Does Stock Market Volatility Impact Real Estate Markets?

What just happened?

No one could have failed to notice the impact that the recent economic policies of the current US Administration have had on global stock markets. The sudden raising of US tariffs to levels not seen for a century[1] has had a similar effect to the Smoot-Hawley Tariff Act of 1930, which increased duties on already high tariff rates. US and global stock markets responded entirely predictably to these recent tariffs in a rapid, negative way. The S&P fell by more than 10% in two days[2]. Bond markets also reacted strongly,[3] and their influence was deemed sufficiently negative for the Administration to ‘blink’ almost immediately and retract some of the tariff measures amidst multiple reciprocal measures, most notably from China.[4] This resulted in markets promptly recovering much of their losses. It is evident that dramatic and frequent policy changes of this kind result in markets moving more quickly than usual in both directions. The benchmark whipsawed in a single day, falling as much as 4.8% before bouncing as much as 4%.[5]

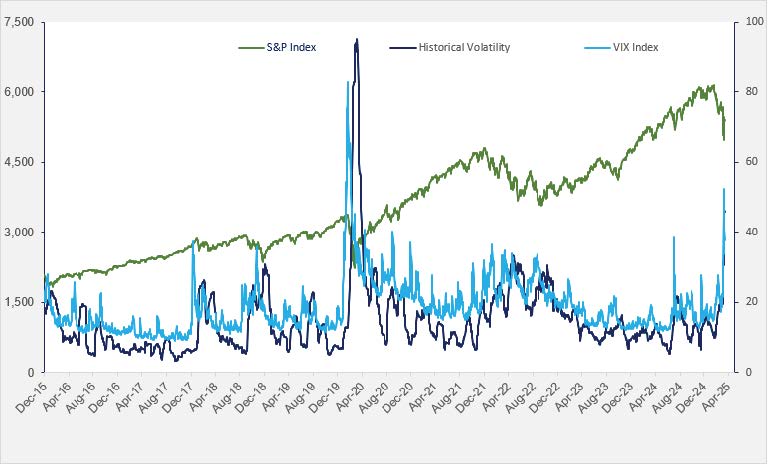

How quickly markets move is measured by volatility. Historical volatility is generally regarded as an indicator of market risk. It is frequently expressed as a function of standard deviation over a given time period. It can also be projected through targeted options that are priced on the basis of expected future volatility.[6] The CBOE Volatility Index (VIX), built on this methodology, tripled following the initial tariff announcement in March 2025 and has remained consistently higher than its historical average since then. Despite the announcement of a 90-day pause on the introduction of the new tariff levels, markets continued to experience significant volatility.

Figure 1: S&P market and volatility, 2015–2025

Source: Kamco Invest,[7] Wall Street Numbers.[8]

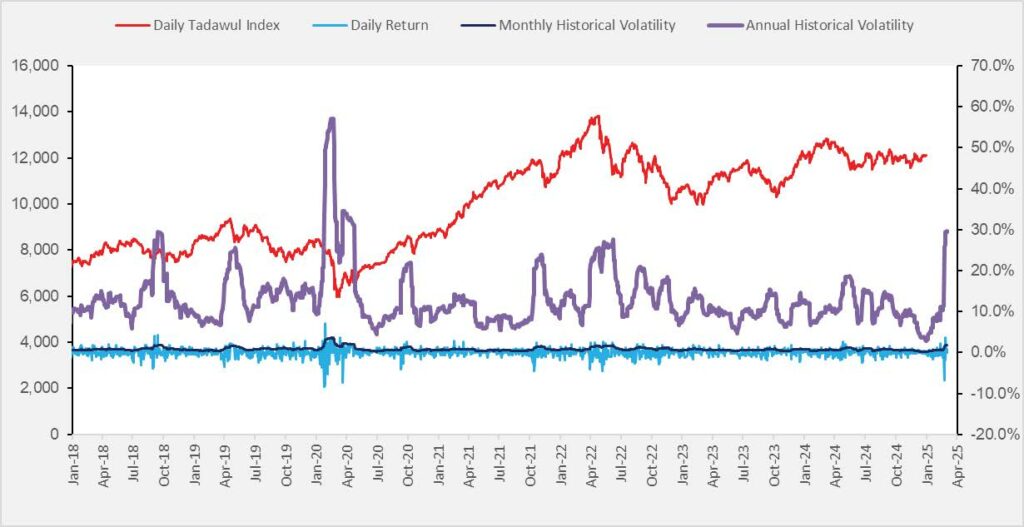

Gulf markets reflected much – though not all – of this volatility, but it is important to visualise what has happened in historical context. The Saudi stock market, for example, displayed volatility levels higher than those seen since the pandemic but still much lower than at that time of massive uncertainty.

Figure 2: Saudi stock market returns and volatility, 2018–2025

Source: Kamco Invest,[9] Trading Economics.[10]

While not on the scale of the pandemic, this sudden and accentuated stock market volatility inevitably played havoc with equity investment portfolios, for example actuarial calculations of pension payments.[11] But what is the impact of volatility of this kind on other asset markets, real estate in particular?

Have US tariffs affected real estate markets?

There are several difficulties in analysing the effect of market volatility on real estate markets.

First is the difference in frequency between share and direct real estate pricing. While there are a few monthly indices available for relatively liquid markets where transaction volume is sufficient to provide confidence that the monthly data are reliable, most real estate market indices are published quarterly, some even annually. This means that the sector and share relative volatility indicated through data is not easily available for real estate. A liquid futures market based on a real estate index would potentially provide useful indications of volatility, but there are few such actively traded futures markets based on real estate indices worldwide; even the US Case-Shiller Home Price Indices traded on the CME trade so infrequently, with only one market-maker,[12] that it is not possible to derive any meaningful conclusions from their flat trajectory.

The second problem is connected with liquidity. In times of crisis, the volume of real estate transactions often evaporates. Analysts may believe that prices have fallen but are unable to verify their assumptions in the absence of supporting data. There is also a countervailing trend to consider. Like gold, which is easily trackable and has certainly risen in price during recent market turmoil, real estate is a haven for investors seeking to avoid stock market turbulence. However, since most real estate transactions take months to be registered, the effect is significantly lagged.

With these constraints in mind, what is the evidence?

Historically, evidence from the US show that ‘the returns derived from the NCREIF [direct real estate] index had extremely low volatility, as well as very low correlations with stock and bond returns’.[13] A relatively recent study in the US confirmed this view, indicating that for apartments, ‘In terms of volatility, returns nationally saw an annualized volatility of 4.9% over the same period, with the most volatile region being the Northeast (19.4%) and the least volatile the South (6.5%)’.[14] These are long-term time series analyses.

To understand the effect of recent share price volatility, it is necessary to turn to what are probably the best international sources for short-term movements, the monthly MSCI direct property indices. We have had only one month since the tariff announcements, so the impact on volatility can only be judged by the response to the tariff uncertainty over the previous monthly period. Internationally, this has been relatively subdued. The only real estate indicators that can provide answers are monthly, but these are rare. The data for the month of April are not yet available, but the Property Monitor monthly dynamic price index for Dubai rose from 210 to 214 between February and March, an increase of slightly less than 2% over the month. Analogous data for Australia from CoreLogic indicated that overall house prices rose by 0.4% across the country.[15]

It is quite evident that the volatility of these indices is vastly less than the S&P 500 which can record changes of this magnitude in a single day – it increased by 9.5% once the 90-day tariff suspension was announced, for example.[16] In fairness, these are total returns, and with rents locked in over the medium term, it is inevitable that total return volatility will be substantially less for real estate than for shares.

Capital values alone may be expected to move more rapidly. However, the evidence from the Baseline Partners study suggests that even monthly changes in cap rates, provided through valuations by appraisers, are not of the same magnitude as in stock markets and hence volatilities are lower. Another US study indicated that ‘Since 2001, cap rates for all property types have remained within a range of under 500 basis points (bps), experienced very low volatility, and are highly correlated’.[17]

Evidence from the Gulf

The evidence from market valuations in the Gulf over the past month indicates exactly the same as from the US in the past: valuers have not adjusted cap rates to reflect stock market volatility, nor have reported prices of either residential or commercial real estate been highly correlated with the rapid stock market changes of the past two months. This remains under review and may change if conditions warrant it. However, there are several explanations for this lack of correlation.

Firstly, real estate transactions take time, and in the case of recent market turmoil, sentiment has swung so rapidly – even on an intra-day basis – that it cannot directly translate into changes in cap rates or apartment prices. Secondly, Gulf real estate markets depend on major investment projects, the majority either directly or indirectly Government sponsored. Their timeframes are longer than even the majority of global real estate assets, let alone those of corporate reporting seasons that drive share prices. Thirdly, volatility in Gulf stock markets has been less than in other global markets, the US in particular but also China and Europe. Partly this is a function of the lower concentration of speculative traders in Gulf markets, and partly it is because investors recognise that the fundamentals of Gulf economies, such as their real estate markets and international trade, are sufficiently diversified to withstand the effects of US tariffs in a way they were not even a decade ago.

This in turn leads to a significant recognition: the causal direction is not necessarily one way by any means. In an economy such as the UAE, and increasingly KSA, where a significant proportion of the stock market comprises firms linked either directly or indirectly with construction and real estate investment, changes in real estate market confidence can and will filter through to overall stock market performance. Models of other markets, such as Korea, have demonstrated impressive predictive power.[18] Volatile real estate markets would cause volatile share markets, and vice versa[19]

What about REITs?

As a hybrid between physical real estate and shares, combining the asset of the former with the structure of the latter, one would expect REITs to respond in an intermediate fashion to overall stock market volatility. It would also be expected that REITs pricing would be correlated with national stock market pricing. This is exactly what has happened to REIT prices in KSA. For example, in the week before writing, the Saudi share market overall rose 3.1%, with gains in every sector, although over the past year the market overall fell by 13%. REITs prices were closely correlated with the market as a whole, rising 1.2%, the Al Rajhi REIT Fund notably rising 1.3% and the Al Khabeer REIT fund 1.8%, but in the past year, the REIT market overall has fallen by 14%.[20] While this is a significant change on an annual basis, a relatively quiet trading market for most Saudi REITs has ensured that volatility for the sector remains low. The converse argument also applies to the effect of adding rental returns for Saudi REITs in order to obtain the volatility of total returns – there is little doubt that the effect would be to reduce volatility by comparison to equities still further.

Conclusions

Real estate has always been perceived as a safe asset at times of market volatility. Analysis has also strongly suggested that while the wealth effect propels investment into real estate at a time of rising share prices, the housing market becomes a hedge against a volatile or declining stock market.[21] Rents do not move on a daily basis, which stabilises total monthly returns and so inevitably reduces volatility. Cap rates and therefore capital values can change more rapidly, but the evidence from recent sales does not support any suggestion of volatility akin to that experienced by share markets. Illiquidity in real estate markets, while reducing over time with the introduction of blockchain transactions and the rising importance of REITs, is still sufficiently low to prevent instantaneous reactions as seen in stock markets.

Volatility in real estate markets is caused by structural factors, such as variations in GDP, the inflation rate, bank rates and construction costs.[22] So unless there is a structural factor driving real estate volatility – as during the pandemic when prices climbed by comparison to other assets – it is likely that, as in past periods of share price volatility, real estate prices will continue their own trajectory. Volatility will depend on industry-specific factors, while the Gulf’s resilience — driven by a diversified investor base, exceptionally high levels of FDI, and proactive Government policies — will add further stability.

[1] Holland & Knight (2025, April 3) President Trump Announces 10 Percent Global Tariff, 11 Percent to 50 Percent Reciprocal Tariffs. https://www.hklaw.com/en/insights/publications/2025/04/president-trump-announces-10-percent-global-tariff-11-percent#:~:text=Contribute%20to%20Large%20and%20Persistent,These%20will%20take%20effect%20at

[2] Reuters (2025, April 8) Global markets are in meltdown: here’s how it looks in charts.

[3] New York Times (2025, April 11) ‘This is Not Normal’: Trump’s Tariffs Upend the Bond Market. https://www.nytimes.com/2025/04/11/business/economy/treasury-bonds-tariffs.html

[4] Caporal, J. (2025, April 14) Tariff and Trade Investigation Tracker. https://www.fool.com/research/tariff-and-trade-tracker/?utm_source=msnrss&utm_medium=feed&utm_campaign=article&referring_guid=c744c1c0-0bca-480a-b60a-935beafc43d7

[5] Reuters, ibid.

[6] Kuepper, J. (2024, August 7) CBOE Volatility Index (VIX): What Does It Measure in Investing? https://www.investopedia.com/terms/v/vix.asp.

[7] Omar, M. A. and Ansari, J. (2024, February). Volatility Analysis: Saudi Arabia . Kamco Invest. https://www.kamcoinvest.com/sites/default/files/research/pdf/Tadawul%20Volatility_Final_.pdf

[8] Wall St Numbers (2025) S&P Index Price. https://wallstreetnumbers.com/indexes/spx/price.

[9] Omar, M. A. and Ansari, J. ibid.

[10] Trading Economics (2025) Saudi Arabia Stock Market (TASI). https://tradingeconomics.com/saudi-arabia/stock-market

[11] Rosenberger, J. (2025, April 4) Markets & tariffs in 2025: What retirement investors should know. https://www.guideline.com/education/articles/markets-and-tariffs-in-2025-what-retirement-investors-should-know

[12] Dolan, J. (2025) Home Price Futures. https://www.homepricefutures.com/

[13] Linneman, P. (2017) The Return Volatility of Publicly and Privately Owned Real Estate. https://realestate.wharton.upenn.edu/wp-content/uploads/2017/03/493.pdf#:~:text=These%20studies%20found%20that%20the%20returns%20derived%20from,very%20low%20correlations%20with%20stock%20and%20bond%20returns.

[14] Baseline Partners (2025) Cap Rate Analysis: Apartments. https://www.baseline-partners.com/learn/cap-rate-analysis-apartments

[15] Corelogic (2025, April 1) Australian home values recover to new record highs in March.. https://www.corelogic.com.au/news-research/news/2025/australian-home-values-recover-to-new-record-highs-in-march

[16] Reuters (2025, April 10) Mass ‘relief’ as Wall St soars after tariff pause, says analyst https://www.reuters.com/video/watch/idRW574110042025RP1/?utm_source=chatgpt.com

[17] CBRE (2024, January 16) Connections & Disconnections of Commercial Property Cap Rates. https://www.cbre.com/insights/viewpoints/connections-and-disconnections-of-commercial-property-cap-rates

[18] Zareeihemat, P., Mohamadi, S., Valipour, J., & Moravvej, S. V. (2025). Forecasting stock market volatility using housing market indicators: A reinforcement learning-based feature selection approach. IEEE Access 13, 52621-52643. https://ieeexplore.ieee.org/stamp/stamp.jsp?arnumber=10938134.

[19] Jana, S. and Sahu, T.N. (2024) Exploring the interdependence of stock markets, interest rates, and housing prices: empirical insights from India. International Journal of Sustainable Real Estate and Construction Economics 3(1), 45-62. https://doi//10.1504/IJSRECE.2024.144311.

[20] Simply Wall St. (2025, April 15) Saudi Arabian (Tadawul) REITS Industry Analysis. https://simplywall.st/markets/sa/real-estate/reits.

[21] Chiang, M. C., Sing, T. F., & Wang, L. (2020). Interactions Between Housing Market and Stock Market in the United States: A Markov Switching Approach. Journal of Real Estate Research, 42(4), 552–571. https://doi.org/10.1080/08965803.2020.1837604.

[22] Nguyen, N.T., Nguyen, L.H.M., Do, Q. and Luu, L.K. (2025). Determinants of apartment price volatility in Vietnam: a comparison between Hanoi and Ho Chi Minh City. International Journal of Housing Markets and Analysis 18(1), 249-271. https://doi.org/10.1108/IJHMA-06-2023-0081.