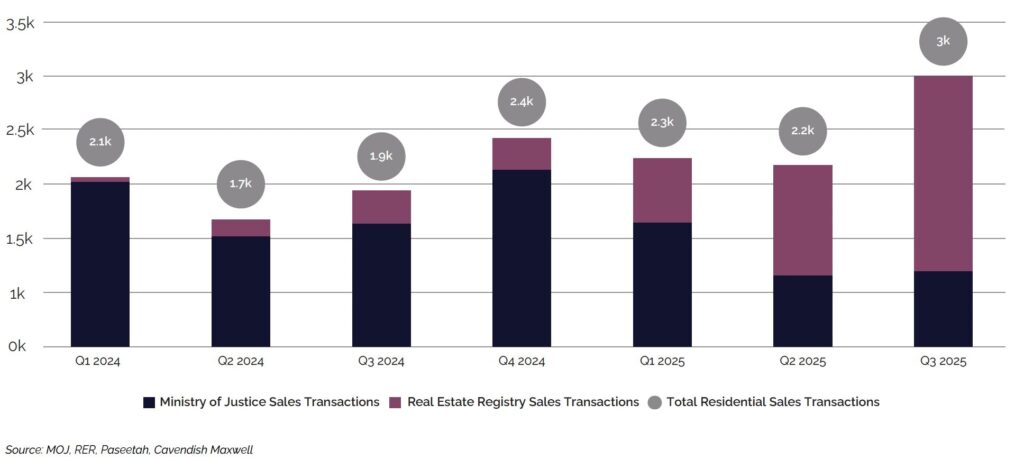

Dammam Sales Transactions: By Volume and Value

Moving to Dammam in the Eastern Province, the city recorded around 3,000 residential sales transactions in Q3 2025, its highest level in recent years, with volumes up 37% quarter-on-quarter and 58.5% year-on-year. This surge highlights strong demand from both end-users and investors, supported by the city’s relative affordability compared with other major Saudi cities.

Dammam Transactions – By Volume

In terms of sales value, Dammam recorded approximately SAR 3.2 billion in residential transactions in Q3 2025, marking a 9.9% increase from Q2 2025 and a 67.8% rise compared with the same period in 2024.

Dammam Transactions – By Value (SAR)

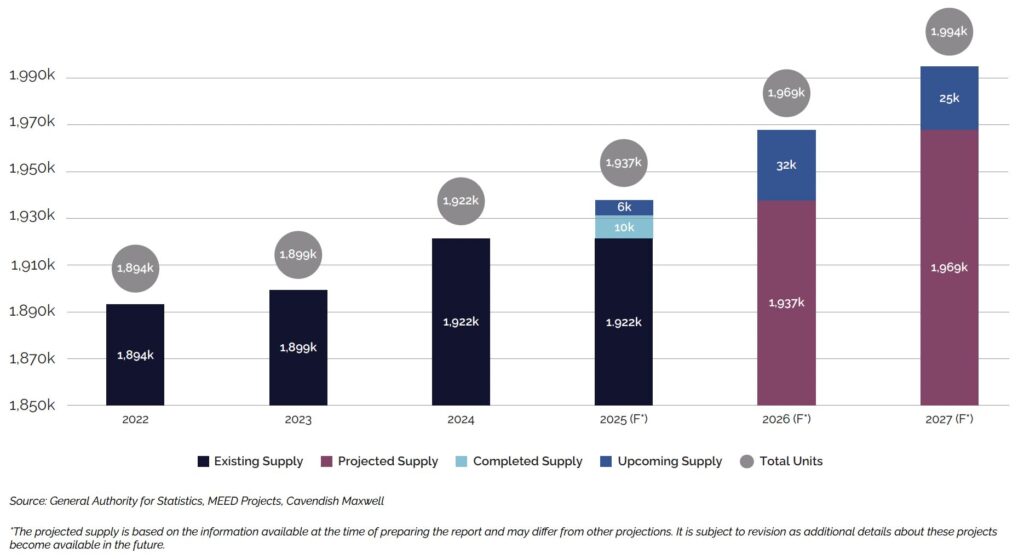

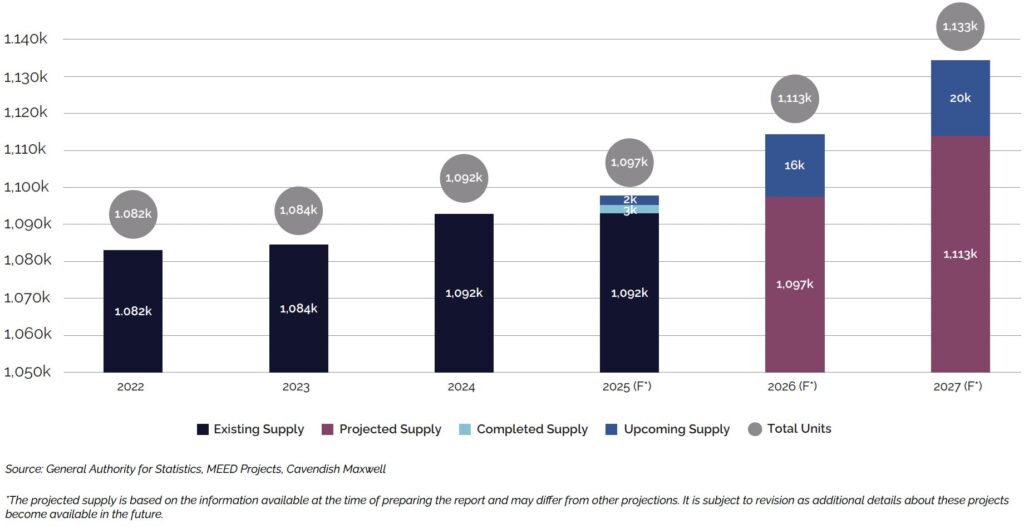

Existing and Future Supply: Riyadh

In the first nine months of 2025, Riyadh delivered approximately 10,000 residential units, with a further 6,000 units expected by year-end. Looking ahead, the capital’s residential pipeline remains strong, with around 57,000 units scheduled for delivery across 2026 and 2027. However, actual completions may be impacted by shifting market dynamics, evolving buyer preferences, and potential construction delays.

At the same time, the recently amended White Land Tax is expected to stimulate market activity by encouraging vacant landowners to either develop or release their plots to the market, bringing additional supply into the pipeline. This regulatory push should help narrow the gap between Riyadh’s housing demand and supply, potentially easing price pressures and improving overall affordability.

Riyadh Supply – Number of Units

Existing and Future Supply: Jeddah

Jeddah’s residential supply grew by approximately 3,000 units in the first nine months of 2025, with a further 2,000 expected by year-end and an additional 36,000 projected for delivery across 2026 and 2027. The steady expansion of supply has moderated price growth, supporting a healthier balance between demand and supply while offering buyers greater choice and improving overall market accessibility.

Jeddah Supply – Number of Units

Existing and Future Supply: Dammam

Dammam’s residential supply has experienced modest growth so far in 2025, increasing by approximately 500 units and bringing the city’s total stock to around 430,000 units. Looking ahead, about 1,300 units are expected to enter the market in Q4 2025, with an additional 12,000 units projected for delivery across 2026 and 2027. This steady pipeline of new supply is likely to provide buyers with greater choice and negotiating power, while helping to moderate price growth.

Dammam Supply – Number of Units

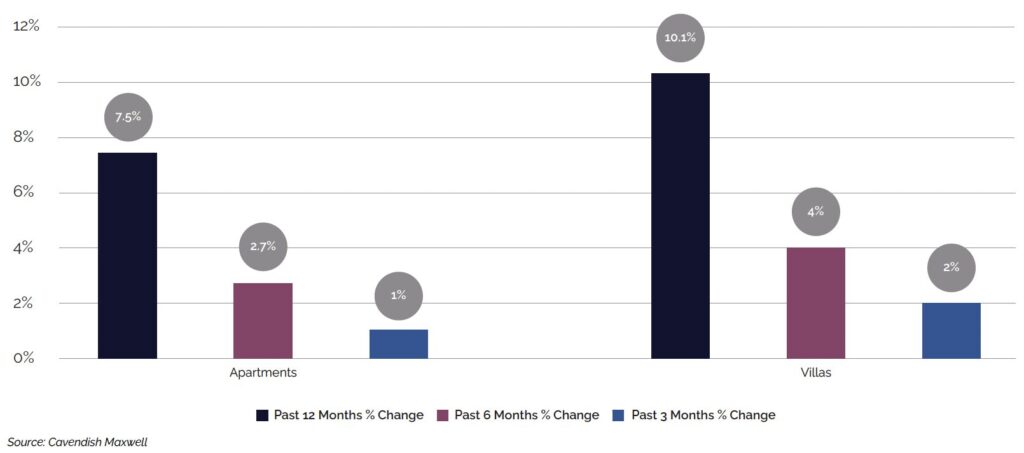

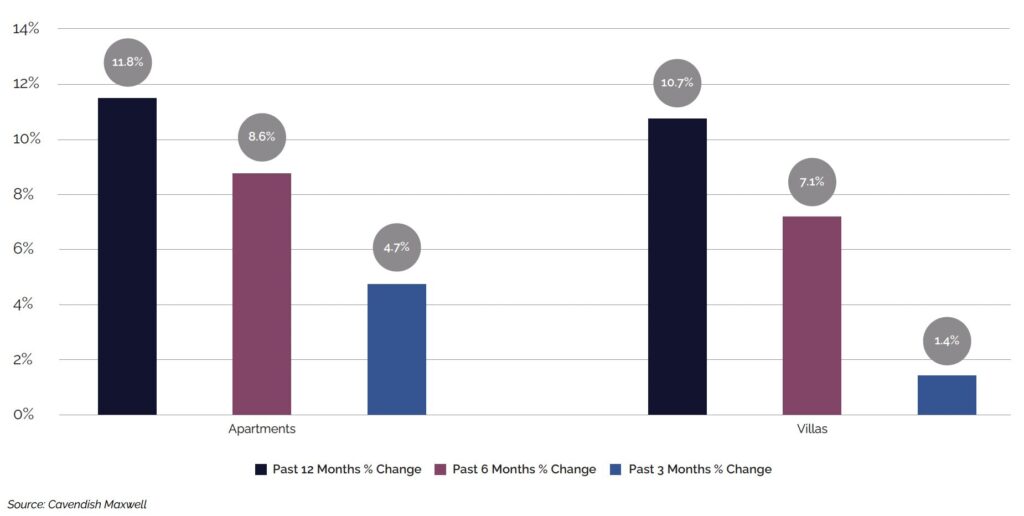

Sales Price and Rental Rates Change – Riyadh

Sales prices in Riyadh continued to rise amid limited inventories. By the end of Q3 2025, apartment sales averaged SAR 6,160 per sqm, while villa prices stood at SAR 5,500 per sqm, reflecting 12-month increases of 7.5% and 10.1%, respectively. Looking ahead, demand is expected to accelerate as the market prepares to allow foreign/ non-Saudi ownership. At the same time, the Government is encouraging increased development by taxing vacant land, a measure aimed at incentivising landowners to either sell or develop their plots, which should help boost supply in the medium term.

Rental rates for both apartments and villas also continued to climb, rising 11.8% and 10.7% year-on-year, respectively. To address affordability concerns, the Government introduced a new regulation in late September 2025 to freeze rental rates in Riyadh for the next five years. While this measure aims to improve housing affordability, it may also reduce landlords’ incentives to maintain properties and could create short-term pressure on future developments. It will be important to track how these regulations influence market dynamics in the near term.

Riyadh Sales Price Change (%)

Riyadh Rental Rates Change (%)

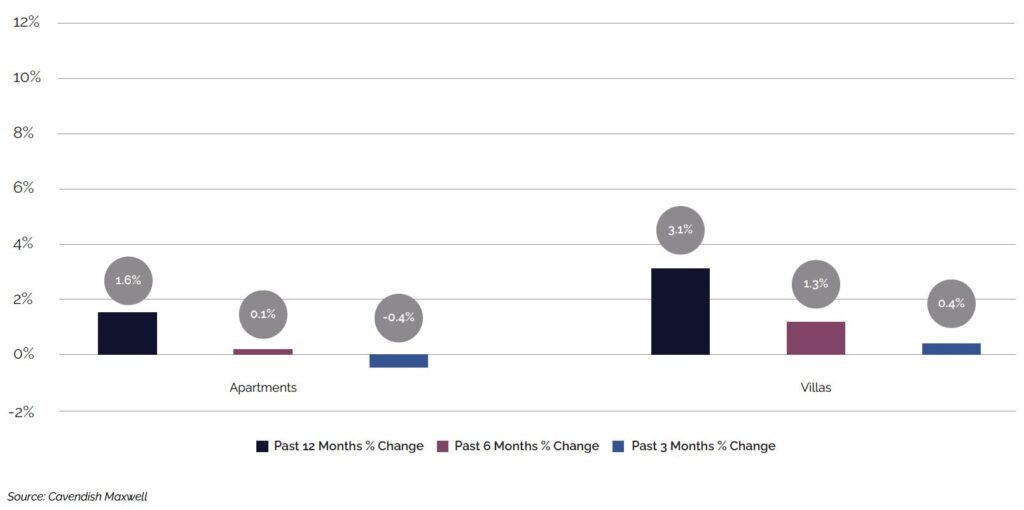

Sales Price and Rental Rates Change – Jeddah

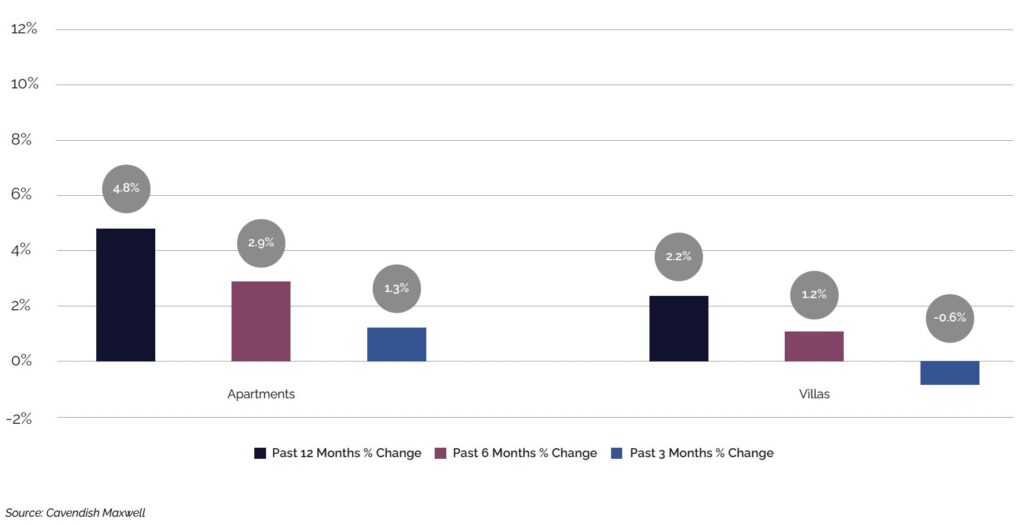

Despite a growing pipeline of new residential supply, Jeddah’s market has held firm, maintaining a balanced dynamic between buyers and sellers that has supported steady price growth. By the end of Q3 2025, apartment prices averaged SAR 4,360 per sqm and villa prices reached SAR 5,140 per sqm, marking 12 month increases of 1.6% and 3.1%, respectively. The rental market, however, showed mixed performance, with apartment rents rising 5.6% year on year while villa rents experienced a slight decline of 2.1% over the same period.

Jeddah Sales Price Change (%)

Jeddah Rental Rates Change (%)

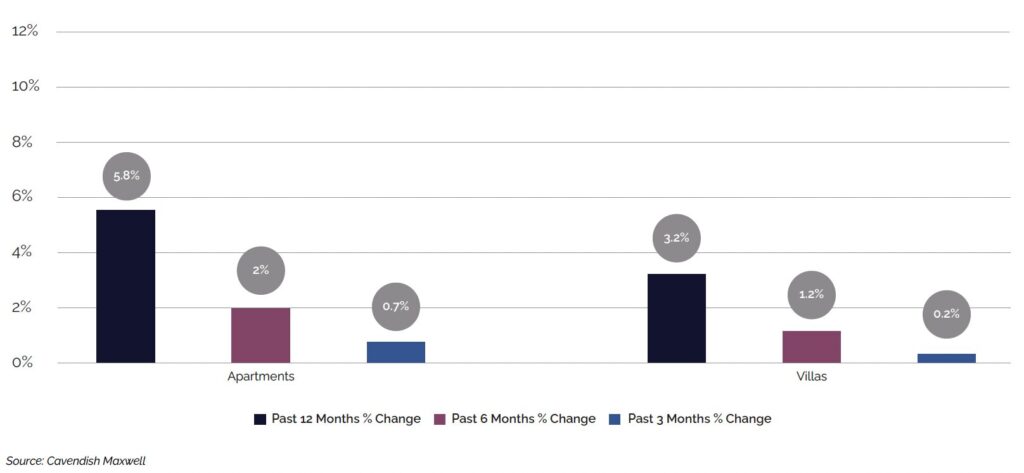

Sales Price and Rental Rates Change – Dammam

In Dammam, the residential market continued to strengthen through Q3 2025, supported by steady demand from both end users and investors alongside limited new supply. As a result, apartment prices rose by 5.8% year on year while villa prices increased by 3.2% over the same period. The rental market also recorded solid gains, with apartment rents climbing 4.8% year on year and villa rents rising 2.2%.

Dammam Sales Price Change (%)

Dammam Rental Rates Change (%)

Real Estate Market Outlook

Saudi Arabia’s residential real estate market is expected to expand further in 2026, supported by strong macroeconomic fundamentals, continued Government investment in infrastructure, and the ongoing implementation of Vision 2030 initiatives. While overall sentiment remains positive, market dynamics continue to vary across major cities.

In Riyadh, the residential market is gradually stabilising after a period of rapid growth. Although transaction activity slowed earlier in 2025 due to affordability pressures, demand remains resilient, particularly for high-quality apartments and villas. The introduction of foreign/ non-Saudi ownership rules is expected to unlock significant demand both in the capital and across the Kingdom, especially from expatriates and regional investors, potentially boosting transaction volumes. Meanwhile, the amended White Land Tax is likely to encourage landowners to release plots or proceed with development, gradually easing supply constraints that have contributed to price growth in recent years. However, the five-year rental freeze introduced in late 2025 may reduce landlords’ incentives to maintain properties or invest in future rental stock, potentially placing short-term pressure on new developments.

Saudi Arabia’s residential market in Q3 2025 reflects a transitional phase marked by strong macroeconomic fundamentals and evolving regulatory measures. While Riyadh faces affordability challenges following rapid price growth, demand remains resilient, supported by upcoming foreign/ non-Saudi ownership reforms and incentives like the amended White Land Tax. Jeddah demonstrates stability with balanced supply-demand dynamics, and Dammam stands out as a growth hotspot driven by affordability and investor interest. Looking ahead, Vision 2030 initiatives and infrastructure investments will be pivotal in sustaining momentum and unlocking new opportunities across all major cities.

Sean Heckford

Director, Built Asset Consulting

Jeddah’s residential market outlook remains stable and broadly positive, supported by a more balanced relationship between supply and demand compared with Riyadh. The steady pipeline of new units scheduled for delivery through 2026 and 2027 is expected to keep price growth moderate, provide buyers with a wider range of options, and enhance overall affordability.

Dammam is emerging as one of Saudi Arabia’s most dynamic residential markets, driven by strong buyer demand, relative affordability, and robust economic activity in the Eastern Province. Transaction volumes and values have surged in recent quarters, reflecting heightened interest from both end users and investors seeking growth opportunities. With a manageable supply pipeline planned for 2026 and 2027, the city is well positioned to absorb new inventory without significant oversupply risks.

Over the medium term, continued economic expansion, demographic growth, and ongoing policy reforms are expected to support continued residential market activity across the Kingdom, while gradually improving affordability and enhancing long-term accessibility for a broad range of households.