Dubai’s Office Market Performance – Autumn 2024

Quality of office real estate driving occupancy

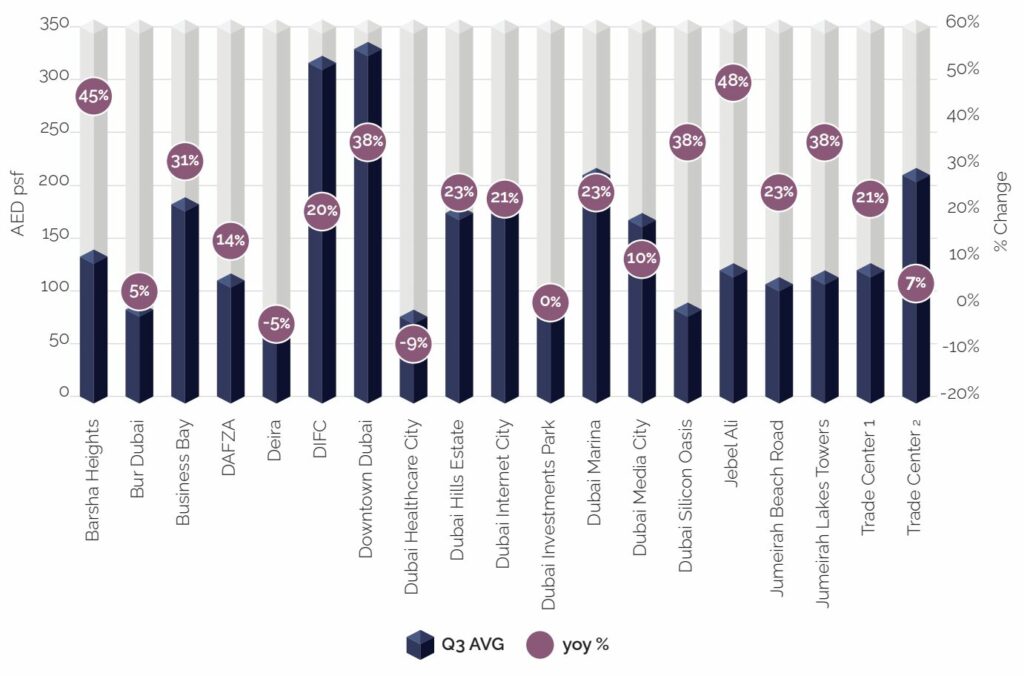

In the third quarter of 2024, strong demand and heightened leasing activity drove rents higher in Dubai’s office market. City-wide office rents increased by 21% compared to the previous year. Notably, average Grade A rents in DIFC experienced a 20% annual increase, reaching AED 317 per sqft per annum. In nearby Downtown Dubai, rents saw a remarkable 37% increase from the previous year, hitting AED 333 per sqft per annum. Most of the tracked submarkets reported significant year-on-year gains, highlighting the resilience and growth potential of Dubai’s office sector.

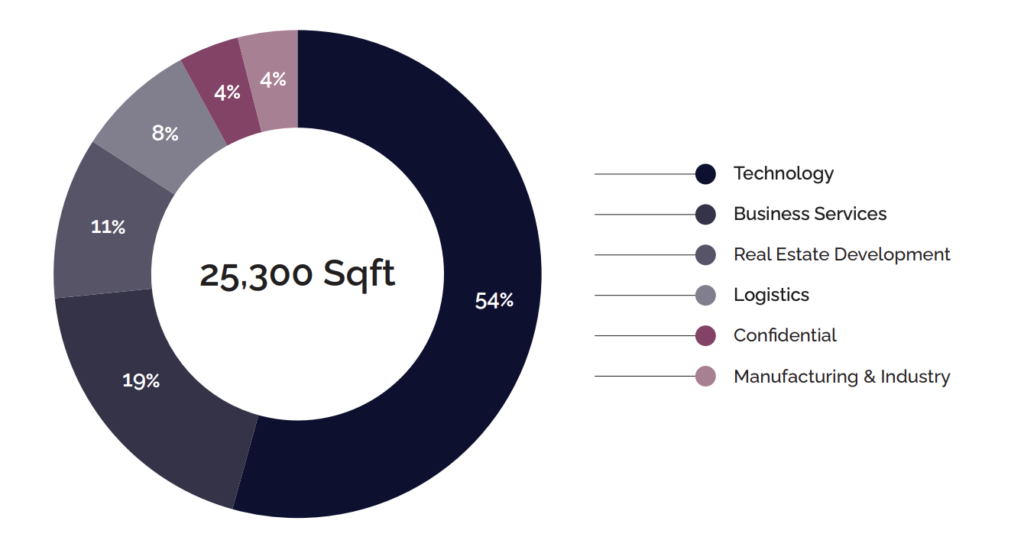

Dubai | New office requirements by sector – H1 2024

The Dubai office market has remained strong throughout the first nine months of 2024, driven by the influx of new companies and the growing business environment. Despite high occupancy rates in prime submarkets like DIFC and Downtown Dubai, many businesses have explored alternative options such as Dubai Hills Estate, Dubai Media City, and Dubai South. Over 34,000 new companies joined the Dubai Chamber of Commerce in the first half of 2024, a 5% increase year on year, with Indian businesses leading the way. This growth reflects Dubai’s vibrant business environment and its ability to attract foreign direct investment.

According to Cavendish Maxwell’s internal data, the technology and business services sectors accounted for over 18,600 square feet of new demand in the first half of 2024, representing 54% and 19% of the total demand, respectively

Dubai Office Rental Transactions – Q3 2024

Source: Cavendish Maxwell Research

IN FOCUS

Dubai Expo City: A thriving hub of growth

Master Plan Overview

His Highness Sheikh Mohammed bin Rashid Al Maktoum has approved a new master plan for Expo City Dubai, positioning it as a key driver of the emirate’s future development and global stature. This vision aligns with Dubai’s long-term strategy to create a sustainable, future-ready city that enhances quality of life and attracts innovators and investors.

Spanning 3.5 sq km, Expo City is projected to accommodate over 35,000 residents and 40,000 professionals, fostering a vibrant community. The development will support key infrastructure projects, including Al Maktoum Airport and Jebel Ali Port, and is integral to Dubai’s Economic Agenda D33, which aims to double the emirate’s economy by 2033.

The new plan prioritises sustainable development and smart urban design, with green spaces and advanced infrastructure aimed at achieving Net Zero emissions by 2050. The expansion of the Dubai Exhibition Centre within Expo City is expected to enhance Dubai’s position in the global MICE (Meetings, Incentives, Conferences, and Exhibitions) sector.

In summary, the master plan for Expo City Dubai marks a significant step towards establishing the emirate as a global leader in sustainability, innovation, and urban development, while also creating a collaborative environment that nurtures creativity and community engagement.

Office Spaces at Dubai Expo City

Expo City Dubai is designed as a fully integrated 15-minute community that harmoniously blends work, living, and leisure. This development features a diverse range of premium office spaces, event venues, green areas, cultural attractions, hotels, restaurants, retail outlets, and residential units, all contributing to a vibrant business ecosystem.

The community encourages collaboration among a variety of stakeholders, including multinational corporations, SMEs, startups, government entities, academic institutions, and entrepreneurs, all within a sustainable and technologically advanced environment. This focus on diversity fosters a dynamic business landscape, promoting innovation and growth.

Office Options and Sustainability

Expo City offers flexible office options tailored to meet a range of business needs, from small workstations to larger offices and entire buildings, accommodating both startups and established firms. The office buildings are certified to LEED Platinum and Gold standards, reflecting a strong commitment to sustainability and innovative design.

Accessibility is a key feature, with direct parking access and extensive outdoor facilities. The site is also conveniently located near hotels, metro stations, and recreational spaces, enhancing the overall experience for users.

Community Features

The development boasts a BREEAM Excellent-rated public realm and a dynamic free zone with tailored business setup options. Car-free districts promote sustainable mobility, while running and cycling tracks, parks, and shaded areas further enhance the quality of life.

Dubai office crunch escalates

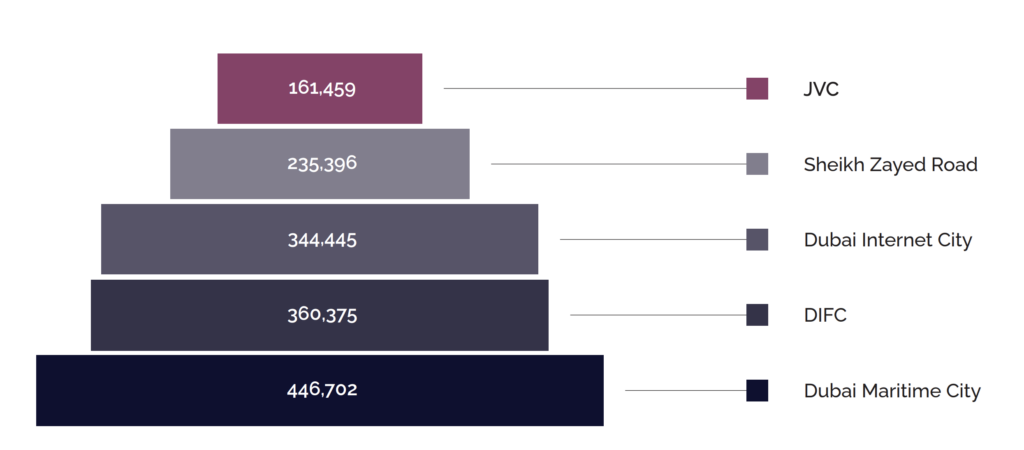

Given the surge in demand and occupancy levels in the emirate, developers plan to add 1.55 million sqft of space to the office stock. However, this amount is not enough to meet the growing needs of businesses. Most of the office spaces currently under construction are already pre-leased.

Several new Grade A office projects have been launched but are still in the planning stages, including Uptown Dubai: Phase 2 in JLT, the Dubai AI & Web 3.0 Campus in DIFC, Aldar Office Tower on Sheikh Zayed Road, and the Lamar Development Grade A Office Park in Business Bay. Together, these projects are expected to add a total of 2.13 million sqft of office space to Dubai’s market by 2028.

Office under construction supply – 2024-2026

Source: MEED, Cavendish Maxwell Research

Investment landscape

The investment market in Dubai has also experienced significant growth, with a 26% increase in transaction volumes compared to the same period last year, amounting to AED 1.5 billion. There were 739 deals recorded during Q3 2024, a 3% rise on the same time last year.

The top five submarkets for sales during the first nine months of 2024 were Business Bay (AED 1.82 billion), JLT (AED 1.26 billion), Downtown (AED 340 million), Barsha Heights (AED 214 million), and Motor City (AED 187 million).

Business Bay (42%) and Jumeirah Lake Towers (29%) accounted for the bulk of office sales in the first nine months of 2024. The city-wide average transacted price was AED 1,363 per sqft from January to September 2024, an 25% increase from last year.

Office Transferred Sales vs. Off-Plan: A resilient recovery

Historical data from the Dubai Land Department indicates that Dubai’s office sales volume from Q1 2017 to Q3 2024 has exhibited several notable trends. Overall, the market has shown fluctuations in transferred sales, with a significant peak in Q4 2021 at 505 office deals, indicating a strong recovery following the pandemic’s impact in 2020, where sales dropped dramatically. After this peak, sales volume remained relatively stable, hovering around 500 to 600 office transactions per quarter until Q3 2024, when it reached 678 office deals.

Conversely, off-plan sales have experienced a more volatile pattern, peaking in at office off-plan transactions in Q2 2024 after a prolonged period of low activity. This reflects a gradual resurgence in off-plan interest, especially notable in the latter part of 2023. Despite this increase, off-plan sales remain significantly lower than transferred sales, highlighting the preference for ready-to-move-in office properties in Dubai in common of course with most other markets.

Historical Dubai office sales volume

Source: MEED, Cavendish Maxwell Research

Expert insight

“From an economic perspective, the survival and growth of Dubai’s office market reflects two main factors. First, sustained economic growth and the continued migration of overseas companies. This has propelled Dubai to a dominant position in global Foreign Direct Investment. But second and equally important, the continued adherence of both firms and their employees in Dubai to the Gulf model of face-to-face interaction that has driven occupancy rates. Dubai offices therefore remain attractive investments. But with substantial variations between districts, careful selection by both investors and tenants remains of paramount importance for value optimisation”

Julian Roche

Chief Economist

Outlook: Emerging opportunities and hedge fund growth

The outlook for securing high-quality office space in Dubai presents both challenges and emerging opportunities. As demand continues to outstrip supply, finding suitable options for relocation or consolidation is becoming increasingly difficult. However, the sublease market is anticipated to expand in the coming months, offering potential avenues for businesses as the market evolves and new developments arise.

A recent survey by the Gensler Research Institute, which included over 16,000 full-time workers globally, revealed that more than 70% of UAE employees believe office settings enhance productivity. This sentiment is reflected in the rising popularity of co-working spaces, with 66% of employees working in such environments. Notably, 94% of highly engaged employees in the UAE value flexible work arrangements, which significantly boost their satisfaction and loyalty. While nearly half of the workforce has returned to traditional office settings, 71% still assert that office environments are vital for optimal productivity. The demand for Grade A office space remains robust, particularly in Dubai, where these premium environments continue to thrive amid stagnation in other markets. With the UAE ranking third among 15 countries for exceptional workplaces, an impressive 97% of highly engaged employees demonstrate strong commitment to their companies.

At the same time, Dubai’s status as a leading global financial hub is further solidified by the thriving hedge fund sector, with Dubai International Financial Centre (DIFC) hosting thirteen of the world’s top 100 hedge funds. Factors such as a favourable regulatory framework, economic stability, and strong infrastructure contribute to this trend, creating a conducive environment for investment. The region’s expanding wealth landscape, driven by a rising population of millionaires, further supports this growth, alongside government initiatives like the establishment of the DIFC Funds Centre. The growth of hedge funds not only aids in diversifying the UAE’s economy by investing in various sectors but also generates high-value jobs and enhances market efficiency through sophisticated investment strategies.

While the office market currently faces challenges, the increasing presence of hedge funds suggests a rising demand for office space in the future. As the market continues to evolve, innovative solutions will likely emerge to meet the changing needs of businesses in this dynamic financial hub.