Renting vs buying in Abu Dhabi – what the data tells us

It is the conversation that dominates many dinner tables: should we take the plunge and become homeowners?

From Dubai to Abu Dhabi and the northern emirates, more residents than ever want to settle down and have a place they can call home, particularly after recent rental surges.

Advocates will say, as a homeowner, you are building equity and will benefit when you sell. But there are pros and cons to either decision.

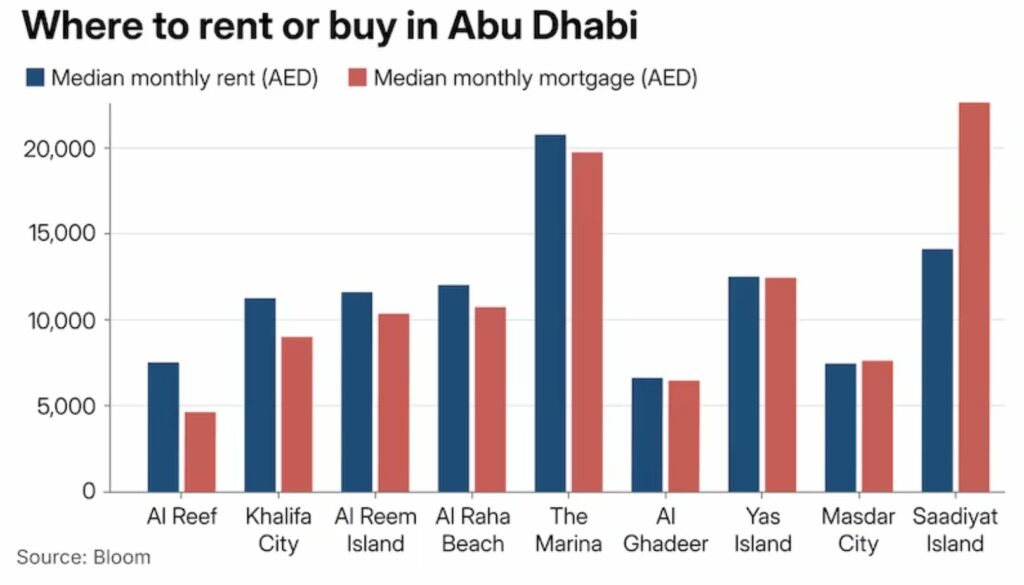

New research from Bloom Holdings and Property Finder shows that in some areas of the country, paying monthly rent is cheaper than a monthly mortgage payment, while in others, it’s more expensive.

Our analysis of the picture in Abu Dhabi is the subject of this week’s Chart of the Week.

Our data suggests a couple of curiosities that require explanation. On average, it’s far more expensive to pay a monthly mortgage on a property on Saadiyat Island, than it is to rent. That’s because rents haven’t caught up with the recent surge in property values and purchases. It may also be that a raft of ultra-high-end properties has distorted the figures.

There’s a different picture in Al Reef, an affordable suburb near Zayed International Airport. There, rent is much more expensive than the average mortgage rate – and it’s a similar picture, though to a lesser extent, in Khalifa City, Al Reem Island and Al Raha Beach.

“In many cases, property prices have become disconnected from rental rates,” says Andrew Laver, associate director in Cavendish Maxwell’s Abu Dhabi office.

In Al Reef, for example, he expects average monthly payments to even out, and the next data report should reflect that.

“Affordable purchase prices create strong buying opportunities for purchasers. Only recently have both rents and prices begun increasing across Al Reef. Al Reem Island shows a similar pattern, with limited apartment price growth in 2023-2024,” he says.

So, with some of the data showing lower monthly mortgage payments for owners, does it always make sense to buy? Not necessarily, says Mr Laver.

Newly arrived professionals or families will naturally want to settle into their jobs, and save for a deposit before taking the plunge, while others may feel priced out of the market. In the long term, he believes many more people will take the leap and buy.

“This transition is especially likely if we continue to see an upward trend in the average duration of expat residency in the UAE, as longer-term outlooks tend to support homeownership over leasing,” Mr Laver says.

For renters who feel priced out, but still want to build long-term stability in the UAE, there are innovative options worth exploring. This can include real estate tokenisation, allowing investors to see the benefit of a strong market.

There is also a host of new off-plan developments in the works, which are often aimed at middle-income families.

“With the right timing and planning, off-plan investments can offer a more stable entry point into ownership, especially in emerging communities with strong growth potential,” says Mr Laver.

This article was originally published in The National.