Mena hotel construction to focus on Saudi Arabia and Egypt

The Middle East and North Africa is forecast to see a rapid increase in hotel construction over the next 12 months, led in particular by high-end properties in Saudi Arabia and Egypt, new industry data suggests.

During the second quarter of 2024 there were 607 projects and 147,088 rooms in the overall regional pipeline at the end of June.

This represents a 2 percent increase over the same time last year for hotels, and less than 1 percent growth for rooms.

About half of those, or 300 developments and 80,867 rooms, were under construction in Q2, according to Lodging Econometrics’ latest report.

Another 145 hotels and 34,706 rooms are slated to break ground in the next 12 months, which would represent a 42 percent year-on-year jump in ongoing projects and 45 percent more rooms being built.

According to Tatiana Veller, managing director of Stirling Hospitality Advisors, the “modest” 2 percent annual increase in the second quarter stems partially from the many projects delayed during the pandemic.

Their construction resumed as things began normalising in late 2020 and 2021, and they are now being finished and exiting the pipeline.

The 42 percent “surge” in projects that have entered Phase 2, meaning those expected to commence construction within the next year, “can be partially explained by heightened investor interest in the Middle Eastern hospitality market during 2022-2023,” Veller says.

There were an additional 162 hotels with 31,515 rooms in the early planning stage, according to Lodging Econometrics.

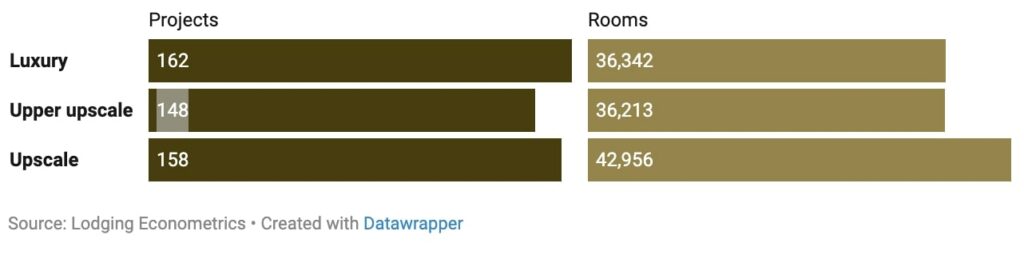

Construction pipeline Q2 2024 – sector

“Hilton has a robust pipeline in the Middle East and Africa across 11 brands, with half of these projects currently under construction,” says Carlos Khneisser, Hilton’s vice president of development for the Middle East & Africa.

“Looking at the Middle East region specifically, we have almost 200 properties trading or under development and are set to more than double our portfolio in the years ahead.”

Khneisser says the group plans to “more than quadruple” its presence in Saudi Arabia to more than 100 hotels, and more than double its portfolio in Egypt to more than 30 properties.

Construction pipeline Q2 2024 – cities

Luxury and upscale hospitality development is driving such growth across the region, with Riyadh, Jeddah, Cairo, Doha and Mecca the five cities with the largest pipeline at the end of Q2.

Growth in construction starts over the next year is likely to be “quite market specific,” says Matthew Green, head of research at CBRE Middle East.

“In the case of locations such as Ras Al Khaimah and Abu Dhabi, we see an increase in new starts based on recent announcements and current demand,” he says.

“However, for Dubai and Qatar we probably see less, given that the peak of the respective hotel development cycles has already passed.”

Ras Al Khaimah is currently in the midst of a hospitality construction drive as the emirate is in line to become the first location in the UAE to house a casino in 2027.

Construction pipeline Q2 2024 – countries

The UAE, as well as Qatar, likely saw peak hotel building activity ahead of Expo 2020 and the 2022 football World Cup, respectively, though both nations continue to expand their tourism offerings to meet growing visitor numbers.

“In 2023, around 67 percent of existing hotel room inventory was in the luxury categories. Of new supply 73 percent was in the luxury segments,” says Gergely Balint, associate partner for valuation at Cavendish Maxwell.

This year, the real estate consultancy expects 50 percent of new rooms in Dubai will be in the luxury space, with 4,600 keys in the pipeline. Of those 3,500 are slated for completion in the second half, according to Balint.

Nils Heckscher, managing director of PKF Hospitality, wrote in AGBI earlier this month that Oman has a “healthy” hotel development pipeline.

Projects by big groups such as Anantara, Four Seasons, Mandarin Oriental, Nikki Beach and St Regis are expected to deliver about 11,000 rooms in the next five years.

Egypt is a dominant player in Africa, says CBRE’s Green. It has a strong, long-term pipeline and has received a massive $35 billion investment from Abu Dhabi’s sovereign wealth fund ADQ to develop tourism on its north coast.

French hotelier Accor in June announced it would build a Novotel property and two Swissôtel ones along the Egyptian coast in partnership with local developers. IHG Hotels and Resorts said in May it would build two new Crowne Plaza hotels in the larger Cairo region through an agreement with Urbnlanes Development.

However, there remain lingering questions over the North African nation’s ability to sustain targeted tourism growth amid currency volatility and regional instability.

“For me, Saudi Arabia is perhaps the most interesting dynamic, given that there is clearly huge latent demand and will from the government to help develop the tourism market,” says Green.

“However, there is also increased scrutiny on where money is being spent and the value that it will return.”

At the end of last year, Marriott laid out plans to add 40 hotels to its Saudi portfolio, including in under-development destinations like Neom and the Red Sea coast, according to news reports.

“Regardless of whether the pace slows or increases in the kingdom over the next 12 months, it will remain one of the most exciting hotel construction markets globally and a market where operators clearly want to be,” says Green.

Ascott, a Singaporean owner of service apartments and hotels, started out in the Gulf with a few properties in Dubai, Bahrain and Qatar a decade ago. It now has 14 properties, or some 2,000 units in operation. Another 24 properties and 3,000 units are already in the pipeline and it plans to add a further 5,000 units by the start of 2026.

Vincent Miccolis, managing director for the Middle East, Africa, Turkey and India, says the firm is planning to launch in Ras Al Khaimah and Egypt and broaden its presence in Saudi Arabia and Morocco.

“The potential is immense in Saudi Arabia,” Miccolis says.

“We are trying to also focus on second-tier cities that also have high potential. Especially post-Covid everyone is starting to discover the hidden treasures of Saudi Arabia.”

This article was originally published in AGBI.