Dubai Office Market Performance 2024

Executive Summary

In 2024, Dubai reinforced its position as a global hub for trade and investment through strategic initiatives and progressive policies. The Emirate’s economy demonstrated strong growth, with GDP expanding by 3.1% in the first nine months of the year, reaching AED 339.4 billion. This positive momentum was further reflected in the Dubai Chamber of Commerce’s performance, which recorded 70,500 new members, leading to an 18% year-on-year increase in active memberships. Foreign direct investment (FDI) remained a key driver of economic expansion as well, with 1,826 announced projects—an 10.7% rise from the previous year and the highest level since 2015. Additionally, the city secured the top global ranking for Greenfield FDI projects, surpassing major business hubs such as Singapore and London.

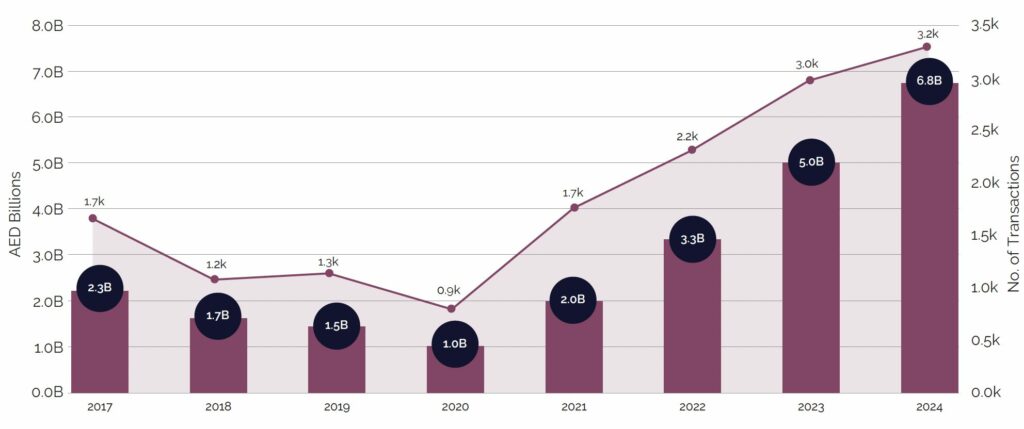

Dubai’s economic growth is reflected in the strong performance of its office real estate market. In 2024, over 3,150 transactions were recorded, valued at AED 6.8 billion, marking a 7.1% increase in volume and a 35.9% rise in value compared to the previous year. This surge in demand for both ready and off-plan office spaces emphasises the city’s growing role as a prominent business hub, attracting investors and companies from around the world. With supply being limited, the market continues to see upward pressure on both sales prices and rental rates. In 2024, office space prices rose by 24.2%, while rental prices increased by 23.6%.

Looking ahead to 2025, the market is set to continue its growth, with supply remaining limited to around 185,000 sqm, predominantly consisting of Grade A space. With minimal new supply entering the market, demand is expected to continue outpacing supply.

This report delves into the key factors fuelling the momentum of the Dubai office market, examines trends in office property prices and transaction volumes, and provides an outlook for the sector.

Dubai Market Snapshot for 2024

- Dubai GDP Growth in 2024 (First 9 Months): +3.1%

- Dubai GDP Forecast for 2025: +4 to +5%

- Overall Office Sales Transactions Volume: 3,150 (+7.1% vs. 2023)

- Ready Office Sales Transactions Volume: 2,900 (+5% vs. 2023)

- Off-Plan Office Sales Transactions Volume: 250 (+37% vs. 2023)

- Overall Office Sales Transactions Value: AED 6.8 Billion (+35.9% vs. 2023)

- Ready Office Sales Transactions Value: AED 6 Billion (+25.5% vs. 2023)

- Off-Plan Office Sales Transactions Value: AED 0.8 Billion (+248.9% vs. 2023)

- Total Office Space as of 2024 (in SQM): 9,260,000

- Total Office Space Delivered in 2024 (in SQM): 84,000

- Projected Office Space Supply for 2025 (in SQM): 185,000

Dubai’s Economic Growth and Investment Highlights 2024

Source: Dubai Chamber of Commerce, Cavendish Maxwell

Dubai has emerged as a leading global hub for trade and investment, driven by strategic initiatives and forward-looking policies. The city’s commitment to economic diversification and innovation has been reinforced by key milestones such as hosting the Expo 2020, COP 28, and the Dubai Economic Agenda (D33), which aims to transform Dubai’s economy over the next decade. As a result, Dubai’s economy has maintained strong growth, with GDP expanding by 3.1% in the first nine months of 2024 to reach AED 339.4 billion.

This positive trajectory is further highlighted by the performance of the Dubai Chamber of Commerce, which recorded 70,500 new members in 2024—a 3% increase from the previous year. The total number of active members grew to 258,000, reflecting an 18% year-on-year rise.

Source: Dubai Economy and Tourism, Financial Times Ltd., Cavendish Maxwell

Dubai’s remarkable economic growth in 2024 is also reflected in its foreign direct investment (FDI) performance. The city recorded a total of 1,826 announced FDI projects in 2024, marking an 10.7% increase compared to 2023. This represents the highest total of announced FDI projects since 2015. In parallel, Dubai ranked number one globally for Greenfield FDI projects, with 1,117 projects in 2024, surpassing leading cities like Singapore, London, and New York. These new FDI projects are estimated to have generated approximately 58,680 jobs. These milestones reinforce Dubai’s ongoing appeal to investors and businesses, further solidifying its position as a global leader in foreign direct investment.

Office Sales Transactions

The Dubai office sales market experienced substantial growth in 2024, with approximately 3,150 transactions valued at AED 6.8 billion. This represents a 7.1% increase in transaction volume and a significant 35.9% rise in value compared to 2023. Both the transaction volume and value have reached their highest levels in recent years.

The growth in transactional activity was primarily driven by increased demand for office spaces in the Emirate from both local and international buyers. The city’s favourable business environment, coupled with strategic Government initiatives and foreign investments, has further bolstered market confidence. Additionally, Dubai’s expanding role as a hub for various industries, with companies either expanding their operations or relocating to the Emirate, has significantly contributed to the surge in office sales transactions.

Dubai Office Transactions – By Volume and Value

Source: Property Monitor, Cavendish Maxwell

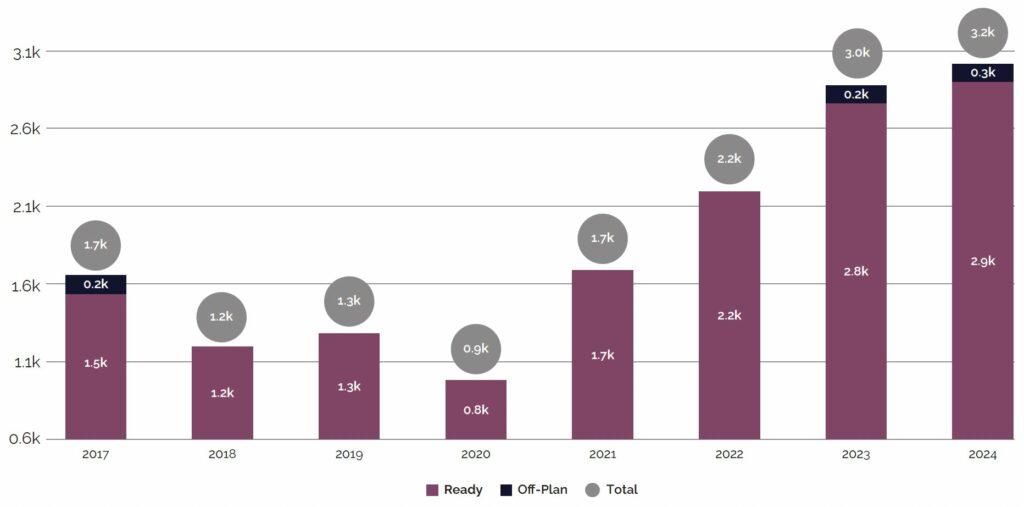

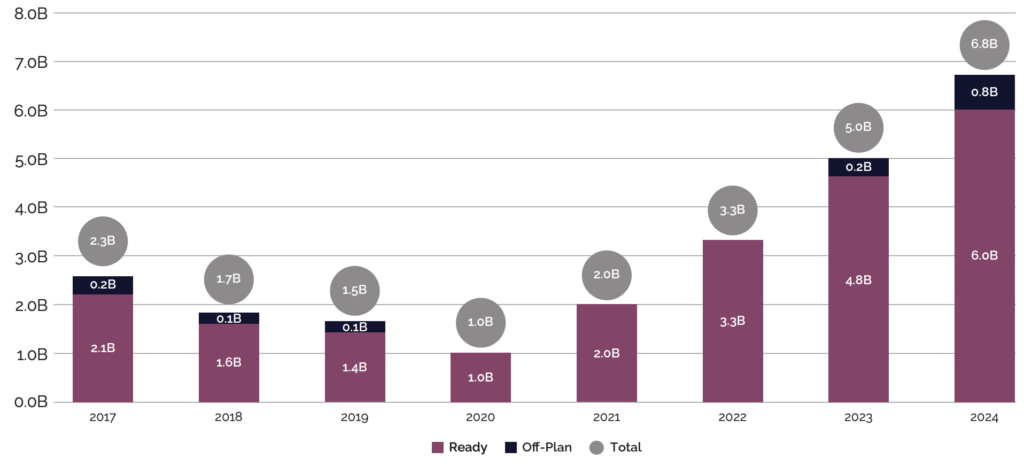

Office Sales Transactions by Type: Ready & Off-Plan

Ready offices continue to dominate office sales transactions, accounting for 91.8% of all transactions; however, this is down from 93.6% in 2023 due to the rise in off-plan office transactions.

The increase in off-plan office transactions can be attributed to growing investor confidence in upcoming office developments, the rising demand for newer office spaces in emerging business districts, and the availability of attractive payment plans. Additionally, businesses are securing office space for the long term by purchasing off-plan properties, thereby avoiding potentially higher rental costs in the future.

The volume of ready office transactions has reached 2,900 transactions, while off-plan transactions have amounted to 250 transactions, representing a 5% and 37% increase, respectively, compared to 2023. In terms of value, ready office transactions have risen by 25.5%, while the value of off-plan transactions has surged by 248.9% compared to 2023.

Dubai Office Transactions – By Volume

Source: Property Monitor, Cavendish Maxwell

Dubai Office Transactions – By Value (AED Billions)

Source: Property Monitor, Cavendish Maxwell

Top 5 Areas with the highest transactions

Ready Office Transactions

- Business Bay

1,343 Transactions - Jumeirah Lakes Towers

920 Transactions - Dubai Silicon Oasis

200 Transactions - Barsha Heights (Tecom)

148 Transactions - Motor City

68 Transactions

Off-Plan Office Transactions

- Jumeirah Village Circle

91 Transactions - Dubai Maritime City

65 Transactions - Culture Village

47 Transactions - Dubai Silicon Oasis

20 Transactions - Jumeirah Lakes Towers

15 Transactions

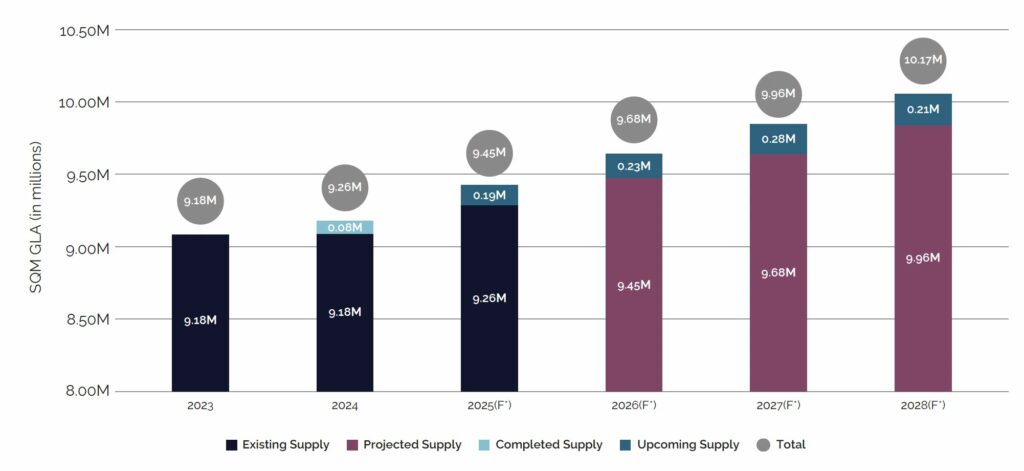

Existing and Future Office Supply

In 2024, approximately 84,000 sqm of office Gross Leasable Area (GLA) was added to the Dubai office market across key locations such as Sheikh Zayed Road, Dubai Silicon Oasis, and Dubai Media City, among others. Despite this expansion, demand for office spaces in Dubai is expected to remain strong, driven by a limited supply of prime locations and continued business growth.

Looking ahead, an additional 185,000 sqm and 230,000 sqm of office GLA is projected to enter the market in 2025 and 2026, respectively, with the majority classified as Grade A office space. However, historical trends suggest that the actual materialisation rate may fall short due to market adjustments. If this pattern persists, the ongoing supply-demand imbalance will continue to exert upward pressure on office prices and rental rates across Dubai.

Dubai Office Supply

Source: MEED Projects, Cavendish Maxwell

*The projected supply is based on the information available at the time of preparing the report and may differ from other projections. It is subject to revision as additional details about these projects

become available in the future.

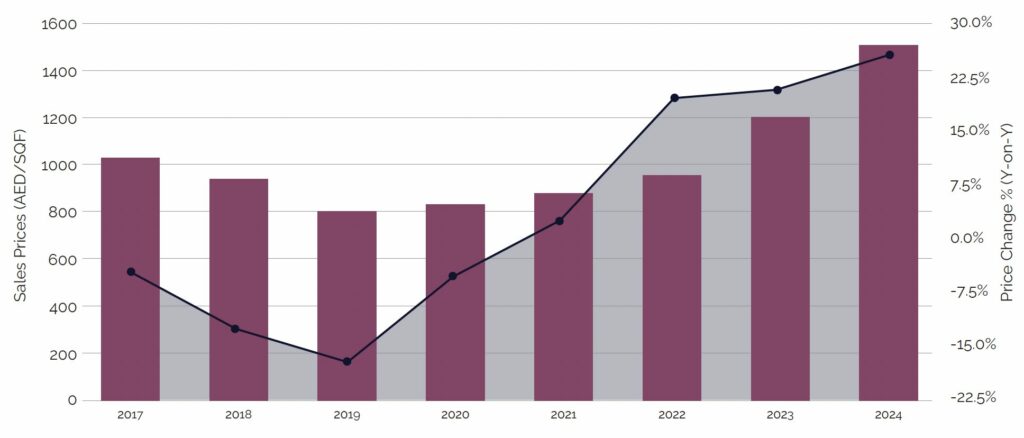

Office Sales Price Trend

Dubai office sales price has continued its upward trajectory, rising by 24.2% compared to 2023. This increase in sales prices reflects the strong demand for ready office spaces, primarily driven by a limited supply of available office properties, coupled with the expansion of business operations and the establishment of new companies.

Moreover, Dubai’s robust economic performance, along with its business-friendly legislation, has further fuelled this demand, solidifying the city’s position as a leading destination for commercial investments. The growing presence of multinational corporations, alongside a rising number of startups and SMEs, has intensified competition for prime office locations.

As Dubai continues to enhance its infrastructure, expand free zone benefits, and introduce pro-business policies, demand for office space is expected to remain strong.

Dubai Office Sales Price Trend

Source: Property Monitor, Cavendish Maxwell

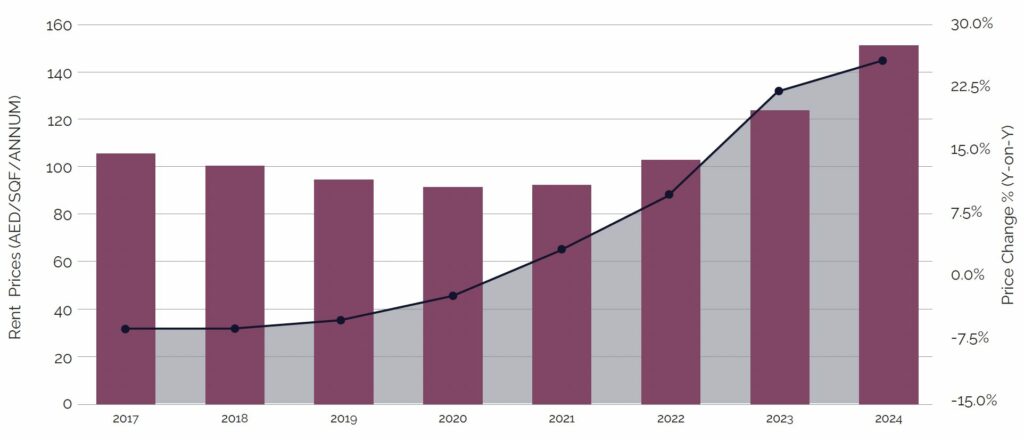

Office Rent Price Trend

In line with the increase in sales prices, Dubai’s office rental market has also witnessed significant growth, with rental prices rising by 23.6% compared to 2023. This surge is primarily driven by high occupancy levels, fuelled by the expansion of operations by existing businesses, the entry of new companies, and a limited supply of available office stock.

As occupancy levels remain high, the market continues to favour landlords, making it challenging for tenants to secure prime office locations. This has led to increased demand for flexible leasing options and alternative office spaces. With the demand for prime office space increasing, landlords are likely to refurbish their existing properties to command higher rentals.

Given the expected continued expansion of the Dubai economy, the entry of new supply into the market will largely determine the extent of price growth in 2025.

Dubai Office Rent Price Trend

Source: Property Monitor, Cavendish Maxwell

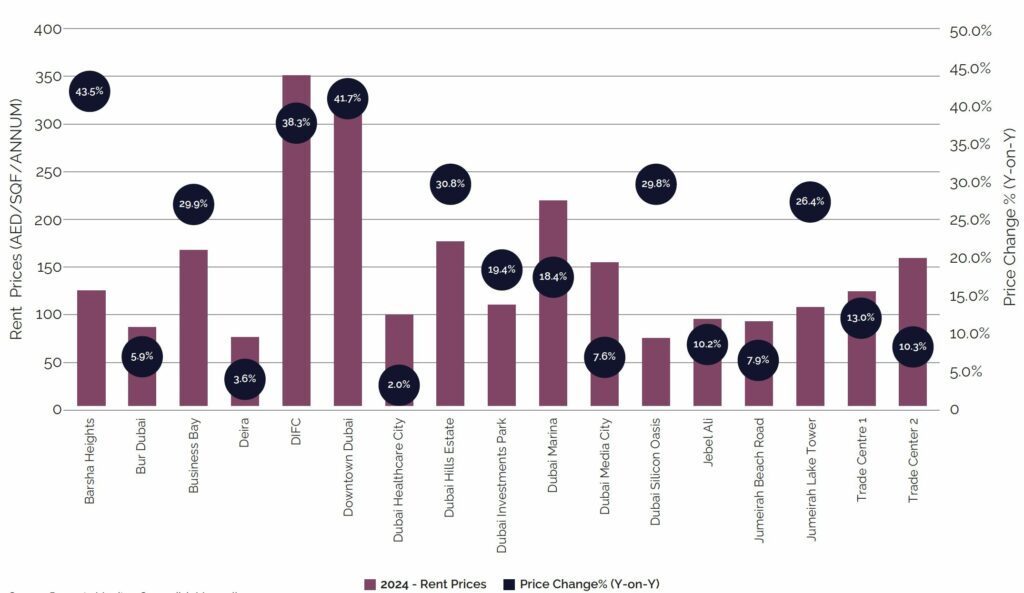

Office Rent Price Change by Area (2023 vs. 2024)

Rental prices across Dubai have risen, with Grade A office spaces seeing the highest increases—41.7% in Downtown Dubai and 38.3% in DIFC. Additionally, other office spaces have also experienced price hikes, with Barsha Heights witnessing the highest increase at 43.5% compared to last year.

Amid the ongoing supply shortage and rising costs of Grade A office spaces, upward pressure is also being exerted on Grade B and Grade C office rents, as tenants could be seen shifting to these affordable options.

Dubai Office Rent Price Movement in 2024

Source: Property Monitor, Cavendish Maxwell

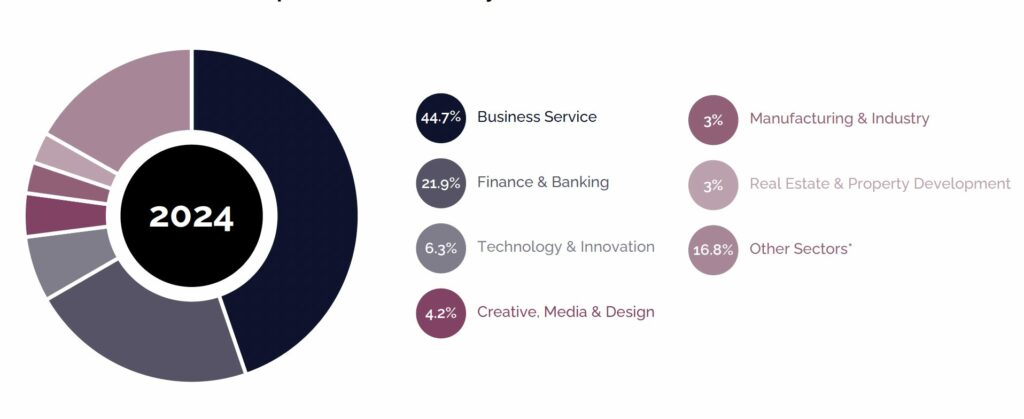

New Office Requirements by Sector in 2024

When it comes to new office space requirements, the Business Services sector leads the demand, accounting for 44.7% of the total. It is followed by the Finance & Banking sector at 21.9% and the Technology & Innovation sector at 6.3%. Collectively, these three sectors represent nearly 73% of all office space requirements in 2024.

Volume of New Office Requirements in Dubai by Sector – 2024

Source: Cavendish Maxwell

*Other sectors include a mix of industries, such as Automotive, Transportation, Logistics, Health & Medical Services, Legal Services, and Retail & Leisure, among others.

2025 Real Estate Market Outlook

As Dubai continues to experience robust economic growth, the demand for office real estate is expected to accelerate, driven by the expansion of existing companies, the influx of new small and medium enterprises (SMEs), startups, multinational corporations (MNCs), ongoing foreign investment, and the city’s growing stature as a global business hub. 2024 marked one of the strongest sales periods for office real estate in recent years, and this momentum is expected to extend into 2025. The sales market is likely to remain strong, supported by increased investor and business interest, as well as Dubai’s appeal as a leading business destination.

Dubai’s office market, driven by business expansion and international investment, has seen remarkable growth in both sales and rental prices in 2024. This growth further strengthens Dubai’s position as a global hub for corporate expansion and new business ventures. As new supply enters the market in 2025 and 2026, it will be crucial to monitor its effects on market dynamics and business strategies.

Vidhi Shah

Partner, Head of Commercial Valuation

If prices continue to rise in 2025, there could be a surge in off-plan activity, as businesses could look to secure office space for the long term to avoid potential future rental cost hikes or supply shortages. The quality of new developments will play a key role in shaping this trend. As occupancy rates rise and supply remains limited, rental prices for office spaces in Dubai are anticipated to increase further, with Grade A offices seeing the highest demand. However, upward pressure on rental prices is also expected to affect Grade B and C office spaces, as some businesses may opt for more affordable options.

The market is expected to remain landlord-driven, and landlords of older properties may refurbish their assets to secure higher rental rates. The extent of price growth in 2025 will depend largely on the entry of new supply into the market. Overall, the Dubai office real estate market is set to sustain its strong growth in 2025, fuelled by rising demand, limited supply, and economic expansion under the Dubai Economic Agenda D33. Additionally, as the market evolves, innovative solutions are expected to emerge, further shaping the future of the sector.