Gulf Real Estate Investment Trusts (REITs) – Still a safe haven?

Why REITs matter

The global quest for a liquid version of physical real estate has been lengthy. It is littered with long-forgotten attempts that fell by the wayside, derailed mainly by the resolute refusal of numerous ministries of finance to grant them tax exemption.[1] Eventually a champion emerged, nurtured since 1961 in the United States: the Real Estate Investment Trust (REIT), an investment structure that eventually spread across the globe.[2] REITs solved the problem: a form of real estate investment at a manageable unit size even for retail investors that provided them liquidity and governance guarantees through listing on an Exchange. Backed by physical assets and administered by a dedicated management team, the REIT promised liquidity, consistent dividends and potential capital growth.

As REITs proliferated, investment analysts sought ways to value them. Two methods stood out: a direct price–earnings ratio, and an adjusted version based on a REIT-specific cashflow measure known as ‘funds from operations’ (FFO). FFO added back depreciation and amortisation, excluded one-off gains and losses from property sales and, in its adjusted form, also took account of required recurrent capex in order to calculate a more sustainable cash flow. Armed with these valuation measures, analysts felt increasingly confident about REITs as an investment destination. By the mid-2000s they had therefore become a staple of pension funds and other investors seeking stable but remarkably high cash flows, a combination of risk and return that defied conventional portfolio analysis and enabled them to outperform many hedge funds as well as the majority of real estate private equity. In more recent years specialist REITs have emerged across many different sectors, such as student housing, telecoms towers, Build-to-Rent housing, warehousing and hospitality. Their lustre did rather fade during the pandemic – real estate is always quick to decline in a crisis but equally swift to recover afterwards. Therefore, as workforces have gradually returned to the office, confidence has been returning to the global REIT market.

Recent history in the Gulf

Dubai introduced REIT regulations as long ago as 2006, but the absence of corporate taxation in the UAE at the time meant there was little incentive to deploy this particular species of financial engineering in the Gulf. The first in the UAE, Emirates REIT, launched only in 2010. Other Gulf jurisdictions followed Dubai in introducing regulations, most notably Saudi Arabia in 2016. The Saudi REIT market developed much more extensively than in the UAE, with the first, Riyad REIT, launching in 2016 and the market growing relatively rapidly. In principle, the grounds for Saudi REIT success were well laid and did not rely on the introduction of corporate taxation. Their ability to provide a facsimile relied on a regulatory regime that followed the proven structure of US and other successful REIT jurisdictions. Central to a REIT regime is the distribution requirement. For example, in the UAE, provided that the REIT invests exclusively in and derives its income from real estate itself, maintains moderate liquidity, and distributes no less than 80% of its income to its unit holders, it will be exempt from income tax.[3] In Saudi Arabia it is 90%.[4] Rapid population growth and the continued appeal of high-quality offices in particular should have combined with the active backing of Saudi Vision 2030 with its emphasis on diversification to enable the Saudi REIT market to achieve its potential as a leading channel of international capital into the Kingdom.

The market has certainly grown. Today, it includes more than a dozen listed REITs that, with their subsidiaries, provide investors with the opportunity to choose the sectors in which they want to invest – residential, many types of commercial, hospitality and education. They were managing a strong portfolio of 229 properties, 216 situated in Saudi Arabia and even 13 overseas. Yet they still represent a very small percentage of total market capitalisation of Gulf markets and of the size of local real estate markets – much less than 1%. Why is this the case? Is it explained by their financial performance?

Comparing investment performance with physical property

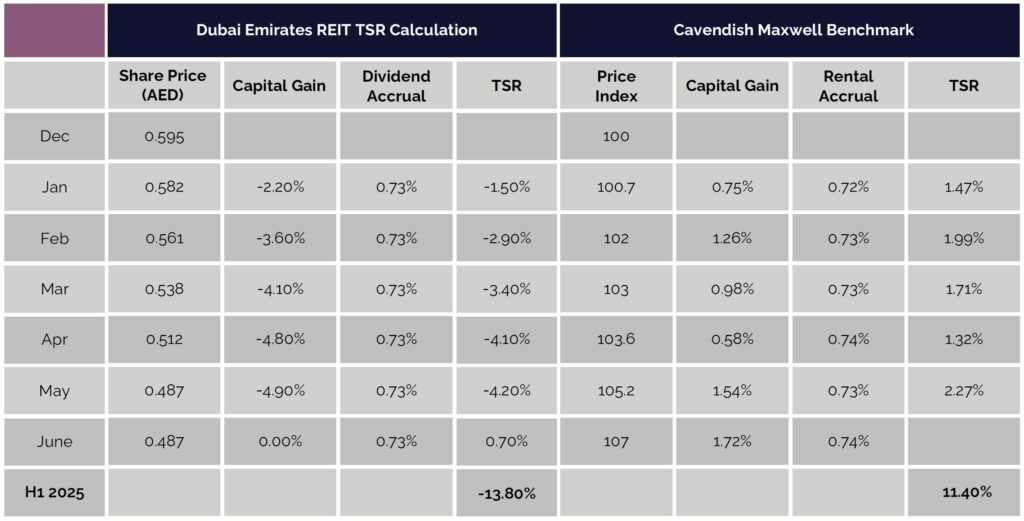

How are UAE and Saudi REIT investors faring? Would they have been better off investing in physical real estate? The first part of answering this question is to determine how we should compare REITs with physical property from an investment standpoint. The most logical way is to imagine we start with AED1m invested in the Emirates REIT at the end of December 2024 and see what we arrive at after the first half of 2025 by comparison to investment in physical residential real estate in Dubai. For the capital values part of the calculation, we can use the monthly share price of the Emirates REIT and, for comparison, commercial real estate prices and rents for Dubai derived from Cavendish Maxwell data. For the rental part, given that both REITs and physical property will return cash in the form of dividends and rents respectively, we can compare REIT dividends with Cavendish Maxwell rental estimates. By contrast we do receive rents monthly so we should add to the Property Monitor monthly rental index the monthly equivalent of 5%. Having selected Cavendish Maxwell data as the benchmark and made these assumptions, we can now generate the comparative model depicted in the table below.

The true promise of Gulf REITs lies not just in their structure, but in the region’s willingness to embrace transparency, governance, and global best practices. As the market matures and policy evolves, REITs have the potential to become the cornerstone of diversified, resilient investment portfolios across the Gulf.

Hassan Alladin

Associate Director, Strategy and Consulting

Figure 1. UAE Monthly Total Shareholder Return (TSR) Comparison: Emirates REIT vs physical property

The comparative advantage of physical property is stark. For a range of reasons, almost all of them connected with market sentiment, Emirates REIT, and many other REITS worldwide, continues to trade well below its net asset value. How does this compare with the new market entrant, Dubai Residential REIT? Early indications are positive, with a capital gain of 26.4% from its IPO until the end of August, accompanied by a dividend yield equivalent to 1.7% quarterly – a very impressive quarterly total return of 28.1%. By comparison, using Property Monitor as a benchmark for physical real estate, an investment in Dubai residential property (excluding brokerage fees) would have yielded a total return of 5.8%, made up of 4.1% capital appreciation and in fact the same rental return of 1.7%. On this basis of comparison, investment in the Dubai Residential REIT joins a select few of global REITS in outperforming equivalent physical real estate no less than fivefold over the quarter in question. But these are still very early indications. A post-IPO valuation bounce is common, especially when a stock has been underpriced, and the REIT’s performance also reflects institutional-grade asset management, near-full occupancy, and strong dividend discipline. It is therefore too early to deliver a verdict on its comparative performance with residential real estate in Dubai. The most one can possibly say is that the Dubai Residential REIT has begun its career impressively and that, at least based on its debut, there is absolutely no reason to presume that every Dubai REIT will always underperform physical real estate.

How does this compare to what happened in Saudi Arabia over the same time period? Saudi has many more REITs, as of course would be expected in a much larger jurisdiction with a greater institutional impulse (from the Capital Markets Authority) towards the expansion of the REIT market. Opportunities abound – the most successful Saudi REITs have outperformed the residential market, and valuation multiples are still only two-thirds that of US REITs.[5] [6] But careful choices need to be made given the weighting many Saudi REITs have towards legacy retail and commercial assets, some of which are still recovering from post-pandemic lease renegotiations and delayed refurbishments. The opportunities will lie in the way these REITs rebalance their portfolios. The entire REIT market will also potentially benefit from the improving interest rate environment,[7] although refinancing lags will delay this from flowing through into improved cash flows and higher dividends.

There are three other potentially positive permanent factors for Saudi REITs associated with the structural differences between them and physical property that will eventually pay off for investors. Firstly, buying and selling physical property involves brokerage fees at both ends of the investment process; those associated with REITs are an order of magnitude lower. Entering and exiting the physical property market inside six months would normally be associated with options trading, for example ‘flipping’ off-plan property, and rarely buying and selling existing property with title. Secondly, physical real estate, especially commercial property, is only available in much larger individual trading lots. Diversification is a harder ask for most investors in the physical real estate market than in REITs. Nevertheless, even taking these two countervailing arguments, investors might well take the position based on recent market performance that only exceptional REITs can deliver financial returns that match those of the underlying asset. Thirdly, however, current very low levels of corporate tax in the UAE and its absence altogether in Saudi Arabia do not permit REITs to exhibit their key relative advantage compared to their listed peers. In a market in which all assets enjoy the same kind of freedom from domestic taxation, REITs’ advantages remain hidden. Other equities have greater appeal. This in turn leads to a cumulative effect with pension funds largely out of the market, yields remaining relatively high and capital growth restrained. This effect is magnified by the fact that, unlike in markets such as the UK and USA, foreign investment in local REITs is as yet subdued. The exception is Dubai Residential REIT: its IPO, which put only 15% of units on the market, was oversubscribed 26×, pointing to strong foreign demand. That appetite has undoubtedly supported its performance since.[8]

Conclusion

There are still too few REITs in the UAE to draw a firm conclusion about their eventual role. Corporate tax rates remain vastly lower than in those Western jurisdictions[9] where REITs have enjoyed success as low-risk, high-return investments over several decades. Triangulating from the very different experience of the two existing REITs suggests that management quality and sectoral choices determine how the share price of any individual REIT compares to its underlying net asset value. By comparison, despite the absence of corporate taxation, the potential of Saudi REITs has yet to be fully exploited.

Yet it would be quite wrong to judge the future on the basis of the past. The Gulf REIT market is a sleeping giant. It awaits only the scent of corporate taxation along international lines to awaken and write its own chapter in the history of global capital. At that point it will indeed be a safe haven for Gulf investors, just as its counterparts have been for those in other jurisdictions worldwide. Gulf policymakers may well, however, regard a slower maturing REIT market as being far outweighed by the strategic benefits of much lower corporate taxation rates than in most other jurisdictions. It is hard to disagree with that logic.

[1] Roche, J. (1995) Property Futures and Securitisation. Abingdon, Woodhead Publishing, chapter 4.

[2] The UK was a late adopter: with exquisitely poor timing, they were introduced in January 2007. See Taylor Wessing (2025) Taxation of UK real estate investment trusts (REITs). https://www.taylorwessing.com/-/media/taylor-wessing/files/uk/2024/2406_brochure_taxationofukrealestateinvestmenttrusts.pdf

[3] Ample Inc (2025) Corporate Tax UAE REIT Update: An Essential & Promising Guide for 2025. https://ample.ae/corporate-tax-uae-reit-update-2025/

[4] Capital Markets Authority (Saudi Arabia) (2025) Real Estate Investment Funds Regulations. https://cma.gov.sa/RulesRegulations/Regulations/DocLib/REAL%20ESTATE%20INVE%20FUND%20REG__EN.pdf.

[5][5] Simply Wall Street (2025, Sep 18) Saudi Arabian (Tadawul) REITS Industry Analysis. https://simplywall.st/markets/sa/real-estate/reits

[6] Simply Wall Street (2025, Sep 19) U.S. REITS Industry Analysis. https://simplywall.st/markets/us/real-estate/reits

[7] Trading Economics (2025) Saudi Arabia Repo Rate. https://tradingeconomics.com/saudi-arabia/interest-rate

[8] Dubai Holding (2025, May 28) Dubai Residential REIT Debuts on DFM as the GCC’s Largest and First Listed Pure-play Residential Leasing Focused REIT. https://www.dubaiholding.com/en/media-hub/press-releases/dubai-residential-reit-debuts-on-dfm-as-the-gccs-largest-and-first-listed-pure-play-residential-leasing-focused-reit

[9] Roshan, V.S. (2024, November 12) UAE Corporate Tax: A Comparative Analysis with Other Countries. https://www.facts.ae/uae-corporate-tax-comparative-analysis-with-other-countries/ It is important, however, to be clear whether corporate tax rates are overall or only apply to foreign investors.