Dubai’s Residential Market Performance – Autumn 2024

Dubai’s Residential Market Performance

Dubai’s residential real estate market continued to see a remarkable surge in activity throughout the first nine months of 2024. Both transaction volume and value have reached new highs, surpassing previous records. This unprecedented growth can be attributed to several factors, including increased investor confidence, economic stability, and a favourable regulatory environment. In this report, we explore the key drivers behind this momentum, analyse trends in property prices and sales volumes, and examine the outlook for Dubai’s residential sector

Price Appreciation and Market Stability

Price appreciation has slowed somewhat compared to the previous month, where we saw a surge nearly double the average rate seen during this recovery cycle. The rate of growth has now moderated to just over 1%, representing a more stable and sustainable figure. Looking at past market cycles, we aim to avoid runaway growth, where month-on-month increases of 2% to 2.5% persist. If such growth continued over several months, it could risk becoming unsustainable.

Record Transactions and Strong Momentum

The impact of price appreciation stability has been significant on sales transactions. October 2024 marked a record month, with over 20,459 transactions—the highest recorded this year. Every month this year, with the exception of April, has seen record-breaking activity. With 131,000 transactions as at end of October, we are now just a couple of thousand behind last year’s total of 133,000, and with two months remaining, the momentum shows no signs of slowing.

Market Performance and Leading Developers

Dubai’s residential market continues to soar, with the property index reaching a new high of 206 in October 2024, showing a strong month-on-month increase of 1.73%. Prices have now reached AED 1,473 per square foot, a 77.9% increase from the market low of April 2009. Year-over-year growth remains robust, climbing 17.19% for the 44th consecutive month of gains. Quarter-on-quarter, prices have surged by 5.44%, pushing the market to even greater heights.

Leading developers continue to play a significant role in this growth. Emaar, DAMAC, and Sobha Realty secured the top three spots in October, with Emaar holding the largest market share at 16.3%, closing 2,053 transactions. DAMAC followed closely with 14.8% market share and 1,863 transactions, while Sobha Realty captured 11.6% of the market with 1,463 transactions. These figures highlight the ongoing strength and competitiveness of Dubai’s real estate sector.

Luxury Market Activity

The luxury property market in Dubai remains exceptionally strong, with continued record-breaking sales. In October 2024, the most expensive property sold was a luxury villa in Jumeirah Bay, priced at AED 175 million. Following closely was an off-plan villa at EOME Residences on Palm Jumeirah, which sold for AED 170.5 million. Despite limited inventory in the ultra-high-end segment, the top-end of the market continues to experience strong transaction activity. These high-value transactions highlight Dubai’s position as a premier destination for exclusive, high-end real estate. This is complemented by substantial growth in the mid-market, where demand is driving both prices and sales volumes higher.

Mortgage Market Trends

Mortgage activity surged in October, reflecting the broader rise in sales transactions. The number of registered loans hit an all-time high of 4,318, marking a 3.26% increase from September and a 1.34% rise over the previous record. This uptick in mortgage activity aligns with recent interest rate easing, making financing more accessible and attractive for buyers. There has also been an unexpected surge in bulk mortgage transactions. This increase is likely driven by developers and investors with large portfolios, capitalising on the small rate reduction ahead of their loan maturities. With limited time remaining on their loans, many have chosen to act now.

Should interest rates drop further by 75 to 100 basis points, refinancing could become an attractive option for many mortgage holders, potentially leading to further market activity and refinancing opportunities.

Off-Plan Project Launches

This exceptional growth underscores the ongoing demand and resilience of Dubai’s property market. Each month, we’re witnessing historic transaction levels, signalling a robust investment climate.

The total transaction volume this year is four times that of pre-COVID levels. This isn’t merely a result of pandemic recovery; it reflects a market that was already stable and growing year after year. The current transaction volume is driven by strong demand, particularly in the off-plan market, which continues to outperform expectations.

Off-plan project launches have been booming in 2024, with nearly 100,000 new units brought to market, surpassing last year’s total. On average, a new off-plan development is being launched every day, or roughly every 19 hours, adding around 350 units to the market daily. These units are being rapidly absorbed, with developers selling the majority within a short time frame. This continued supply of off-plan projects suggests that the market will remain buoyant, with strong demand expected to persist.

Leading five Dubai submarkets – Units delivered (Q1-Q3 2024)

- Mohammed Bin Rashid City

1,129 units - Jumeirah Village Circle

768 units - Rukan, Dubailand

657 units - Al Furjan

630 units - Business Bay

549 units

Leading five Dubai submarkets – Future property supply (2024-2027)

- Jumeirah Village Circle

25,356 units - Business Bay

18,061 units - Dubai South

16,976 units - Mohammed Bin Rashid City

15,506 units - DAMAC Lagoons

15,150 units

Rental Yields & Payment Preferences

Dubai’s apartment rental yields remain strong, offering lucrative returns for property investors across a variety of key areas. As of October 2024, International City leads the way with an impressive 9.49% yield, followed closely by Dubai Investments Park at 9.43%. The average apartment rental yield in Dubai for October stood at 7.4%, reflecting the continued strength of the city’s dynamic real estate market. Whether in Dubai Production City, Downtown Jebel Ali, or other popular areas, rental yields continue to make Dubai an attractive destination for investors seeking strong returns.

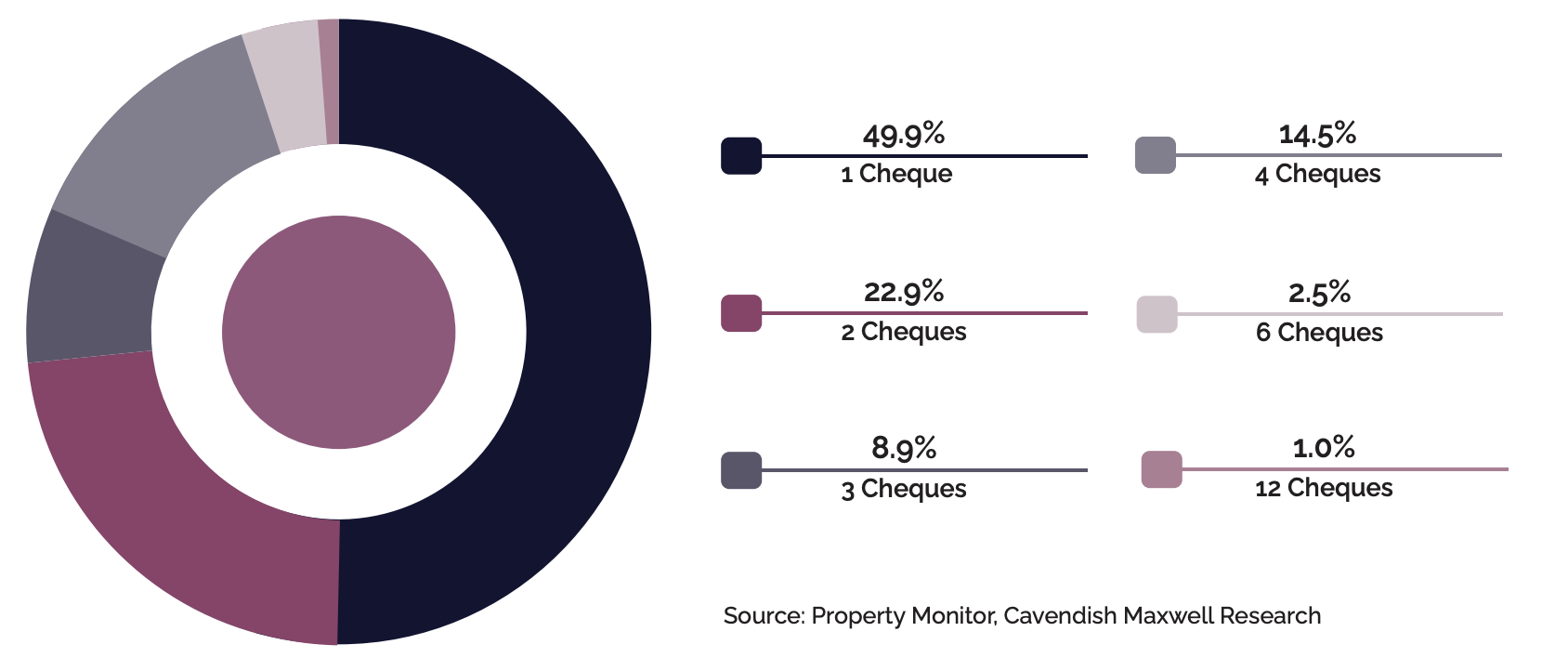

In addition to strong rental yields, tenants’ payment preferences also play a key role in the market dynamics. The graph below highlights the distribution of residential rent payment cheques in Dubai from January to October 2024. There is a clear preference for fewer cheques, largely driven by landlord preferences. Most tenants (49.9%) pay in a single cheque, followed by 22.9% who pay in two cheques and 14.5% who opt for four cheques. Other payment structures, including three, five, six, eight, nine, and twelve cheques, are far less common. This trend reflects landlords’ preference for lump-sum payments, with tenants generally adapting to these terms.

Rent Cheque Trends – YTD October 2024

Monitoring the Property Pipeline

Property Monitor tracks not only transactions but also the precursors to these sales. Prior to a sale being recorded, the platform monitors the mortgage process and property evaluations. It also tracks contracts, sales and buy agreements (SBAs), and listings. This comprehensive data provides valuable insights into the market pipeline at various stages. Indicators suggest the potential for further record-breaking months ahead. For example, October 2024 marked another milestone, with over 20,000 transactions recorded. The steady pipeline of off-plan projects, combined with ongoing demand for ready properties, indicates that the gap between the ready market and the off-plan market is likely to continue widening in the coming months.