Dubai Residential Market Performance Q1 2025

Executive Summary

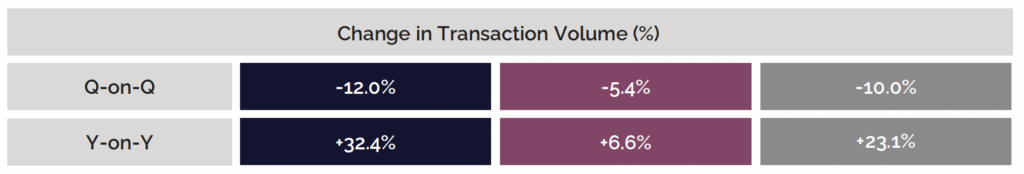

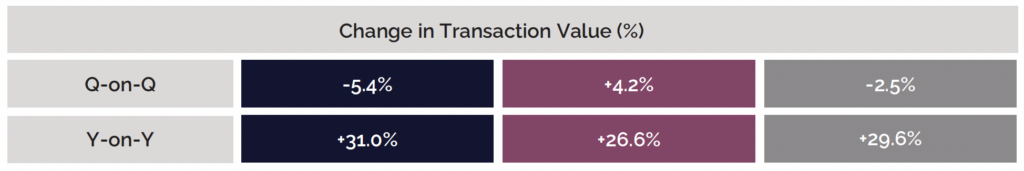

The UAE’s GDP is forecasted to grow by 4.7% in 2025, while Dubai is expected to see a 3.3% increase. This sustained economic expansion, supported by population growth and continued investor confidence, reinforces the UAE’s and Dubai’s positions as competitive global hubs. In the real estate sector, Dubai’s residential market recorded over 42,000 sales transactions in Q1 2025, reflecting a 10.0% quarterly decline due to a slowdown in new project launches and seasonal factors. However, year-on-year performance remained strong, with transaction volumes rising by 23.1% and total sales value reaching AED 114.4 billion, a 29.6% increase. Apartment sales led the market, while demand for villas and townhouses also grew, reflecting end-users’ preference for larger living spaces.

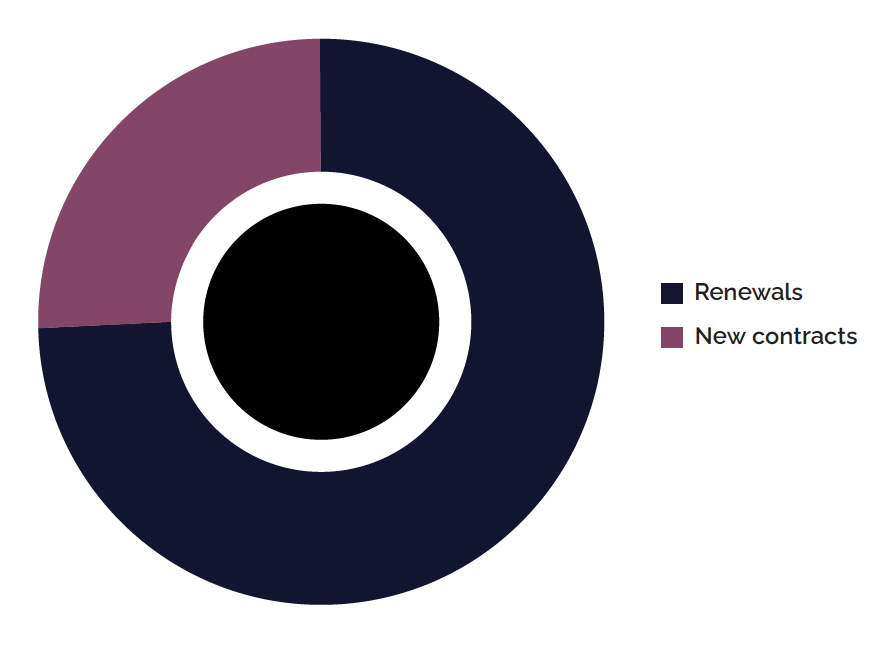

Approximately 9,300 units were completed in Q1, with Jumeirah Village Circle leading the way. An additional 73,000 units are expected in 2025, with a projected 300,000 units by 2028. Price growth moderated to 2.8% quarter-on-quarter and 15.8% year-on-year, while rental prices rose by 1.0% quarter-on-quarter and 14.4% year-on-year. Renewals now account for 70% of rental contracts, largely due to the implementation of the new Smart Rental Index. Gross rental yields stood at 7.3% for apartments and 5.0% for villas.

Despite a softer Q1, Dubai’s real estate market is projected to remain robust throughout 2025, although the performance of the remaining quarters will be closely monitored. The market is expected to be driven by population growth, sustained investor interest, strong demand in the luxury segment, and a solid macroeconomic foundation.

This report examines the key drivers behind this momentum, analyses trends in property prices and transaction volumes, and offers an outlook for Dubai’s residential real estate sector.

Dubai Market Snapshot for Q1 2025

- Dubai GDP Forecast for 2025: +3.3%

- Overall Residential Sales Transactions Volume: 42,200 (+23.1% vs. Q1 2024)

- Secondary Residential Sales Transactions Volume: 13,100 (+6.6% vs. Q1 2024)

- Off-Plan Residential Sales Transactions Volume: 29,100 (+32.4% vs. Q1 2024)

- Overall Residential Sales Transactions Value: AED 114 Billion (+29.6% vs. Q1 2024)

- Secondary Residential Sales Transactions Value: AED 37 Billion (+26.6% vs. Q1 2024)

- Off-Plan Residential Sales Transactions Value: AED 77 Billion (+31.0% vs. Q1 2024)

- Overall Residential Mortgage Transactions Volume: 9,200 (+23.7% vs. Q1 2024)

- Overall Residential Mortgage Transactions Value: AED 20 Billion (+46.2% vs. Q1 2024)

- Number of Residential Units Delivered in Q1 2025: 9,300 Units

- Number of New Residential Launches in Q1 2025: 28,600 Units

- Project Residential Supply for 2025: 73,200 Units

Macroeconomic Overview and Outlook

Macroeconomic Overview

According to estimates from the Central Bank of the UAE, the national economy expanded by 3.9% in 2024, marking the highest growth rate among GCC countries. This strong performance was predominantly driven by sustained growth in the non-oil sector, reflecting the success of the UAE’s long-term diversification strategy. Dubai played a pivotal role in this progress, further consolidating its status as a regional hub for innovation, trade, and investment, and exerting a significant influence on the nation’s overall economic trajectory.

Building on this strong economic foundation, the value of exports and re-exports by Dubai Chamber of Commerce members surged by 16.8% year-on-year to reach AED 86 billion in Q1 2025. At the same time, Dubai’s population grew by over 50,000 in Q1 2025, increasing 1.3% from the previous quarter to 3.915 million, highlighting the city’s continued appeal as a dynamic destination for talent and opportunity.

Macroeconomic Outlook

Both GDP and population are projected to continue their upward trajectory in 2025. According to the Central Bank of the UAE, the country’s GDP is expected to grow by 4.7% in 2025 and 5.7% in 2026, driven by strong performance across both non-hydrocarbon and hydrocarbon sectors. Meanwhile, the IMF forecasts Dubai’s GDP to grow by 3.3% in 2025 and 3.5% in 2026, reflecting continued strength across key economic sectors. If population growth continues at the pace observed in 2024, Dubai’s population could approach 4 million by the end of 2025, further supporting economic expansion through increased domestic demand and a growing workforce.

These positive developments reflect both the UAE’s and Dubai’s resilience and global competitiveness, enhancing investor confidence and strengthening their position as premier destinations for innovation, talent, and long-term economic advancement. 3 Dubai

Residential Sales Transactions

Residential Sales Transactions: By Volume

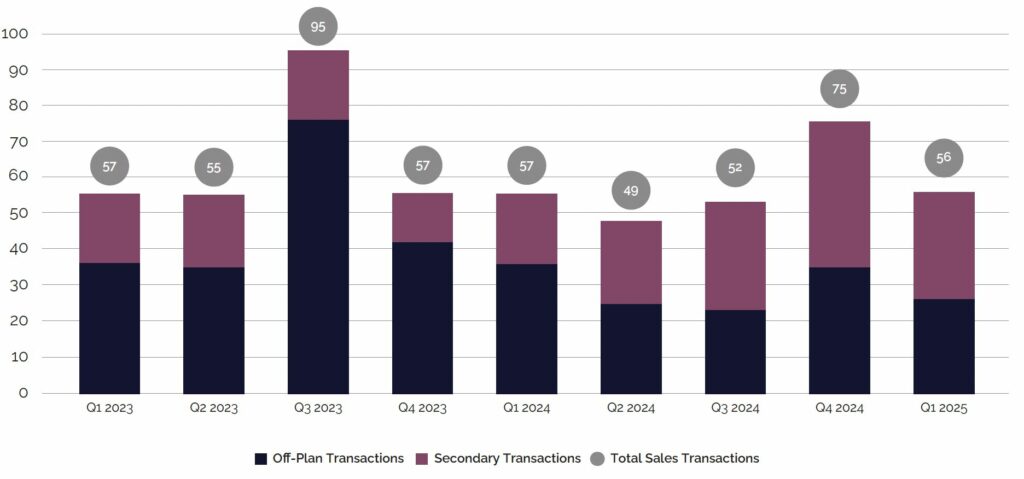

In the first quarter of 2025, the total volume of residential sales transactions reached approximately 42,000, reflecting a 10.0% decline from the previous quarter. This decline was observed across both the off-plan and secondary markets, driven by fewer new project launches during the period, as well as the possible seasonal impact of reduced activity during Ramadan and the Eid holidays, which fell within the reporting period.

However, on a year-on-year basis, both off-plan and secondary market transaction volumes showed growth, driven by a combination of investor activity and end-user demand. Investors remain attracted to the market’s potential for stable returns and capital appreciation, while more end-users are choosing to purchase rather than rent—likely influenced by increasing rental prices and growing concerns over long-term affordability

Dubai Residential Sales Transactions – By Volume

Source: Property Monitor, Cavendish Maxwell

Based on initial figures from the Dubai Land Department (DLD), off-plan transaction volume was recorded at approximately 24,000. Although Oqood registrations are typically used to measure off-plan activity, several villa and townhouse sales were recorded as completed properties with Title Deeds rather than as under-construction units sold off-plan. Following the technical adjustment for this classification, the revised off-plan transaction volume increases to around 29,000. These updated figures have been incorporated into the report.

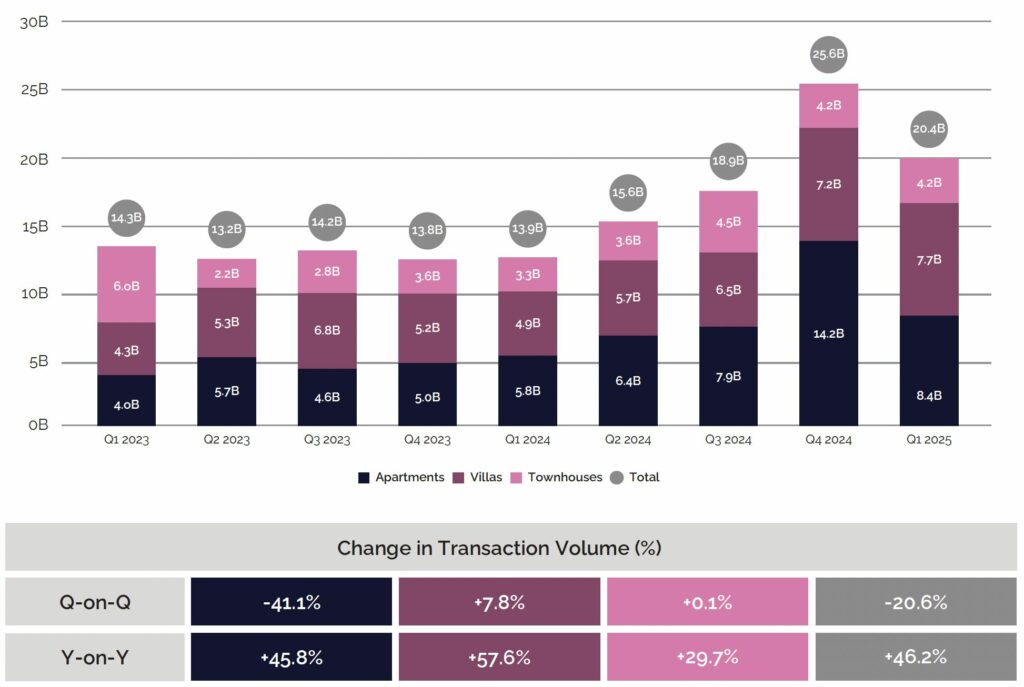

Residential Sales Transactions: By Value

A similar trend is observed in terms of sales transaction value. The total value of residential transactions reached AED 114.4 billion in Q1 2025, with the secondary segment contributing AED 36.9 billion and the off-plan segment accounting for AED 77.5 billion.

Interestingly, while the volume of secondary transactions declined compared to the previous quarter, the value increased, indicating that higher-value properties were transacted.

Dubai Residential Sales Transactions – By Value (AED Billions)

Source: Property Monitor, Cavendish Maxwell

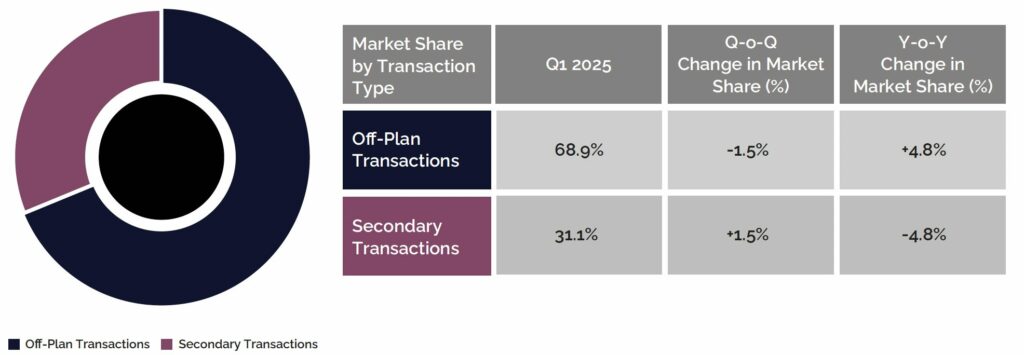

Residential Sales Transactions: Off-Plan vs. Secondary Market

In Q1 2025, off-plan sales accounted for approximately 29,100 transactions, representing a market share of 68.9%—a clear indication of the segment’s continued dominance in Dubai’s real estate market. Although Oqood registrations are typically used to measure off-plan activity, several villa and townhouse transactions have been recorded by the Dubai Land Department as completed properties with Title Deeds, rather than as under-construction and sold off-plan. Before accounting for this classification difference, the off-plan segment’s market share stood at 58.9%.

Residential Sales by Transaction Type – Q1 2025

Source: Property Monitor, Cavendish Maxwell

Residential Sales Transactions: By Property Type

Apartments continue to account for the majority of property sales in Dubai, making up around 76% of all transactions. However, their market share has seen a slight decline on both a quarterly and annual basis. This shift is largely driven by growing demand for larger homes such as townhouses and villas. Many end-users, particularly families, are seeking more space as they plan to settle in the city for the long term. At the same time, investors are increasingly targeting these larger properties, recognising their appeal to a rising tenant base of families and long-term residents.

Residential Sales Transactions by Property Type – Q1 2025

Source: Property Monitor, Cavendish Maxwell

Residential Sales Transactions: Top Real Estate Developers by Transactional Volume

Emaar reclaimed the top position in terms of transactional volume, capturing 15.2% of initial sales and surpassing DAMAC Properties, which held a 13.1% share. Sobha Group secured third place with 5.5%. Notably, Aldar Properties made a significant leap into the top 10, climbing 95 positions, highlighting its growing presence in Dubai’s real estate market, driven by strong sales from projects such as Haven and Athlon. The shift in rankings reflects the intense competition within the market, as developers could be seen differentiating themselves through attractive payment plans, distinctive designs, premium amenities, and well-planned communities that appeal to both local and international buyers.

Top 10 Real Estate Developers by Transactional Volume (Initial Sale)

| Developers | Rank – Q1 2025 | Rank – Q1 2024 | Rank change from Q1 2024 |

| Emaar | 1 | 2 | +1 |

| Damac Properties | 2 | 1 | -1 |

| Sobha Group | 3 | 4 | +1 |

| Binghatti | 4 | 8 | +4 |

| Danube Properties | 5 | 3 | -2 |

| Samana Developers | 6 | 6 | – |

| Dubai Properties | 7 | 11 | +4 |

| Nakheel | 8 | 13 | +5 |

| Aldar Properties | 9 | 104 | +95 |

| Azizi | 10 | 5 | -5 |

Source: Property Monitor, Cavendish Maxwell

The year began with a brief dip in the rate per square foot, marking the first decline in the current market cycle. This was followed by a steady recovery over the subsequent months. Although recent growth has been more moderate compared to earlier periods, the trend suggests that prices may be starting to stabilise. Nevertheless, the market remains on track for a modest annual increase.

With a weakened Dollar, strong rental returns and appealing yields, Dubai continues to attract both local and international buyers. This trend is likely to support the absorption of upcoming off-plan launches throughout the year.

Ronan Arthur

Director, Head of Residential Valuation

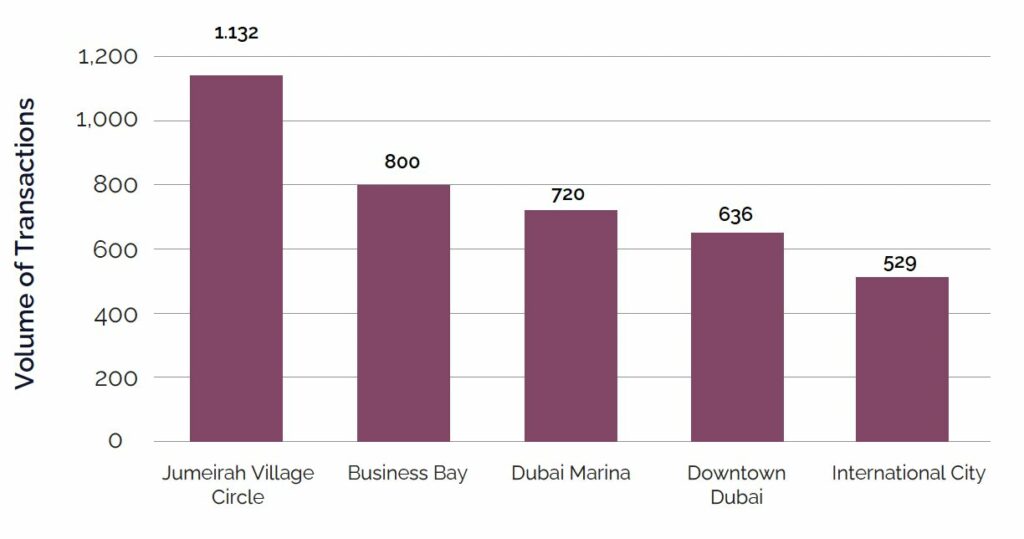

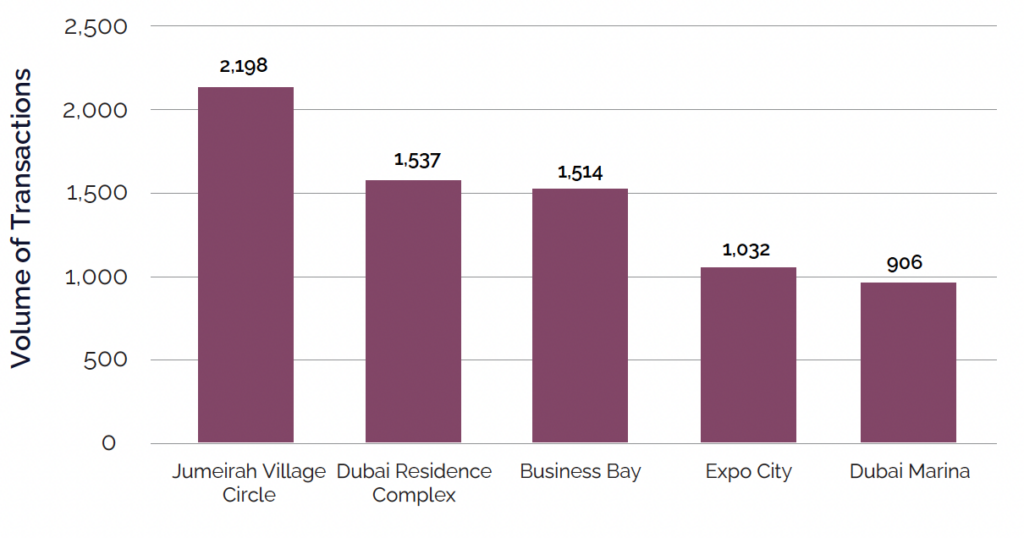

Residential Sales Transactions: Top Five Locations

For Apartment Transactions by Volume – Q1 2025

Source: Property Monitor, Cavendish Maxwell

Source: Property Monitor, Cavendish Maxwell

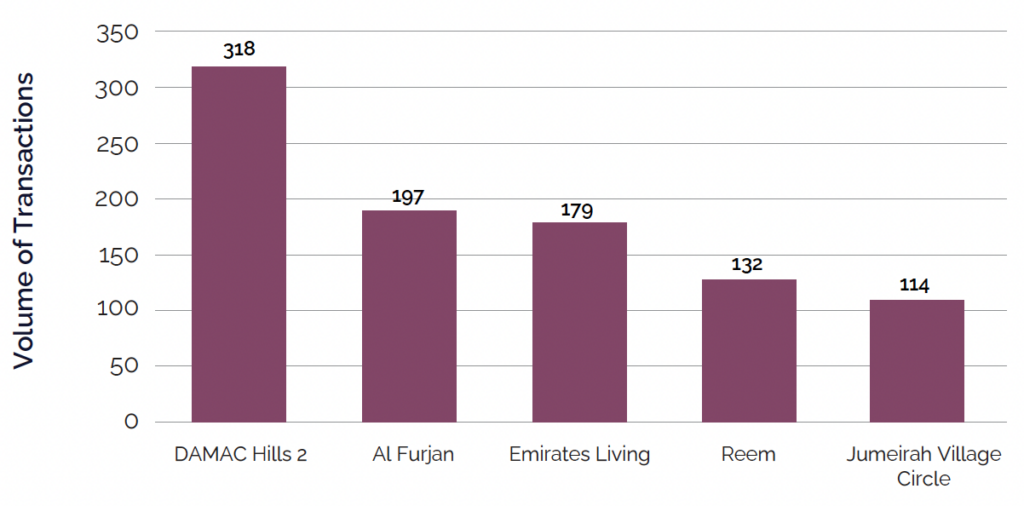

For Villa/Townhouse Transactions by Volume – Q1 2025

Source: Property Monitor, Cavendish Maxwell

Source: Property Monitor, Cavendish Maxwell

Residential Sales Transactions: Luxury Properties (AED 20 million and above)

Dubai’s luxury property market continues to perform strongly, with steady momentum across both the off-plan and secondary segments. In Q1 2025, nearly 590 transactions were recorded for properties priced at AED 20 million and above, highlighting robust demand from High-Net-Worth Individuals (HNWIs) and reinforcing Dubai’s reputation as a global destination for luxury real estate. This demand is fuelled by favourable tax policies, long-term residency incentives, and the city’s exceptional global connectivity, all of which continue to attract HNWIs and contribute to the luxury market’s sustained growth and resilience.

Dubai Luxury Property Sales Transactions – By Volume

Source: Property Monitor, Cavendish Maxwell

Residential Sales Transactions: Ultra-Luxury Properties (AED 50 million and above)

Although Dubai’s Ultra-Luxury segment has limited supply, transaction volumes continue to reflect steady performance. Despite quarterly fluctuations, the segment remains stable and is steadily cementing its position as a niche investment class for both local and international elite buyers.

Dubai Ultra-Luxury Property Sales Transactions – By Volume

Source: Property Monitor, Cavendish Maxwell

Residential Mortgage Transactions

In line with the overall decline in sales transactions, residential mortgage activity in Dubai also saw a quarterly drop, with decreases across all property types. Apartments experienced the most significant decline. However, on a year-on-year basis, the trend reverses, with mortgage volumes showing growth across the board, indicating continued confidence and long-term interest in the market. If the US Federal Reserve cuts interest rates in the coming months, borrowing conditions in Dubai could improve, potentially driving an increase in mortgage activity and supporting demand from both end-users and investors.

Dubai Residential Mortgage Transactions – By Volume

Source: Property Monitor, Cavendish Maxwell

There was a noticeable quarterly decline in mortgage transaction values as well, primarily driven by reduced activity in the apartment segment. However, the value of villa mortgage transactions saw an increase, likely reflecting higher-value properties being mortgaged, which suggests stronger demand in the premium and end-user segments.

Dubai Residential Mortgage Transactions – By Value

Source: Property Monitor, Cavendish Maxwell

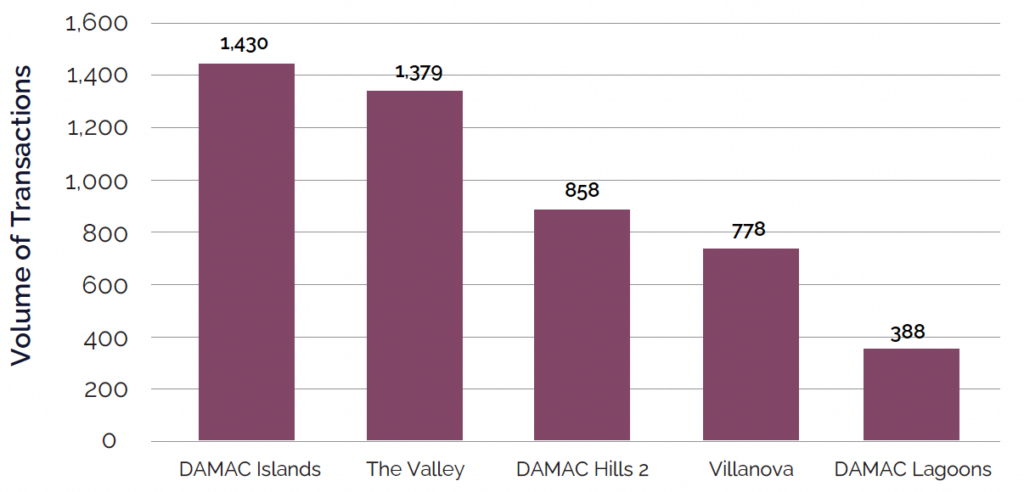

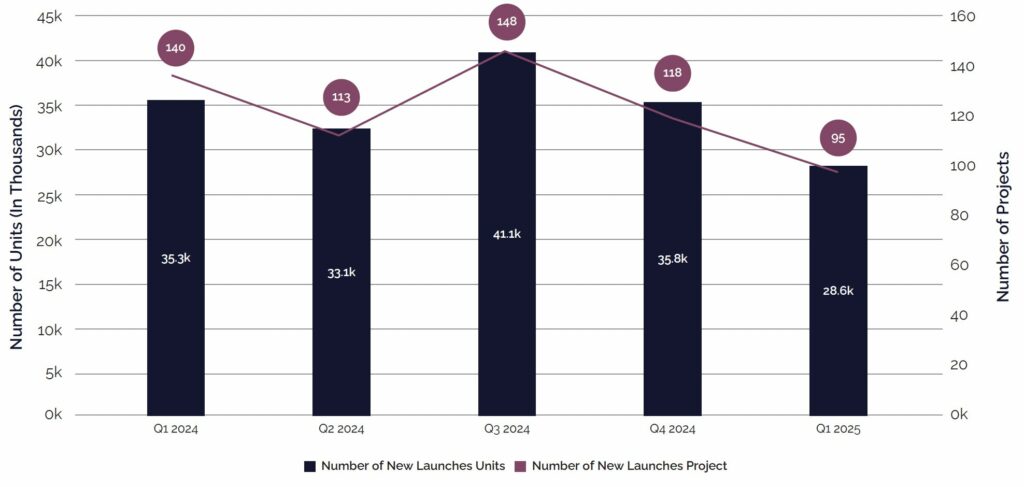

New Residential Project Launches

In the first quarter of 2025, approximately 95 new projects were launched, which are expected to bring nearly 28,600 residential units to the market. The slower pace of launches compared to previous quarters appears to have contributed to the decline in off-plan transactional volume. The number of new launches throughout the year will likely play a significant role in shaping off-plan market activity. If this downward trend continues, it may indicate that developers are focusing on clearing existing inventory to improve absorption rates before releasing additional supply.

New Launches: Number of Units and Projects

Although apartments continue to dominate both new project launches and sales transactions, villas and townhouses are increasingly gaining traction, driven by end-user demand for larger family homes. Developers could be seen responding to this shift by increasing the supply of villas and townhouses, likely anticipating continued or growing demand for these property types.

New Unit Launches by Property Type – Q1 2025

Source: Property Monitor, Cavendish Maxwell

Residential Supply: Number of Completed Units

Approximately 9,300 residential units were completed in the first quarter of 2025, with apartments accounting for 79% of the total and the remainder comprising of villas and townhouses. This marks the second-highest quarterly completion volume in the past two years, surpassed only by the fourth quarter of 2023.

Number of Completed Residential Units (in Thousands)

Source: Property Monitor, Cavendish Maxwell

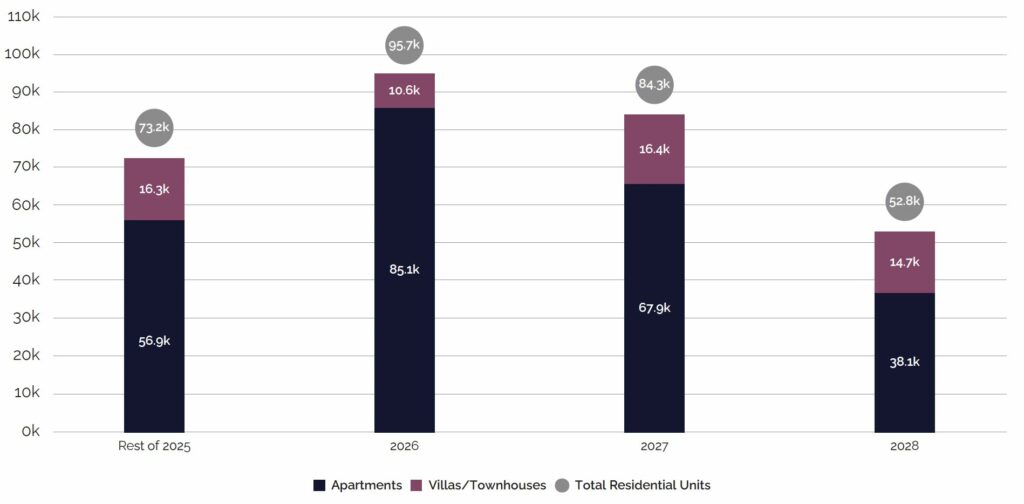

Residential Supply: Upcoming Residential Supply

Dubai’s housing supply is expected to experience substantial growth, with nearly 300,000 units projected to enter the market by 2028. A significant portion of this new supply is anticipated in 2026 and 2027, indicating a potential surge in completions during those years. Over the remainder of 2025, approximately 73,000 units are expected for delivery; however, actual completions may be impacted by shifting market dynamics, evolving buyer preferences, and potential delays in construction timelines. Given these factors, it will be crucial to observe how developers adjust their strategies to manage this increased supply, respond to market demand, and ensure timely delivery.

Upcoming Residential Supply (in Thousands)

Source: Property Monitor, Cavendish Maxwell

Leading five Dubai submarkets

Completed Units in Q1 2025

- Jumeirah Village Circle

2,433 units - Mohammed Bin Rashid City

1,037 units - Business Bay

743 units - Downtown Jebel Ali

647 units - Rukan

636 units

Upcoming Property Supply (2025-2028)

- Jumeirah Village Circle

27,082 units - Business Bay

19,472 units - Azizi Venice

17,108 units - DAMAC Lagoons

10,733 units - Arjan

9,752 units

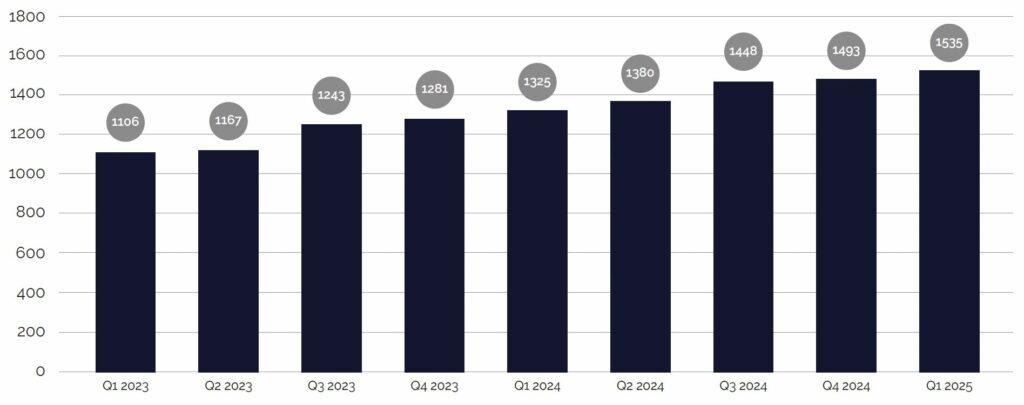

Dubai Sales Price Trend

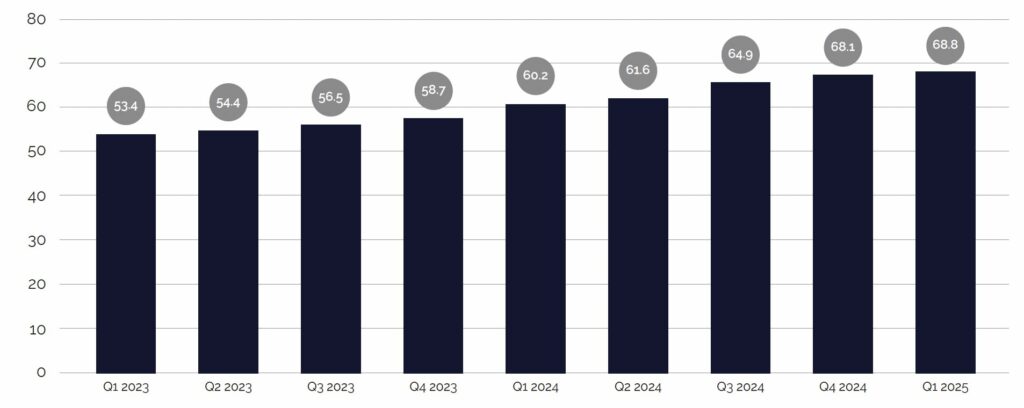

The Dubai residential market extended its growth momentum into the first quarter of 2025, with sales prices rising by 2.8% quarter-on-quarter and 15.8% year-on-year. This sustained increase has been fuelled by strong demand from a diverse buyer base, including investors, end-users—particularly first-time homeowners.

The wide range of available residential properties continues to cater to various budgets and lifestyle preferences, reinforcing Dubai’s position as a dynamic and inclusive housing market. Growth has also been supported by developer-led incentives and ongoing Government initiatives, both of which have helped strengthen buyer confidence.

Although sales prices dipped slightly in January 2025, they have since rebounded. That said, compared to previous years, the pace of quarterly price growth appears to be moderating. The average quarterly increase in 2023 and 2024 was approximately 4.0%, suggesting the market may be entering a more stable and mature phase.

As a result, it will be crucial to closely monitor these trends in the coming quarters to assess the sustainability of this growth and potential shifts in market dynamics.

Dubai Sales Price Trend (in AED/SQF)

Source: Property Monitor, Cavendish Maxwell

Dubai Rental Price Trend

According to rental contract data from the Dubai Land Department, residential rents increased by 1.0% quarter-on-quarter and 14.4% year-on-year in Q1 2025. While demand for housing remains strong amid continued population growth, the first quarter recorded the lowest quarterly rental growth in the past two years—previous quarters saw increases ranging from 2% to 6%. This slower pace of growth could be partly attributed to the influx of approximately 9,300 new units delivered in Q1 2025, as well as the introduction of the New Smart Rental Index, which may be influencing tenant expectations and price adjustments.

As additional supply is expected to enter the market in the coming quarters, it will be crucial to monitor how rental trends evolve in response to this increasing inventory and shifting regulatory framework.

Dubai Rental Price Trend (in AED/SQF/YEAR)

Source: Property Monitor, Cavendish Maxwell

Share of New and Renewal Rental Contracts – Q1 2025

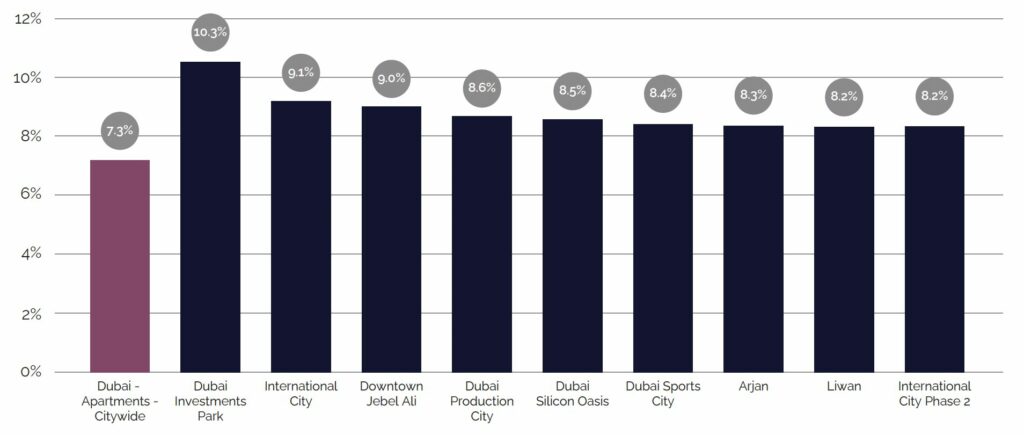

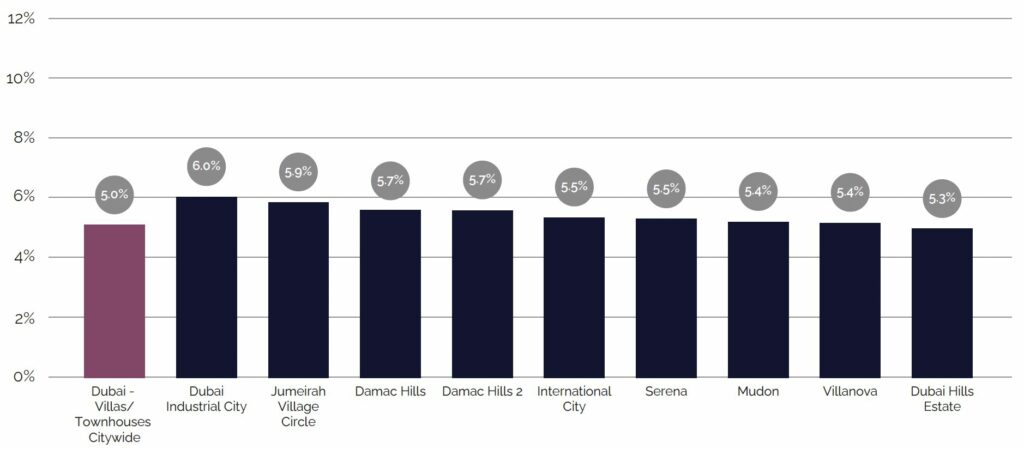

Gross Rental Yields: Apartments and Villas/Townhouses

As of the end of Q1 2025, gross rental yields in Dubai stood at 7.3% for apartments and 5.0% for villas and townhouses. Gross Rental Yields have remained relatively stable and continue to outperform many global markets. The consistency and strength of rental returns remain a key driver for investor interest, reinforcing Dubai’s appeal as a uniquely attractive real estate investment destination.

Top 10 Areas by Gross Rental Yields – Apartments

Source: Property Monitor, Cavendish Maxwell

Top 10 Areas by Gross Rental Yields – Villas/Townhouses

Source: Property Monitor, Cavendish Maxwell

2025 Real Estate Market Outlook

Following a subdued start to 2025, the performance of Dubai’s real estate market in the remaining quarters will be closely watched. While both sales and rental prices posted growth in Q1, the pace of quarter-on-quarter increases was relatively modest. This was largely due to a surge in residential supply, with Q1 2025 recording the second-highest quarterly completion volume in the past two years, exceeded only by Q4 2023. If this delivery pace continues, the market may experience another stable quarter, potentially signalling a transition towards a more balanced and mature phase. Although approximately 73,000 residential units are projected for delivery in 2025, actual completion rates tend to be lower. Additionally, the introduction of the New Smart Rental Index is also expected to influence rental price trends, shaping both landlord strategies and tenant expectations.

In terms of sales transactions, both the off-plan and secondary markets experienced a decline in Q1’2025 compared to Q4 2024, primarily due to a slowdown in new launches and seasonal factors. Despite this, demand remains strong, with both segments showing notable year-on-year growth. This ongoing momentum is driven by investor interest in attractive yields and end-users seeking long-term residency options in Dubai. Government initiatives and developer incentives continue to play a key role in boosting buyer confidence and solidifying the city’s status as a prime property investment destination.

Dubai’s Luxury and Ultra-Luxury residential segments are also expected to remain robust throughout 2025. With nearly 590 transactions exceeding AED 20 million recorded in Q1 alone, demand from high-net-worth Individuals shows no signs of weakening. This strong demand is supported by favourable residency schemes, a competitive tax environment, and Dubai’s positioning as a globally connected, lifestyle-driven hub — factors that continue to attract elite regional and international buyers.

Overall, Dubai’s steady macroeconomic performance continues to provide a strong foundation for the real estate sector, with both GDP and population growth expected in 2025, supported by a consistent inflow of expatriates and long-term residents. These key structural factors are expected to support demand across both the sales and rental markets throughout the year.

Dubai’s residential market now stands at the intersection of three key trends. First, continued job opportunities, favourable tax structures, infrastructure improvements, and lifestyle factors, particularly healthcare, safety, and education, all of which continue to attract international talent and have propelled Dubai up the major global city liveability rankings.

Dubai’s residential market now stands at the intersection of three key trends. First, continued job opportunities, favourable tax structures, infrastructure improvements, and lifestyle factors, particularly healthcare, safety, and education, all of which continue to attract international talent and have propelled Dubai up the major global city liveability rankings.

Second, strong macroeconomic fundamentals have driven economic growth, stock market performance, and foreign direct investment, all of which continue to outpace those of comparable developed markets.

How these three trends interact will determine not only the trajectory of prices for the remainder of 2025, but also their influence on the market over the longer term.

Julian Roche

Chief Economist, Cavendish Maxwell