Reports and Whitepapers

Read our in-depth and insightful market analysis

Dubai Hospitality Market Performance H1 2025

Hospitality Market Overview

Dubai was officially recognised as the first Certified Autism Destination™ in the Eastern Hemisphere, demonstrating its commitment to accessible and inclusive tourism. The Emirate’s safety credentials also received global recognition, with Dubai placing third and Abu Dhabi first in Numbeo’s city-level safety index, reinforcing the UAE’s position as one of the world’s safest destinations.

This reputation for safety and inclusivity helped drive strong tourism growth in H1’2025. Dubai welcomed 9.9 million international visitors, up 6.1% from the same period in 2024. The increase was also fuelled by Government initiatives, strategic international partnerships, a packed events calendar, and new attractions catering to diverse visitor profiles. With direct connections to over 260 destinations and its blend of modern innovation and cultural heritage, Dubai solidified its status as a premier global hub.

Reflecting this momentum, the hospitality sector recorded strong performance, with hotel occupancy reaching 81.4% in H1’2025, an increase of 4.5% year-on-year. Average Daily Rate (ADR) also climbed 5.5% to AED 754.5, supported by both international arrivals and domestic staycations.

This report examines the key drivers behind Dubai’s robust performance, analyses trends in occupancy and average daily rates, and provides an outlook for the hospitality market through the remainder of 2025.

Market Snapshot for H1 2025

- International visitors: 9.9 million (+6.1% Y-on-Y)

- Average Daily Rate (ADR): AED 754.5 (+5.5% Y-on-Y)

- Occupancy Rates: 81.4% (+4.5% Y-on-Y)

- Estimated Upcoming Hotel Supply (H2’2025)

- Hotels: 19

- Rooms: ~5,000

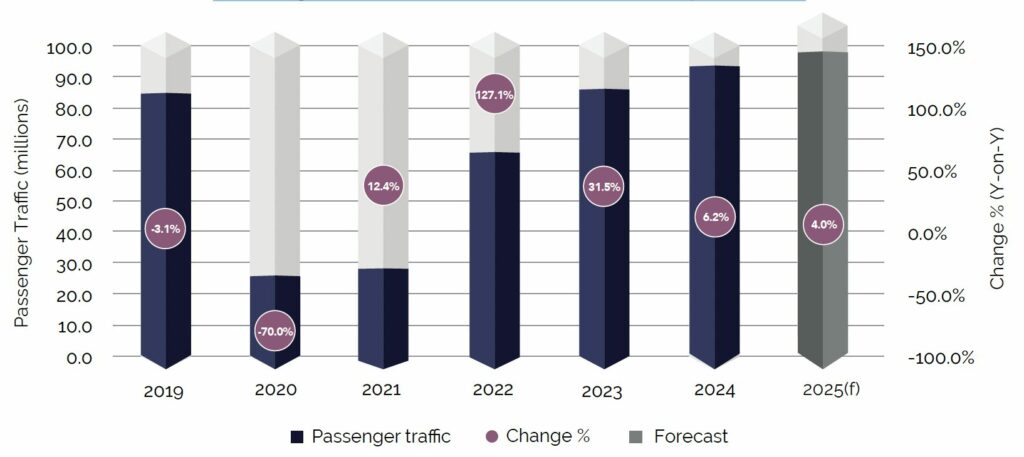

Dubai Airport Passenger Traffic

In the first half of 2025, Dubai International (DXB) handled 46 million passengers, a 2.3% year-on-year increase. Despite temporary airspace disruptions in May and June, the airport posted its busiest first half on record, driven by its extensive connectivity to more than 260 destinations across 107 countries. By year-end, DXB is projected to handle around 96 million passengers, keeping it on track to remain the world’s busiest international airport.

Dubai World Central (DWC) also continued to grow, with passenger traffic rising 36.4% year-on-year in H1′ 2025, reflecting its expanding role as Dubai’s secondary aviation hub. At the same time, Phase 1 of DWC’s expansion is underway, including a new terminal, concourses, and a second runway, and is expected to increase the airport’s capacity to 150 million passengers annually upon full completion.

The combined momentum at DXB and DWC highlighted Dubai’s integrated approach to aviation, where record passenger volumes and large-scale infrastructure investments reinforced the Emirate’s position as a global trade and tourism gateway.

Passenger Traffic – Dubai International Airport (DXB)

Source: Dubai Airports, Cavendish Maxwell

As Dubai continues to set new benchmarks in safety, inclusivity, and connectivity, the hospitality sector is not just keeping pace – it is leading the way. The city’s ability to attract diverse visitor profiles, while consistently elevating guest experiences, underpins its resilience and growth. Looking ahead, Dubai’s focus on premium offerings and strategic innovation will ensure it remains a global destination of choice for both leisure and business travellers.

Vidhi Shah

Director, Head of Commercial Valuation

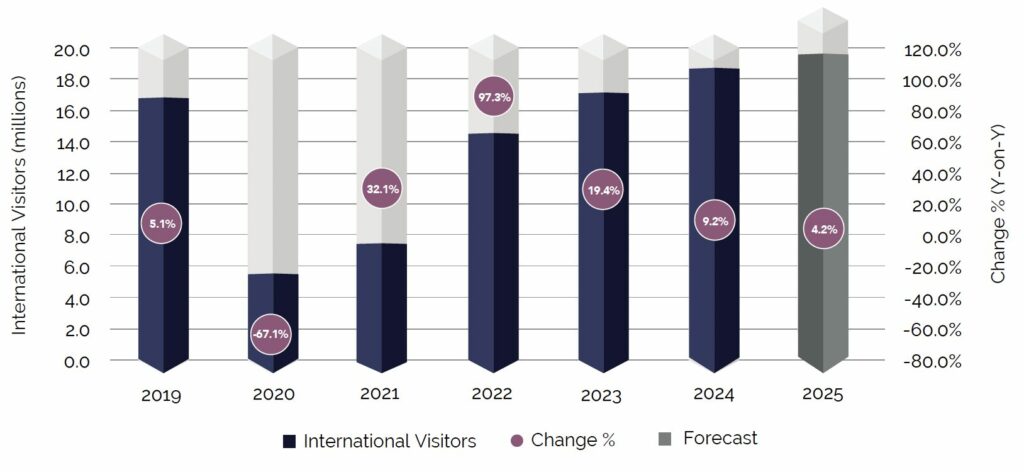

International Visitors

Dubai welcomed 9.9 million international visitors in the first half of 2025, a 6.1% increase compared to the same period last year. The city’s reputation as a safe, well-connected destination offering a blend of traditional and modern experiences has reinforced its position as a preferred global hub. This growth was supported by Government-led initiatives, including international partnerships, major events, global activation programmes, and the launch of new attractions that appeal to both first-time and returning visitors.

Based on current trends, international visitor numbers are conservatively forecasted to reach 19.5 million by the end of 2025, although the Emirate had set an ambitious target of 23–25 million visitors for the year. With continued improvements in connectivity and key events planned for H2’2025, Dubai’s appeal is expected to grow further, supporting robust growth in international tourism.

Source: Department of Economy & Tourism, Cavendish Maxwell

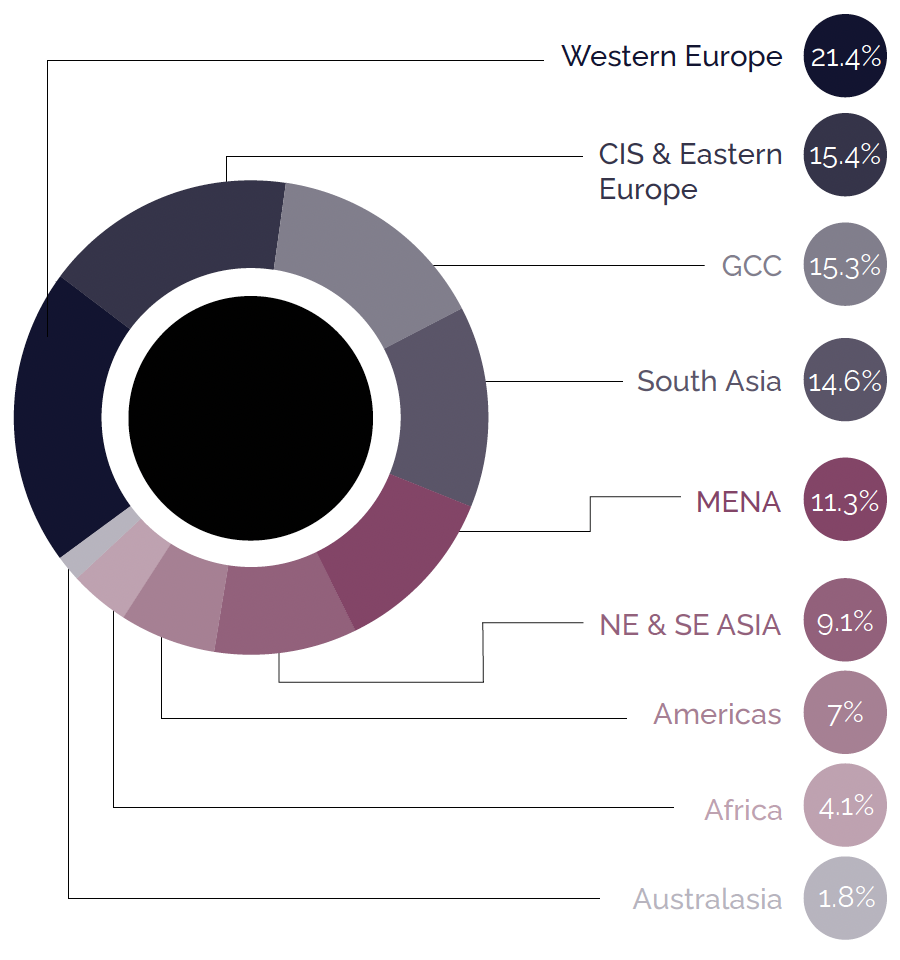

International Visitors: By Source Market

Western Europe continued to lead Dubai’s source markets in H1’2025, accounting for 21.4% of arrivals, up 12.0% compared to the same period last year. CIS & Eastern Europe and the GCC each contributed 15% of visitors, with year-on-year growth of 10.9% and 19.1%, respectively. The Americas (7% of total visitors) and Australasia (1.8%) also recorded notable increases of 11.7% and 14.3%, while South Asia experienced a decline of 10.7%. Overall, this growth was supported by Dubai’s accessibility, strengthened through enhanced flight connectivity and visa reforms, along with the city’s diverse offerings, which continue to attract both leisure and business travellers.

Dubai Tourism Distribution By Region (Jan – Jun 2025)

Source: Department of Economy & Tourism, Cavendish Maxwell

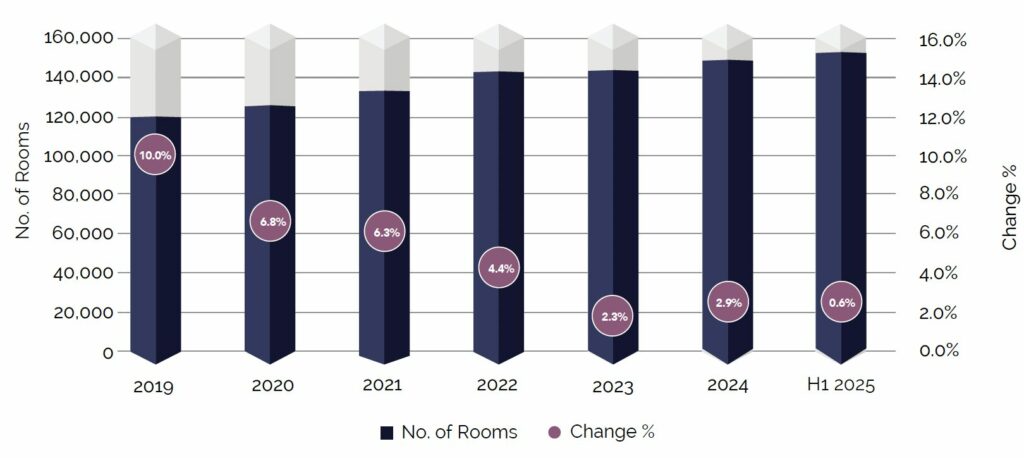

Current Supply

According to the latest data from AM:PM Hotels, as of June 2025, Dubai’s hospitality sector comprised of nearly of 730 properties, with a combined capacity of approximately 152,000 keys.

The supply side of the picture

The hospitality industry has been keeping up with tourism levels in Dubai, adjusting supply to meet demand.

Our insights reveal that:

Source: Dubai Tourism, AM:PM Hotels, Cavendish Maxwell

Existing Hospitality Supply

Dubai’s hospitality sector experienced steady growth between 2021 and H1’2025. The number of hotels rose from approximately 670 in 2021 to around 730 by mid-2025, representing an overall increase of 9.3%. Room inventory similarly expanded from about 137,600 keys to 152,000 keys, a 10.6% rise. This consistent growth reflected the city’s efforts to expand capacity in line with rising visitor demand.

Dubai Hospitality Building Supply – 2019 to H1 2025

Source: AM:PM Hotels, Cavendish Maxwell

Dubai Hospitality Room Supply – 2019 to H1 2025

Source: AM:PM Hotels, Cavendish Maxwell

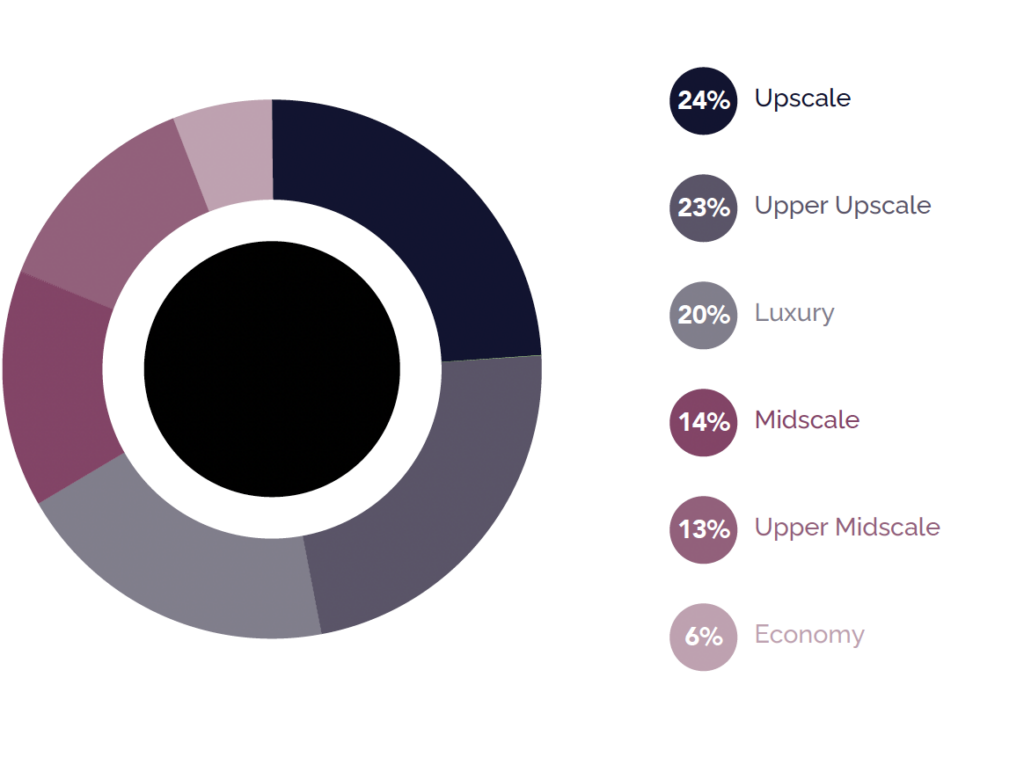

Current Hospitality Room Inventory: By Classification

As of H1’2025, the majority of Dubai’s existing room supply was concentrated in the Upscale segment, accounting for 24.4% of total rooms. Together, the Luxury, Upper Upscale, and Upscale categories comprised 67.4% of the current inventory, while the remaining 32.6% was distributed across Midscale (14.0%), Upper Midscale (12.9%), and Economy (5.5%) segments. Notable hotel openings during H1’2025 included Jumeirah Marsa Al Arab, Vida Dubai Mall, and Cheval Maison Expo City Dubai.

Current Hospitality Room Inventory by Classification – As of H1 2025

Source: AM:PM Hotels, Cavendish Maxwell

Future Supply

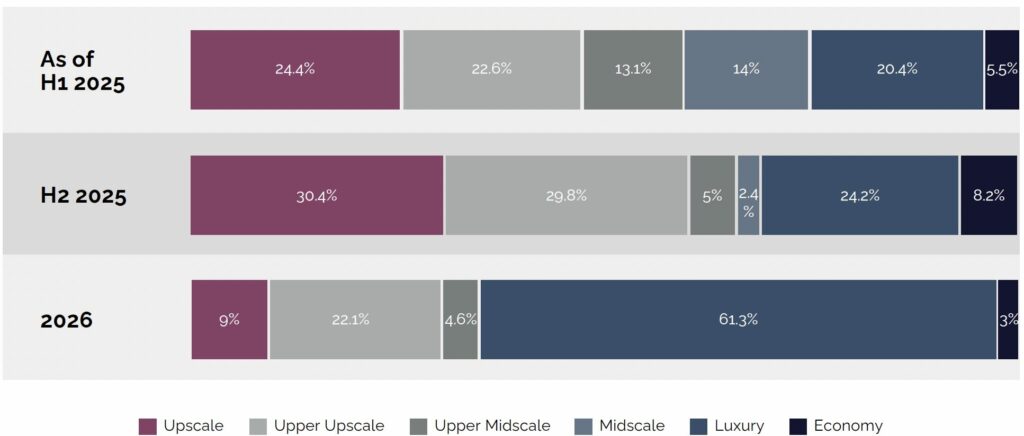

In terms of upcoming supply, approximately 42 new hotels, adding around 11,000 keys, are scheduled to enter the market by 2027. Most of these openings are planned for the second half of 2025 and thro ughout 2026.

Source: AM:PM Hotels, Cavendish Maxwell

In the remainder of 2025, around 5,000 rooms are expected to enter the market, the majority concentrated in the Upscale (30.4%), Upper Upscale (29.8%), and Luxury (24.2%) segments, which together account for 84.4% of the upcoming supply. Prominent projects slated for delivery include the Mandarin Oriental Downtown Dubai (259 keys), Seven City JLT (78 keys), and Jumeirah Living Business Bay (82 keys), among others. Looking ahead to 2026, the pipeline shows a marked shift towards the Luxury segment, which is expected to represent 61.3% of new supply. Notable additions include Ciel Dubai Marina, Dorchester Collection Ela by Omniyat, and InterContinental Portofino. Overall, Dubai’s upcoming hotel pipeline highlights a strong emphasis on premium categories, reflecting the city’s positioning as a global luxury destination and its continued focus on catering to high-spending travellers.

Hospitality Room Inventory by Classification – Projected Upcoming Supply

Source: AM:PM Hotels, Cavendish Maxwell

Market Performance

Occupancy

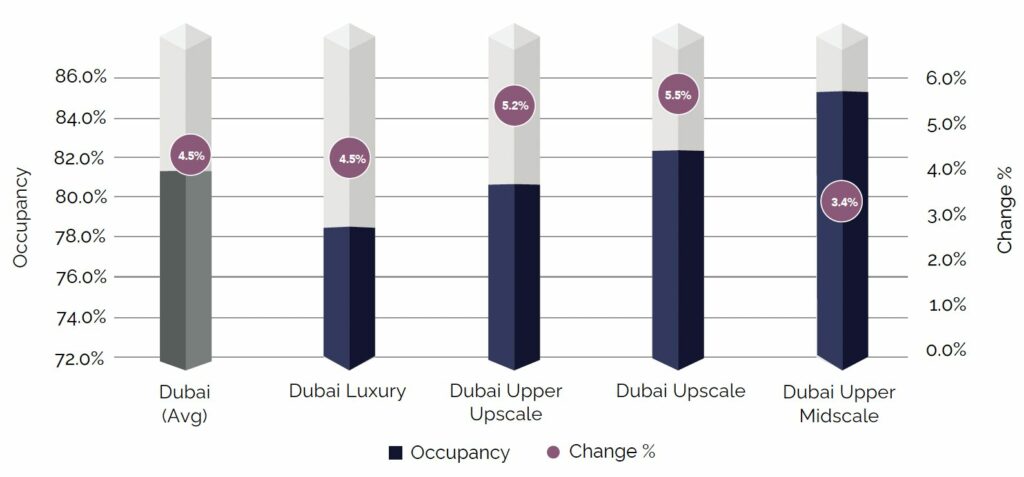

Dubai’s hospitality market experienced a notable uplift in H1’2025, with overall occupancy rising to 81.4%, up 4.5% compared to the same period in 2024. Growth was recorded across all segments, led by Upscale hotels (+5.5%), followed by Upper Upscale (+5.2%) and Luxury (+4.5%), while Upper-Midscale hotels, despite maintaining the highest occupancy, recorded a modest gain of 3.4% year-on-year. The increase was driven by both a surge in international visitors and strong domestic staycation demand, which highlighted Dubai’s ability to absorb new supply.

Occupancy by Classification – YTD June 2025

Source: STR, Cavendish Maxwell

Average Daily Rate (ADR)

Rising demand from both international and domestic travellers drove ADR growth across Dubai’s hotel market in H1’2025, with city-wide rates climbing 5.5% to AED 754.5. By segment, Upper-Midscale hotels recorded the strongest increase at 8.5%, while Luxury hotels, despite maintaining the highest rates, saw a rise of 4.9%, supported by high-spending leisure and business visitors. Meanwhile, the Upscale and Upper Upscale segments posted more modest gains of 2.7% and 2.5%, respectively.

Average Daily Rate by Classification – YTD June 2025

Source: STR, Cavendish Maxwell

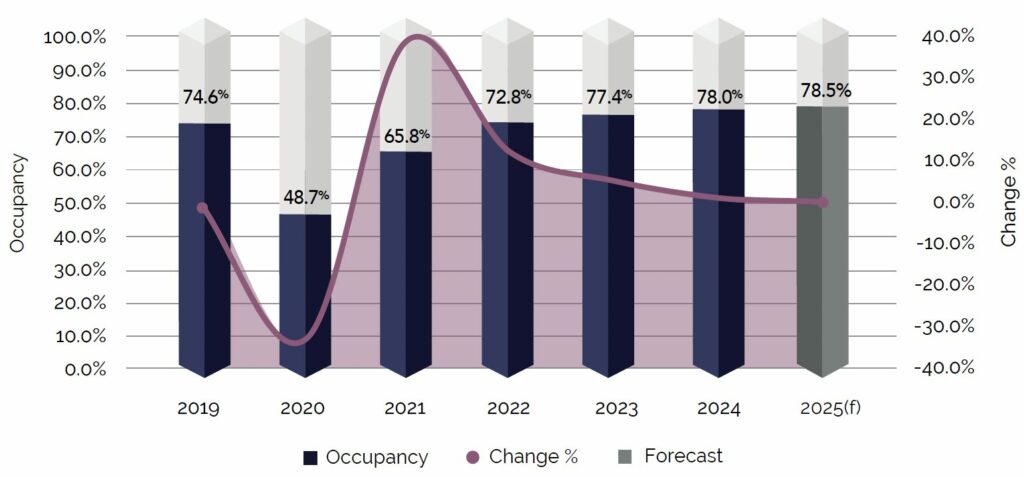

Hospitality Market Forecast

Dubai’s hospitality market continued its upward momentum in the first half of 2025, driven by strong demand from both international and domestic travellers. This performance, combined with a strong events calendar for H2’2025, has led to an upward revision of the full-year occupancy forecast to 78.5%. Around 5,000 rooms are scheduled for delivery by year-end, primarily in the Upscale, Upper Upscale and Luxury segments, which notably were also the strongest performers in H1 2025. While the actual delivery rate may be lower, full completion of these rooms could temporarily soften occupancy levels in these segments. Nevertheless, robust demand is expected to carry the market through the remainder of 2025.

Dubai – Occupancy – Historic and Forecast

Source: STR, Cavendish Maxwell

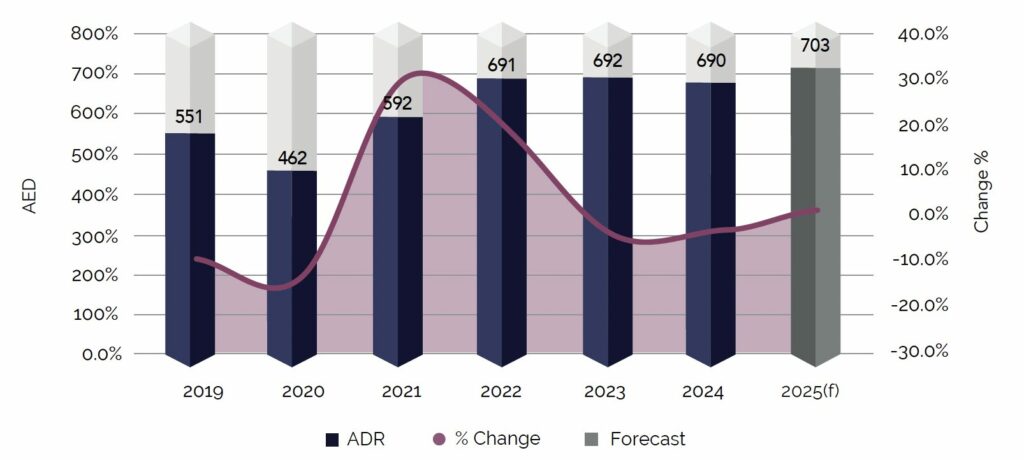

Alongside this, ADR is also projected to increase through the remainder of 2025, supported by resilient leisure and business demand, a strong calendar of citywide events, and Dubai’s positioning as a premium global destination. Even in the absence of major events, growth is expected to follow a steady, organic trajectory, driven by baseline tourism and corporate travel. The continued expansion of Dubai’s luxury hotel supply is also set to push ADR upward, as high-end properties command premium pricing and attract affluent travellers. As a result, ADR growth is projected to remain positive, building on the solid gains recorded in the first half of the year.

Dubai – Average Daily Rate (ADR) – Historic and Forecast

Source: STR, Cavendish Maxwell

Disclaimer:

It is important to note that the Average Daily Rate (ADR) figure for 2023, as reported by STR, varies between their 2023 and 2024 datasets. The 2023 report listed an ADR of 692.07, while the 2024 report retroactively lists it as 688.55. For consistency with our previous reporting standards, we have opted to use the figure of 692.07.

STR data is subject to annual revisions due to the dynamic nature of the hospitality industry, including new hotel openings, closures, and updated data collection. For year-on-year comparisons, STR utilises consistent datasets to ensure alignment.

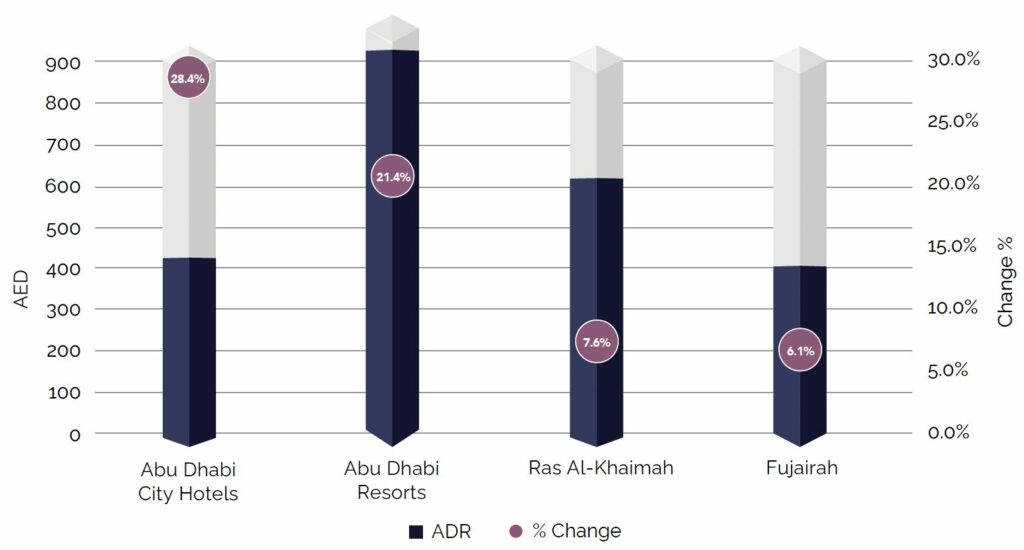

Hospitality Market Performance – Other Emirates

The increase in Average Daily Rate (ADR) observed in Dubai was reflected across other Emirates as well. Abu Dhabi City hotels led with a 28.4% rise, driven by business travel, cultural attractions, and high-profile events. Abu Dhabi Resorts followed with a 21.4% increase, supported by luxury resorts, beach tourism, and wellness retreats that appealed to both domestic and international visitors.

Ras Al Khaimah saw ADR climb 7.6%, benefiting from adventure tourism, mountain resorts, and nature-based experiences, while Fujairah recorded a 6.1% increase, fuelled by interest in coastal getaways and boutique resorts. Overall, targeted tourism offerings, effective marketing, and a limited influx of new supply across these Emirates ma rkets helped maintain demand and supported room rates.

Average Daily Rate by Emirates – YTD June 2025

Source: STR, Cavendish Maxwell

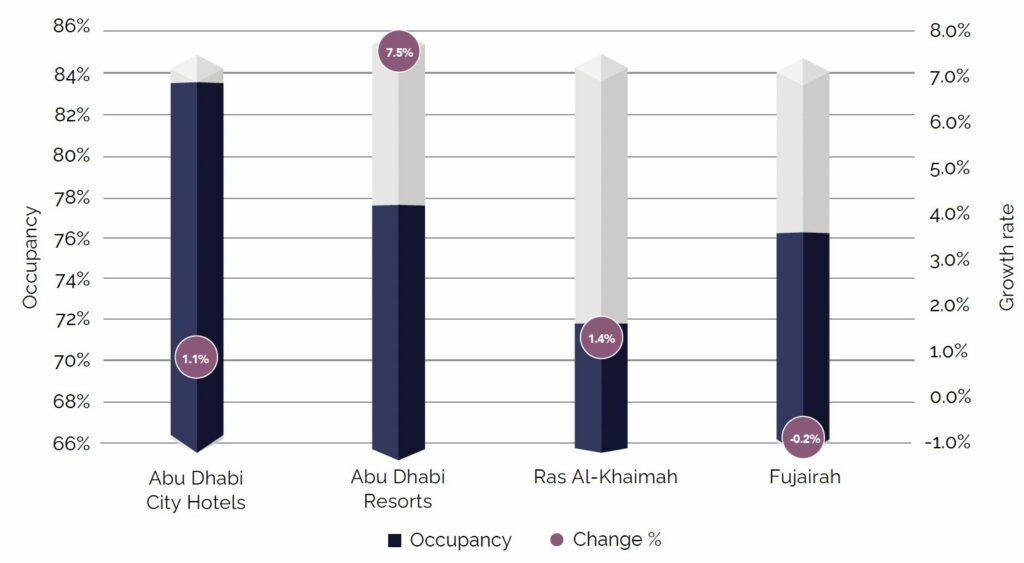

Abu Dhabi City hotels recorded a modest 1.1% increase in occupancy during H1’2025, while Abu Dhabi Resorts saw stronger growth of 7.5%. This improvement was supported by the 13.0% rise in passenger traffic at Abu Dhabi International Airport, which welcomed 15.8 million passengers in the first half of the year. Enhanced air connectivity, combined with steady demand from corporate travel, MICE activities, and Government-backed tourism initiatives, further supported hotel performance across the capital.

Ras Al Khaimah welcomed 653,000 visitors in the first half of 20 25; a 5.7% increase compared to the same period in 2024. The to tal included 325,000 international and 328,000 domestic travellers, reflecting balanced demand from both segments. Occupancy rates rose 1.4% as a result. Growth was further supported by strategic partnerships with global and local entities, along with an expanding events calendar, which reinforced the Emirate’s position as a leading leisure and adventure destination.

Fujairah’s occupancy remained stable in H1 2025, supported by initiatives that highlighted its adventure tourism potential, including a United Nations World Tourism Organisation (UNWTO)-backed event that highlighted the Emirate’s landscapes, culture, and strategic location. Connectivity also improved with IndiGo launching daily direct flights from Mumbai, enhancing international access.

Occupancy by Classification – YTD June 2025

Source: STR, Cavendish Maxwell

Hospitality Market Outlook

Dubai’s hospitality market kicked off the first half of 2025 strongly, with passenger traffic, international visitors, occupancy rates, and average daily rates all rising compared to the same period last year. Growth was supported by the city’s safety, accessibility, diverse offerings, and a vibrant calendar of citywide events, while Government-led initiatives and new attractions further enhanced Dubai’s appeal.

Based on current trends, international visitor numbers are conservatively forecasted to reach 19.5 million by the end of 2025. On the supply side, Dubai’s hospitality inventory reached around 152,000 keys across 730 properties by mid-2025, with Upscale, Upper Upscale, and Luxury hotels representing 67.4% of the total. Approximately 5,000 new rooms are expected to enter the market in H2’2025, primarily in the premium segments.

For the remainder of the year, occupancy is forecasted to reach 78.5%, supported by a strong H2’2025 events calendar and continued domestic demand. ADR is also expected to rise, supported by ongoing leisure and business travel, the expansion of premium hotel supply, and Dubai’s position as a leading global luxury destination. Even in the absence of major events, organic growth from baseline tourism and corporate travel is likely to maintain both occupancy and ADR growth.

GET YOUR COPY NOW

Stay up to date