What are The Prospects for Saudi Tourism?

The evidence to date

The need to diversify the Saudi economy away from oil has never been in doubt. Saudi Vision 2030 envisaged tourism playing a central role in that process. The plan originally set what was regarded as an ambitious target of 100m domestic and international tourists by 2030, but immediate success resulted in this being revised upwards to 150m, of whom 37m would be Hajj and Umrah. This would create 1.6m jobs in the industry and advance it to 10% of GDP from a starting point of less than 3.6%.[1] What has been the story to date?

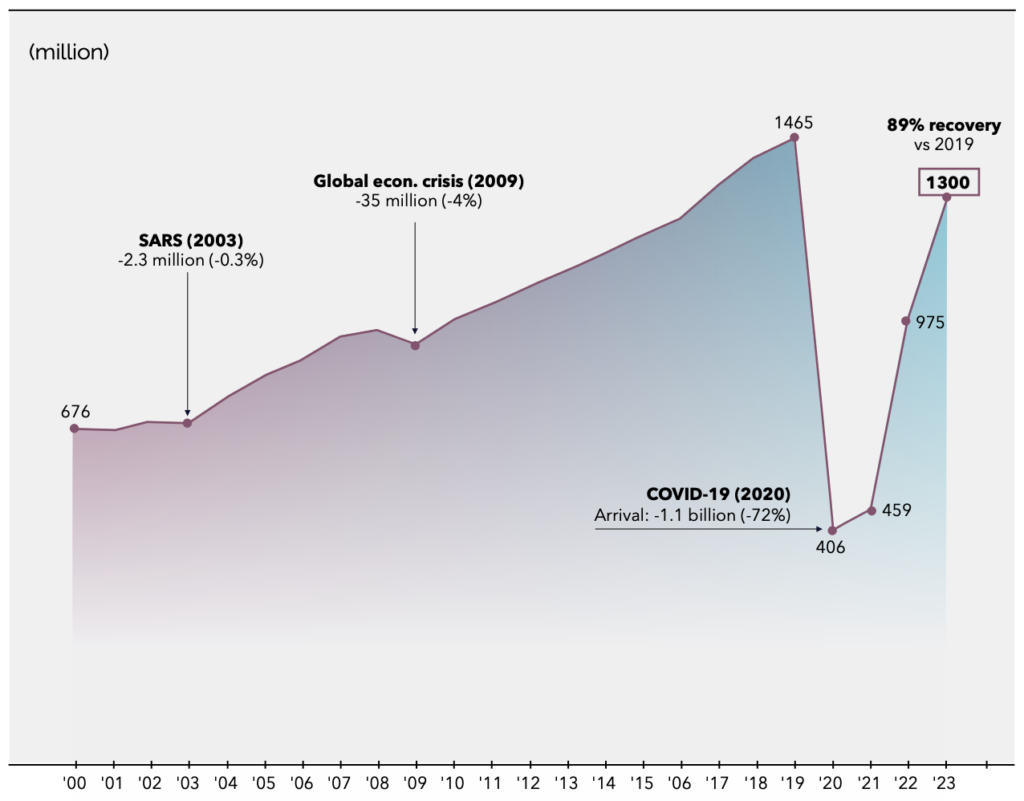

First, it is important to place the evolution of Saudi tourism in the global context of the revival after Covid. This has been tracked by the UN World Tourism Authority (UNWTO):

Figure 1.1 Global Tourism Arrivals

Source: UN Tourism (May 2024)Worldwide, these tourist numbers were responsible for $1.5 trillion of spending in 2023, representing about 97% of the pre-Covid numbers in 2019. The UN estimates that considering the direct and indirect effects of this spending, tourism created $3.3tn of GDP last year. So far this year, tourist arrivals are tracking 2019 very closely. But the regional picture is very different: the Middle East has seen the strongest percentage growth, with international arrivals up 36% by comparison to 2019 compared to just 1% in Europe. As a result, whereas in that year only 4.9% of international arrivals were in the Middle East, last year they reached 6.7%. The trend is unmistakeable.

The story in Saudi Arabia is one of even more spectacular success. From a base of 15m in 2015, 27.4m international tourists visited in 2023, the fastest growth rate last year in the world. 1 in 50 international tourist arrivals are now into the Kingdom, which is the 13th most visited country in the world. For comparison, Egypt was visited by 14.9m and Dubai, 17.2m. When added to the 79.3m domestic tourists, this means that the Kingdom has already surpassed the original Vision 2030 target and is already two-third way towards the revised target. The UN World Tourism Organisation has rightly called these ‘extraordinary results’.[2]

Figure 2. Large[3] best-performing tourist destinations in 2023

Source: UN Tourism (May 2024) [4]

It is worth adding that in addition to this growth in numbers, international tourists are staying longer and spending more. They spent 57% more year-on-year to reach $60.62bn in 2023. This was almost five as much per visitor as the much more numerous domestic tourists. Their spending also grew, by 21.5%, to reach $38bn. Spending of this magnitude has resulted in tourism climbing rapidly in economic importance within the Kingdom; it currently stands around 11.5% as a proportion of GDP.

Tourism has also generated the sought-after jobs: by 2022, 879,815 people worked in the industry,[5] but 436,000 jobs were added last year alone.[6] Considering both direct and indirect employment, one in five jobs now depends on the industry.

Drivers of tourism success

The National Tourism Strategy evidently recognise that continuing to grow the Saudi tourism market requires a co-ordinated and sustained effort across multiple dimensions. What are they? Vision 2030 itself advanced three: ‘create attractions that are of the highest international standards, improve visa issuance procedures for visitors, and prepare and develop our historical and heritage sites’[7]. How is the Kingdom faring on these and other parameters?

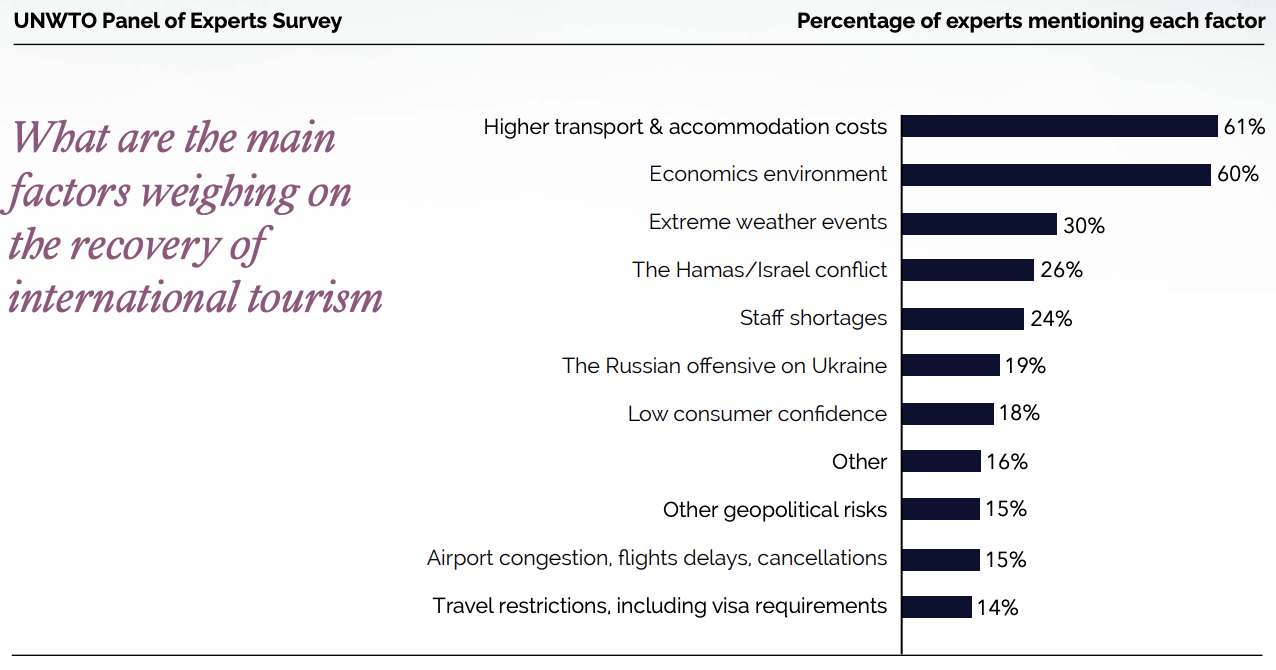

Source: UN Tourism Panel of Experts Survey ( May 2024)

- Reasons to go. Historically, it has been Makkah, Riyadh, Jeddah, Alkhobar, and Abha followed by Al Ula, Tabuk, and Hail that have been the destinations of choice for tourists. But no other country in the world is investing as much as Saudi Arabia in the future of its tourist sector, nor diversifying so much geographically. TimeOut magazine recently counted twenty-six new tourism destinations, many of them unique.[8] The National Tourism Strategy encourages private investment in Jouf, Hail, Al Ula, Medina, Riyadh, Eastern Province, Jeddah, Taif, Al Baha and Aseer. There is now also a regular schedule of events across the country aimed at tourists.[9] Nor is a country which has seven UNESCO heritage sites already neglecting the appeal of history and culture.[10]

- Security. The safety and low crime rate of the country as a whole need only to be maintained. It is safer than countries such as Singapore, still more so than tourism competitors such as France, the UK or Turkey. If crimes against the person were the only index of measurement, Saudi’s relative position would be even higher.[11]

- Travel. The creation of 8000km of further track for the rail network is an undoubted positive for future Saudi tourism, but it will be challenging to deliver within the timeframe of Vision 2030. The Haramain High Speed Rail network, for example, is a flagship project that connects Mecca and Medina with Jeddah and King Abdullah Economic City. It has delivered a potential 60m passenger capacity. But the network does not connect with Riyadh. The road network remains the primary method of domestic transport for tourists: Investment is already significant, especially around Riyadh, and while the results will extend beyond the Vision 2030 timeframe, the groundwork is being laid for future success.[12]

- Visas. Saudi Arabia has already streamlined its visa policies, with evident success. E-visas and visas-on-arrival have undoubtedly contributed to tourism growth and the programme will no doubt continue to expand. Faster processing times on arrival are also helping, but more no doubt will be done to reduce them still further. The tourism visa already permits a 90 day stay with multiple entries, but expanding visa-free travel beyond the GCC would be another possibility.

- Hotels and hospitality. Last year only 20% of international tourists visited the Kingdom for leisure, while visiting friends and relatives made up 23% and religious tourism accounted for 45%. The expectation is that this balance will shift in favour of leisure tourists. Will there be sufficient hotels and other accommodation for them? AMPM data show that there were 164,413 hotel rooms available in early 2024, compared to 132,631 in 2015.[13] The number of new rooms has been growing at more than 2% annually, but this has not been reflected in total room numbers because older hotels of a previous generation are closing. Occupancy rates have risen as a result, reaching 72% in Mecca and Madinah, 65% in Riyadh and 55% in Dammam. Across the country AMPM estimates that almost 100,000 new rooms will become available by 2030, which given further closures of older hotels will match projected demand very closely or even fall slightly below it. That would be an ideal outcome for Saudi hotel developers.

- Language, culture, workforce. The rise of Saudi English language competence is quite noticeable to those who have visited the Kingdom for many years.[14] Recent estimates suggest that over almost all of the population now has conversational English.[15] Numerous studies have also pointed out the social and cultural changes in Saudi society that align well with international tourists.[16] Finally in respect of employment, wages paid continue to attract expatriates at all levels, including in the hospitality sector which is catching up in terms of remuneration.[17] There are therefore no significant obstacles in any of these directions.

- Marketing. The Saudi Government has already launched collaborations with UN Tourism and the World Travel and Tourism Council. More partnerships can be expected. The online multilingual presence of Saudi tourism is now very noticeable — and very slick.

The evidence suggests that at a national level almost everything that can be done to increase Saudi tourism is being done. There are however global constraints, as UNWTO experts noted, including the continued impact of inflation on accommodation costs and the global economic environment, geopolitical tensions and extreme weather events.[18]

With significant investments in major projects such as the Red Sea Development, AlUla, Neom, Diriyah Gate, and others, Saudi Arabia’s share of leisure tourism is expected to grow substantially in the coming years. These projects align with the Kingdom’s Vision 2030, which aims to diversify the economy and increase the tourism sector’s contribution to GDP up to 10% by 2030. The Red Sea Project alone is projected to attract up to one million visitors annually by 2030, while AlUla, with its cultural and heritage significance, aims to draw two million tourists per year by 2035.

Siraj Ahmed

Partner, Head of Strategy and Consulting

Forecasts for Saudi tourism

A traditional approach to forecasting is to use time series analysis. If the annual rate of growth remains the same as between 2015-2023, 7.8%, international tourism numbers would reach 46m by 2030. Mapping this onto the UNWTO forecast of 1.8bn for global tourism would suggest only a modest increase in the percentage of global tourists taken by the Kingdom, up from 2.1% to 2.5%. This is eminently achievable. But time series analysis assumes that the future will resemble the past. Saudi Arabia is likely to take a larger share of the global tourist market until it reaches its stabilised percentage of global tourism. What is that likely to be?

Other jurisdictions will compete — most obviously the UAE, but others such as Egypt and Turkey are also both longstanding players in the international tourist market. Both have comparative advantages, whether they be the cost of accommodation or access to the Mediterranean Sea. And yet neither of them is in the top ten in the World Tourism Rankings. But against this must be set the continued success of the National Tourism Strategy and the sheer novelty and scale of Saudi tourism. In the last decade, Dubai’s annual tourism growth has been similar to that of Saudi Arabia, 8%. But what if the Kingdom’s trajectory were to follow that of Dubai in its earlier much more rapid expansion as a tourist destination? Between 1990-2000, for example, Dubai tourist numbers grew 17% annually, and between 2000-2010, 10.8%.

The result of growth rates of this order would propel Saudi Arabia to 82m or 56m international tourists, an 8.1% or 5.6% share of global tourism respectively. But for context, in the former case this would be greater than global leader France’s current share, so in such a scenario, the UNWTO projections themselves would probably be too low. In either case, however, Saudi entering the top ten of global tourist hubs is entirely likely. It even places the revised target of being amongst the top five of global tourist destinations within sight.

Growth in domestic tourism is likely to be much less rapid. This is because it depends on growth in population and real GDP. The UN estimates that the population will grow on average by 1.5% in the coming decade whilst real GDP is increasing by 1%. Assuming a conservative 2% annual increase, which is what was achieved last year but exceeded so far in 2024, this would result in domestic tourism reaching 91m by 2030, which would entail each person making just under three trips a year on average At the other extreme, if nominal economic growth were to continue along the path set in 2023,[19] and continued this year, with inflation hovering around the 3% mark, Saudis would become approximately 5% wealthier in real terms every year. If this translated into discretionary spend on visits insider the country, the figure would reach 111m trips. A mid-point estimate of 3.5% would produce a figure of 100m. These six projections are combined in the figure below.

Saudi tourism projections 2023-2030

Source: Cavendish Maxwell analysis

Under each of these scenarios, there would be significant implications for the key cities and regions where tourists will enter and then visit. Riyadh and Jeddah already hold dominant positions, and this is likely to continue for at least the next decade. Access is one aspect of their dominance: Red Sea International Airport, for example, has now begun international flights, but as yet only to Dubai.[20] The rise of low-cost carriers has if anything further reinforced that dominance: their market share in domestic air travel rose from 68% in 2023 to 72% in the so far this year.

In future, more low-cost flying, the planned expansion of Riyadh airport and the network of Riyadh Air will thereafter be three amongst a new set of parameters, along with the consequences of the rise in liveability of Saudi cities that has only just begun. Many other positive changes may therefore well lie beyond the forecast horizon of Vision 2030. But given that the Euromonitor ‘best cities to visit’ index measures economic and business performance, tourism performance and infrastructure, policy and attractiveness, health and safety and sustainability, it is highly likely that in decades to come Riyadh will rise up the list, given that Dubai already stands second only to Paris.[21]

Drawing conclusions

If the co-ordinated approach of recent years continues, Saudi tourism holds the same promising growth potential as seen before in other rapidly expanding markets. Recent evidence of significant achievements in digital government development, climbing 25 places in the UN’s E-Government Development Index,[22] suggests strongly that it will. The remainder of this decade and into the 2030s will likely be marked by significant growth, outpacing more established tourism destinations.The achievement of the revised Vision 2030 target is within easy reach and may well be exceeded. This in turn will require the continued investment in high-quality hotels and alternative accommodation such as serviced apartments. Infrastructure investment will continue to be of critical importance throughout this period.

By the mid-2030s, however, the market may be approaching maturity. We will have become used to the idea that Saudi Arabia is as much if not more of a tourist destination as for example the UK. Infrastructure improvements will have come through, and tourism growth will moderate. It will be time to reflect on the impressive transformation that will no doubt have been achieved, but also to recognise the need for continual reinvention, upgrading, and investment. Successful tourism markets continue to grow rapidly because they never rest on its laurels. Saudi must not do so either.

[1] Saudi Government (2024) National Tourism Strategy. https://mt.gov.sa/about/national-tourism-strategy

[2] UN World Tourism Organisation (2024, May) World Tourism Barometer, p. 2. https://pre-webunwto.s3.eu-west-1.amazonaws.com/s3fs-public/2024-06/UNWTO_Barom24_02_May_excerpt.pdf.

[3] By the UN definition of tourist market size

[4] https://pre-webunwto.s3.eu-west-1.amazonaws.com/s3fs-public/2024-06/Barom_PPT_May_2024.pdf?VersionId=U7O62HatlG4eNAj.wcmuQG1PMCjK.Yss

[5] https://www.stats.gov.sa/sites/default/files/Tourism%20Establishment%20Statistics%202022%20EN.pdf

[6] Saudi Tourism Authority (2024) Open Data. https://www.sta.gov.sa/en/open-data.

[7] Al Arabiya (2016, 26 April) Full text of Saudi Arabia’s Vision 2030. https://english.alarabiya.net/features/2016/04/26/Full-text-of-Saudi-Arabia-s-Vision-2030

[8] Time Out (2024, 10 July). 26 upcoming Saudi Arabia attractions that are worth the wait. https://www.timeoutjeddah.com/travel/upcoming-saudi-arabia-attractions#:~:text=26%20upcoming%20Saudi%20Arabia%20attractions%20that%20are%20worth,…%208%20Jeddah%20Central%20Project%20…%20More%20items

[9] Holtham, A. (2024, 24 June) 24 incredible things to look forward to in Saudi Arabia in the second half of 2024. https://whatsonsaudiarabia.com/2024/06/24-incredible-things-to-look-forward-to-in-saudi-arabia-in-2024/

[10] Time Out (2024, August 4). Your full guide to Saudi’s UNESCO World Heritage Sites. https://www.timeoutriyadh.com/attractions/saudi-arabia-unesco-world-heritage-sites

[11] Numbeo (2023) Safety Index by Country 2023. https://www.numbeo.com/crime/rankings_by_country.jsp?title=2023&displayColumn=1.

[12] Kumar, P. (2024, August 19) Riyadh’s road network gets a $3.5bn upgrade. https://www.agbi.com/infrastructure/2024/08/riyadhs-road-network-gets-a-3-5bn-upgrade/

[13] Source

[14] Al-Seghayer, K. (2023). The Newfound Status of English in 21st-Century Saudi Arabia. International Journal of Linguistics. 15. 82-103. https://doi.org/10.5296/ijl.v15i4.21262.

[15] AlRawi, M., AlShurafa, N. & Elyas, T. Saudi English: A Descriptive Analysis of English Language Variations in Saudi Arabia. J Psycholinguist Res 51, 865–884 (2022). https://doi.org/10.1007/s10936-022-09866-8.

[16] Madani, R. (2022). The new image of Saudi cultural shift; MDL Beast music festival; Saudi Vision 2030. Cogent Arts & Humanities, 9(1). https://doi.org/10.1080/23311983.2022.2105511.

[17] Cooper Fitch (2023) Kingdom of Saudi Arabia Salary Guide 2023. https://cooperfitch.ae/salary-guides/ksa-salary-guide-2023/

[18] UN World Tourism Organisation (2024, June) World Tourism Barometer. https://pre-webunwto.s3.eu-west-1.amazonaws.com/s3fs-public/2024-06/Barom_PPT_May_2024.pdf?VersionId=U7O62HatlG4eNAj.wcmuQG1PMCjK.Yss.

[19] Mati, A. and Rehman, S. (2023, September 28 2023). Saudi Arabia’s Economy Grows as it Diversifies. Washington DC, IMF. https://www.imf.org/en/News/Articles/2023/09/28/cf-saudi-arabias-economy-grows-as-it-diversifies.

[20] Red Sea Global (2024, March 28). Red Sea International Airport soars with first overseas flights. https://www.redseaglobal.com/en/-/red-sea-international-airport-soars-with-first-overseas-flights

[21] Bloom, L. (2023, December 16). Ranked: The 100 Best Cities in The World to Visit, According To A New Report. https://www.forbes.com/sites/laurabegleybloom/2023/12/14/ranked-the-100-best-cities-in-the-world-according-to-a-new-report/.

[22] United Nations (2024) E-Government Development Index (EGDI). https://publicadministration.un.org/egovkb/en-us/About/Overview/-E-Government-Development-Index.