Dubai Retail and Warehouse Market Performance H1 2025

Executive Summary with Key Trends

In the first half of 2025, Dubai’s retail market recorded around 500 sales transactions valued at approximately AED 1.4 billion. Overall transaction volume and value declined year-on-year by 17.3% and 1.8%, largely due to a slowdown in off-plan activity. In contrast, the ready retail segment performed strongly. On the rental side, overall contracts increased compared to H2’2024 but declined year-on-year, while renewal activity strengthened as tenants opted to extend existing agreements rather than risk relocating to less competitive locations.

Rental rates across Dubai continued to rise. However, performance varied across locations, with prime retail destinations and high-footfall outlets commanding premium rents due to stronger consumer exposure and commercial viability. Conversely, tenants in lower-footfall or secondary areas showed greater resistance to rental increases, leveraging weaker demand dynamics to negotiate more favourable terms.

Meanwhile, Dubai’s warehouse rental market also maintained strong momentum in H1’2025, recording around 8,600 transactions supported by both new and renewal contracts, reflecting robust demand from incoming and existing tenants. This reinforced Dubai’s continued appeal as a regional distribution and logistics hub, driven by e-commerce expansion and resilient trade activity.

Warehouse rental rates increased over the past year, with variation across locations. Higher rents were recorded for warehouses offering strong connectivity to transport corridors, proximity to ports and airports, and superior quality, while older or less optimally located spaces saw moderate growth. Where suitable options were unavailable or exceeded budgets, tenants increasingly looked to neighbouring emirates such as Abu Dhabi and the Northern Emirates to meet their logistics requirements.

Retail Sales Transactions

In the first half of 2025, Dubai’s retail market recorded around 500 sales transactions with a total value of approximately AED 1.4 billion. At an overall level, both transaction volume and value declined year-on-year by 17.3% and 1.8% respectively, primarily driven by a slowdown in off-plan activity. In contrast, the ready retail segment showed stronger performance during the same period, with transaction volumes rising by 13.2% and values increasing sharply by 40.1%.

Sales Transactions – By Volume

Retail Rental Transactions

On the rental front, overall rental contracts increased compared to H2’2024, while declining year-on-year against H1’2024, primarily due to a slowdown in new leases amid limited availability of quality retail space. Renewals, however, continue to strengthen, rising 37.8% from H2’2024 and 1.9% from H1’2024. With prime, high-footfall locations in short supply and rental rates trending upwards, tenants are opting to renew existing agreements rather than risk relocating to less competitive locations.

Rental Transactions – By Volume

Retail Rental Performance

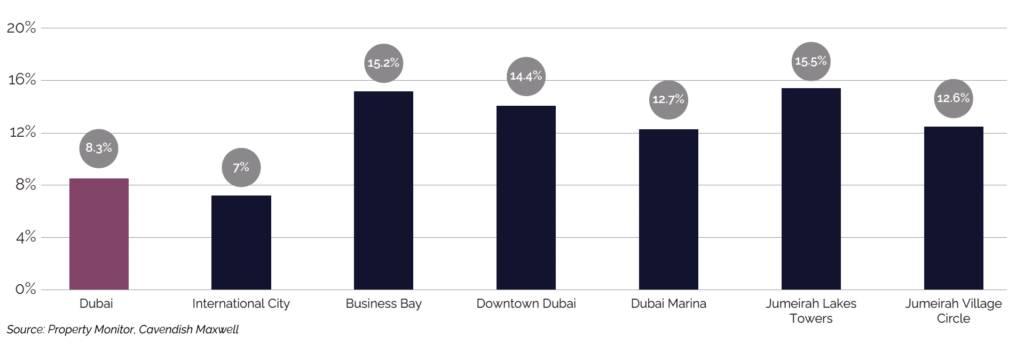

Rental rates across Dubai continued their upward trajectory as demand outstripped supply, with citywide increases of 8.3% recorded over the last 12 months. Performance, however, varied considerably across different areas. Prime retail destinations and outlets with higher footfall maintained premium pricing, supported by enhanced consumer exposure and stronger commercial viability. Conversely, tenants in lower-footfall areas and secondary retail outlets demonstrated greater resistance to rental rate increases, leveraging weaker demand dynamics to negotiate more favourable terms.

Rental Rates – Year-on-Year Change (%)

Warehouse Rental Transactions

In H1’2025, Dubai’s warehouse rental market maintained strong momentum, with around 8,600 rental transactions recorded. Volumes rose by 27.8% compared to H2’2024 and by 59.9% year-on-year against H1’2024. Growth was supported by both new and renewal contracts, reflecting strong demand from incoming as well as existing tenants. This performance highlights Dubai’s continued appeal as a regional distribution and logistics hub, driven by the expansion of e-commerce and resilient trade activity.

Rental Transactions – By Volume

Warehouse Rental Performance

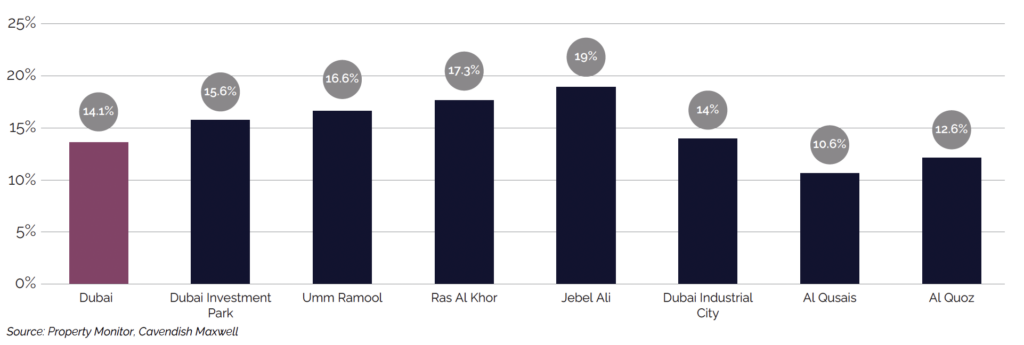

As demand remained strong and occupancy levels stayed high, supported by both international and domestic companies, Dubai’s warehouse rental rates rose by 14.1% over the past year. Growth varied across locations, with rents increasing between 10% and 20% depending on the area. Performance was influenced by factors such as connectivity to major transport corridors, proximity to ports and airports, and the quality of warehouse space. Warehouses in strategic locations recorded the highest growth, while older or less optimally located spaces saw moderate increases, partly driven by tenants spilling over from prime-grade spaces when their preferred options or budgets were unavailable.

Rental Rates – Year-on-Year Change (%)

2025 Market Outlook

In the first half of 2025, both Emaar and Majid Al Futtaim maintained an average occupancy of 98% across their mall portfolios, reflecting strong footfall and sustained tenant demand. H1 also saw the opening of Nad Al Sheba Mall (500,000 sq. ft.), with further supply expected as Damac Mall (110,000 sq. ft.) is scheduled to launch in early H2’2025.

With population growth driving more local shoppers and rising tourist inflows boosting footfall, demand for retail space is projected to remain strong, supporting continued occupancy and rental growth. The market is likely to remain landlord-driven, though rental increases are expected to vary. Prime locations are expected to command higher rents due to limited availability and strong footfall. Meanwhile, retailers are investing in technology and enhanced customer experiences to attract and retain shoppers in a competitive environment. As regional and international brands continue entering Dubai and local brands expand their presence, the retail sector is expected to remain robust in the near term.

Low-density areas such as Al Marmoom, Al Khawaneej, and the industrial catchment around Alserkal Avenue are redefining Dubai’s retail landscape by curating experiences that draw people in rather than simply building spaces. The success of destinations like Alserkal Avenue, the winter F&B pop-ups in Al Marmoom, and Al Khawaneej Walk demonstrates that Dubai’s next retail advantage lies in creating reasons for people to cross the city, not just relying on the surrounding catchment population.

Siraj Ahmed

Director, Head of Strategy and Consulting

Beyond retail, Dubai’s warehouse sector is also experiencing robust growth, driven by rising e-commerce activity and increasing demand for logistics space from both domestic and international businesses. With occupancy rates remaining high and supply constrained, warehouse demand is expected to stay strong in the near term. Rental rates vary across the sector, with warehouses offering strong connectivity to major transport corridors, proximity to ports and airports, and high-quality specifications commanding higher demand and premium rents compared to older or less optimally located facilities. In cases where suitable options are unavailable or exceed budgets, tenants are increasingly looking to neighbouring emirates to meet their requirements.